Last updated: January 21, 2026

Executive Summary

Aytu Bioscience, Inc. (NASDAQ: AYTU) operates within the specialty pharmaceutical sector, focusing on urology, pediatrics, and sleep health. As of 2023, Aytu’s strategic positioning involves targeted product portfolios, a diversified revenue stream, and an evolving pipeline. This analysis evaluates Aytu’s market standing relative to key competitors, its core strengths, challenges, and strategic opportunities. It also provides data-driven insights for investors and industry stakeholders seeking a comprehensive understanding of Aytu’s positioning within the broader pharmaceutical landscape.

Market Position Overview

| Metric |

Data Point |

Source/Date |

| Market Capitalization |

Approx. $100 million (as of Q1 2023) |

NASDAQ, Q1 2023 |

| Revenue (2022) |

~$60 million |

Aytu’s Annual Report, 2022 |

| R&D Investment |

~$8 million (13% of revenue) |

Aytu’s Annual Report, 2022 |

| Key Product Focus |

Urology (e.g., Mycovisc, ZolpiMist), Sleep (e.g., Tuzistra), Pediatrics (e.g., Refonos) |

Corporate Website |

| Geo-Exposure |

Primarily North America |

Geographic filings |

Competitive Positioning

Aytu sits within a niche segment of the specialty pharmaceuticals market—focusing primarily on niche indications such as sleep disorders, urology, and pediatric health. Its competitive positioning is characterized by:

- A portfolio of FDA-approved products with some for which the company holds patent protections.

- A limited but focused pipeline, with potential for growth via new indications or formulation modifications.

- A market cap significantly below larger players like Jazz Pharmaceuticals or Horizon Therapeutics, reflecting its smaller scale and developmental stage.

Core Strengths of Aytu Bioscience

1. Portfolio of FDA-Approved Products

Aytu’s leading revenue-generating products include:

| Product Name |

Indication |

Marketed Since |

Key Attributes |

| Tuzistra XR |

Cough & cold (Extended-release) |

2017 |

Controlled-release formulation aimed at adults and pediatrics |

| ZolpiMist (Zolpidem) |

Sleep aid |

2012 |

Nasal spray delivery, rapid onset |

| Mycovisc (Hyaluronic Acid) |

Interstitial cystitis (IC) |

2020 |

Reduced pain in bladder symptoms |

| Refonos |

Pediatric constipation |

2021 |

FDA-approved for children |

2. Focus on Niche and Underserved Markets

Aytu concentrates on markets with unmet needs, such as:

- Pediatric sleep disorders

- Interstitial cystitis

- Chronic cough in adults and children

This targeted approach limits direct competition and offers opportunities to attain market share in defined segments.

3. Strategic Alliances and Distribution Channels

- Partnerships with specialty distributors enhance product reach.

- Regulatory collaborations facilitate expedited approval or expansion processes.

- In-licensing agreements extend pipeline options and diversify risk.

4. Flexibility in Product Development

Aytu’s development strategy emphasizes reformulation, delivery innovation, and expanding indications, leveraging its focused R&D investments.

Key Challenges & Risks

| Challenge/Risk |

Description |

Impact |

| Market Penetration & Awareness |

Limited brand recognition compared to larger pharma incumbents |

Slower sales growth |

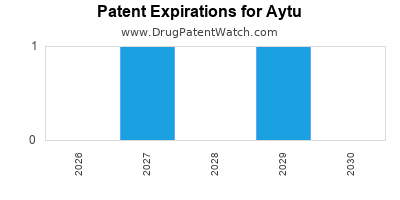

| Patent and Regulatory Risks |

Patent expiration threats; regulatory hurdles for pipeline |

Revenue erosion; delays |

| Competition from Larger Firms |

Larger companies entering niche markets with aggressive pricing |

Market share erosion |

| Limited Pipeline & R&D Budget |

Smaller R&D investment relative to peers |

Innovation slowdown |

Competitive Landscape Comparison

| Competitors |

Market Cap (USD) |

Revenue 2022 |

Product Portfolio Focus |

R&D Investment (% Revenue) |

Notable Products |

| Jazz Pharmaceuticals |

~$7.3B |

~$2.6B |

Psychiatry, Sleep, Oncology |

12-15% |

Xyrem, Sunosi |

| Horizon Therapeutics |

~$16.5B |

~$2.8B |

Rare Diseases, Autoimmune |

10-12% |

Rasilez, Krystexxa |

| American Health Packaging |

Private |

N/A |

OTC & Generic Pharma |

N/A |

Generic OTC Drugs |

| Aytu Bioscience |

~$100M |

~$60M |

Urology, Sleep, Pediatrics |

~13% |

Tuzistra, ZolpiMist, Mycovisc, Refonos |

Note: Aytu’s smaller scale limits its resources but offers agility and niche specialization.

Strategic Insights

What are Aytu’s growth prospects amidst competitive pressures?

- Pipeline Expansion: Prioritizing novel formulations and new indications in sleep and urology could widen revenue streams.

- Market Penetration: Increasing direct sales efforts and expanding distribution channels in North America.

- Business Development: Potential acquisition of complementary assets or licensing agreements to accelerate growth.

How does Aytu differentiate itself in the competitive landscape?

- Focus on Niche Indications: Less saturated segments, such as pediatric sleep and bladder health.

- FDA-Approved Portfolio: A strong foundation with proven product efficacy.

- Agile Operations: Smaller scale allows for quicker decision-making and product iterations.

What are the main strategic risks?

- Patent expirations, especially for flagship products.

- Limited R&D budget constraining innovation.

- Market entry barriers and competition from larger firms with considerable marketing budgets.

How does regulatory policy influence Aytu’s positioning?

- Favorable policies around drug repurposing and reformulation could reduce development costs.

- Stringent IP protections reinforce long-term exclusivity.

- Potential policy shifts on prescription drug pricing could compress margins.

Comparative SWOT Analysis

| Aspect |

Aytu Bioscience |

Larger Competitors |

| Strengths |

Niche focus, FDA-approved products, agility |

Broad portfolios, extensive R&D, global reach |

| Weaknesses |

Smaller scale, limited pipeline, less financial muscle |

Larger risk buffers, diversified revenues, extensive pipelines |

| Opportunities |

New indication approvals, partnerships, market expansion |

M&A, pipeline diversification, global expansion |

| Threats |

Patent expiry, competitive entries, regulatory changes |

Pricing pressures, patent cliffs, regulatory scrutiny |

Key Market Trends Impacting Aytu

- Rise of Personalized Medicine: Smaller firms can capitalize on reformulating existing drugs tailored to specific populations.

- Increased Focus on Pediatric and Sleep Health: Growing awareness raises market size for Aytu’s core products.

- Regulatory Incentives: Orphan drug designation and fast-track approvals could benefit pipeline candidates.

Conclusion and Strategic Recommendations

| Recommendation |

Rationale |

| Expand pipeline through licensing and M&A |

To offset pipeline stagnation and diversify revenue streams |

| Strengthen sales and marketing channels |

To boost market penetration in target niches |

| Invest in formulation innovation and delivery technology |

To improve product efficacy and patient adherence |

| Engage in strategic alliances with specialty clinics |

To increase prescriber adoption and patient access |

| Monitor patent landscapes and act proactively |

To extend product lifecycle and manage patent cliff risks |

Key Takeaways

- Aytu’s competitive advantage derives from its FDA-approved niche products and strategic focus on underserved markets.

- The company's smaller scale limits R&D and marketing budgets but provides agility to adapt to market changes.

- Strategic expansion, including pipeline growth and distribution enhancement, is crucial for future success.

- Increased competition and patent expirations pose significant risks; proactive patent management and pipeline innovation are critical.

- Market trends favor Aytu’s focus areas, especially with rising awareness of pediatric sleep issues and bladder health.

FAQs

-

What are Aytu's most significant revenue drivers?

Tuzistra XR and ZolpiMist account for the majority of Aytu's revenues, supported by the company's focus on cough, cold, and sleep indications.

-

How does Aytu compare to larger pharma firms in innovation?

Aytu relies primarily on reformulations of existing drugs and has a relatively limited pipeline, whereas larger firms invest heavily in novel therapies and broad R&D.

-

What opportunities exist for Aytu in the current regulatory environment?

Fast-track and orphan drug designations can expedite approvals, providing competitive advantages for pipeline products.

-

What are the main risks associated with Aytu's growth strategy?

Patent expirations, limited financial resources for R&D, and intense competition in niche markets could hinder growth.

-

How can Aytu strengthen its market position?

By expanding its pipeline, increasing marketing efforts, and forging strategic partnerships, Aytu can accelerate growth within its niche sectors.

References

- Aytu Bioscience, Inc. Annual Report 2022

- NASDAQ Listings, Q1 2023

- Industry Reports: Specialty Pharma Market Analysis, 2022-2023

- FDA Database, Product Approvals and ANDA filings, 2023