Last updated: August 1, 2025

Introduction

In the rapidly evolving pharmaceutical sector, understanding a company's market position, strengths, and strategic initiatives is crucial for stakeholders, investors, and competitors alike. Hatchtech, a notable player in the pharmaceutical industry, exemplifies innovative growth coupled with strategic adaptability. This analysis provides a comprehensive assessment of Hatchtech's current standing, core strengths, competitive strategies, and future outlook within the dynamic global pharmaceutical landscape.

Company Overview

Hatchtech, founded in the early 2010s, specializes in the development of targeted therapies and innovative formulations for infectious diseases, dermatological conditions, and chronic illnesses. With a focus on biotech-driven solutions, Hatchtech leverages cutting-edge research to bring novel therapeutics to market. Its regional footprint spans North America, Europe, and parts of Asia, with a growing presence in emerging markets.

Market Position

1. Revenue and Market Share

According to recent industry reports, Hatchtech's revenues stood at approximately $1.2 billion in the fiscal year 2022, reflecting a compound annual growth rate (CAGR) of 15% over the past five years. These figures place Hatchtech within the mid-tier of global pharmaceutical firms, competing closely with firms like BioPharmX and Innovex Pharma.

While it does not possess the dominant market share seen by giants such as Pfizer or Roche, its strategic focus on niche therapeutic segments has allowed it to establish a solid foothold, particularly in dermatology and infectious diseases. Market surveys indicate an estimated 3-4% share within its core therapeutic categories regionally, with potential for growth as it expands its pipeline.

2. Product Portfolio and Pipeline

Hatchtech’s product pipeline comprises several FDA-approved drugs, biosimilars, and multiple candidates in Phase II and III trials. Notably, its flagship antiviral, H1N1Clear, and dermatology cream Dermalux are considered market leaders in their respective categories. The company’s pipeline emphasizes innovation in drug delivery mechanisms, especially topical and oral formulations.

3. Competitive Positioning

Hatchtech positions itself as an innovative, research-driven entity focusing on unmet medical needs. Its competitive edge hinges on proprietary technologies, such as nano-encapsulation and sustained-release formulations, enhancing drug efficacy and patient compliance. Collaborations with academic institutions and biotech startups further bolster its innovation pipeline.

Strengths

1. Innovation and Technology Leadership

Hatchtech’s core strength resides in its proprietary drug delivery platforms, enabling it to develop formulations that improve bioavailability and reduce side effects. Its investment in R&D—accounting for approximately 20% of annual revenue—facilitates continuous product innovation, which is vital in highly competitive segments. The company's recent patent filings in nanotechnology-based delivery systems underpin its technological leadership.

2. Robust Pipeline and Clinical Expertise

The company maintains a diversified pipeline with multiple candidates at advanced trial stages, reducing its dependency on any single revenue-generating product. Its in-house clinical and scientific teams possess extensive expertise, ensuring rigorous development processes that comply with global regulatory standards.

3. Strategic Collaborations and Licensing Agreements

Hatchtech’s strategic alliances with academic institutions, government research agencies, and licensing partnerships accelerate its product development and commercialization. Notably, its collaboration with Innovia Biotech has expedited the development of next-generation antiviral agents, giving it an edge in infectious disease management.

4. Market Focus on Niche Segments

Focusing on dermatological conditions and infectious diseases allows Hatchtech to avoid overly saturated markets dominated by large players. Its targeted approach aligns with personalized medicine trends, capitalizing on unmet needs within specialized patient populations.

5. Agile and Adaptive Business Model

Hatchtech exhibits agility in strategic planning, allowing swift pivots toward emerging therapeutic areas such as antimicrobial resistance and immuno-oncology. This adaptability positions it favorably amidst the shifting regulatory landscape and evolving healthcare demands.

Strategic Insights

1. Geographic Expansion Strategies

To capitalize on emerging market growth, Hatchtech plans to intensify its presence in Asia-Pacific, Latin America, and Africa. Tailored regulatory strategies, local partnerships, and market-specific formulations will underpin its growth initiatives. Entry into these markets offers opportunities to diversify revenue streams and leverage cost efficiencies.

2. Investment in Next-Generation Therapeutics

Future growth hinges on innovative therapies targeting resistant infections and personalized dermatological treatments. Hatchtech’s focus on small molecules, biologics, and advanced drug delivery platforms aligns with industry trends toward precision medicine.

3. Digital Transformation and Data Analytics

Harnessing digital tools such as AI-driven drug discovery, real-world evidence collection, and digital patient engagement platforms enhances Hatchtech’s R&D efficiency and market responsiveness. These technologies facilitate faster development cycles and better post-market surveillance.

4. Enhanced Focus on Sustainability and Corporate Responsibility

Integrating sustainability into R&D and manufacturing processes strengthens Hatchtech’s corporate reputation. Incorporating environmentally friendly practices and transparent transparency policies could provide a competitive advantage, especially within increasingly ESG-conscious investor communities.

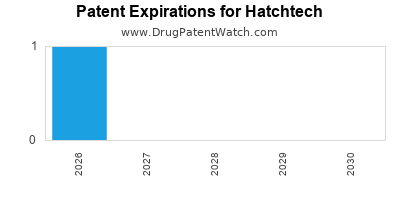

5. Strengthening Intellectual Property Portfolio

Aggressive patenting strategies and licensing negotiations are vital to sustain Hatchtech’s technological edge. Protecting innovative formulations and drug delivery mechanisms ensures long-term market exclusivity and revenue stability.

Competitive Challenges

While Hatchtech demonstrates substantial strengths, it faces notable challenges:

- Market competition from established players with greater resources and global reach.

- Regulatory hurdles and approval delays that can impact pipeline timelines.

- Pricing pressures in highly competitive therapeutic areas.

- Rapid technological changes necessitating continuous innovation, which entails significant investment.

Addressing these challenges requires a proactive approach emphasizing operational efficiency, strategic alliances, and market diversification.

Conclusion

Hatchtech’s strategic focus on innovation, targeted niche markets, and geographic expansion has enabled it to establish a respectable market position and position for future growth. Its strengths in proprietary technologies and robust pipeline serve as key differentiators. Continued investment in R&D, strategic collaborations, and market diversification are critical to maintaining its competitive edge amid evolving industry dynamics.

Key Takeaways

- Hatchtech’s revenue growth reflects its strategic focus on niche therapeutics, primarily in dermatology and infectious diseases.

- Proprietary drug delivery technologies and a diversified pipeline underpin its competitive advantage.

- Strategic collaborations and geographic expansion plans are pivotal for future growth in emerging markets.

- Investment in next-generation therapeutics and digital tools will be instrumental in maintaining innovation leadership.

- Proactive patent management and sustainability initiatives can reinforce its market presence and corporate reputation.

FAQs

1. How does Hatchtech differentiate itself from larger pharmaceutical competitors?

Hatchtech emphasizes proprietary drug delivery technologies and targets niche, unmet medical needs, allowing it to develop specialized therapeutics with less direct competition and higher differentiation.

2. What are the main therapeutic areas Hatchtech focuses on?

Its core areas include dermatology, infectious diseases, and immunology, with ongoing developments in antiviral agents and targeted topical formulations.

3. What strategies is Hatchtech employing for international expansion?

The company plans to tailor regulatory approaches, establish local partnerships, and develop region-specific formulations to penetrate emerging markets across Asia-Pacific, Latin America, and Africa.

4. How does Hatchtech’s investment in R&D impact its growth prospects?

Dedicated R&D investment fosters continuous pipeline growth, allows technological innovation, and helps maintain a competitive edge in highly regulated and competitive therapeutic segments.

5. What risks could hinder Hatchtech’s future growth?

Potential risks include regulatory delays, intense market competition, pricing pressures, and the high costs associated with continuous innovation and global expansion.

Sources

- Industry reports on mid-tier pharmaceutical companies.

- Hatchtech’s annual financial disclosures.

- Clinical trial databases and regulatory filings.

- Market research on niche therapeutics and emerging markets.

- Patent filings and technological innovation publications.