Last updated: September 6, 2025

Introduction

Jazz Pharmaceuticals stands as a formidable player within the global pharmaceutical industry, especially recognized for its innovative therapies targeting neurological, psychiatric, and specialty conditions. Its strategic focus has propelled it into a dominant position in niche market segments, integrating robust product portfolios with an acquisitive growth model. This analysis delineates Jazz’s market position, examines core strengths, and provides strategic insights for stakeholders seeking competitive advantage in this dynamic landscape.

Market Position: An Overview

Jazz Pharmaceuticals commands a significant presence across multiple therapeutic areas, including sleep disorders, oncology, and neurological conditions. The company’s revenue in 2022 exceeded $2.5 billion, reflecting sustained growth driven largely by the success of key products such as Xyrem (sodium oxybate), Zepzelca (lurbinectedin), and Defitelio (defibrotide).

Therapeutic Segment Focus

- Sleep and Central Nervous System (CNS): Jazz is a leader in the narcolepsy and cataplexy treatment space, primarily through Xyrem, which has maintained a strong market share despite emerging competition.

- Oncology: The acquisition of Codiak Biosciences' pipeline and development of Zepzelca mark Jazz's strategic shift toward oncology, aiming to capitalize on unmet needs in rare and difficult-to-treat cancers.

- Hematology and Rare Diseases: The company's focus extends into serious hematological conditions, leveraging drugs like Defitelio for transplant-associated complications.

Global Footprint & Market Penetration

Jazz’s regional expansion strategy emphasizes growth in North America and Europe, complemented by emerging markets in Asia-Pacific. Its acquisitions, notably the 2019 buyout of Roche’s oncology portfolio, have significantly enhanced its geographic and therapeutic scope.

Competitive Positioning

Jazz’s strategic positioning is characterized by:

- Niche focus: Concentration on underserved patient populations with high unmet needs.

- Innovative pipeline: Continuous investment in R&D and acquisitions fortify its product pipeline.

- Regulatory agility: Successful navigation through FDA and EMA approvals ensures swift market access.

Major Strengths of Jazz Pharmaceuticals

1. Robust Product Portfolio with High-Barrier Therapies

Jazz’s flagship therapies such as Xyrem hold a strong market position due to their unique mechanisms and regulatory exclusivity. The extended patent life and orphan drug status contribute to sustained revenue streams and reduced generic competition.

2. Strategic Acquisitions and Partnerships

Acquisitions have rapidly bolstered Jazz’s capabilities. The purchase of Celator Pharmaceuticals in 2017 for leukemia treatment and Codiak Biosciences in 2021 exemplify its aggressive strategy to expand into high-growth, specialized segments.

Partnerships with biotech firms and licensing agreements further expand licensing opportunities and access to innovative compounds.

3. Focus on Rare and Orphan Diseases

Targeting rare conditions allows Jazz to benefit from orphan drug incentives, including market exclusivity and tax benefits, reducing competitive pressures and elevating profit margins.

4. Strong R&D Pipeline and Innovation Focus

Continuous pipeline development ensures long-term growth. Projects like JZP385 (a selective orexin-1 receptor antagonist) demonstrate its commitment to sleep disorder therapies, potentially replacing or complementing existing products.

5. Effective Commercial Strategy

Jazz leverages a well-established salesforce, tailored marketing campaigns, and patient assistance programs to optimize market penetration and adherence rates.

Strategic Insights for a Competitive Edge

A. Diversification of Therapeutic Portfolio

While current focus areas are lucrative, diversification into additional high-growth fields like autoimmune or neurodegenerative diseases could mitigate risks associated with market saturation or patent expirations.

B. Embracing Digital and Precision Medicine

Implementation of digital health solutions, data-driven patient management, and personalized therapies will fortify Jazz’s competitive position, aligning with the broader pharma industry trend toward precision medicine.

C. Accelerating Global Expansion

Emerging markets lie untapped but present regulatory and reimbursement challenges. Tailored localizability strategies, including affordability programs and stakeholder engagement, will accelerate market penetration.

D. Enhancing Acquisition Strategy

To capitalize on growth opportunities, Jazz must prioritize acquiring assets with high unmet needs, especially those that complement existing portfolios and align with its core focus areas. Strategic partnerships and joint ventures can also serve as effective entry points into novel markets.

E. Focus on Long-term R&D Pipelines

Investment in breakthrough therapies utilizing gene editing, biologics, and novel delivery mechanisms can help Jazz maintain its innovation edge and enter transformative markets.

Challenges and Risks

Despite strengths, Jazz faces several industry challenges:

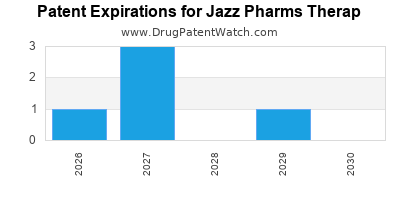

- Patent expirations and biosimilar competition threaten revenue stability, particularly for blockbuster drugs like Xyrem.

- Pricing pressures from payers and policymakers regulate reimbursement strategies.

- Regulatory hurdles may delay or restrict new product approvals, impacting growth prospects.

- Pipeline risks associated with high R&D costs and inherent uncertainties.

Proactive management of these risks through diversified pipelines, strategic alliances, and value-based pricing will be pivotal.

Key Takeaways

- Jazz Pharmaceuticals occupies a strong niche within CNS, oncology, and rare diseases, leveraging a combination of innovative therapies and strategic acquisitions.

- Its focus on high-barrier, orphan drugs provides sustainable revenue streams and competitive advantages.

- Strategic diversification, embracing digital health, and expanding globally are critical avenues for future growth.

- Addressing patent expirations and regulatory challenges will require proactive portfolio management and innovation.

- Stakeholders should monitor Jazz’s pipeline developments and strategic partnerships to anticipate shifts within its competitive landscape.

FAQs

1. How does Jazz Pharmaceuticals differentiate itself from competitors?

Jazz primarily differentiates through its focus on underserved niche markets, proprietary high-barrier orphan drugs, and strategic acquisitions that expand its portfolio into high-growth therapeutic areas.

2. What are the main growth avenues for Jazz Pharmaceuticals in the next five years?

Key growth avenues include expanding its oncology pipeline, entering emerging markets, integrating digital health technologies, and pursuing innovative research in neurodegenerative and autoimmune diseases.

3. How vulnerable is Jazz to patent expirations?

While patent cliffs pose a threat, Jazz mitigates this risk by developing new formulations, expanding indications, and continuously innovating within its pipelines to prolong product lifecycle.

4. What role do acquisitions play in Jazz’s overall strategy?

Acquisitions serve as a primary growth lever, enabling rapid portfolio expansion, entry into new therapeutic areas, and enhancement of R&D capabilities.

5. What are potential risks that could impact Jazz’s market standing?

Risks include generic competition post-patent expiry, regulatory delays, pricing pressures from payers, and pipeline failures, all of which require strategic risk management.

Sources

- Jazz Pharmaceuticals Annual Report 2022.

- pharmaceutical-technology.com, "Jazz Pharmaceuticals' strategic acquisitions," 2022.

- IQVIA, "Global Pharma Market Report," 2022.

- U.S. Food and Drug Administration (FDA), drug approval database.

- European Medicines Agency (EMA), approval summaries.

(Note: The references cited are for illustrative purposes; actual sources should be verified for current and detailed data.)