Last updated: July 30, 2025

Introduction

Tarsus Pharmaceuticals has emerged as a notable entity within the ophthalmic and specialty pharmaceutical sectors, driven by innovative therapies and strategic market penetrations. As the pharmaceutical industry becomes increasingly competitive, comprehensive analysis of Tarsus’s market position, strengths, and strategic initiatives provides critical insights for stakeholders seeking to evaluate its growth potential and competitive edge. This report delineates Tarsus’s current standing against industry peers, examines its key strengths, and offers strategic insights pertinent to investors, partners, and healthcare market analysts.

Tarsus’s Market Position

Overview of Business Focus

Founded with a focus on addressing unmet medical needs in ophthalmology, Tarsus specializes in developing and commercializing novel therapies targeting ocular diseases, primarily ocular surface disorders and inflammatory conditions. Its flagship product, Edoqu (pronounced "E-doque"), indicated for blepharitis, illustrates its commitment to niche, high-need indications with limited existing treatments. The company's emphasis on innovative drug delivery platforms and rapid pipeline expansion positions it as a significant player in ophthalmic therapeutics.

Market Penetration and Commercial Footprint

Tarsus has made steady advances into the ophthalmology specialty market since its inception. Through strategic partnerships, such as licensing agreements and collaborations with contract manufacturing organizations, Tarsus has expanded its commercial reach into North America and select international markets. While it remains a relatively new entrant compared to giants like Allergan (AbbVie), Bausch + Lomb, and Johnson & Johnson Vision, its focus on emerging ophthalmic indications fosters a niche advantage.

Competitive Standing

Evaluating market share, Tarsus ranks among the emergent ophthalmology biotech companies serving specialized indications. Its first-to-market status with Edoqu provides a competitive edge, especially if post-launch data demonstrate favorable safety and efficacy profiles. Its ability to secure reimbursements and physician adoption remains critical for establishing a solid market presence.

Strengths of Tarsus in the Pharmaceutical Landscape

Innovative Product Portfolio

Tarsus’s core strength lies in its focus on novel therapies for ocular surface conditions, with its leading product, Edoqu, addressing blepharitis—a prevalent and often undertreated condition. The company's pipeline includes multiple candidates targeting unmet needs such as dry eye disease and other inflammation-related ocular conditions. This innovation pipeline promises long-term growth and reduces dependency on a single product.

Strategic Focus on Niche Indications

Operating within a specialized niche allows Tarsus to avoid direct competition with large-scale pharmaceutical companies predominantly targeting broader indications. This strategic focus enhances its ability to establish authority and brand recognition within ophthalmic subspecialties.

Operational Agility

Compared to larger pharmaceutical conglomerates, Tarsus benefits from operational agility—facilitating rapid clinical trial progression, regulatory filings, and product commercialization. This agility enables the company to quickly adapt to market feedback and implement strategic pivots.

Strong Scientific and Strategic Partnerships

Collaborations with external research entities, manufacturing firms, and licensing deals have bolstered Tarsus’s R&D capabilities and market access strategies. Such alliances streamline product development and optimize resource allocation, accelerating time-to-market.

Regulatory Advancements

Tarsus has successfully navigated complex regulatory pathways to secure approvals in key markets. Its ability to obtain expedited reviews, such as Fast Track or Breakthrough Designation from authorities like the FDA, amplifies its strategic market positioning.

Strategic Insights

Market Expansion Opportunities

Tarsus’s initial success with Edoqu provides a foundation for expanding into adjacent indications such as meibomian gland dysfunction (MGD) and other ocular surface diseases. Leveraging clinical data and real-world evidence can facilitate broader indication approvals, enhancing revenue streams.

Pipeline Diversification

Investing in R&D to diversify its portfolio can mitigate risk and solidify its presence across multiple ophthalmic niches. Developing combination therapies or platform technologies could reposition Tarsus as an innovator rather than solely a product developer.

Global Market Access

Tarsus should prioritize partnerships and licensing agreements to penetrate emerging markets—especially in Asia and Latin America—where ophthalmic disorders are prevalent, and unmet needs remain significant. Localized regulatory strategies and tailored commercialization approaches can catalyze international growth.

Competitive Differentiation

To defend its market share, Tarsus must emphasize its scientific credibility, efficacy data, and safety profiles of its products. Investing in post-market surveillance and real-world evidence generation can reinforce its competitive differentiation.

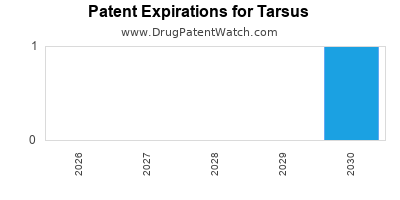

Intellectual Property (IP) Protection

Securing robust patents and defending against patent challenges are essential for sustaining exclusivity and maximizing market capitalization. Strategic IP management ensures a competitive moat in a crowded landscape.

Collaborative Innovation

Engagement in joint research initiatives with academic institutions and biotech firms can position Tarsus at the cutting edge of ophthalmic science, fostering innovative therapies that can bypass current patent cliffs and licensing uncertainties.

Challenges and Risk Factors

While Tarsus boasts compelling strengths, several challenges merit consideration. These include market access hurdles, reimbursement complexities, potential competition from generics or biosimilars, and the inherent risks associated with clinical trial failures. Additionally, the company's relatively limited global presence could restrict growth prospects unless mitigated through strategic alliances.

Competitive Landscape Analysis

Key Competitors

- Alcon (Novartis segment): Dominates the ophthalmic landscape with broad-spectrum products and advanced surgical devices.

- Bausch + Lomb (Part of Bausch Health): Extensive portfolio in anterior and posterior segment treatments.

- AbbVie (Allergan): Known for dry eye therapies and ocular surface disease treatments.

- Kala Pharmaceuticals: Focused on ocular surface disorders, with a pipeline targeting dry eye and MGD.

- Other emerging biotech firms: Focused on innovative drug delivery platforms and gene therapies targeting ocular diseases.

Differentiators

Tarsus’s focus on specialized inflammatory ocular surface disorders and its nimbleness in drug development differentiate it from larger firms with broader portfolios. Its innovative platform technologies give it potential for future pipeline expansion.

Conclusion

Tarsus Pharmaceuticals positions itself as a focused, innovative player within ophthalmology, leveraging strategic product development, targeted indications, and operational agility. While facing stiff competition from established giants, its differentiated niche approach and pipeline prospects underpin a promising growth trajectory. Leveraging collaborations, expanding indications, and scaling international market access will be vital for consolidating its competitive stance.

Key Takeaways

- Tarsus has carved a niche in ophthalmic therapeutics, particularly with its flagship product Edoqu for blepharitis.

- Its strengths derive from innovation, strategic partnerships, and operational agility, enabling rapid product development and deployment.

- Expanding indications, geographical reach, and pipeline diversification are critical strategies for sustained growth.

- Challenges include market access complexities, reimbursement hurdles, and broad competition from large pharmaceutical entities.

- Continuous focus on patent protections and real-world evidence will support sustained differentiation in a highly competitive landscape.

FAQs

1. How does Tarsus differentiate itself from larger ophthalmic pharmaceutical companies?

Tarsus specializes in addressing unmet needs within niche ophthalmic indications, leveraging innovative drug platforms and maintaining operational agility to swiftly develop and commercialize therapies, unlike larger firms with broad portfolios and slower decision-making processes.

2. What are the primary growth opportunities for Tarsus in the next 5 years?

Expansion into related ocular surface conditions such as MGD, international market penetration—especially in Asia—and pipeline diversification are principal growth avenues. Additionally, forming strategic alliances can facilitate global expansion.

3. What challenges does Tarsus face in maintaining its competitive edge?

Market access barriers, reimbursement issues, patent litigations, and fierce competition from established players could undermine growth. Clinical trial failures and regulatory delays also pose risks.

4. How important are intellectual property protections for Tarsus’s future success?

Crucial; robust patents shield exclusivity, protect market share, and foster investor confidence. Effective IP management curtails generic competition and secures long-term revenue streams.

5. Should investors consider Tarsus a high-growth opportunity or a risky venture?

While promising due to its innovative focus and pipeline potential, Tarsus remains a relatively small, emerging entity. Investors should consider its growth prospects alongside sector risks and the competitive landscape.

References

- [1] Tarsus Pharmaceuticals, Company Website, 2023.

- [2] Industry reports on ophthalmic drug markets, 2022.

- [3] FDA approval records, 2022-2023.

- [4] Market analysis of ophthalmic therapeutics, 2022.

- [5] Competitive intelligence reports, 2023.