ZURAGARD Drug Patent Profile

✉ Email this page to a colleague

Which patents cover Zuragard, and what generic alternatives are available?

Zuragard is a drug marketed by Zurex Pharma and is included in one NDA. There are seven patents protecting this drug.

This drug has sixty-five patent family members in twenty-two countries.

The generic ingredient in ZURAGARD is isopropyl alcohol. There are thirty-one drug master file entries for this compound. Additional details are available on the isopropyl alcohol profile page.

DrugPatentWatch® Generic Entry Outlook for Zuragard

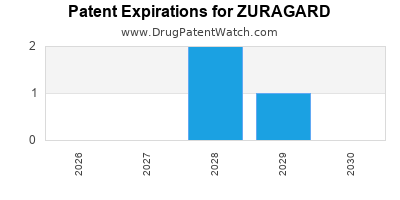

By analyzing the patents and regulatory protections it appears that the earliest date

for generic entry will be May 23, 2028. This may change due to patent challenges or generic licensing.

Indicators of Generic Entry

AI Deep Research

Questions you can ask:

- What is the 5 year forecast for ZURAGARD?

- What are the global sales for ZURAGARD?

- What is Average Wholesale Price for ZURAGARD?

Summary for ZURAGARD

| International Patents: | 65 |

| US Patents: | 7 |

| Applicants: | 1 |

| NDAs: | 1 |

| Raw Ingredient (Bulk) Api Vendors: | 384 |

| Clinical Trials: | 1 |

| DailyMed Link: | ZURAGARD at DailyMed |

DrugPatentWatch® Estimated Loss of Exclusivity (LOE) Date for ZURAGARD

Generic Entry Date for ZURAGARD*:

Constraining patent/regulatory exclusivity:

NDA:

Dosage:

SOLUTION;TOPICAL |

*The generic entry opportunity date is the latter of the last compound-claiming patent and the last regulatory exclusivity protection. Many factors can influence early or later generic entry. This date is provided as a rough estimate of generic entry potential and should not be used as an independent source.

Recent Clinical Trials for ZURAGARD

Identify potential brand extensions & 505(b)(2) entrants

| Sponsor | Phase |

|---|---|

| Zurex Pharma, Inc. | Phase 3 |

US Patents and Regulatory Information for ZURAGARD

ZURAGARD is protected by seven US patents.

Based on analysis by DrugPatentWatch, the earliest date for a generic version of ZURAGARD is ⤷ Get Started Free.

This potential generic entry date is based on patent 8,703,828.

Generics may enter earlier, or later, based on new patent filings, patent extensions, patent invalidation, early generic licensing, generic entry preferences, and other factors.

| Applicant | Tradename | Generic Name | Dosage | NDA | Approval Date | TE | Type | RLD | RS | Patent No. | Patent Expiration | Product | Substance | Delist Req. | Exclusivity Expiration |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Zurex Pharma | ZURAGARD | isopropyl alcohol | SOLUTION;TOPICAL | 210872-001 | Apr 26, 2019 | OTC | Yes | Yes | 9,629,368 | ⤷ Get Started Free | ⤷ Get Started Free | ||||

| Zurex Pharma | ZURAGARD | isopropyl alcohol | SOLUTION;TOPICAL | 210872-001 | Apr 26, 2019 | OTC | Yes | Yes | 8,703,828 | ⤷ Get Started Free | Y | ⤷ Get Started Free | |||

| Zurex Pharma | ZURAGARD | isopropyl alcohol | SOLUTION;TOPICAL | 210872-001 | Apr 26, 2019 | OTC | Yes | Yes | 8,389,583 | ⤷ Get Started Free | ⤷ Get Started Free | ||||

| Zurex Pharma | ZURAGARD | isopropyl alcohol | SOLUTION;TOPICAL | 210872-001 | Apr 26, 2019 | OTC | Yes | Yes | 9,844,654 | ⤷ Get Started Free | Y | ⤷ Get Started Free | |||

| Zurex Pharma | ZURAGARD | isopropyl alcohol | SOLUTION;TOPICAL | 210872-001 | Apr 26, 2019 | OTC | Yes | Yes | 10,688,291 | ⤷ Get Started Free | Y | ⤷ Get Started Free | |||

| >Applicant | >Tradename | >Generic Name | >Dosage | >NDA | >Approval Date | >TE | >Type | >RLD | >RS | >Patent No. | >Patent Expiration | >Product | >Substance | >Delist Req. | >Exclusivity Expiration |

Expired US Patents for ZURAGARD

| Applicant | Tradename | Generic Name | Dosage | NDA | Approval Date | Patent No. | Patent Expiration |

|---|---|---|---|---|---|---|---|

| Zurex Pharma | ZURAGARD | isopropyl alcohol | SOLUTION;TOPICAL | 210872-001 | Apr 26, 2019 | 8,226,971 | ⤷ Get Started Free |

| Zurex Pharma | ZURAGARD | isopropyl alcohol | SOLUTION;TOPICAL | 210872-001 | Apr 26, 2019 | 9,011,897 | ⤷ Get Started Free |

| >Applicant | >Tradename | >Generic Name | >Dosage | >NDA | >Approval Date | >Patent No. | >Patent Expiration |

International Patents for ZURAGARD

When does loss-of-exclusivity occur for ZURAGARD?

Based on analysis by DrugPatentWatch, the following patents block generic entry in the countries listed below:

Australia

Patent: 09249541

Patent: Antimicrobial compositions and methods of use

Estimated Expiration: ⤷ Get Started Free

Brazil

Patent: 0913086

Patent: Composições antimicrobianas e métodos de uso

Estimated Expiration: ⤷ Get Started Free

Canada

Patent: 24784

Patent: COMPOSITIONS ANTIMICROBIENNES ET LEURS PROCEDES D'UTILISATION (ANTIMICROBIAL COMPOSITIONS AND METHODS OF USE)

Estimated Expiration: ⤷ Get Started Free

China

Patent: 2105055

Patent: Antimicrobial compositions and methods of use

Estimated Expiration: ⤷ Get Started Free

Patent: 6466319

Patent: 抗微生物组合物和使用方法 (Antimicrobial compositions and methods of use)

Estimated Expiration: ⤷ Get Started Free

Denmark

Patent: 93668

Estimated Expiration: ⤷ Get Started Free

European Patent Office

Patent: 93668

Patent: COMPOSITIONS ANTIMICROBIENNES ET LEURS PROCÉDÉS D'UTILISATION (ANTIMICROBIAL COMPOSITIONS AND METHODS OF USE)

Estimated Expiration: ⤷ Get Started Free

Israel

Patent: 9507

Patent: תכשירים אנטימיקרוביים ושיטות לשימוש בהם (Antimicrobial compositions and methods of use thereof)

Estimated Expiration: ⤷ Get Started Free

Japan

Patent: 34848

Estimated Expiration: ⤷ Get Started Free

Patent: 11520960

Estimated Expiration: ⤷ Get Started Free

Mexico

Patent: 3841

Patent: COMPOSICIONES ANTIMICROBIANAS Y METODOS DE USO. (ANTIMICROBIAL COMPOSITIONS AND METHODS OF USE.)

Estimated Expiration: ⤷ Get Started Free

Patent: 10012739

Patent: COMPOSICIONES ANTIMICROBIANAS Y MÉTODOS DE USO. (ANTIMICROBIAL COMPOSITIONS AND METHODS OF USE.)

Estimated Expiration: ⤷ Get Started Free

Poland

Patent: 93668

Estimated Expiration: ⤷ Get Started Free

Russian Federation

Patent: 19038

Patent: АНТИМИКРОБНЫЕ КОМПОЗИЦИИ И СПОСОБЫ ПРИМЕНЕНИЯ (ANTIMICROBIAL COMPOSITIONS AND METHODS OF USING THEM)

Estimated Expiration: ⤷ Get Started Free

Patent: 48456

Patent: АНТИМИКРОБНЫЕ КОМПОЗИЦИИ И СПОСОБЫ ПРИМЕНЕНИЯ (ANTIMICROBIAL COMPOSITIONS AND METHODS OF USE)

Estimated Expiration: ⤷ Get Started Free

Patent: 10152555

Patent: АНТИМИКРОБНЫЕ КОМПОЗИЦИИ И СПОСОБЫ ПРИМЕНЕНИЯ

Estimated Expiration: ⤷ Get Started Free

Patent: 14111445

Patent: АНТИМИКРОБНЫЕ КОМПОЗИЦИИ И СПОСОБЫ ПРИМЕНЕНИЯ

Estimated Expiration: ⤷ Get Started Free

South Africa

Patent: 1008713

Patent: ANTIMICROBIAL COMPOSITIONS AND METHODS OF USE

Estimated Expiration: ⤷ Get Started Free

Spain

Patent: 23909

Estimated Expiration: ⤷ Get Started Free

Generics may enter earlier, or later, based on new patent filings, patent extensions, patent invalidation, early generic licensing, generic entry preferences, and other factors.

See the table below for additional patents covering ZURAGARD around the world.

| Country | Patent Number | Title | Estimated Expiration |

|---|---|---|---|

| Australia | 2014254271 | Medical skin applicator apparatus | ⤷ Get Started Free |

| Mexico | 2015014692 | ⤷ Get Started Free | |

| China | 110251819 | 医疗皮肤涂敷器装置 (Medical skin applicator apparatus) | ⤷ Get Started Free |

| Japan | 6396993 | ⤷ Get Started Free | |

| Hong Kong | 1094323 | A CATHETER LOCK SOLUTION COMPRISING CITRATE AND A PARABEN | ⤷ Get Started Free |

| >Country | >Patent Number | >Title | >Estimated Expiration |

Supplementary Protection Certificates for ZURAGARD

| Patent Number | Supplementary Protection Certificate | SPC Country | SPC Expiration | SPC Description |

|---|---|---|---|---|

| 0289349 | SPC/GB04/007 | United Kingdom | ⤷ Get Started Free | PRODUCT NAME: ISOPROPYL(+)-(Z)-7-((1R,2R,3R,5S)-3,5-DIHYDROXY-2-(3-OXODECYL)CYCLOPENTYL)-5-HEPTENOATE; REGISTERED: CH 55634 01 20010329; UK PL00101/0667 20031112 |

| 1920764 | 2012/033 | Ireland | ⤷ Get Started Free | PRODUCT NAME: TRAVOPROST (ALSO CALLED FLUPROSTENOL ISOPROPYL ESTER); NAT REGISTRATION NO/DATE: EU/1/01/199/001-002 20011129; FIRST REGISTRATION NO/DATE: EU/1/01/199/001-002 20011129; PAEDIATRIC INVESTIGATION PLAN: P/0298/2013 PROCEEDINGS UNDER SECTION 37 OF THE PATENTS ACT, 1992 RESTORATION ORDER DATED 12TH JANUARY 2016, WAS MADE RESTORING THE PATENT MENTIONED BELOW S85583 PAUL DOYLE A RE-USABLE BAG SYSTEM RESTORATION ORDERS DATED 16TH FEBRUARY 2016, WERE MADE RESTORING THE PATENTS MENTIONED BELOW S86133 MERVYN GREENE MULTI PURPOSE TANK STAND WITH COMPLEX LOCKING MECHANISM 86119 MPC GREEN LIMITED ANEW BIN |

| 2447254 | 2018015 | Norway | ⤷ Get Started Free | PRODUCT NAME: 2-4-(N-(5,6-DIFENYLPYRAZIN-2- YL)-N- ISOPROPYLAMINO)BUTYLOKSY-N-; REG. NO/DATE: EU/1/15/1083 20160530 |

| 1448186 | 2012C/051 | Belgium | ⤷ Get Started Free | PRODUCT NAME: MELANGE DE CATECHOLS ISOLES D'UN EXTRAIT DE THE (CAMELLIA SINENSIS (L.) O. KUNTZE) AVEC DU MYRISTATE D'ISOPROPYLE; AUTHORISATION NUMBER AND DATE: BE424383 20120719 |

| 2203462 | 2014029 | Norway | ⤷ Get Started Free | PRODUCT NAME: SOFOSBUVIR. (S)-ISOPROPYL 2-; NAT. REG. NO/DATE: EU/1/13/894 20140116; FIRST REG. NO/DATE: (001-002) 20140117 |

| >Patent Number | >Supplementary Protection Certificate | >SPC Country | >SPC Expiration | >SPC Description |

Market Dynamics and Financial Trajectory for ZURAGARD

More… ↓

Make Better Decisions: Try a trial or see plans & pricing

Drugs may be covered by multiple patents or regulatory protections. All trademarks and applicant names are the property of their respective owners or licensors. Although great care is taken in the proper and correct provision of this service, thinkBiotech LLC does not accept any responsibility for possible consequences of errors or omissions in the provided data. The data presented herein is for information purposes only. There is no warranty that the data contained herein is error free. We do not provide individual investment advice. This service is not registered with any financial regulatory agency. The information we publish is educational only and based on our opinions plus our models. By using DrugPatentWatch you acknowledge that we do not provide personalized recommendations or advice. thinkBiotech performs no independent verification of facts as provided by public sources nor are attempts made to provide legal or investing advice. Any reliance on data provided herein is done solely at the discretion of the user. Users of this service are advised to seek professional advice and independent confirmation before considering acting on any of the provided information. thinkBiotech LLC reserves the right to amend, extend or withdraw any part or all of the offered service without notice.