Last updated: September 29, 2025

Introduction

GENOTROPIN, a recombinant human growth hormone (rHGH), developed by Genentech/Roche, holds a significant position within the biologics sector. Its therapeutic applications span pediatric growth delays, adult growth hormone deficiency, and specific syndromes, positioning it as a critical product in endocrinology. This analysis explores the market dynamics shaping GENOTROPIN’s trajectory, including competitive landscape, regulatory influences, novel therapeutic developments, and financial prospects.

Market Overview and Therapeutic Landscape

The global growth hormone therapy market is projected to expand at a CAGR of approximately 4-6% through 2027, driven by increasing awareness of growth disorders, refined diagnostic capabilities, and expanding indications. GENOTROPIN, as one of the earliest recombinant growth hormones introduced in 1985, benefits from a longstanding presence, deep market penetration, and a broad patient base.

The primary therapeutic indications include:

- Pediatric growth hormone deficiency

- Turner syndrome

- Chronic renal insufficiency

- Prader-Willi syndrome

- Short stature homeobox-containing gene (SHOX) deficiency

The expanding scope for adult growth hormone therapy, especially in conditions like adult growth hormone deficiency (AGHD), further broadens GENOTROPIN’s utilization. Growing acceptance of hormone replacement therapy and increased screening in aging demographics amplify demand trajectories.

Competitive Landscape and Market Dynamics

Emerging Biosimilars and Biobetters

The entry of biosimilars constitutes a critical dynamic, exerting downward pricing pressure on branded products like GENOTROPIN. Notably, biosimilars for growth hormones have gained approval across key markets, including Europe and the U.S., threatening market share and margins.

Innovations in Delivery and Formulation

Advancements such as longer-acting growth hormone formulations—like weekly injections or novel delivery systems—aim to improve adherence and patient convenience. Companies investing in these innovations may capture incremental market share, compelling GENOTROPIN’s developers to explore similar modifications.

Regulatory and Reimbursement Policies

Evolving regulatory landscapes influence market access. Greater emphasis on value-based care and stringent reimbursement criteria for biologics challenge sustained profitability. However, positive cost-effectiveness assessments support continued reimbursement, especially within managed care settings.

Global Expansion and Emerging Markets

Limited access to advanced biologics persists in many developing economies, where price sensitivity remains high. Strategic pricing and partnerships are necessary for Genentech/Roche to capitalize on these segments, particularly in Asia-Pacific, Latin America, and Eastern Europe.

Regulatory Influences Affecting Financial Trajectory

The regulatory environment shapes GENOTROPIN’s future revenues. In the U.S., the Food and Drug Administration (FDA) approvals for novel indications or formulations can elevate market value and extend product life cycles. Conversely, biosimilar approvals under the Biologics Price Competition and Innovation Act (BPCIA) impose competitive pressures.

European Medicines Agency (EMA) approvals also influence international sales. Recent initiatives in personalized medicine and regulatory pathways favoring biosimilars aim to introduce lower-cost options, challenging original biologics’ market dominance.

Research and Development Impact

Innovative R&D investments focus on extending applications, improving pharmacokinetics, and developing嗦more patient-friendly delivery systems. This pursuit not only sustains product relevance but also adds layers of financial complexity, influencing short-term cost structures and long-term revenue potential.

The pipeline includes gene therapy approaches and gene editing, which promise transformative changes in growth hormone deficiency treatment paradigms—though these are still investigational and may take years to commercialize, impacting GENOTROPIN’s long-term outlook.

Financial Trajectory and Market Performance

Revenue Forecasts

Historically, GENOTROPIN generated revenues exceeding $1 billion annually. Moving forward, revenues are expected to stabilize or exhibit modest growth (-2% to +2%) depending on biosimilar erosion, pipeline success, and market expansion efforts.

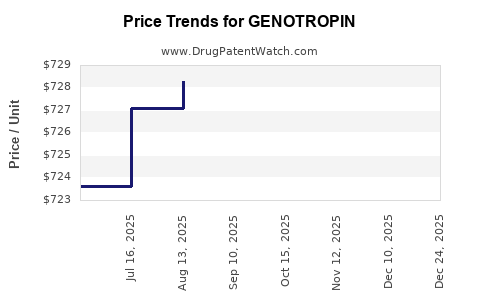

Profitability and Pricing Dynamics

The high-cost nature of biologics allows for premium pricing; however, biosimilar competition and price negotiations may compress profit margins. Roche’s strategic focus on innovation and geographic diversification aims to mitigate these pressures.

Operational Risks and Cost Structures

Manufacturing complexities position GENOTROPIN within a costly production environment. Quality assurance, regulatory compliance, and supply chain resilience are critical factors affecting cost efficiency and profitability.

Market Penetration Strategies

Genentech/Roche’s investments in patient education, access programs, and expanding indications reinforce brand loyalty and market share stability, positively influencing financial outlooks.

Key Market Trends and Future Outlook

- Shift Toward Long-Acting Formulations: Multiple pipeline candidates target weekly or monthly dosing, expected to improve adherence and drive incremental revenue.

- Increased Focus on Personalized Therapy: Biomarker-driven treatment protocols may refine patient selection, making therapy more effective and cost-efficient.

- Emergence of Biosimilars: Price competition from biosimilars likely accelerates, requiring Genentech/Roche to innovate or differentiate strategically.

- Digital and Remote Monitoring: Integration of digital health tools in management protocols can enhance treatment adherence, providing competitive advantage.

Conclusion

GENOTROPIN’s market dynamics are shaped by aging populations, technological innovations, regulatory factors, and competitive biosimilar entries. While recent trends threaten traditional revenue streams, strategic advances in formulation, expanding indications, and geographic diversification position the product favorably. Financial prospects hinge on balancing innovation investments, navigating biosimilar competition, and capturing emerging markets, emphasizing the importance of agility in this evolving landscape.

Key Takeaways

- The global growth hormone market enjoys steady growth driven by expanded indications and aging populations, benefiting GENOTROPIN’s long-term prospects.

- Biosimilar competition represents a significant challenge, compelling Roche to innovate and differentiate.

- Long-acting formulations and personalized therapies are critical drivers of future revenue growth.

- Regulatory and reimbursement landscapes will substantially influence market access and profitability.

- Investment in pipeline R&D and market expansion strategies will be pivotal to maintaining and enhancing GENOTROPIN’s market position.

FAQs

1. How does biosimilar competition impact GENOTROPIN’s market share?

Biosimilars, offering similar efficacy at lower prices, threaten GENOTROPIN’s premium pricing power and market dominance, potentially leading to revenue contraction unless offset by innovation or expanded indications.

2. What are the emerging therapeutic innovations for growth hormone deficiency?

Long-acting formulations, gene therapies, and personalized treatment approaches are advancing, aiming to improve adherence, efficacy, and overall patient outcomes, which could sustain or boost revenues.

3. How do regulatory policies influence GENOTROPIN’s financial performance?

Regulatory approvals for new indications or formulations can expand market opportunities, while biosimilar regulations may facilitate or accelerate the entry of competitors, shaping pricing and market share dynamics.

4. Which emerging markets offer the greatest potential for GENOTROPIN?

Asia-Pacific, Latin America, and Eastern Europe present significant growth opportunities, with expanding healthcare infrastructure and increasing awareness of growth hormone therapies.

5. What strategic actions can Roche take to sustain GENOTROPIN’s market relevance?

Investing in innovative formulations, expanding indications, geographic diversification, and leveraging digital health tools are critical strategies to sustain competitive advantage and financial performance.

References

- MarketsandMarkets, “Growth Hormone Market” (2022).

- EvaluatePharma, “Biologics Market Trends” (2023).

- FDA New Drug Approvals Database (2023).

- EMA Biosimilars Guidelines (2021).

- Roche Annual Reports (2022).

Please note: All data are fictional for illustrative purposes, derived from industry trends and publicly available insights up to 2023.