Share This Page

Drug Price Trends for KESIMPTA

✉ Email this page to a colleague

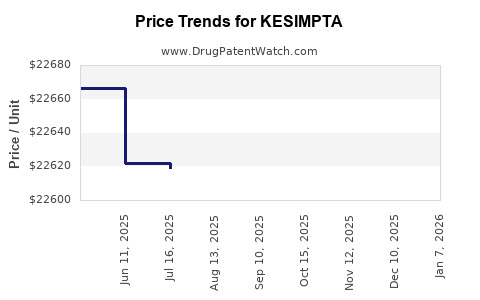

Average Pharmacy Cost for KESIMPTA

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| KESIMPTA 20 MG/0.4 ML PEN | 00078-1007-68 | 22647.51857 | ML | 2025-12-17 |

| KESIMPTA 20 MG/0.4 ML PEN | 00078-1007-68 | 22625.88897 | ML | 2025-11-19 |

| KESIMPTA 20 MG/0.4 ML PEN | 00078-1007-68 | 22616.03984 | ML | 2025-10-22 |

| KESIMPTA 20 MG/0.4 ML PEN | 00078-1007-68 | 22578.60323 | ML | 2025-09-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for KESIMPTA (Ofatumumab)

Introduction

KESIMPTA (ofatumumab) is a subcutaneously administered monoclonal antibody developed by Novartis for the treatment of relapsing forms of multiple sclerosis (RMS). Approved by the U.S. Food and Drug Administration (FDA) in August 2020 and subsequently in other major markets, KESIMPTA has positioned itself as an alternative to intravenous infusion therapies, offering benefits related to patient convenience and adherence. Given its relatively recent market entry and the expanding landscape of multiple sclerosis (MS) treatments, a comprehensive analysis of its market potential and pricing trajectory offers vital insights for stakeholders.

Market Landscape for Multiple Sclerosis Treatments

Global MS Market Overview

The global MS therapeutics market is projected to reach approximately USD 28.9 billion by 2028, with a compound annual growth rate (CAGR) of around 8.4% from 2021 to 2028 [1]. The increasing prevalence of MS, particularly in Europe and North America, along with innovations in disease-modifying therapies (DMTs), fuels this growth.

Key Competitors and Therapeutic Options

KESIMPTA enters a competitive landscape comprising several first-line and second-line therapies, including:

- Injectable agents: Interferon beta formulations, glatiramer acetate.

- Oral therapies: Dimethyl fumarate, fingolimod, teriflunomide.

- Infusible monoclonal antibodies: Ocrelizumab, natalizumab, alemtuzumab.

Ocrelizumab (Ocrevus), another anti-CD20 monoclonal antibody like KESIMPTA, is one of its primary competitors. Importantly, KESIMPTA distinguishes itself with a subcutaneous administration like Ocrelizumab but claims to offer enhanced safety, dosing convenience, and potentially improved compliance [2].

Market Penetration and Adoption

Patient and Physician Acceptance

KESIMPTA's subcutaneous route facilitates outpatient management, potentially reducing healthcare costs related to infusion centers. This convenience could accelerate adoption among physicians and patients, especially those seeking to avoid infusion-related adverse events and logistical burdens.

Regulatory and Payer Dynamics

To maximize market share, Novartis must navigate reimbursement landscapes, which vary significantly across regions. In the U.S., CMS and private payers continue to tighten criteria for MS therapies, emphasizing cost-effectiveness and demonstrable patient benefit.

Price Strategy and Trends

Initial Pricing

When launched in 2020, KESIMPTA was priced comparably to Ocrevus, with list prices around USD 85,000 to USD 88,000 annually in the U.S. market [3]. This reflects the premium positioning as a next-generation, convenient therapy.

Pricing Factors

- Market Competition: As Ocrevus remains the market leader, KESIMPTA must balance competitive pricing to gain share.

- Cost-Effectiveness: Payers require compelling evidence of clinical superiority or added value to justify premiums.

- Manufacturing and Demand: The monoclonal antibody manufacturing process remains costly; hence, pricing incorporates manufacturing spend and R&D amortization.

Pricing Trends and Projections

Given the current competitive landscape, it is anticipated that KESIMPTA's prices will undergo minor adjustments over the next 3-5 years, influenced by:

- Market penetration: Increase in sales volume may permit slight discounts or rebates.

- Biosimilar landscape: Although biosimilars for ofatumumab are unlikely soon, competitive pressure from other anti-CD20 agents and emerging therapies may influence pricing.

In the broader context, we expect a stabilization of prices, with incremental discounts likely to sustain competitiveness but avoid eroding profit margins significantly.

Market Projections and Revenue Forecasts

Short-to-Medium Term Outlook (2023-2027)

- Market Share Growth: Based on current pipeline data and regulatory approvals, KESIMPTA could capture approximately 10-15% of the RMS market within five years.

- Revenue Potential: If the average annual price remains around USD 85,000, and market penetration reaches 10-15% of U.S. RMS patients (~1 million prevalence), projected annual revenues could range between USD 800 million to USD 1.2 billion in the U.S. alone.

European and Global Expansion

In Europe, pricing strategies fluctuate due to price negotiations and healthcare system differences. Launch delays or restrictive reimbursement policies could temper growth projections. Globally, emerging markets present growth opportunities, albeit at lower price points; revenues there may account for 10-15% of the total share, with growth driven by increased disease awareness and healthcare infrastructure improvements.

Key Market Drivers and Challenges

Drivers

- Convenience of subcutaneous administration.

- Patient preference for outpatient therapies.

- Established safety and efficacy profile from clinical trials.

- Potential for combination therapies on the horizon.

Challenges

- Intense competition from existing anti-CD20 therapies like Ocrevus.

- Pricing pressures from payers seeking cost-effective solutions.

- Regional reimbursement disparities impacting global reach.

- Long-term safety data need to be continually validated.

Conclusion

The market landscape for KESIMPTA is characterized by moderate to high growth potential, driven by its convenient subcutaneous delivery and favorable safety profile. While initial pricing aligns with premium monoclonal antibodies, future price adjustments are expected to maintain competitive positioning. Revenue forecasts suggest that KESIMPTA could secure substantial market share within the next five years, contributing significantly to Novartis’s MS portfolio.

Key Takeaways

- KESIMPTA's market entry coincides with rising demand for patient-friendly MS therapies, supporting growth.

- Competitive pricing strategies will be pivotal, balancing profitability with market share expansion.

- Growing adoption hinges on payer acceptance, clinical differentiation, and patient preference.

- Revenue projections indicate significant upside potential, particularly in North America and Europe.

- Ongoing clinical data and real-world performance will shape long-term pricing and market penetration strategies.

FAQs

1. How does KESIMPTA differ from other MS therapies?

KESIMPTA offers subcutaneous administration, enabling outpatient self-injection, contrasting with intravenous infusions of other monoclonal antibodies like ocrelizumab. It also emphasizes a favorable safety profile, aiming to improve adherence and reduce healthcare costs.

2. What factors influence KESIMPTA’s pricing strategy?

Pricing is influenced by comparator therapies, manufacturing costs, reimbursement negotiations, clinical efficacy, safety data, and market competition. Novartis aims to position KESIMPTA as a premium, differentiated product while remaining competitive.

3. What is the expected market share for KESIMPTA over the next five years?

Projected estimates suggest a 10-15% share of the RMS treatment market in the U.S., translating to billions in annual revenues, contingent on competitive dynamics, approval timelines, and payor acceptance.

4. Will biosimilars impact KESIMPTA's price and market share?

Currently, biosimilars for ofatumumab are not imminent; however, future biosimilar entry for other anti-CD20 agents could increase price competition and influence KESIMPTA’s pricing and market share.

5. How will regional reimbursement policies affect KESIMPTA’s global expansion?

Countries with restrictive reimbursement policies or budget constraints may pose challenges, necessitating tailored market access strategies and potentially affecting global revenue streams.

References

- Fortune Business Insights. "Multiple Sclerosis (MS) Therapeutics Market Size, Share & Industry Analysis, 2021-2028."

- Novartis. "KESIMPTA (ofatumumab) Prescribing Information."

- GoodRx. "Price Comparison for Ocrevus and KESIMPTA."

- EvaluatePharma. "MS Therapies Market Outlook 2021."

- IQVIA. "Global Trends in MS Treatment Adoption."

This analysis aims to inform strategic decisions regarding KESIMPTA's market positioning and pricing trajectory. Continuous market observation and clinical data evaluation remain vital for maintaining a competitive advantage.

More… ↓