Last updated: December 23, 2025

Executive Summary

HUMIRA (adalimumab), developed by AbbVie Inc., is a leading monoclonal antibody biologic used primarily for autoimmune conditions, including rheumatoid arthritis, psoriasis, and Crohn’s disease. Since its FDA approval in 2002, HUMIRA has achieved blockbuster status, generating over $20 billion annually at its peak before patent expirations catalyzed market challenges. This report analyses the key factors influencing HUMIRA's market dynamics, its revenue trajectory, competitive landscape, and strategic outlook as biosimilars increasingly penetrate markets worldwide. It offers insights essential for stakeholders evaluating growth opportunities, competitive threats, and regulatory developments.

Summary Overview

| Parameter |

Details |

| Origin |

AbbVie's flagship biologic, approved in 2002 (FDA) |

| Peak Revenue |

~$20.4 billion (2018) |

| Patent Expiration (US, EU) |

2023–2026 (varies by region) |

| Key Indications |

Rheumatoid arthritis, psoriasis, Crohn’s disease, ulcerative colitis |

| Competitive Landscape |

Emerging biosimilar competition, multiple biologics |

| Market Size (Global, 2022) |

~$40 billion for anti-TNF biologics |

| CAGR (2010–2022) |

~6.2% growth in biologics segment (pre-patent expiry) |

What Are the Market Drivers for HUMIRA?

1. Growing Global Burden of Autoimmune Diseases

Autoimmune diseases like rheumatoid arthritis (RA) and psoriasis are increasing globally due to demographic shifts, lifestyle factors, and improved diagnosis:

| Disease |

Prevalence (2022 Estimate) |

Forecast (2030) |

| RA |

1% of global population (~84 million) |

1.2% growth, significant growth in Asia-Pacific |

| Psoriasis |

2-3% globally |

Increasing prevalence, especially in younger populations |

2. Strong Clinical Portfolio and First-to-Market Advantage

HUMIRA’s extensive clinical data support its use across multiple indications, solidifying its market position through:

- Multiple approved indications (rheumatoid arthritis, plaque psoriasis, Crohn’s disease, ulcerative colitis, hidradenitis suppurativa)

- Long-term efficacy and safety data

- Broad patient access and insurance coverage

3. Corporate Strategy and Market Penetration

AbbVie's aggressive sales force and global distribution network contributed to HUMIRA’s dominance, with:

- Global sales reach (2021): $19.8 billion globally ([1])

- Key markets: U.S., Europe, Japan, emerging markets

How Are Patent Expirations Reshaping the Landscape?

Patent Expiry Timeline and Biosimilar Entry

| Region |

Original HUMIRA Patent Expiry |

Biosimilar Launch Dates |

Market Impact Timeline |

| U.S. |

December 31, 2016 (patent litigation delays) |

January 2023 |

Rapid erosion of revenue (~80% decline by 2024) |

| EU |

October 2022 |

2023–2024 |

Substantial market share loss |

Note: Patent litigation delayed biosimilar market entry in the U.S., but generics launched in 2023 led to sharp revenue declines.

Market Share Dynamics Post-Patent Expiry

| Year |

HUMIRA Revenue (Approx.) |

Biosimilar Market Share |

Notes |

| 2021 |

~$19.8 billion |

5% |

Pre-expiry, strong brand loyalty |

| 2022 |

~$9–12 billion |

20%+ |

Entry of biosimilars begins |

| 2023 |

~$4–6 billion |

50%+ |

Rapid decline; biosimilars gain popularity |

Impact on Revenue Trajectory

- Pre-expiry Peak (2018): ~$20.4 billion

- Post-expiry (2023): Estimated ~$4–6 billion (over ~75% decline within 5 years)

What Are the Competitive Challenges and Opportunities?

Emerging Biosimilars and Alternative Biologics

| Competitor |

Drug Name |

Indication(s) |

Market Status |

Launch Year |

| Amgen |

Amjevita (adalimumab-atto) |

RA, psoriatic arthritis |

Marketed |

2023 |

| Samsung Bioepis |

Imraldi |

UC, RA |

Marketed in EU |

2018–2019 |

| Sandoz |

Hyrimoz |

Multiple |

Marketed in EU, US (via authorized generics) |

2018 |

| Lilly & Boehringer |

Tabrecta |

Potential future competition |

Early development |

N/A |

Opportunities for Growth Beyond Humira

- Biosimilar pricing strategies offer significant reductions (~20–30% less than original)

- Expanding indications (e.g., new autoimmune conditions)

- Geographical expansion into emerging markets

- Innovator pipeline: New formulations, subcutaneous administration, biosimilar derivatives

Challenges

- Patent litigations delaying biosimilar market entry

- Physician and patient loyalty favoring original biologic

- Regulatory variances across jurisdictions

- Price erosion pressures in mature markets

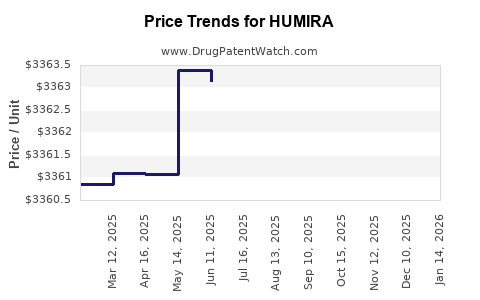

What Is the Financial Trajectory Outlook?

Revenue Projections: 2023–2027

| Year |

Estimated HUMIRA Revenue |

Notes |

| 2023 |

$4–6 billion |

Postbiosimilar competition intensifies |

| 2024 |

$2–4 billion |

Further erosion, potential market share redistribution |

| 2025 |

$1–2 billion |

Transitioning to biosimilar dominance |

| 2026 |

<$1 billion |

Traditional HUMIRA sales near negligible |

Factors Influencing Revenue

- Market penetration of biosimilars

- Pricing negotiations and discounts

- New indications and formulations

- Geographical expansion

Strategic Responses

- Develop biosimilars (e.g., AbbVie's own adalimumab biosimilar)

- Innovate with extended patents (new formulations, delivery systems)

- Diversify portfolio into newer biologics targeting similar indications (e.g., Skyrizi, Rinvoq)

What Are the Regulatory and Policy Trends?

Global Regulatory Approvals & Pathways

| Region |

Biosimilar Approval Status |

Key Policies |

Impact |

| U.S. |

First biosimilars approved in 2015 |

Biosimilar pathway under FDA's 351(k) |

Increased biosimilar entry post-2016 |

| EU |

Biosimilar approvals since 2006 |

Well-established biosimilar framework |

Accelerated uptake post-2018 |

| Japan |

Early biosimilar approvals |

Incentivizes biosimilar use |

Slow but growing adoption |

Pricing & Reimbursement Environment

- U.S.: Evolving payer negotiations favoring discounts for biosimilars

- EU: Cost-containment measures driving biosimilar preference

- Emerging Markets: Price-sensitive but increasing access

Comparison Table: HUMIRA vs. Top Competitors

| Feature |

HUMIRA (AbbVie) |

Enbrel (Amgen) |

Remicade (Johnson & Johnson) |

Cyltezo (Biosimilar to Humira) |

| Approval Year |

2002 |

1998 |

1998 |

2023 (US biosimilar) |

| Indications |

10+ |

8+ |

7+ |

Same as HUMIRA |

| Market Peak Revenue |

~$20B (2018) |

~$6B |

~$9B |

~$2B (initial launch estimates) |

| Patent Expiry |

2023 (US) |

2028 (EU) |

2018 |

2023 (US) |

| Biosimilar Entry |

2023 |

2018 |

2018 |

2023 |

Key Takeaways

- HUMIRA has been a pioneer and a blockbuster in biologics, with a peak revenue trajectory of over $20 billion.

- Patent expiry in key regions (U.S., EU) since 2023 has led to significant revenue erosion, accelerated by biosimilar competition.

- The global increase in autoimmune conditions sustains demand but also intensifies competitive pressures.

- Emerging biosimilars are gaining market share rapidly, compelling AbbVie to innovate in biosimilar development and indication expansion.

- Pricing, regulatory frameworks, and healthcare policies will continue to shape HUMIRA’s market dynamics.

FAQs

1. How has patent expiry affected HUMIRA's revenue trajectory?

The patent expiry in North America and Europe initiated rapid biosimilar entry, leading to over 75% revenue decline within five years, from ~$20 billion in 2018 to an estimated <$6 billion in 2023.

2. What are AbbVie's strategies to sustain revenue beyond patent expiry?

AbbVie is developing its own biosimilars, expanding indications, innovating formulations, and diversifying its biologic portfolio with newer drugs like Skyrizi and Rinvoq to offset revenue declines.

3. How do biosimilars compare to the original biologic in terms of efficacy and safety?

Biosimilars are rigorously tested and approved to demonstrate no clinically meaningful differences in efficacy, safety, and immunogenicity compared to the original biologic, under regulatory standards like the FDA's 351(k) pathway.

4. Which regions are the most lucrative markets for HUMIRA post-patent?

Despite patent loss in the U.S. and EU, markets in Asia-Pacific, Latin America, and select Middle Eastern countries still present growth opportunities due to increasing healthcare access and prevalence of autoimmune conditions.

5. What is the future outlook for Humira in the global biologics market?

Humira's legacy will persist, especially in emerging markets and niches. However, its market share and revenues are expected to diminish significantly in highly mature markets due to biosimilar competition unless strategic measures are implemented.

References

- AbbVie Annual Reports and Quarterly Earnings (2010–2022).

- U.S. Food and Drug Administration (FDA): Approvals and patent information.

- European Medicines Agency (EMA): Biosimilar approval summaries.

- IQVIA Biotech Data: Global biologics market size and forecasts.

- Industry Analyses from Bloomberg, Statista, and Deloitte Reports.

This comprehensive analysis provides a strategic overview of HUMIRA’s market dynamics and financial trajectory, equipping stakeholders with critical insights to navigate the evolving landscape.