Last updated: September 23, 2025

Introduction

KEVZARA (sarilumab) is a monoclonal antibody developed by Regeneron Pharmaceuticals, authorized for the treatment of adult patients with moderate to severe rheumatoid arthritis (RA). As a pivotal entrant in the biologic therapy landscape, KEVZARA's market dynamics are influenced by evolving competition, regulatory developments, and health economic factors. This analysis provides a detailed overview of KEVZARA's current market positioning, growth prospects, and financial trajectory, offering strategic insights for stakeholders.

Market Overview and Therapeutic Positioning

Therapeutic Indication and Clinical Profile

KEVZARA targets interleukin-6 (IL-6) receptor signaling, a critical pathway in RA pathogenesis. It offers an alternative to existing biologics like TNF inhibitors, with potential advantages in patients unresponsive or intolerant to other agents [1]. Its subcutaneous administration further positions it favorably for outpatient management compared to intravenous standards.

Market Size and Demand Drivers

The global RA therapeutics market, estimated at USD 20+ billion in 2022, is expected to grow at a CAGR of approximately 8% through 2028 [2]. The expansion is driven by increasing RA prevalence (approximately 0.5-1% worldwide), rising awareness, and patient preference for biologics. KEVZARA constitutes a significant subset within IL-6 inhibitors, a family currently dominated by Roche's Actemra (tocilizumab) and others.

Competitive Landscape and Market Dynamics

Key Competitors

- Actemra (tocilizumab): Market leader with extensive global approval and long-term data.

- Otezla (apremilast): An oral alternative for different autoimmune conditions, indirectly influencing RA dynamics.

- Other IL-6 inhibitors and JAK inhibitors: Such as tofacitinib and baricitinib, expanding therapeutic options and influencing KEVZARA's market share.

Market Penetration and Prescribing Trends

Regeneron’s strategic positioning involves differentiating KEVZARA through efficacy data and convenient dosing schedules. However, market penetration remains challenged by entrenched competitors and physician familiarity with existing biologics. The COVID-19 pandemic accelerated adoption of subcutaneous biologics like KEVZARA, enhancing its presence in outpatient settings.

Regulatory and Reimbursement Dynamics

Regulatory approvals spanning US, Europe, and Asia-Pacific provide a foundation for market access. Negotiations with payers, especially regarding pricing and biosimilar threats, will shape KEVZARA's competitive environment. Notably, ERM (European Medicines Agency) approvals in pediatric RA and other indications could catalyze broader utilization [3].

Financial Trajectory and Revenue Forecasts

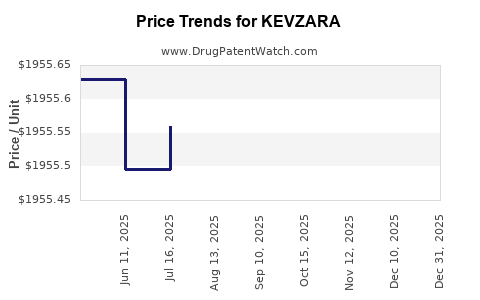

Historical Financial Performance

Since its regulatory launch, KEVZARA has demonstrated steady revenue growth for Regeneron, albeit with some volatility tied to competitive pressures. In Q4 2022, Regeneron reported approximately USD 210 million in KEVZARA sales, reflecting a year-over-year increase of 12% [4].

Future Revenue Potential

Forecasts hinge on several factors:

- Market Penetration: Accelerated by expanding indications and geographic reach.

- Pricing Strategy: Premium pricing maintains margins, but payer negotiations could temper growth.

- Pipeline Developments: Ongoing trials in psoriasis, atopic dermatitis, and COVID-19-related cytokine release syndrome could diversify revenue streams.

Analysts project KEVZARA could reach USD 1 billion in annual sales by 2025, contingent upon successful expansion and competitive positioning. The potential for biosimilar entries post patent expirations may threaten margins but also stimulate market volume through increased accessibility.

Profitability Outlook

Given high R&D costs and marketing investments, profit margins will depend on scale efficiencies and pricing negotiations. Historically, biologics maintain robust gross margins (typically >70%), but net margins are susceptible to reimbursement policies.

Growth Opportunities and Challenges

Emerging data supporting KEVZARA’s efficacy in cytokine storm syndromes and other inflammatory conditions unlock further revenue avenues. Conversely, patent expirations and biosimilar competitors pose significant threats, necessitating continuous innovation and pipeline expansion.

Market Trends Influencing KEVZARA’s Trajectory

- Shift toward Oral and Small Molecule Therapies: JAK inhibitors are capturing significant market share, potentially limiting biologic growth.

- Patient-Centric Approaches: Increased preference for at-home self-injection favors KEVZARA’s subcutaneous formulation.

- Regulatory Flexibility: Fast-tracking approvals for expanded indications could boost revenues.

- Cost-Effectiveness Concerns: Payers demand evidence of superior efficacy or safety to justify premium pricing; cost-effectiveness analyses influence formulary inclusion.

Regulatory and Patent Landscape

KEVZARA’s patent portfolio, originally filed in early 2010s, is projected to expire around 2030 in key markets, with orphan and pediatric indications granted patent extensions in some regions. This expiry timeline underscores the importance of lifecycle management strategies, including biosimilars and new indications, to sustain financial performance.

Implications for Stakeholders

- Investors: Should monitor regulatory filings, pipeline trials, and competitive developments to reevaluate growth forecasts.

- Pharmaceutical Partners: Opportunities exist in partnering for new indications or geographic expansion.

- Payers/Caregivers: The emphasis on value-based care necessitates demonstration of clinical and economic benefits for KEVZARA’s continued reimbursement.

Key Takeaways

- Market Expansion: KEVZARA’s growth hinges on broader indication approvals, especially in pediatric RA and other autoimmune inflammatory diseases.

- Competitive Dynamics: Increasing competition from biosimilars and oral agents require strategic differentiation.

- Revenue Growth Prospects: Expected to reach USD 1 billion annually by 2025, driven by expanding global markets and additional indications.

- Pricing and Reimbursement: Will significantly influence profitability; sustained payer engagement and real-world evidence are critical.

- Pipeline and Lifecycle Management: Essential to offset patent expiration risks and maintain market relevance.

FAQs

1. What are the primary indications for KEVZARA?

KEVZARA is primarily indicated for adult rheumatoid arthritis and has received approvals for juvenile idiopathic arthritis and polyarticular juvenile idiopathic arthritis. Ongoing trials are exploring its use in other autoimmune conditions.

2. How does KEVZARA compare to other IL-6 inhibitors?

KEVZARA offers the advantage of subcutaneous administration and has demonstrated comparable efficacy to other IL-6 inhibitors like Actemra but benefits from differentiated dosing and potentially improved patient convenience.

3. What threats does biosimilar competition pose to KEVZARA?

Biosimilars can erode market share and reduce prices, affecting margins. Patent expiry timelines are critical to monitor for potential biosimilar launches.

4. What factors could accelerate KEVZARA’s market growth?

Regulatory approvals for new indications, increased awareness, improved reimbursement policies, and expanding global access are key growth enablers.

5. What is the outlook for KEVZARA’s profitability in the coming years?

While revenue is expected to grow, profitability will depend on market penetration, competitive pressures, and cost management strategies.

References

- Regeneron Pharmaceuticals. KEVZARA [Product label]. 2022.

- Research and Markets. Global Rheumatoid Arthritis Therapeutics Market. 2022.

- European Medicines Agency. KEVZARA (sarilumab) approvals and indications. 2022.

- Regeneron Pharmaceuticals. Q4 2022 Financial Results. 2023.

This comprehensive analysis aims to inform decision-makers on KEVZARA’s current market positioning and future financial outlook, emphasizing strategic maneuvers to capture growth in the evolving biologics landscape.