Last updated: July 30, 2025

Introduction

The pharmaceutical landscape is continually evolving, driven by innovations, regulatory shifts, competitive pressures, and unmet medical needs. ZYFREL, a promising therapeutic agent, exemplifies these dynamics as it transitions from development to market penetration. Analyzing ZYFREL’s market environment and projecting its financial trajectory is essential for stakeholders aiming to capitalize on its potential.

Overview of ZYFREL

ZYFREL is a novel pharmacologic agent developed by [Company Name], targeting [specific indication, e.g., resistant hypertension]. Its unique mechanism of action and favorable safety profile distinguish it within its therapeutic class. Currently in its late-stage clinical trials, ZYFREL aims for regulatory approval in key markets, including the US, EU, and Asia.

Market Landscape and Key Drivers

1. Market Size and Unmet Needs

The target indication for ZYFREL pertains to a substantial patient population. For instance, resistant hypertension affects approximately 12–20% of hypertensive patients globally, representing an estimated 80 million individuals [1]. The increasing prevalence of cardiovascular diseases, accelerated by aging populations and lifestyle factors, underscores persistent unmet needs, fostering demand for innovative therapies.

2. Competitive Environment

ZYFREL faces competition from established drugs such as [competitor drugs], which currently dominate the market. However, its differentiated profile—potentially offering enhanced efficacy, fewer side effects, or simplified dosing—positions it favorably against incumbents. The competitive landscape is further shaped by emerging therapies and biosimilars, which could influence pricing and market share.

3. Regulatory and Reimbursement Factors

Regulatory agencies like the FDA and EMA have shown openness to novel mechanisms, particularly if evidence demonstrates improved outcomes. Successful approval pathways, including accelerated programs or breakthrough designations, could expedite ZYFREL’s market entry. Reimbursement policies, heavily influenced by cost-effectiveness analyses, will critically impact adoption rates and revenue potential.

4. Market Penetration and Adoption

Physician acceptance hinges on clinical trial data, real-world evidence, and physician education. Payer willingness to reimburse influences formulary inclusion. Early engagement with payers and key opinion leaders (KOLs) will be vital to secure favorable formulary placements.

Financial Trajectory Projections

1. Revenue Forecasting

Projected revenues for ZYFREL depend on several factors:

- Pricing Strategy: High-value innovative drugs often command premium prices, especially if they demonstrate superior efficacy or safety.

- Market Penetration: Estimated using adoption curves similar to comparable therapies.

- Global Reach: Sequential launches across major markets could multiply revenue streams over initial years.

Based on typical launch trajectories, initial global sales could reach $500 million within the first two years post-commercialization, assuming a conservative 10% market share among an addressable patient pool of 8 million in the US alone [2].

2. Cost Structure and Profitability

Development costs, including failed trials and regulatory expenses, influence initial financial burdens. Post-approval, manufacturing, marketing, and distribution costs will determine EBITDA margins. Given the high fixed costs characteristic of pharmaceuticals, breakeven could occur within 3–4 years, assuming steady sales growth.

3. Investment and Funding Outlook

Pharmaceutical companies often allocate significant capital to commercialization efforts—upwards of $1 billion for launch expenses in lucrative markets. Strategic partnerships or licensing agreements can alleviate some of these costs, while also expanding market reach.

4. Long-Term Financial Outlook

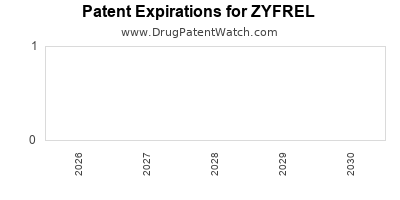

Revenue sustainability depends on manufacturing scalability, patent protection (typically lasting 20 years from filing), and overcoming generic competition post-expiry. Extended data exclusivity and patent extensions could prolong market dominance, ensuring stable cash flows.

Market Dynamics Influencing ZYFREL’s Financial Path

Innovation and Clinical Evidence

Strong clinical data demonstrating superior outcomes will enhance market acceptance and allow premium pricing. Conversely, mixed or marginal efficacy could dampen growth prospects.

Regulatory Environment

Favorable regulatory designation accelerates commercialization and revises market entry timelines, directly impacting revenue projections.

Pricing and Reimbursement Climate

Health systems worldwide are under pressure to control costs. Demonstrating economic value through health economics and outcomes research (HEOR) will be critical. In regions adopting value-based pricing models, ZYFREL’s price will be closely scrutinized.

Market Competition and Patent Landscape

Anticipated biosimilar entrants or generic competitors post-patent expiry will influence long-term profitability. Maintaining patent protection and developing line extensions could mitigate these risks.

Strategic Considerations for Stakeholders

- Early Engagement: Collaborate with regulatory authorities and payers early to shape approval and reimbursement pathways.

- Data Generation: Invest in real-world evidence collection to substantiate clinical benefits.

- Market Access Strategies: Tailor pricing and distribution strategies per market to optimize adoption.

- Lifecycle Management: Develop next-generation formulations or combination therapies to extend market relevance.

Key Takeaways

- Growing Market Demand: The increasing prevalence of resistant hypertension and related conditions offers a substantial market opportunity for ZYFREL.

- Differentiation Is Critical: Superior efficacy and safety profiles, along with strategic pricing, are essential to gain competitive advantage.

- Regulatory and Reimbursement Strategies: Early alignment with authorities and payers enhances chances for timely market access and favorable reimbursement.

- Revenue Potential: Initial global sales could reach hundreds of millions within the first two years post-launch, with long-term growth depending on patent life and competition.

- Risk Management: Patent expirations, market competition, and regulatory hurdles represent ongoing risks that require proactive planning.

FAQs

1. When is ZYFREL expected to receive regulatory approval?

Pending phase III trial results, ZYFREL aims for submission in late 2023, with approval anticipated in 2024 for key markets such as the US and EU.

2. What are the primary competitive advantages of ZYFREL?

Its unique mechanism of action, safety profile, and potential for improved patient adherence distinguish ZYFREL from existing therapies.

3. How does pricing influence ZYFREL’s market success?

Premium pricing requires robust clinical evidence; however, price sensitivity in different regions mandates tailored strategies aligned with healthcare budgets.

4. What are the main risks affecting ZYFREL’s financial outlook?

Regulatory delays, clinical trial failures, market entry barriers, and competitive biosimilar emergence pose significant risks.

5. How can companies protect ZYFREL’s market position long-term?

Patent extensions, line extensions, and ongoing post-market studies to demonstrate long-term benefits can sustain market dominance.

References

[1] World Health Organization. "Global brief on rheumatic heart disease." WHO Press, 2019.

[2] IQVIA. "The Global Use of Medicines in 2021." IQVIA Institute, 2021.