Last updated: September 25, 2025

Introduction

AVONEX (interferon beta-1a), developed by Biogen Idec (now Biogen), stands as one of the pioneering biologic therapies for multiple sclerosis (MS). Since its approval in 1996, AVONEX has significantly influenced the MS treatment landscape, serving as a foundation for disease-modifying therapies (DMTs). Understanding the evolving market dynamics and financial trajectory of AVONEX provides critical insights into its current positioning and future prospects within the competitive biologic segment.

Market Landscape and Competitive Dynamics

1. Historical Positioning and Market Penetration

Initially, AVONEX dominated the MS biologics market due to its early entry and proven efficacy. As a subcutaneous injectable administered weekly, it established a reputation for reliability and safety, securing longstanding physician and patient trust. Over the subsequent decades, AVONEX maintained significant market share, especially among patients with relapsing-remitting MS (RRMS) who preferred established biologic options.

2. Competitive Landscape Evolution

The MS biologic market has rapidly expanded, now featuring over two dozen therapies including oral agents, monoclonal antibodies, and newer biologics. Key competitors include Betaseron (Bayer), Rebif (Eli Lilly), glatiramer acetate (Copaxone, Teva), and monoclonal antibodies such as Ocrevus (Roche/Genentech) and Mavenclad (Eisai). Notably, oral therapies like Tecfidera (Biogen) and Gilenya (Novartis) gained popularity due to ease of administration, putting pressure on injectable therapies like AVONEX.

3. Regulatory and Pricing Pressures

Regulatory agencies have increasingly scrutinized biologic pricing, especially as biosimilars enter the market globally. Although biosimilar versions of interferon beta-1a have yet to significantly impact AVONEX’s market share—primarily due to patent exclusivities and manufacturing complexities—they pose potential future threats. Additionally, healthcare systems’ push toward cost-effective treatment options influences the DNA of MS therapy procurement strategies.

4. Therapeutic Paradigm Shift

The landscape shifts toward high-efficacy treatments such as Ocrevus and Kesimpta, which demonstrate superior efficacy in reducing relapses and disease progression. These have gradually drawn patients away from conventional therapies like AVONEX, especially among newly diagnosed patients seeking aggressive treatment.

Financial Trajectory and Revenue Performance

1. Historical Revenue Trends

Biogen’s revenues from AVONEX constituted a significant revenue stream through the 2000s and early 2010s. For years, AVONEX contributed substantially to Biogen’s top line, with peak global revenues exceeding $3 billion annually. However, these figures have experienced a gradual decline, influenced by:

- Increased competition from high-efficacy agents

- Market saturation

- Pricing pressures and reimbursement hurdles

- Patent expirations in several key jurisdictions

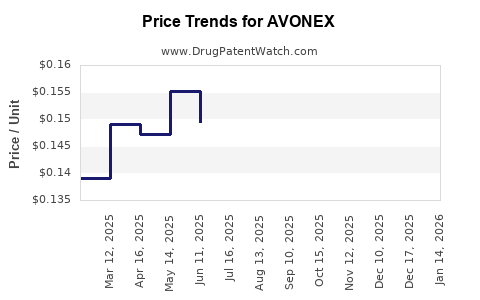

2. Recent Revenue Dynamics

In 2022, AVONEX’s global revenue declined to approximately $1.2 billion, representing a decline of nearly 50% from its peak. The U.S. remains its primary market, with Europe and emerging markets showing mixed performance.

3. R&D and Product Lifecycle Management

Biogen’s strategic response involves diversifying its portfolio into innovative therapies, including anti-amyloid treatments like Aducanumab for Alzheimer’s, and expansion into neuromuscular and neurodegenerative disorder therapeutics. Although AVONEX’s revenue diminishes, it remains profitable, supporting R&D investments.

4. Impact of Biosimilars and Patent Expiries

The expiration of key patents—principally in Europe—has led to the emergence of biosimilars, which exert downward pricing pressure. While biosimilars for interferon beta-1a are in development, they have yet to significantly erode AVONEX’s market share, partly due to limited biosimilar approvals and patent litigations.

Strategic Outlook and Future Market Dynamics

1. Market Share Growth and Retention Strategies

Biogen has employed various strategies to sustain AVONEX’s market share:

- Formulation and Delivery Enhancements: Improving injection devices for better patient adherence.

- Patient Support Programs: Enhancing compliance through education and support.

- Market Expansion: Targeting emerging markets with tailored pricing models.

However, the overall trend favors high-efficacy treatments, implying steady erosion of AVONEX’s market presence.

2. Regulatory Developments and Biosimilar Competition

The global regulatory landscape is intensifying scrutiny of biologic medicines. The approval of biosimilars could threaten AVONEX’s revenue in regions with cost-sensitive healthcare systems. Nevertheless, patent litigations and manufacturing complexities may delay biosimilar market entry.

3. Innovation and Pipeline Developments

Biogen’s pipeline includes next-generation interferons and combination therapies, potentially extending the lifecycle of MS biologics. Investment in precision medicine approaches and biomarkers could also refine patient selection, optimizing AVONEX’s clinical positioning.

4. Financial Outlook

Based on current trends, AVONEX revenue is projected to decline at an annual rate of 5-10% over the next five years, reflecting increased competition and market saturation. However, it will likely remain a minimally impactful, stable component of Biogen’s overall portfolio, especially as the company diverts focus towards emerging therapeutic areas.

Key Market Drivers Influencing Future Trajectory

- Patent expiries and biosimilar entry: Could accelerate revenue decline if biosimilars gain approval.

- Efficacy and safety profiles: High efficacy agents may displace AVONEX for new patients.

- Treatment paradigm shifts: The increasing preference for oral and high-efficacy injectable therapies.

- Regulatory and reimbursement environment: Cost containment initiatives may prioritize newer, high-cost therapies over age-old biologics.

- Global market expansion: Emerging markets present untapped growth potential, provided affordability barriers are addressed.

Conclusion

AVONEX’s market dynamics exemplify the maturation and evolution of biologic therapies within the MS space. While historically a blockbuster drug generating substantial revenue for Biogen, its dominance is waning amid fierce competition, regulatory challenges, and shifting clinical preferences. Although it remains part of Biogen’s revenue landscape, future growth prospects depend on strategic adaptation—including pipeline innovation, market expansion, and cost management. The biologic’s financial trajectory over the next decade likely favors a gradual decline unless disruptive innovations or new indications emerge that rejuvenate its commercial viability.

Key Takeaways

- AVONEX's peak revenue achieved over $3 billion annually but declined approximately 60% due to market saturation and competition.

- The entry of high-efficacy therapies, biosimilars, and oral agents constrains AVONEX’s growth potential.

- Patent expirations and regulatory hurdles pose threats to its market exclusivity.

- Biogen’s strategic pivot towards innovative neurotherapies will underpin its long-term revenue diversification, with AVONEX maintaining a smaller, steady revenue stream.

- Emphasizing patient adherence, global expansion, and pipeline innovation remains critical for prolonging AVONEX’s market relevance amidst evolving dynamics.

FAQs

1. What are the primary factors driving the decline of AVONEX’s market share?

The rise of high-efficacy oral and injectable therapies, patent expirations leading to biosimilar entry, and shifting treatment paradigms favoring aggressive disease management diminish AVONEX’s market dominance.

2. How does biosimilar competition affect AVONEX’s financial outlook?

Biosimilars threaten to reduce pricing power and market share, especially in cost-conscious regions. Although biosimilars for interferon beta-1a have yet to be widely introduced, their approval could accelerate revenue declines.

3. Is AVONEX still a profitable product for Biogen?

Yes, despite declining revenues, AVONEX remains profitable due to established manufacturing processes and existing market presence, providing a financial cushion for Biogen’s broader portfolio.

4. What role does geographical expansion play in AVONEX’s future?

Emerging markets offer growth opportunities as healthcare systems expand access; however, affordability and local regulatory landscapes influence these prospects.

5. What strategic measures can sustain AVONEX’s relevance?

Enhancing formulation, patient support, exploring new indications, and integrating personalized medicine approaches can help maintain its clinical importance and revenue stability.

Sources

[1] Biogen Annual Report 2022.

[2] MarketWatch, “Multiple Sclerosis Therapeutics Market Analysis,” 2022.

[3] FDA and EMA drug approvals database.

[4] IMS Health Data, “Global MS Treatment Market,” 2022.

[5] Industry Expert Commentary, “The Future of MS Biologics,” 2023.