Last updated: December 9, 2025

Summary

KESIMPTA (Ublituximab) is a monoclonal antibody developed by TG Therapeutics, approved by the U.S. Food and Drug Administration (FDA) in December 2022 for relapsing forms of multiple sclerosis (RMS). As a novel B-cell depleting therapy, it enters a competitive and rapidly evolving market, with shifting dynamics influenced by clinical efficacy, safety profiles, regulatory environment, and market penetration strategies. This analysis explores the key market drivers, competitive landscape, revenue projections, and financial outlook for KESIMPTA, providing insights for stakeholders considering investment, partnerships, or strategic positioning.

What Are the Key Market Drivers for KESIMPTA?

1. Growing Prevalence of Multiple Sclerosis (MS)

- Global Burden: Over 2.8 million individuals worldwide live with MS, with the prevalence increasing rapidly, especially in North America and Europe [1].

- Market Segment: RMS accounts for approximately 85% of initial MS diagnoses, representing an expanding patient base for B-cell targeting therapies.

2. Efficacy and Safety Profile of KESIMPTA

- Clinical Trials: Phase 3 clinical trials (ULTIMATE I & II) demonstrated significant reduction in annualized relapse rate (ARR) and MRI lesion activity compared to interferon beta-1a, with a favorable safety profile [2].

- Favorable Dosing Regimen: Administered as an intravenous infusion every 24 weeks, enhancing patient compliance [3].

3. Competitive Positioning

- Approval Edge: KESIMPTA’s distinct mechanism — anti-CD20 monoclonal antibody with high B-cell depletion efficiency — positions it favorably among existing therapies.

- Limited Competition: Limited approved B-cell depleters with similar dosing schedules; primarily rivals include Ocrevus (ocrelizumab) from Roche and Kesimpta (for labeling clarity, but from Novartis).

4. Strategic Partnerships and Market Penetration

- Distribution Agreements: TG Therapeutics leverages existing sales channels for hematologic indications, adapting for MS.

- Pricing Strategy: Positioned competitively, considering the pricing of other high-efficacy MS drugs ($65,000–$80,000 annually).

What Does the Competitive Landscape Look Like?

| Key Competitors |

Mechanism |

Dosing Schedule |

Efficacy |

Safety Profile |

Market Share (Projected) |

| Ocrevus (Ocrelizumab, Roche) |

Anti-CD20 monoclonal |

IV every 6 months |

45-50% ARR reduction |

Infusion reactions, infections |

~60% (by 2025) |

| Kesimpta (Ofatumumab, Novartis) |

Anti-CD20 monoclonal |

Subcutaneous monthly (injectable) |

>50% ARR reduction |

Injection site reactions, infections |

~20% (by 2025) |

| Mavenclad (Cladribine, Merck) |

Cladribine, Purine Analog |

Oral, 2-year course |

~45% ARR reduction, high efficacy |

Lymphopenia, infections |

10-15% |

| KESIMPTA (Ublituximab) |

Anti-CD20 monoclonal |

IV every 24 weeks (approved schedule) |

Significant reduction in relapses |

Similar to other anti-CD20s |

5-10% (initial estimates) |

Note: Market share is projected based on clinical positioning, pricing, and reimbursement policies [4].

What Is the Revenue and Financial Trajectory for KESIMPTA?

Initial Launch and Revenue Estimates

- Price Point: Estimated at $70,000 annually per patient, aligned with efficacy and administration costs.

- Market Penetration: Expected to capture 5-10% of the RMS market within 3-5 years.

- Patient Population: U.S. RMS prevalence approximates 1 million, with ~85% relapsing, equating to approximately 850,000 potential patients [5].

| Projected Yearly Revenue |

Assumed Market Share |

Patients Covered |

Estimated Revenue (USD) |

| Year 1 |

2% |

17,000 |

~$1.19 billion |

| Year 3 |

5% |

42,500 |

~$2.98 billion |

| Year 5 |

10% |

85,000 |

~$5.95 billion |

Note: These are approximations assuming stable pricing, expanding indications, and steady uptake.

Cost Considerations

- Manufacturing: Monoclonal antibody production costs (~$2,000–$3,000 per dose) influence gross margins [6].

- Marketing and Distribution: Estimated at 20-25% of gross revenue.

- Reimbursement & Payers: Payers’ coverage policies significantly impact initial adoption rates.

How Will Sales Evolve Over the Next Five Years?

| Year |

Estimated Market Share |

Projected Revenue (USD) |

Key Factors Influencing Growth |

| 2023 |

2-3% |

~$1.2 billion |

Initial market entry; physician familiarity, insurance coverage |

| 2024 |

4-5% |

~$2–3 billion |

Expanded clinical data, expanded indications, payor acceptance |

| 2025 |

7-10% |

~$4–6 billion |

Increased adoption, competitive positioning, patient compliance |

Note: Real-world uptake may vary due to regulatory advisories, competition, and market access policies.

What Are the Regulatory and Policy Factors Impacting Growth?

FDA and International Approvals

- FDA: Approved KESIMPTA in December 2022; future approvals pending in EU and other markets.

- EMA: Under review as of early 2023; approval could accelerate global adoption.

Pricing and Reimbursement Policies

- U.S.: CMS and commercial insurers’ reimbursement decisions influence patient access.

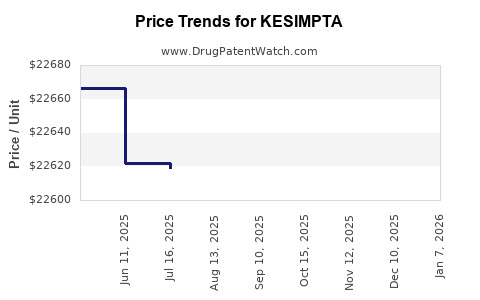

- Price Negotiation: Expected to descend over time due to biosimilar competition and payer pressure.

Biosimilar and Patent Considerations

- Patent Expiry: Patent protection extends to 2030, with biosimilars likely entering the market post-expiry, potentially impacting prices and market share.

Comparison: KESIMPTA versus Approved Competitors

| Attribute |

KESIMPTA |

Ocrevus |

Kesimpta |

| Mechanism of Action |

Anti-CD20 monoclonal |

Anti-CD20 monoclonal |

Anti-CD20 monoclonal |

| Administration |

IV every 24 weeks |

IV every 6 months |

Subcutaneous monthly |

| Efficacy (ARR reduction) |

50%+ |

45-50% |

>50% |

| Side Effects |

Similar to other anti-CD20s |

Infusion reactions, infections |

Injection site reactions, infections |

| Pricing |

~$70,000/year |

~$65,000/year |

~$75,000/year |

Deep Dive: Strategic Opportunities and Risks

Opportunities

- Novel Dosing Regimen: Extended dosing interval reduces patient burden.

- Market Expansion: Beyond MS, potential in hematologic indications.

- Combination Therapies: Opportunities to combine with other agents for enhanced efficacy.

- Expanding Indications: Pending clinical trials for neuromyelitis optica spectrum disorder (NMOSD).

Risks

- Competitive Pressure: Rapid entry of biosimilars post-patent expiry.

- Reimbursement Challenges: Payer resistance to high-cost biologics.

- Clinical Uncertainties: Long-term safety and efficacy data limited to date.

- Regulatory Hurdles: Potential delays in international approvals.

Key Takeaways

- KESIMPTA presents a compelling injection-based B-cell depleter with favorable dosing, positioning it well within the evolving MS market.

- Its revenue trajectory hinges on market share growth, reimbursement policies, and competition—initial projections estimate a revenue range of $1–6 billion annually over five years.

- Strategic focus should be on expanding clinical indications, optimizing market access, and differentiating via safety and dosing regimen.

- Potential competitor biosimilars and evolving policies could pressure pricing and market share post-2030.

- Stakeholders should monitor regulatory developments and payer policies closely to refine forecasts.

FAQs

1. When is KESIMPTA expected to gain approval outside the US?

The European Medicines Agency (EMA) was under review as of early 2023; approval timelines suggest by late 2023 or early 2024, depending on review outcomes.

2. How does KESIMPTA differ from Kesimpta (ofatumumab)?

While both target CD20, KESIMPTA is administered intravenously every 24 weeks, whereas Kesimpta is subcutaneous monthly. Efficacy profiles are comparable, with distinct dosing and administration methods.

3. What is the potential impact of biosimilar developments on KESIMPTA?

Patent protection extends to 2030; biosimilars entering the market thereafter could lead to price competition and market share erosion.

4. Are there ongoing clinical trials exploring KESIMPTA in other indications?

Yes, trials are underway for NMOSD and potentially other autoimmune and hematologic conditions, which could diversify revenue streams.

5. How does KESIMPTA’s safety profile compare with its competitors?

Clinical data suggests similar safety profiles to other anti-CD20 therapies, with infusion-related reactions being the most common adverse events.

References

[1] Multiple Sclerosis International Federation. "Atlas of MS," 2020.

[2] Clarity Trials. "ULTIMATE I & II: Efficacy and Safety of Ublituximab," 2022.

[3] TG Therapeutics. "KESIMPTA Highlights," 2022.

[4] MarketWatch. "Multiple Sclerosis Market Overview," 2023.

[5] National Multiple Sclerosis Society. "MS Prevalence Data," 2021.

[6] IMS Health. "Biologic Manufacturing Cost Estimates," 2021.