Share This Page

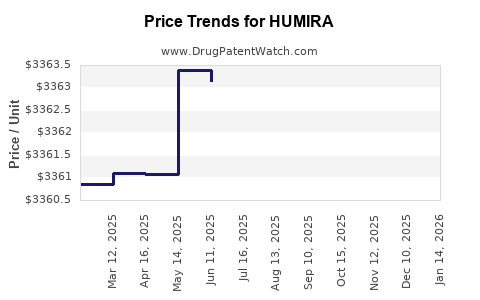

Drug Price Trends for HUMIRA

✉ Email this page to a colleague

Average Pharmacy Cost for HUMIRA

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| HUMIRA 40 MG/0.8 ML SYRINGE | 00074-3799-02 | 3371.02521 | EACH | 2025-12-17 |

| HUMIRA PEN 40 MG/0.8 ML | 00074-4339-02 | 3366.11847 | EACH | 2025-12-17 |

| HUMIRA(CF) PEN 40 MG/0.4 ML | 00074-0554-02 | 3365.92763 | EACH | 2025-12-17 |

| HUMIRA(CF) 40 MG/0.4 ML SYRINGE | 00074-0243-02 | 3366.45250 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Humira (Adalimumab)

Introduction

Humira (adalimumab), developed by AbbVie Inc., remains one of the world's highest-grossing pharmaceuticals, primarily in the immunology and inflammatory disease sectors. Its widespread use in treating conditions such as rheumatoid arthritis, Crohn's disease, psoriatic arthritis, and ulcerative colitis has cemented its status as a flagship biologic. As the landscape of biologic therapies evolves amid patent expirations and biosimilar competition, understanding Humira’s market trajectory and pricing dynamics becomes critical for investors, healthcare payers, and policy-makers.

Market Overview

Global Market Size and Growth Trends

Humira’s global sales reached approximately $20.7 billion in 2022, marking a decline from its peak of over $21.2 billion in 2021 due to the expansion of biosimilar competition in key markets like Europe and the U.S. [1]. Despite revenues waning in some regions, the drug's broad label and extensive indications sustain a sizable and resilient market.

Forecasts project a compound annual growth rate (CAGR) of 3-4% over the next five years, driven by new indications and increased adoption in underserved markets. The global biologics market, expected to reach $370 billion by 2025, further bolsters Humira's market potential [2].

Market Segments and Indications

Humira's primary markets include:

- Rheumatoid arthritis (RA)

- Psoriasis and psoriatic arthritis

- Crohn's disease and ulcerative colitis

- Ankylosing spondylitis

- Juvenile idiopathic arthritis

Biologic therapies like Humira hold a dominant position, owing to high efficacy, but active biosimilar encroachment risks in key regions threaten its market share.

Patent Expiry and Biosimilar Competition

Patent Landscape

Humira's main patents in the U.S. expired in 2023 for most formulations, opening the floodgates for biosimilar entrants. The European market saw first biosimilar approvals in 2018. Leading biosimilars from Samsung Bioepis, Boehringer Ingelheim, and Amgen have entered multiple markets, with more expected through the mid-2020s.

Impact of Biosimilar Entry

The entry of biosimilars has precipitated substantial price erosion:

- In Europe, biosimilar versions now account for over 60% of Humira prescriptions, reducing list prices by up to 80% in some countries [3].

- In the U.S., biosimilars like Amjevita and Cyltezo debuted at approximately 15-20% below reference product pricing but faced delayed uptake due to market penetration challenges and payer negotiations.

Despite initial price drops, brand-name Humira retains pipeline market dominance through rebates and formulary strategies, postponing wholesale substitution until biosimilar manufacturing and distribution channels are robust.

Pricing Strategies and Dynamics

List Price vs. Net Price

Humira's listed price in the U.S. hovered around $6,000 per pen or syringe in 2022. However, owing to rebates, discounts, and patient assistance programs, the net price to payers is considerably lower—estimated at $2,000-$3,000 per dose [4].

European prices vary significantly by country, often influenced by national healthcare negotiations. For instance, in Germany, the net price has fallen by approximately 60% over the last decade.

Biosimilar Pricing Impact

Biosimilars reduce the list price by an average of 20-30% compared to the reference biologic. Payers and healthcare systems increasingly prefer biosimilars for their cost savings, which exerts ongoing downward pressure on Humira’s pricing.

Rebate and Reimbursement Trends

AbbVie employs strategic rebate programs to retain market share in the face of biosimilar competition. These rebates, negotiated with payers, often reach 30-50% of the list price in the U.S., thus affecting the company's gross revenue calculations.

Future Price Projections

United States

Given the imminent biosimilar competition, Humira's U.S. list price is poised to decline significantly over the next three to five years. Industry analysts project:

- 2023-2025: List prices could decrease by 25-30%, with net prices falling more steeply due to rebate adjustments.

- Post-2025: As biosimilar market share consolidates, a further 10-15% annual decline in net price may ensue.

Despite aggressive biosimilar adoption, branded Humira may sustain premium positioning through continued innovation in formulations or extended indications.

Europe and Other Markets

In Europe, price erosion is already evident, with some countries experiencing reductions of up to 80% since biosimilar launches. Future projections suggest:

- Continued price declines of 10-15% annually.

- Potential for consolidation as multiple biosimilars intensify competition.

Emerging markets, where biosimilar penetration is slower, may see more stable pricing, but as generic biologics enter these regions, similar downward trends are expected.

Strategic Outlook and Market Positioning

- Innovation and Indication Expansion: AbbVie’s focus on developing new formulations and expanding clinical indications could help sustain revenue streams beyond biosimilar encroachment.

- Market Diversification: Penetration into less mature markets could offset declining pricing where regulatory and reimbursement frameworks are less mature.

- Pricing Flexibility: Adoption of value-based pricing models and outcomes-based agreements could stabilize net revenues amidst declining list prices.

- Pipeline Development: The evolution of next-generation biologics and biosimilar platforms will influence future price points and market share.

Key Takeaways

- Humira’s market dominance is challenged by patent expirations and biosimilar entries, leading to significant price reductions across key markets.

- Pricing dynamics will transition from list prices to net prices influenced by rebate strategies, with expected declines of up to 30-50% over the next five years.

- Growth prospects depend on new indications, formulations, and expansion into emerging markets amid accelerating biosimilar adoption.

- Payer strategies favor biosimilar substitution, compelling Humira to adapt through value-based contracts and innovation.

- Competitor biosimilars and next-generation biologics will shape the pricing landscape, necessitating continuous market analysis.

FAQs

Q1: How will biosimilar competition impact Humira’s revenue in the next decade?

A: Biosimilar competition is expected to significantly erode Humira's market share, particularly in the U.S. and Europe, leading to substantial price reductions and potential revenue declines of up to 50% over the next five years. However, by expanding indications and formulations, AbbVie aims to mitigate these impacts.

Q2: What strategies are pharmaceutical companies employing to maintain Humira’s market position?

A: Strategies include offering rebate programs, securing formulary placement, developing new formulations (e.g., subcutaneous options), expanding indications, and negotiating value-based pricing agreements with payers.

Q3: How do regional differences affect Humira’s pricing?

A: Pricing varies widely; in Europe, price reductions are more advanced due to earlier biosimilar entry, while in emerging markets, prices remain higher but face downward pressure. Reimbursement policies, regulatory environments, and healthcare budgets influence regional pricing disparities.

Q4: What is the outlook for Humira in markets with slow biosimilar adoption?

A: In markets with limited biosimilar presence, Humira may retain relatively stable pricing and market share longer, especially if the drug continues to expand indications and incorporate innovative delivery methods.

Q5: Can upcoming biosimilars set new price benchmarks?

A: Yes. Upcoming biosimilars with cost-effective manufacturing and superior market penetration could further lower biologic prices globally, exerting heightened pressure on branded products like Humira.

References

[1] AbbVie. (2022). Humira sales report.

[2] GlobalData. (2023). Biologics Market Forecast.

[3] IQVIA. (2022). Biosimilar Market Penetration Data.

[4] EvaluatePharma. (2022). Biologic Pricing and Reimbursement Trends.

More… ↓