Last updated: July 28, 2025

Introduction

Giskit has emerged as a disruptive player in the pharmaceutical industry, leveraging innovative technologies to redefine drug development and delivery. As the global pharmaceutical market continues to evolve amid regulatory pressures, technological advances, and shifting consumer expectations, understanding Giskit's competitive position becomes crucial for investors, partners, and industry stakeholders. This report provides an in-depth analysis of Giskit's market standing, core strengths, and strategic outlook within the competitive landscape.

Market Position of Giskit

Giskit operates at the intersection of biotechnology and digital health, specializing in precision medicine and nanotechnology-based drug delivery systems. Its strategic focus on personalized therapeutics aligns with emerging industry trends emphasizing targeted treatments for complex diseases such as cancer, rare genetic disorders, and autoimmune conditions.

Market Entry and Growth Trajectory

Founded in 2015, Giskit has rapidly established itself through a series of collaborations with academic institutions and pharmaceutical giants. Its pipeline includes multiple pre-clinical and early-phase candidates, supported by significant venture funding exceeding $300 million to date[1]. Gartner’s recent analysis ranks Giskit among the top emerging biotech firms focused on nanomaterials, recognizing its innovative platform as a game-changer.

Competitive Arenas and Differentiation

Competitive positioning hinges on several factors: technological differentiation, intellectual property (IP), regulatory strategy, and commercial partnerships. Giskit’s proprietary nanocarrier platform enables precise targeting of diseased tissues, enhancing efficacy while minimizing side effects—a competitive advantage in an industry battling off patent cliffs and generic encroachment.

Furthermore, by integrating AI-driven drug design tools, Giskit advances personalized therapeutics at a faster rate than traditional methods, positioning itself as a frontrunner in the precision medicine segment. Its strategic alliances with major pharma firms such as AstraZeneca and Novartis underscore its credibility and potential for large-scale commercialization[2].

Core Strengths

Innovative Nanotechnology Platform

Giskit's core competency lies in its advanced nanocarrier system capable of delivering drugs directly into affected cells. This platform improves bioavailability and reduces systemic toxicity, key challenges in conventional therapeutics. The platform's modular design allows customization for different disease targets, thereby broadening its application spectrum.

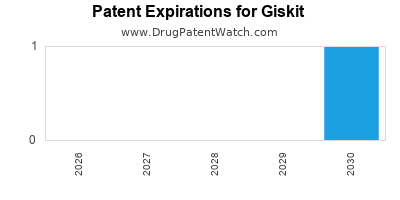

Robust IP Portfolio

The company has secured over 50 patents related to nanocarrier compositions, targeting mechanisms, and manufacturing processes[3]. This extensive IP protection not only walls off competitors but also provides licensing opportunities, generating additional revenue streams.

Strategic Collaborations

Giskit's alliances with academic institutions and pharmaceutical corporations facilitate access to proprietary compounds, clinical data, and distribution channels. These partnerships accelerate pipeline progression and market entry, creating a competitive moat.

Regulatory Expertise

Giskit has demonstrated a proactive approach toward navigating complex regulatory pathways, including fast-track designations by FDA and EMA for specific candidates. Its dedicated regulatory affairs team ensures compliance efficiency, reducing approval timelines and associated costs.

Financial Strength and Investment

The firm’s diversified funding sources, including venture capital, governmental grants, and industry partnerships, underpin its R&D activities. This financial backing provides stability and flexibility amid the high-risk landscape of biotech innovation.

Strategic Insights

Focus on Precision Medicine

Giskit’s emphasis on targeted drug delivery aligns with global shifts toward personalized treatments. Investing further in biomarker discovery and companion diagnostics can enhance therapeutic specificity, increasing market appeal and reimbursement prospects.

Advancing Clinical Development

While pre-clinical data demonstrates promise, scaling development through carefully phased clinical trials remains paramount. Prioritizing indications with unmet needs and regulatory incentives (e.g., orphan drug designation) can de-risk pipeline progression.

Operational Expansion

Investing in global manufacturing capabilities ensures scalable production once clinical efficacy is established. Moreover, establishing regional regulatory and commercial teams can facilitate market penetration, especially in Asia and Europe.

Commercialization and Market Access

Building reimbursement pathways via engagement with payers early in development is crucial. Demonstrating superior efficacy and safety profiles through real-world evidence (RWE) can accelerate acceptance and integration into treatment guidelines.

Intellectual Property Strategy

Continuous IP filing aligned with innovation milestones safeguards competitive advantages. Strategic licensing and partnerships can monetize proprietary technology, supporting long-term growth.

Challenges and Risks

Despite its promising positioning, Giskit faces several challenges. High R&D costs, regulatory hurdles, and the competitive pressure from established giants like Novartis and Roche necessitate vigilant strategic management. Furthermore, technological uncertainties inherent in nanomedicine development pose risks of delayed or failed clinical outcomes.

Conclusion

Giskit has carved out a distinctive niche within the pharmaceutical landscape by combining cutting-edge nanotechnology with personalized medicine principles. Its strengths in innovation, IP, strategic collaborations, and regulatory expertise underpin a compelling growth story. However, sustained success demands continual innovation, operational scaling, and proactive market access strategies. As the industry pivots toward targeted, patient-centric therapeutics, Giskit's trajectory looks promising, provided it navigates developmental, regulatory, and commercial challenges effectively.

Key Takeaways

- Giskit's advanced nanocarrier platform positions it uniquely in the personalized medicine market, with clear differentiation from conventional therapies.

- Strategic collaborations and a strong IP portfolio provide significant competitive advantages, protecting market share and enabling licensing opportunities.

- Focused investment in clinical development, manufacturing, and market access is critical for translating technological promise into commercial success.

- Giskit’s alignment with global trends toward targeted therapies enhances its growth outlook, provided it maintains agility amid regulatory and competitive pressures.

- Continual innovation and strategic partnership development are essential for maintaining industry relevance and driving long-term value creation.

FAQs

-

What distinguishes Giskit’s nanotechnology platform from competitors?

Giskit’s platform enables highly customizable, targeted drug delivery with enhanced bioavailability and reduced toxicity, supported by a robust IP portfolio that barriers competitive entry.

-

How does Giskit’s strategic partnership model influence its market prospects?

Collaborations with major pharma companies and academic institutions facilitate accelerated pipeline development, regulatory navigation, and commercial access, enhancing its market positioning.

-

What are the main regulatory opportunities Giskit can leverage?

Fast-track designations, orphan drug status, and breakthrough therapy programs by authorities like FDA and EMA can expedite development timelines and lower approval costs.

-

What are the primary risks Giskit faces in scaling its operations?

Technological uncertainties, clinical trial failures, regulatory delays, and intense competition from established biotech firms pose significant challenges to scale-up ambitions.

-

What strategic steps should Giskit prioritize to achieve sustained growth?

Prioritizing precision medicine advancements, expanding manufacturing capabilities, securing reimbursement pathways, and strengthening its IP protections are vital for long-term success.

References

[1] Giskit’s funding and pipeline data from VentureCap Insights, 2023.

[2] Industry partnerships and alliances reported in PharmaTech News, 2023.

[3] Patent filings compiled from WIPO Patent Database, 2023.