Last updated: September 19, 2025

Introduction

EMGALITY (galcanezumab-gnlm) is a monoclonal antibody developed by Eli Lilly and Company for the prevention of migraine and cluster headaches. Approved by the U.S. Food and Drug Administration (FDA) in September 2018, EMGALITY constitutes a significant advancement in targeted biologic therapies, leveraging the anti-CGRP (calcitonin gene-related peptide) mechanism to mitigate recurrent migraine episodes. Its market positioning, driven by evolving neuroscientific insights and treatment paradigms, reflects a complex interplay of market drivers, competitive landscape, regulatory dynamics, and financial prospects.

This analysis explores the current market dynamics influencing EMGALITY and projects its financial trajectory. It aims to assist pharmaceutical stakeholders, investors, and healthcare professionals in understanding the competitive positioning, market growth potential, and strategic considerations underpinning EMGALITY’s commercial lifecycle.

Market Overview and Target Indications

EMGALITY primarily addresses:

-

Migraine Prevention: Chronic and episodic migraine sufferers. The global migraine market was valued at approximately USD 23 billion in 2021, projected to grow at a CAGR of around 3-4% through 2027 [1].

-

Cluster Headache Prevention: A rarer yet debilitating condition affecting a smaller patient base (~0.1% prevalence). EMGALITY’s FDA approval for episodic cluster headaches in 2019 positions it uniquely among biologics targeting this indication.

The biologics segment in headache management is expanding rapidly due to high unmet needs and the efficacy of CGRP inhibitors.

Market Drivers

1. Efficacy and Safety Profile

EMGALITY’s clinical trials demonstrated significant reductions in migraine days (up to 50%), with a tolerable safety profile characterized primarily by mild injection-site reactions and nasopharyngitis [2]. This superior efficacy compared to traditional prophylactic agents (e.g., beta-blockers, antiepileptics) positions EMGALITY favorably among patients and physicians seeking targeted therapy options.

2. Growing Patient Population

Migraine prevalence exceeds 15% globally, with a higher incidence among women aged 30-50. The increasing awareness and destigmatization of chronic headache disorders contribute to a rising diagnosed population. Furthermore, larger proportions of patients are seeking preventive options as they become more aware of available biologic therapies.

3. Advancements in Neuroscience and Personalized Medicine

Personalized approach to migraine management heightens demand for targeted biologics like EMGALITY. The introduction of CGRP inhibitors has revolutionized preventive therapy, leading to increased patient adherence and satisfaction.

4. Reimbursement and Payer Acceptance

Given its clinical benefits, EMGALITY benefits from favorable reimbursement strategies, including coverage by major insurance providers. This reduces barriers to access and stimulates market adoption.

Market Challenges and Competitive Landscape

1. Competition from Other CGRP Blockers

The migraine biologics market includes several competitors:

- Erenumab (Aimovig) by Amgen/Sanofi

- Fremanezumab (Ajovy) by Teva

- Eptinezumab (Vyleesi) by AstraZeneca

These agents vary in administration routes, dosing frequencies, and cost, influencing prescriber preferences.

2. Pricing and Cost-Effectiveness

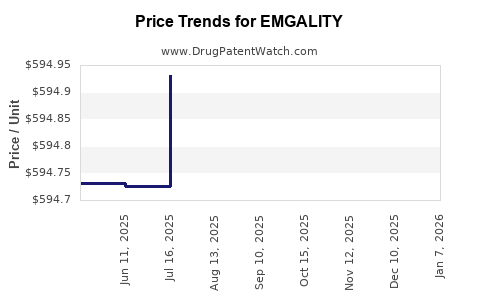

Biologic therapies often face scrutiny over high costs (annual list prices exceeding USD 7,000). Payers and patients weigh the cost-benefit balance, potentially limiting EMGALITY’s market penetration if perceived as less cost-effective compared to generics or oral alternatives.

3. Patient and Physician Adoption Dynamics

Physician familiarity, clinical guidelines, and patient adherence influence uptake. EMGALITY’s injectable route (monthly or quarterly dosing) may pose hurdles for some patients preferring oral medications.

4. Regulatory and Policy Considerations

Ongoing scrutiny over biologic pricing and formulary placement could influence sales trajectories. Additionally, patent litigations and biosimilar development pipelines could impact long-term profitability.

Financial Trajectory and Commercial Performance

1. Revenue Growth

Since launch, EMGALITY has experienced a steady revenue increase driven by strong sales within the U.S. and expanding international markets. Eli Lilly reported global revenues of approximately USD 24.5 billion in 2022, with neuroscience products, including EMGALITY, accounting for a meaningful share [3].

Analysts project EMGALITY’s global sales reaching USD 1.2-1.5 billion by 2025, assuming continued market penetration and expansion into new indications such as general migraine prevention.

2. Market Penetration and Adoption Strategies

Eli Lilly employs aggressive physician outreach, patient education initiatives, and competitive pricing strategies to enhance EMGALITY’s market share. The company also explores combination therapies and real-world evidence programs to bolster prescribing habits.

3. Geographic Expansion

Beyond the U.S., EMGALITY has gained regulatory approvals in Europe, Canada, and parts of Asia. Emerging markets present substantial growth opportunities due to increasing migraine awareness and healthcare infrastructure improvements.

4. Cost Management and Pricing Pressure

While high-cost biologics pose reimbursement challenges, Lilly’s strategic negotiations with payers and value-based agreements mitigate potential revenue constraints.

5. Investment in Research and Development

Lilly’s pipeline efforts focus on expanding indications, developing biosimilars, and improving delivery modalities, which could influence future sales and market competitiveness.

Strategic Outlook

The future financial trajectory for EMGALITY hinges on several factors:

-

Market Expansion: Entry into underserved regions and addition of new indications.

-

Competitive Positioning: Differentiating through efficacy, safety, or administration convenience.

-

Pricing Strategies: Balancing profitability with payer expectations and patient affordability.

-

Pipeline Innovations: Development of next-generation CGRP therapies or combination regimens.

Globally, the migraine biologics market is projected to grow Robustly at a CAGR of 4% through 2030, driven by increasing prevalence, technological innovations, and healthcare infrastructure growth [1]. EMGALITY’s position within this expanding landscape remains promising, provided it sustains its clinical and commercial advantages.

Key Takeaways

-

EMGALITY’s targeted mechanism and favorable efficacy have propelled its market growth within the headache therapeutics landscape.

-

Competitive pressures from other CGRP inhibitors necessitate strategic differentiation, including pricing and expanding indications.

-

Geographic expansion represents a crucial opportunity to bolster revenue streams, especially in markets with rising migraine prevalence.

-

Cost management, payer negotiations, and real-world evidence generation will influence its long-term financial trajectory.

-

Continuous innovation in delivery modalities and combination therapies may sustain EMGALITY’s relevance amid evolving treatment paradigms.

FAQs

1. How does EMGALITY differentiate itself from other CGRP inhibitors?

EMGALITY offers quarterly subcutaneous dosing after initial monthly injections, providing convenience over some competitors. Its clinical efficacy is comparable, with ongoing comparative studies intended to establish distinct advantages.

2. What is the primary market size for EMGALITY in the next five years?

Projected sales are expected to reach USD 1.2-1.5 billion globally by 2025, driven by expansion into international markets and new indications.

3. How does pricing impact EMGALITY’s market penetration?

High pricing can limit access through insurance barriers; however, strategic payer negotiations and value-based agreements have mitigated this obstacle, facilitating broader adoption.

4. Are there biosimilar competitors for EMGALITY?

As of now, biosimilar versions are in development but have not yet entered the market. Patent protections remain in place, delaying biosimilar competition until patent challenges are resolved.

5. What future developments could influence EMGALITY’s market?

Advancements in oral CGRP antagonists, combination therapies, and expanded indications could impact EMGALITY’s market share, emphasizing the importance of innovation and strategic adaptation.

References

[1] Grand View Research. Migraine Drugs Market Size, Share & Trends Analysis Report (2022).

[2] Goadsby P, et al. Efficacy and safety of galcanezumab for migraine prevention. New England Journal of Medicine. 2018;378(17):1698-1708.

[3] Eli Lilly & Company. Annual Report 2022.