Last updated: July 30, 2025

Introduction

The Danish pharmaceutical market exemplifies a mature, innovation-driven landscape, characterized by robust healthcare infrastructure, high regulatory standards, and a focus on specialty medicines. Within this context, Zevra Denmark emerges as a distinctive player, emphasizing niche therapeutic areas and leveraging strategic positioning to create competitive advantages. This comprehensive analysis evaluates Zevra Denmark’s market position, delineates its core strengths, and offers strategic insights to inform future growth trajectories.

Market Overview: Denmark’s Pharmaceutical Sector

Denmark’s pharmaceutical sector benefits from a well-established health system, strategic R&D investments, and a supportive regulatory environment. Notably, Denmark is a hub for biotech innovation, hosting numerous intense R&D activities and collaborations underpinned by the government’s "Innovation Strategy" (2018–2022) and proactive engagement with the European Medicines Agency (EMA) [1]. The market is predominantly driven by chronic disease management, aging populations, and a rising prevalence of rare diseases, fostering demand for specialized, targeted therapies.

Zevra Denmark’s Market Position

Zevra Denmark operates predominantly within the niche segment of specialized pharmaceuticals, leveraging its focus on rare and complex conditions. Its positioning is distinguished by several strategic elements:

-

Niche Therapeutic Focus: Zevra specializes in therapies for rare neurological, hematological, and metabolic disorders, addressing unmet clinical needs. This focus aligns with Denmark’s evolving health priorities, especially in personalized medicine.

-

Regulatory Adaptation: Zevra’s products have received regulatory clearance via EMA pathways, such as orphan drug designations, enabling expedited market access and incentivized innovation [2].

-

Local Market Penetration: Through partnerships with Danish health authorities, hospitals, and specialists, Zevra has embedded itself into the treatment landscape, establishing credibility and clinical evidence for its therapies.

-

Pricing & Reimbursement: Zevra’s strategic engagement with Danish health authorities has facilitated favorable reimbursement coverage, critical for market penetration of high-cost specialty drugs.

In the competitive landscape, Zevra maintains a distinctive position relative to multinational corporations (MNCs) and local biotech firms, especially by prioritizing innovation in underserved therapeutic areas, thereby reducing direct competition.

Strengths of Zevra Denmark

1. Focused Niche Portfolio:

Zevra’s concentrated portfolio allows for tailored marketing, stronger clinical collaborations, and enhanced reputation within specific therapeutic areas. This focus minimizes head-to-head competition with large MNCs predominantly targeting broader markets.

2. Regulatory Expertise & Accelerated Access:

Having navigated EMA designations and Danish health authorities successfully, Zevra secures faster market access, which is crucial in the competitive high-cost specialty drugs segment.

3. Strategic Local Partnerships:

Zevra’s collaborations with Danish hospitals and key opinion leaders (KOLs) facilitate clinical evidence generation and foster trust among healthcare professionals, bolstering product adoption.

4. Commitment to Innovation:

Zevra’s R&D investments in orphan and rare disease therapies establish it as an innovator aligned with Denmark’s genetic research strengths—especially given the nation’s leading position in genomics research (e.g., Danish Genome Centre).

5. Cost-Effective Supply Chain:

Local manufacturing capabilities and logistical efficiencies enable Zevra to maintain reliable supply and respond swiftly to market needs, strengthening supply chain resilience.

Strategic Insights for Sustained Advantage

a. Strengthening Scientific & Clinical Collaborations

Deepening relationships with Danish academic institutions and KOLs can accelerate real-world evidence (RWE) generation, enhancing product credibility and supporting market expansion.

b. Expanding Therapeutic Scope

Leveraging existing expertise, Zevra could diversify into related rare disease domains, capitalizing on Denmark’s favorable regulatory environment for orphan drugs and personalized medicine.

c. Digital & Data-Driven Strategies

Implementing advanced analytics and digital platforms can optimize patient identification, adherence monitoring, and post-marketing surveillance, differentiating Zevra amidst evolving healthcare digitization.

d. Navigating Reimbursement & Pricing Dynamics

Proactive engagement with health authorities can preserve favorable reimbursement statuses, crucial in the Danish system with strict pricing controls and value-based assessment frameworks.

e. Leveraging European Networks

Given Denmark’s strategic location and integration within the European Union’s pharmaceutical frameworks, Zevra should reinforce alignment with regional health initiatives, such as the EU's Orphan Medicinal Products Regulation, to facilitate broader access.

f. Investing in Local Talent & Infrastructure

Enhancing local R&D capabilities and ensuring operational agility can serve as barriers to competitive entry by larger firms, fostering sustainable, innovation-led growth.

Competitive Landscape in Denmark

Zevra faces competition from several quarters:

-

Multinational Pharmaceutical Companies: MNCs like Novartis, Roche, and Sanofi target rare diseases with vast resources, but Zevra’s niche focus and local relationships serve as competitive advantages.

-

Local Biotech Innovators: Smaller Danish biotech firms offer specialized therapies but often lack Zevra’s regulatory expertise and market access strategies.

-

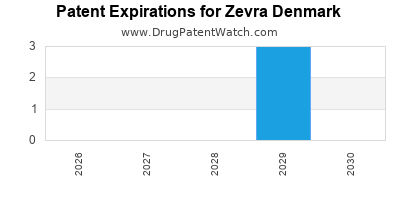

Generic & Biosimilar Manufacturers: As patents expire, biosimilar entrants can erode margins for high-cost therapies; Zevra’s focus on innovation and clinical differentiation is vital to maintain relevance.

Zevra’s agility, coupled with its focus on unmet needs and relations with Danish healthcare providers, positions it well within this competitive milieu.

Regulatory & Policy Environment

Denmark’s robust regulatory framework, aligned with EMA standards, offers transparency and predictable pathways for approvals. The nation’s emphasis on personalized, precision medicine complements Zevra’s strategic focus. The Danish Medicines Agency (Lægemiddelstyrelsen) actively supports innovation, providing pathways for expedited reviews, especially for orphan designations [3].

Policy shifts toward value-based pricing and increased emphasis on RWE present both challenges and opportunities. Zevra’s ability to adapt to these shifts—through comprehensive clinical data and cost-effectiveness demonstrations—will be pivotal.

Key Market Opportunities & Challenges

Opportunities:

-

Growing prevalence of rare diseases and aging population driving demand for specialized therapies.

-

Potential for pipeline expansion through partnerships, licensing, or acquisitions.

-

Incentive programs for orphan drugs and personalized medicine development.

Challenges:

-

High development costs and regulatory hurdles for rare disease therapies.

-

Pricing pressures stemming from health authority austerity measures.

-

Competition from global biotech firms entering Denmark’s niche markets.

Conclusion

Zevra Denmark’s strategic positioning as a focused player within the rare and complex disease segments affords it competitive advantages amid Denmark’s innovative healthcare environment. Its strengths in regulatory navigation, local partnerships, and niche portfolio management form a solid foundation. Future growth hinges on expanding clinical collaborations, diversifying therapeutics, and effectively navigating the evolving reimbursement landscape.

Key Takeaways

-

Zevra capitalizes on its niche focus and regulatory expertise to carve a dedicated space in Denmark’s specialty pharmaceutical market.

-

Strengthening local academic and clinical partnerships remains crucial for evidence generation and market credibility.

-

Diversification into adjacent rare disease areas offers growth avenues aligned with Denmark’s health priorities.

-

Maintaining agility amid pricing pressures requires strategic engagement with policymakers and robust health economics data.

-

Engaging with regional European initiatives can amplify Zevra’s market access and innovation pipeline.

FAQs

1. How does Zevra’s focus on rare diseases influence its competitive positioning in Denmark?

Focusing on rare diseases allows Zevra to target unmet needs with less direct competition from larger multinationals, enabling specialization, stronger relationships with healthcare providers, and eligibility for regulatory incentives like orphan designations.

2. What regulatory pathways benefit Zevra in Denmark?

Zevra benefits from EMA designations for orphan drugs, accelerated approval pathways, and Denmark’s alignment with EMA regulations, facilitating quicker and smoother market entry for its therapies.

3. How can Zevra leverage Denmark’s biotechnology ecosystem?

By collaborating with Danish academic institutions, biotech startups, and genomics centers, Zevra can enhance R&D, access cutting-edge scientific advancements, and accelerate pipeline development.

4. What are the primary challenges Zevra faces in Denmark’s pharmaceutical landscape?

Key challenges include high R&D costs, stringent reimbursement negotiations, competition from global players, and evolving policies emphasizing value-based care.

5. What strategic actions should Zevra prioritize to sustain growth?

Priorities include expanding clinical research collaborations, diversifying its therapeutic portfolio, investing in digital health tools for patient management, and proactively engaging with health authorities on pricing strategies.

References

[1] Danish Ministry of Industry, Business and Financial Affairs, “Denmark’s Innovation Strategy 2018–2022,” 2018.

[2] European Medicines Agency, “Orphan Designation Guidelines,” 2022.

[3] Danish Medicines Agency, “Regulatory Framework for Pharmaceuticals in Denmark,” 2023.