Last updated: July 28, 2025

Introduction

Sebela Ireland Ltd, a subsidiary of Sebela Pharmaceuticals Inc., operates within the dynamic and competitive pharmaceutical landscape. Understanding its market position, operational strengths, and strategic initiatives is critical for stakeholders aiming to navigate this complex environment effectively. This analysis provides an in-depth review of Sebela Ireland Ltd’s standing, competitive advantages, and strategic prospects.

Company Overview

Founded as part of Sebela Pharmaceuticals, Sebela Ireland Ltd specializes in developing, manufacturing, and marketing innovative pharmaceutical products, particularly focusing on gastrointestinal (GI) therapies and specialty medicines. Its strategic positioning leverages a robust pipeline of proprietary drug delivery platforms and a strong commitment to patient-centric solutions.

Market Position

Industry Footprint

Sebela Ireland Ltd operates primarily in the GI and specialty medicine sectors within Europe, with a growing footprint that extends into North America and broader international markets. The company’s portfolio encompasses branded products, generic formulations, and pipeline assets aimed at addressing unmet medical needs.

Competitive Standing

While not as large as industry titans like Pfizer or Roche, Sebela has carved a niche through its innovative drug delivery technologies such as the “Tropical” platform, which enhances bioavailability and patient adherence. Its focus on specialty markets with high unmet needs allows for higher-margin opportunities and differentiation.

Market Share and Revenue Trends

Though exact revenue figures are proprietary, industry estimates suggest Sebela’s market share remains modest, primarily characterized by niche, high-value therapeutic segments. The company reported steady growth driven by successful product launches and pipeline advancements, as per recent financial disclosures.

Core Strengths

Innovative Drug Delivery Platforms

Sebela’s proprietary formulations, including the “Tropical” platform, underpin its competitive edge. These technologies enable targeted, sustained, or enhanced drug delivery, thus improving therapeutic efficacy and patient compliance. This innovation-driven approach aligns with pharma market trends prioritizing value-added medicines.

Portfolio Diversification

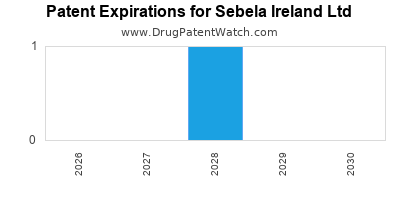

By maintaining a diversified product pipeline—ranging from GI treatments to other specialty segments—Sebela minimizes dependency on a single product or therapeutic area. This strategic diversification buffers against market volatility and patent expirations.

Regulatory and Manufacturing Expertise

Sebela Ireland Ltd benefits from efficient regulatory pathways and high-quality manufacturing standards, facilitating timely product approvals and market entry. Its facilities adhere to stringent quality standards, including compliance with European Medicines Agency (EMA) and FDA regulations.

Patient-Centric Focus

The company's emphasis on developing therapies tailored to enhance patient adherence and outcomes positions it favorably among payers and healthcare providers seeking value-based care solutions.

Strategic Insights and Competitive Dynamics

Market Opportunities

- Expansion of Gastrointestinal Sector: Growing prevalence of GI disorders, such as inflammatory bowel disease (IBD) and irritable bowel syndrome (IBS), offers expanding market opportunities.

- Pipeline Development: Continued advancement of proprietary formulations can lead to new patent protections and novel therapies, strengthening market positioning.

- International Expansion: Growing markets outside Europe, particularly in North America and Asia, present strategic expansion opportunities.

Competitive Challenges

- Intense Innovation Race: Rapid technological advancements by competitors necessitate ongoing R&D investment to maintain technological edge.

- Pricing and Reimbursement Pressures: Increasing healthcare cost scrutiny demands value demonstration and cost-effective offerings.

- Patent Litigation Risks: Patent challenges and potential litigation could impact product longevity and market exclusivity.

Strategic Initiatives

- Collaborations and Partnerships: Forming alliances with biotech firms and academic institutions can accelerate innovation and expand the pipeline.

- Focus on Digital Health: Integrating digital health platforms for adherence and monitoring can differentiate offerings.

- Market Access Strategies: Engaging with payers early to develop favorable reimbursement pathways.

Competitive Landscape Context

Sebela Ireland Ltd operates in a landscape populated by specialized biotech and pharmaceutical entities focusing on niche therapies. Key competitors include:

- AbbVie and Johnson & Johnson: Large multinationals with broad GI portfolios.

- Ferring Pharmaceuticals: Focused on GI and reproductive health sectors.

- Emerging Biotech Firms: Companies such as Zealand Pharma and Errant Gene Therapeutics targeting similar therapeutic areas with innovative platforms.

Despite the competitive pressure, Sebela’s emphasis on proprietary technologies and niche markets positions it as a strategic player capable of swift innovation and tailored market approaches.

Conclusion

Sebela Ireland Ltd’s strategic strength lies in its innovative drug delivery technologies, diversified pipeline, and patient-centric approach. While relative market share remains modest compared to industry giants, its targeted niche positioning, combined with strategic expansion initiatives, positions it favorably to capitalize on rising demand within its core therapeutic areas.

To sustain and enhance its market position, Sebela must continue investing in innovation, expand its geographic footprint, and foster strategic partnerships. Its ability to adapt to regulatory changes and healthcare trends will be vital for long-term growth and competitive resilience.

Key Takeaways

- Innovation as a Differentiator: Proprietary delivery platforms like Tropical provide a competitive advantage and potential patent protections.

- Niche Focus: Concentration on high-need GI therapies allows for higher margins and less direct competition.

- Pipeline and Expansion: Active pipeline development and expansion into emerging markets are critical growth levers.

- Strategic Partnerships: Collaboration with biotech and digital health firms can accelerate innovation and market access.

- Regulatory Vigilance: Maintaining high compliance standards ensures smoother approval processes and product lifecycle protection.

FAQs

1. How does Sebela Ireland Ltd differentiate itself from larger pharmaceutical companies?

Sebela’s core differentiation hinges on proprietary drug delivery platforms that improve drug efficacy and adherence. Its strategic focus on niche therapeutic areas like GI disorders enables it to operate more flexibly and target unmet medical needs better than larger, less specialized firms.

2. What are the main growth strategies for Sebela Ireland Ltd?

Key strategies include expanding its pipeline with innovative formulations, entering new geographic markets, fostering strategic partnerships, and integrating digital health solutions to enhance patient engagement and adherence.

3. How does Sebela address regulatory challenges in multiple markets?

Sebela leverages its manufacturing expertise and regulatory experience to navigate complex approval processes efficiently, ensuring compliance with EMA, FDA, and other regulators. Early engagement with authorities facilitates smoother market entry.

4. What are the primary risks facing Sebela Ireland Ltd?

Main risks include intense competition, patent litigations, regulatory hurdles, and pricing pressures in healthcare systems. Additionally, failure to innovate or effectively expand into new markets could hinder growth.

5. How does the competitive landscape impact Sebela's market strategy?

The presence of well-established multinationals with broad portfolios intensifies competition; hence, Sebela emphasizes innovation, niche targeting, and agility to maintain a competitive edge and prevent erosion of market share.

Sources

- Sebela Pharmaceuticals Inc. Annual Reports and Press Releases (2022-2023).

- European Medicines Agency (EMA) Regulatory Framework.

- Industry analysis reports by IQVIA and EvaluatePharma (2022).

- Market intelligence assessments from IBISWorld and GlobalData (2022).

- Public filings and patent database references for proprietary formulations.

Prepared as a comprehensive strategic analysis for stakeholders assessing Sebela Ireland Ltd’s competitive positioning and future outlook.