Last updated: August 5, 2025

Introduction

Xylocaine Viscous, the topical anesthetic formulation of lignocaine (lidocaine), holds a significant position in the dental, ENT (ear, nose, throat), and minor surgical procedures sectors. Its viscous form offers distinct advantages for direct mucosal application, providing localized anesthesia with a rapid onset. Understanding the market dynamics and financial trajectory involves analyzing regulatory landscape, competitive environment, clinical demand drivers, and emerging trends shaping its future.

Regulatory Landscape and Market Entry Barriers

Regulatory approval remains pivotal in dictating market accessibility for Xylocaine Viscous. Approved by agencies such as the US FDA and EMA, its regulatory pathway emphasizes safety, efficacy, and manufacturing quality. However, evolving regulations concerning compounded preparations, generic substitutions, and labeling requirements have increased barriers for new entrants and may influence market growth negatively in some regions.

In the United States, Xylocaine Viscous has long been FDA approved for topical dental and mucosal anesthesia, with a 510(k) clearance process for generic formulations. Continuous refinement of manufacturing standards and post-marketing surveillance ensures sustained patent protection and market confidence.

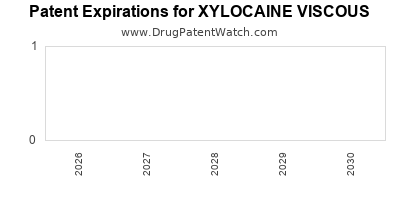

Patent Protectiveness & Market Exclusivity:

While the original patents for lignocaine have expired, formulation patents, such as specific viscous compositions and delivery systems, can extend exclusivity periods, impacting competition dynamics.

Key Market Drivers

-

Clinical Demand and Expansion in Dental and ENT Procedures:

The rising prevalence of dental diseases, owing to aging populations and improved awareness, directly correlates with increased procedural interventions requiring local anesthesia. Xylocaine Viscous, favored for its ease of application and quick onset, remains a preferred agent.

-

Regulatory Endorsements in Emerging Markets:

Growing acceptance and regulatory approvals by authorities in Asia-Pacific, Latin America, and the Middle East expand the scope beyond traditional Western markets, amplifying sales volumes.

-

Technological Innovations:

Developments such as extended-release formulations, combination products, and novel viscous carriers augment the clinical utility—potentially commanding premium pricing and market share.

-

Prevalence of Minimally Invasive Procedures:

The global shift towards minimally invasive dental and surgical procedures favors topical anesthetics like Xylocaine Viscous, which streamline patient comfort and procedural efficiency.

Competitive Landscape

Major players include AstraZeneca (previously through its branded Xylocaine), with generic manufacturers entering the fray post-patent expiry. Generic competition typically drives prices downward while expanding access, influencing revenue trajectories.

Emerging biotech firms are exploring innovative delivery systems—liposomal encapsulation, mucoadhesive gels—that could challenge traditional viscous formulations. Additionally, alternative local anesthetics and non-pharmacologic approaches (e.g., laser anesthesia) present potential competitive threats.

Pricing Strategies:

Price erosion due to generic competition is a key factor impacting revenue prospects. Nevertheless, premium formulations with enhanced efficacy or patient benefits command higher margins, partially offsetting volume pressures.

Market Segmentation and Geographic Trends

-

By Application:

Dental (major), ENT, minor surgical procedures, and pharmaceutical compounding.

-

By Region:

North America dominates due to high procedural volume and established healthcare systems. Europe and Asia-Pacific follow, with growth driven by increasing procedural adoption and expanding healthcare infrastructure.

-

Emerging Markets:

Rapid urbanization, rising healthcare expenditure, and expanding dental chains propel regional growth. The Asia-Pacific market is projected to witness compounded annual growth rates (CAGR) of approximately 6-8% over the next five years.

Financial Trajectory Projections

Current Market Valuation:

The global topical anesthetics market, including lignocaine-based products, was valued at approximately USD 950 million in 2022 (Market Research Future [1]). Xylocaine Viscous accounts for a substantial share, estimated at nearly USD 250-300 million, given its wide clinical utilization.

Growth Forecasts:

Analysts project an average CAGR of 4-6% over 2023-2028, driven chiefly by:

- Increased procedural volumes.

- Penetration into emerging markets.

- Development of innovative formulations.

Revenue Drivers & Risks:

While clinical demand and regulatory support bolster projections, competitive pricing, patent expirations, and generic market saturation present risks. Cost pressures may erode margins, especially where price-based competition intensifies.

Impact of Digital and Supply Chain Dynamics:

Enhanced supply chain management and digital marketing strategies are expected to support revenue stability, particularly with key global distributors and hospital procurement channels.

Emerging Trends and Future Outlook

Innovation and Formulation Development

The future of Xylocaine Viscous hinges on sustained innovation, including:

- Liposomal and gel-based formulations to prolong anesthetic effects.

- Combination therapies incorporating adjunct compounds to reduce procedural discomfort.

- Novel delivery modalities such as transdermal patches or mucoadhesive films.

Regulatory and Market Access Strategies

Proactive engagement with regulatory agencies and early adoption strategies in emerging markets are essential for maintaining growth momentum amid intensifying competition.

Market Consolidation and Collaborations

Partnerships between pharma giants and biotech innovators can accelerate product development, expand distribution networks, and access new customer segments. Private label initiatives further diversify revenue streams.

Key Challenges

- Price erosion from generics.

- Regulatory unpredictability.

- Competition from alternative anesthetic agents and delivery systems.

- Manufacturing costs associated with high-quality viscous formulations.

Conclusion

Xylocaine Viscous’s market outlook remains robust in the face of competitive and regulatory challenges. Its established efficacy, clinical utility, and expanding regional footprints support a steady financial trajectory. Strategic innovation, market expansion, and navigating competitive dynamics are critical to maximizing value in the evolving landscape of topical local anesthetics.

Key Takeaways

- Market Expansion: The increasing demand for minimally invasive procedures globally supports steady growth for Xylocaine Viscous.

- Competitive Dynamics: Patent expirations and generic competition exert downward pressure on pricing, but innovation in formulation can buffer margins.

- Regional Opportunities: High-growth markets in Asia-Pacific and Latin America offer substantial revenue potential.

- Innovation Focus: Investment in advanced delivery systems and combination therapies is vital for maintaining competitive edge.

- Regulatory Landscape: Navigating evolving approval processes and patent protections is central to sustaining market share.

FAQs

1. How does patent expiration influence the market for Xylocaine Viscous?

Patent expiry typically introduces generic competitors, leading to price competition and reduced revenue for brand-name formulations. However, formulation-specific patents can prolong market exclusivity.

2. What are the primary applications driving demand for Xylocaine Viscous?

Its main applications include dental procedures, ENT interventions, and minor surgical procedures requiring localized mucosal anesthesia.

3. Are new formulations or delivery methods emerging for Xylocaine Viscous?

Yes, innovations such as liposomal encapsulation, mucoadhesive gels, and transdermal patches aim to extend anesthetic duration and improve patient comfort.

4. Which regions show the highest growth potential for Xylocaine Viscous?

Emerging markets in Asia-Pacific and Latin America present significant growth opportunities due to increasing procedural volumes and expanding healthcare infrastructure.

5. What are the main risks facing the financial trajectory of Xylocaine Viscous?

Key risks include price erosion from generics, regulatory hurdles, competitive alternative anesthetics, and manufacturing cost inflation.

Sources

[1] Market Research Future. Topical Anesthetics Market Research Report, 2023.