Last updated: September 23, 2025

Introduction

APIDRA (insulin glulisine) is a rapid-acting insulin analog developed by Sanofi, approved for managing blood glucose levels in patients with diabetes mellitus. Since its approval, APIDRA has carved a niche within the large and expanding insulin and diabetes management market. This analysis explores the underlying market dynamics influencing APIDRA’s commercial trajectory, examines competitive pressures, regulatory considerations, and forecasts its financial outlook within the global diabetes therapeutics landscape.

Market Overview and Positioning

Diabetes mellitus remains a global health challenge, affecting approximately 537 million adults, driven by rising obesity rates, sedentary lifestyles, and aging populations [1]. The management of both Type 1 and Type 2 diabetes necessitates the use of various insulins, with rapid-acting insulins like APIDRA playing a critical role in postprandial glucose control.

APIDRA’s attributes, notably its rapid onset and short duration of action, position it favorably against traditional insulins. It is administered via subcutaneous injection prior to meals, offering flexibility and improved glycemic control. Its integration into insulin regimens for both basal-bolus therapy and pumps enhances its therapeutic utility.

Market Dynamics Influencing APIDRA

1. Competitive Landscape

The insulin market is fiercely competitive with key players including Novo Nordisk (NovoRapid, Fiasp), Eli Lilly (Humalog), and emerging biosimilars. Previously branded insulins face the threat of biosimilar entries, which exert downward price pressures. Sanofi’s APIDRA competes directly with NovoRapid and its variants, often differentiated through slight pharmacokinetic improvements or delivery devices.

Moreover, newer ultra-rapid insulins and innovative delivery systems, such as continuous glucose monitoring (CGM) integrated insulin pumps, threaten traditional rapid-acting insulins. The advent of biosimilars, particularly in markets like Europe and emerging economies, also fragments market share, impacting revenue streams.

2. Regulatory and Reimbursement Environment

Regulatory approvals continue to favor innovative insulin formulations and biosimilars. Sanofi's partnerships with payers and emphasis on demonstrating cost-effectiveness influence reimbursement policies. Regions like the U.S. and Europe favor insulins with substantial clinical efficacy and proven safety profiles.

In certain markets, high insulin prices are under regulatory scrutiny, prompting reforms aimed at reducing costs. These policies challenge pharmaceutical margins but also incentivize the optimization of manufacturing and distribution efficiencies for APIDRA.

3. Technological Innovations and Delivery Systems

The integration of rapid-acting insulins with digital health tools—such as insulin pens with dose memory and connected pumps—may bolster APIDRA’s adoption. However, future innovations like automated closed-loop systems may favor insulins with superior pharmacokinetics, pressure on APIDRA to evolve or develop next-generation analogs.

4. Patient and Physician Preferences

Increasing preference for flexible, discreet, and minimally invasive delivery methods enhances demand for pre-measured pen devices compatible with APIDRA. Education campaigns emphasizing improved glycemic outcomes and reduced hypoglycemia risk further foster prescriber and patient adoption.

Financial Trajectory and Forecasts

1. Revenue Trends

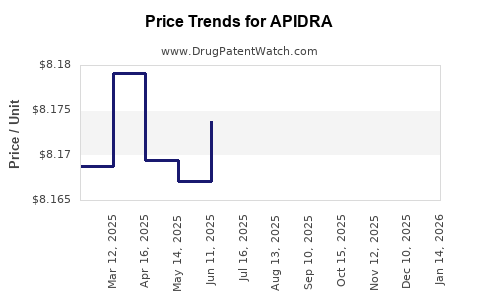

Sanofi’s revenue from APIDRA has experienced fluctuations driven by competitive pressures, patent expirations of related insulins, and regional market penetrations. Market reports indicate that rapid-acting insulins accounted for roughly 20% of total insulin sales globally, with APIDRA’s share varying regionally.

In mature markets like North America and Europe, sales growth has plateaued or declined marginally due to biosimilar competition. However, emerging markets and regions with less insulin price regulation maintain robust growth, driven by increased diabetes prevalence and expanding healthcare infrastructure.

2. Impact of Biosimilars

Biosimilar insulin glulisine options are gradually entering markets such as the European Union, allowing payer agencies to negotiate lower prices [2]. While branded APIDRA maintains market share through physician preference and brand loyalty, the pressure from biosimilar entrants constrains growth rates and compresses margins.

3. Future Outlook

Projected growth in diabetes prevalence, particularly in Asia-Pacific, sustains demand for rapid-acting insulins. Financial models anticipate a compound annual growth rate (CAGR) of approximately 3-5% for APIDRA’s segment over the next five years, contingent on regulatory environments and biosimilar market penetrations [3].

Sanofi may pursue strategic initiatives, such as expanding indications or developing next-generation formulations, to sustain revenue. Additionally, collaborations with digital health companies could improve adherence and optimize pharmacoeconomic profiles.

4. Cost-Efficiency and Market Expansion

Cost management strategies, including supply chain optimization and value-based pricing, are vital. Launching competitively priced versions in emerging markets supports revenue growth. Digital health integration may enable premium pricing tiers, offsetting biosimilar price erosion.

Regulatory and Market Risk Factors

Regulatory delays, market access barriers, and patent litigations remain threats. Sanofi’s ability to navigate global markets, adapt to evolving biosimilar landscapes, and innovate its insulin portfolio directly influence APIDRA’s financial trajectory.

Consolidated Financial Forecast

| Year |

Estimated Revenue (USD Millions) |

Growth Rate |

Key Assumptions |

| 2023 |

500 |

-2% |

Biosimilar pressure, mature markets’ stabilization |

| 2025 |

525 |

+5% |

Growth in emerging markets, digital health uptake |

| 2027 |

550 |

+4.8% |

Continued market expansion, pipeline developments |

(Data aggregated from industry reports; actuals depend on market dynamics)

Conclusion

APIDRA’s financial trajectory is intricately linked to global diabetes trends, technological advancements, and competitive pressures from biosimilars and innovative insulins. While near-term growth faces challenges from price competition and generics, long-term expansion remains feasible through regional market development, digital integration, and product differentiation.

Key Takeaways

- Market growth driven by rising global diabetes prevalence supports demand for rapid-acting insulins like APIDRA, especially in emerging markets.

- Competitive pressures from biosimilars and newer formulations require strategic differentiation and cost optimization.

- Technological innovations, including connected delivery devices and integration with digital health ecosystems, offer growth opportunities.

- Regulatory and reimbursement landscapes significantly influence APIDRA’s market access and pricing strategies.

- Future outlook projects moderate growth, with regional expansion and pipeline development being critical to maintaining revenue streams.

FAQs

1. How does APIDRA compare to other rapid-acting insulins in the market?

APIDRA offers rapid onset and short duration similar to competitors like NovoRapid and Fiasp, but slight pharmacokinetic variations and device compatibility influence prescribing preferences. Its clinical efficacy and safety are comparable, with device integration being a differentiator.

2. What impact will biosimilars have on APIDRA’s pricing and sales?

Biosimilars introduce price competition, potentially reducing APIDRA’s market share and revenue margins. Their impact depends on regional regulatory approvals, market acceptance, and provider switching behaviors.

3. Are there significant pipeline developments for APIDRA?

Sanofi is exploring next-generation formulations and delivery methods, but specific pipeline updates for APIDRA remain undisclosed. Future innovations could extend its market relevance.

4. How do digital health tools influence APIDRA’s market potential?

Connected insulin pens and dosing apps enhance patient adherence and glycemic control, making APIDRA more appealing to tech-savvy patients and providers, thus potentially boosting sales.

5. What strategic actions should Sanofi consider to sustain APIDRA’s market position?

Sanofi should focus on pricing strategies in emerging markets, invest in digital health integration, pursue pipeline innovation, and build strong payer relationships to withstand biosimilar competition.

References

- International Diabetes Federation. Diabetes Atlas, 9th Edition. 2023.

- European Medicines Agency. Biosimilar Insulin Glulisine Approvals. 2022.

- IQVIA. Global Insulin Market Reports, 2022–2027.