Last updated: September 29, 2025

Introduction

AJOVY (fremanezumab-vfrm) is a monoclonal antibody developed by Teva Pharmaceuticals, approved for the prevention of migraine in adults. As a novel biologic targeting the calcitonin gene-related peptide (CGRP) pathway, AJOVY has garnered notable attention within the competitive landscape of migraine therapeutics, which includes both biologics and oral medications. Understanding its market dynamics and financial prospects involves dissecting the migraine treatment paradigm, competitive positioning, regulatory environment, and broader industry trends influencing biologic pharmaceuticals.

Market Landscape and Therapeutic Context

Migraine Market Overview

Migraine affects approximately 1 billion individuals globally—representing a multibillion-dollar market [1]. Historically, prophylactic options were limited to oral modalities such as beta-blockers, antidepressants, and anticonvulsants, often marred by suboptimal efficacy and tolerability issues. The advent of CGRP inhibitors revolutionized preventive therapy, with FDA approvals for agents like erenumab, fremanezumab (AJOVY), galcanezumab, and eptinezumab occurring between 2018 and 2020.

Biologics in Migraine Prevention

AJOVY's primary distinction lies in its subcutaneous quarterly or monthly dosing, which aligns with patient preferences for convenience. Its targeting of CGRP, a neuropeptide central to migraine pathophysiology, has demonstrated significant efficacy. The biologic's competitive edge is strengthened by its FDA approval for both episodic and chronic migraine, with initial safety profiles favoring tolerability.

Market Penetration and Adoption

AJOVY’s uptake is influenced by prescriber familiarity, insurance reimbursement policies, and patient awareness. Teva's established presence in the pharmaceutical ecosystem offers a competitive advantage. However, competition from other CGRP monoclonal antibodies, notably erenumab (Aimovig), galcanezumab (Emgality), and eptinezumab (Vyepti), limits market share growth. The differentiation primarily hinges on administration frequency, reimbursement landscape, and clinical efficacy perceptions.

Market Dynamics: Drivers and Challenges

Key Drivers

- Efficacy and Safety Profile: Clinical trials have demonstrated AJOVY’s substantial reduction in migraine frequency, consolidating its standing as a preferred preventive therapy [2].

- Patient Preference and Compliance: Quarterly and monthly dosing options enhance adherence, a critical factor for chronic disease management.

- Expanding Indications: Ongoing research for use in other neurological conditions could diversify revenue streams.

- Healthcare Policies and Reimbursement: Increasing recognition of biologics’ cost-effectiveness via reduced migraine-related burden enhances reimbursement prospects.

Challenges

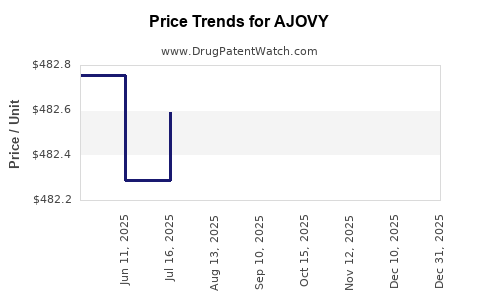

- Pricing Pressure: The high cost typical of biologics exerts pressure on pricing strategies, especially in publicly insured populations.

- Market Competition: Intense rivalry from alternative CGRP inhibitors, as well as emerging oral treatments like gepants and ditans, diminishes market share growth potential [3].

- Generics and Biosimilars: Although biosimilars are still developing for CGRP mAbs, future competition could impact revenues.

- Prescriber and Patient Awareness: Slow adoption trends and variation in prescribing habits challenge rapid market penetration.

Financial Trajectory and Revenue Projections

Revenue Estimation Framework

Forecasting AJOVY’s financial trajectory involves analyzing demand growth, pricing strategies, reimbursement rates, and competitive displacement. Market research indicates the rapid expansion of the CGRP inhibitor segment, with global migraine prophylactic biologics expected to grow at a CAGR of around 9% through 2030 [4].

Current Revenue Position

Teva has not publicly disclosed detailed sales figures for AJOVY; however, estimates from industry analysts suggest revenues in the mid-hundred-million USD range in 2022, with gradual growth anticipated as awareness and reimbursement improve. The drug’s market share is estimated at approximately 4-8% within the global CGRP inhibitor segment.

Projection Scenarios

- Optimistic Scenario: With increased physician adoption, expanded insurance coverage, and potential new indications, annual revenues could surpass $500 million by 2025.

- Conservative Scenario: Market saturation, price competition, and slow adoption could limit revenues to under $300 million annually over the same period.

Impact of Emerging Competition

The entrance of oral CGRP antagonists (gepants, e.g., rimegepant and ubrogepant) and novel therapies poses a continuous threat to biologic dominance. As they offer comparable efficacy with oral administration, they may erode AJOVY’s market share unless differential value or combination strategies are established.

Regulatory and Market Access Strategies

Regulatory Approvals and Expansions

Continued approval for pediatric use and additional indications (e.g., cluster headache) could provide significant revenue uplifts. Regulatory hurdles remain manageable in mature markets, with FDA and EMA reviews reinforcing confidence.

Reimbursement Landscape

Negotiations with healthcare insurers are critical. Value-based pricing models, emphasizing reduced migraine-related healthcare utilization and improved quality of life, are pivotal for favorable reimbursement terms. Market access initiatives are vital for expanding patient populations.

Industry Trends Influencing Financial Trajectory

- Personalized Medicine: Biomarker-driven patient stratification could optimize AJOVY’s usage, increasing efficacy perception and payer willingness to reimburse.

- Direct-to-Consumer (DTC) Marketing: Educational campaigns enhance awareness but face strict regulations around drug promotion.

- Digital Health Integration: Telemedicine and app-based adherence tools amplify drug engagement, indirectly boosting revenue.

Key Competitor and Market Outlook

Competitive Positioning

AJOVY’s differentiation is based on dosing flexibility and safety profile, but market penetration remains challenged by heftier competitors with longer track records. The rising presence of oral CGRP antagonists — which are often less expensive and easier to administer — complicates the market landscape.

Long-term Outlook

Despite competitive pressures, AJOVY’s role in a diversified migraine therapy portfolio remains promising. Growth hinges on geographic expansion, indication broadening, and strategic payer negotiations.

Key Takeaways

- Market dynamics favor biologics like AJOVY, supported by efficacy, safety, and patient adherence advantages.

- Competitive landscape is intense, with oral CGRP antagonists and other emerging therapies eroding market share potential.

- Financial growth prospects depend on expanding indications, improving reimbursement, and strengthening prescriber awareness.

- Industry trends toward personalized medicine and digital health are integral to optimizing revenue trajectories.

- Teva’s strategic focus on market access and geographic expansion will be crucial in maximizing AJOVY’s commercial potential.

FAQs

1. What differentiates AJOVY from other CGRP inhibitors?

AJOVY offers flexible dosing options—monthly or quarterly subcutaneous injections—that enhance patient adherence and convenience, distinguishing it from competitors primarily offering monthly or quarterly regimens.

2. How does the cost of AJOVY impact its market penetration?

As with most biologics, high pricing can limit access, especially under strict payer constraints. Cost-effectiveness analyses demonstrating reductions in migraine-related healthcare utilization are essential to secure broader reimbursement.

3. Are there upcoming indications that could boost AJOVY’s sales?

Yes, ongoing clinical trials are exploring AJOVY for cluster headaches and pediatric migraine, which could expand its market if approved, offering new revenue streams.

4. How does the competition from oral migraine medications affect AJOVY’s market share?

Oral CGRP antagonists provide a non-injectable alternative with comparable efficacy, appealing to patients hesitant about injections, thereby challenging AJOVY’s growth potential unless differentiation strategies are employed.

5. What regulatory hurdles could influence AJOVY’s financial outlook?

Regulatory delays or limitations in expanding approvals to new indications or age groups could restrict market growth, emphasizing the importance of proactive regulatory engagement.

References:

[1] GBD 2019 Diseases and Injuries Collaborators, The Lancet, 2020.

[2] Lipton RB, et al., JAMA Neurology, 2018.

[3] Ashina M, et al., The New England Journal of Medicine, 2020.

[4] MarketsandMarkets, Neurodegenerative Disorders Market, 2022.