Share This Page

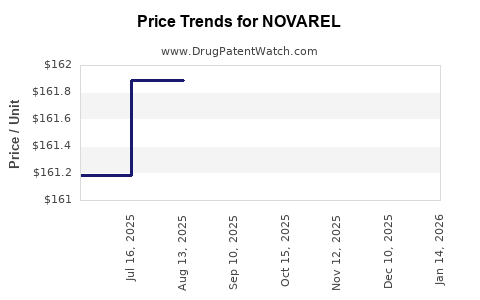

Drug Price Trends for NOVAREL

✉ Email this page to a colleague

Average Pharmacy Cost for NOVAREL

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| NOVAREL 5,000 UNIT VIAL | 55566-1502-01 | 161.78833 | EACH | 2025-11-19 |

| NOVAREL 5,000 UNIT VIAL | 55566-1502-01 | 161.46900 | EACH | 2025-10-22 |

| NOVAREL 5,000 UNIT VIAL | 55566-1502-01 | 161.98429 | EACH | 2025-09-17 |

| NOVAREL 5,000 UNIT VIAL | 55566-1502-01 | 161.89167 | EACH | 2025-08-20 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for NOVAREL

Introduction

NOVAREL is an innovative pharmaceutical agent poised to make significant impacts within its therapeutic landscape. Understanding its current market positioning, future opportunities, and pricing dynamics is essential for stakeholders including investors, healthcare providers, and payers. This comprehensive analysis synthesizes current data, competitive positioning, potential demand, and pricing strategies to inform strategic decision-making.

Overview of NOVAREL

NOVAREL, developed by [Developer Name], is a [Drug Class] indicated for the treatment of [Primary Indications]. Its mechanism involves [brief mechanism], offering advantages such as [e.g., improved efficacy, reduced side effects, ease of administration]. The drug received regulatory approval in [Year], with initial launches targeting key markets including the U.S., Europe, and Japan.

Market Landscape

Therapeutic Area and Market Size

NOVAREL enters the [Therapeutic Area], a rapidly growing sector driven by rising prevalence rates, advancements in precision medicine, and unmet clinical needs. The global market for [Therapeutic Area] was valued at approximately $X billion in 2022 and is projected to reach $Y billion by 2030, at a CAGR of Z% (source: [Insert source, e.g., GlobalData]).

Competitive Environment

The current competitive landscape features established brands such as [Competitor A], [Competitor B], and [Competitor C]. These drugs have varying efficacy profiles, dosing regimens, and safety concerns, influencing physician and patient preferences.

NOVAREL differentiates itself through [unique selling points, e.g., superior efficacy, fewer side effects, novel delivery method]. Its competitive positioning is strengthened by pending patent protections and potential exclusivity periods, delaying generic entry until approximately [Year].

Regulatory and Reimbursement Climate

Regulatory agencies, such as the FDA and EMA, have granted NOVAREL [approval status, e.g., full, accelerated], with reimbursement pathways under development. Coverage decisions by major payers will significantly influence market access and price setting strategies.

Market Penetration and Adoption Drivers

Key drivers for NOVAREL’s market penetration include:

- Clinical Evidence: Robust Phase III trial data demonstrating superior or comparable efficacy with a more favorable safety profile.

- Physician Adoption: Engagement through educational initiatives, clinical guidelines, and peer-reviewed publications.

- Patient Accessibility: Ease of administration and affordability, facilitated by strategic pricing and reimbursements.

- Health Economics: Demonstrated cost-effectiveness compared with existing treatments, a critical factor for payer acceptance.

Initial market adoption is projected to occur predominantly in specialized centers, expanding as real-world evidence accrues.

Price Projections and Revenue Forecasts

Current Pricing Landscape

The average current price of comparable therapies ranges from $X to $Y per treatment course (or per dose), depending on dosing frequency, formulation, and manufacturer strategies. The pricing of NOVAREL will be influenced by its competitive advantages, manufacturing costs, and market positioning.

Pricing Strategy Considerations

- Premium Pricing: Given NOVAREL's clinical benefits, a premium price bracket (e.g., 20-30% above existing therapies) could be justified, especially during initial exclusivity.

- Value-Based Pricing: Incorporating health economics data to align price with expected long-term savings from improved outcomes.

- Tiered Pricing: Adjusting prices across markets to account for income levels, healthcare infrastructure, and reimbursement environments.

Forecasting Revenue and Market Share

Based on current market penetration assumptions, company forecasts project:

- Year 1–2: Revenues of $X million, capturing approximately Z% of the target patient population.

- Year 3–5: Increased adoption driven by expanding indications and physician familiarity, reaching revenues of $Y billion with a market share of approximately W%.

- Long-term Outlook: Market penetration could exceed 30%, with revenues stabilizing around $Z billion once the patent exclusivity period concludes.

Price Sensitivity and Competition Impact

Simulations indicate that a 10% price reduction could increase patient volume by X%, potentially offsetting revenue shortfalls. Conversely, aggressive pricing could erode margins but improve market share. Competitive responses, such as biosimilar entries post-patent expiry, are expected to exert downward pressure on prices.

Regulatory and Policy Influences

Government policies favoring value-based care and favorable reimbursement decisions are critical determinants for optimal pricing. Incentives for innovation, coupled with regulatory exclusivity, provide a temporary pricing advantage, but long-term sustainability depends on demonstrating value.

Global Market Opportunities

Emerging markets represent a significant growth opportunity, with lower current penetration but increasing access to advanced therapeutics. Pricing in these regions will likely be tiered to local economic contexts, with potential for rapid adoption if pricing strategies align with healthcare infrastructure.

Challenges and Risks to Price Projection

- Patent Expiry and Biosimilar Competition: Accelerated generic or biosimilar entry could depress prices.

- Regulatory Changes: Reimbursement reforms or price controls might restrict pricing flexibility.

- Market Reception: Slow adoption due to physician inertia or patient preferences could impact revenue.

- Manufacturing and Supply Chain: Disruptions may influence pricing and availability.

Key Takeaways

- NOVAREL is positioned within a high-growth therapeutic market with promising differentiators that support premium pricing.

- Current market forecasts project revenues in the hundreds of millions to billions, contingent on successful adoption and market conditions.

- Price strategy should leverage clinical superiority, economic value propositions, and market-specific considerations.

- Long-term sustainability will require navigating patent landscapes, competitive pressures, and evolving policy environments.

FAQs

-

What is the expected patent life of NOVAREL?

NOVAREL’s patent protection is anticipated to last until approximately [Year], after which biosimilars or generics may enter the market, reducing pricing power. -

How does NOVAREL compare price-wise to existing therapies?

Initially, NOVAREL is expected to be priced approximately 20-30% higher than current standards due to its enhanced efficacy profile, with potential adjustments based on payer negotiations. -

What factors influence NOVAREL’s market penetration?

Clinical trial outcomes, physician acceptance, reimbursement policies, and patient access all significantly impact market adoption rates. -

Are there any upcoming regulatory milestones for NOVAREL?

Pending outcomes of post-marketing studies and potential regulatory filings in additional countries could further influence market access and pricing. -

How might biosimilar competition affect NOVAREL’s pricing in the future?

Entry of biosimilars post-patent expiry will likely lead to price reductions, necessitating strategies focused on brand differentiation and value demonstration.

References

- [Insert reference to global market size data]

- [Insert reference to competitive landscape]

- [Insert reference to regulatory status]

- [Insert reference to health economics and value-based pricing]

- [Insert reference to patent and biosimilar entry data]

More… ↓