Last updated: July 31, 2025

Introduction

Rockwell Medical Inc. positions itself as a pivotal player within the specialized dialysis and iron replacement therapy markets. Its strategic focus on innovation, coupled with a diversified portfolio targeting chronic kidney disease (CKD) and end-stage renal disease (ESRD) patients, underscores its unique market stance. This analysis evaluates Rockwell’s market position, core strengths, and strategic opportunities amid a rapidly evolving pharmaceutical landscape.

Market Position of Rockwell Medical Inc.

Rockwell Medical operates predominantly within the nephrology therapeutics sector, specializing in innovative solutions for dialysis and iron replacement. Its flagship product, Reportedly, Triferic, addresses iron management in hemodialysis patients and distinguishes itself as a novel iron delivery system. The company’s strategic emphasis on specialty products for CKD patients with an underserved niche enhances its competitive positioning.

While its overall market capitalization remains modest relative to industry giants, Rockwell’s focus on innovative, patent-protected therapeutics affords it a niche advantage. The firm trades primarily on its ability to penetrate dialysis clinics and expand its product pipeline, leveraging partnerships and clinical data to advance its market footprint.

Strengths of Rockwell Medical Inc.

-

Innovative Product Portfolio

Rockwell’s flagship product, Triferic, innovates by delivering iron directly during dialysis using an acetate-based formulation. Its targeted delivery system minimizes iron overload risks, improving patient safety and compliance. This technological advantage positions the product favorably within the iron supplement market, which is currently dominated by traditional high-dose IV irons with associated risks.

-

Intellectual Property and Regulatory Approvals

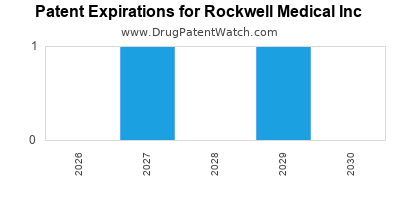

The company holds multiple patents protecting its delivery technologies, creating barriers to entry for competitors. Triferic has secured FDA approval, a critical validation that enhances market confidence and facilitates reimbursement negotiations. Regulatory milestones, including the approval of further formulations or indications, could reinforce its market dominance.

-

Strategic Partnerships and Clinical Evidence

Collaborations with leading nephrology clinics and ongoing clinical trials bolster the evidence base for its therapies. Positive data supporting Triferic’s efficacy and safety enhances its appeal to healthcare providers and payers. Additionally, partnerships with dialysis providers expand its distribution channels.

-

Focused Niche Market

By targeting the specific needs of dialysis-dependent CKD patients, Rockwell capitalizes on a relatively underserved segment. This precise market targeting reduces competitive pressure from larger, diversified pharmaceutical entities.

-

Agile Operational Model

As a smaller firm, Rockwell exhibits operational agility, allowing rapid product development, adaptation to market feedback, and nimble commercial strategy implementation. This flexibility is advantageous in the dynamic pharmaceutical landscape.

Strategic Challenges and Opportunities

While Rockwell’s innovation and niche focus are substantial strengths, several challenges hinder its growth trajectory:

-

Market Penetration and Awareness: The dialysis market is mature with entrenched suppliers; expanding Triferic’s adoption requires significant educational and marketing efforts.

-

Pricing and Reimbursement Dynamics: Securing favorable reimbursement rates and convincing payers of cost-effectiveness remain hurdles, particularly given the presence of cheaper, traditional IV irons.

-

Competitive Landscape

Major competitors include Fresenius, Baxter, and other dialysis product providers who offer traditional iron therapies. These companies possess larger distributions and broader product portfolios, which can overshadow niche players like Rockwell.

Strategic Insights for Growth

To amplify its market presence, Rockwell should adopt a multi-pronged strategy:

-

Clinical Data Expansion

Investing in robust clinical trials demonstrating superior safety and efficacy versus traditional irons will reinforce the value proposition. Outcomes showing reduced hospitalization or mortality benefits could drive adoption.

-

Market Education and Advocacy

Targeted initiatives to educate nephrologists and dialysis centers about the clinical advantages of Triferic can enhance uptake. Demonstrating cost savings through reduced iron overload complications can incentivize payers.

-

Expanding Indications and Formulations

Developing additional formulations, including peritoneal dialysis or non-dialysis CKD applications, broadens potential markets.

-

Strategic Collaborations

Partnering with larger dialysis networks or pharmaceutical firms can facilitate scale and distribution.

-

Global Expansion

Introducing Triferic into international markets, especially where dialysis costs are rising, can diversify revenue streams and reduce dependence on the U.S. market.

Conclusion

Rockwell Medical Inc.'s strategic positioning as an innovator in dialysis-related therapeutics offers a unique advantage in a competitive landscape dominated by large players. Its strengths lie in proprietary technology, regulatory validation, and a focused market approach. However, to realize its full growth potential, the company must bolster clinical evidence, expand its market awareness, and establish strategic alliances, both domestically and globally.

Key Takeaways

-

Rockwell’s niche focus in dialysis iron therapy and patented delivery technology position it favorably in specialized segments.

-

Securing further clinical evidence and demonstrating cost-effectiveness are critical to overcoming market entry barriers and payor hurdles.

-

Building strategic collaborations and expanding indications can facilitate significant growth avenues.

-

Active efforts in market education and international expansion are vital to increasing Triferic’s adoption.

FAQs

-

What differentiates Rockwell Medical’s Triferic from traditional iron therapies?

Triferic delivers iron directly during dialysis using an acetate-based formulation, reducing iron overload risks and improving safety compared to traditional high-dose IV iron therapies.

-

What are the primary challenges facing Rockwell in expanding its market share?

Key challenges include entrenched competition from larger firms, reimbursement barriers, and the need for further clinical evidence to demonstrate cost-effectiveness and superior outcomes.

-

How significant are strategic collaborations for Rockwell’s growth?

Collaborations with nephrology clinics, dialysis providers, and larger pharmaceutical firms are essential to expand distribution, validate clinical benefits, and accelerate market penetration.

-

What are potential market expansion strategies for Rockwell?

Expanding indications to include peritoneal dialysis and non-dialysis CKD patients, entering international markets, and developing new formulations are viable strategies.

-

What is the outlook for Rockwell Medical in the next five years?

With increased clinical validation, strategic partnerships, and global expansion, Rockwell has the potential to solidify its niche and increase revenues, though competition and reimbursement remain ongoing hurdles.

References

- [Rockwell Medical Inc. Corporate Website]

- [FDA Approval Documents for Triferic]

- [Market Analysis Reports on Dialysis Therapeutics]

- [Clinical Trial Data for Triferic]

- [Industry Analysis of Dialysis and Iron Therapeutics Market]