Last updated: July 29, 2025

Introduction

XULANE (contraceptive transdermal system) stands as a prominent player in the hormonal birth control market, leveraging innovative transdermal technology to deliver contraceptive hormones. Its market trajectory is shaped by a confluence of demographic trends, regulatory environments, competitive landscapes, and technological advancements that collectively influence its commercial prospects and revenue potential.

Market Overview

The global contraceptive market was valued at approximately USD 20 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of around 4.5% through 2030, driven by increasing awareness, expanding reproductive health initiatives, and rising female workforce participation (1). XULANE, as a non-daily alternative to oral contraceptives, benefits from the growing demand for user-friendly, adherent contraceptive options.

Market Dynamics

Drivers

-

Innovative Delivery Technology: XULANE’s transdermal patch offers a discreet, once-weekly alternative to daily pills. This convenience enhances user compliance, a critical factor in contraceptive efficacy, thereby bolstering its adoption amid increasing demand for long-acting reversible contraceptives (LARCs) (2).

-

Regulatory Approvals and Labeling: Since its FDA approval in 2014, XULANE has undergone label updates to expand indications and improve safety profiles, reinforcing its market presence. Regulatory support, especially in emerging markets, facilitates wider distribution and acceptance.

-

Rising Female Population and Reproductive Health Awareness: The global increase in women of reproductive age (15-49 years), along with heightened awareness about family planning, propels demand for reliable contraceptive methods like XULANE (3).

-

Strategic Partnerships and Market Expansion: Collaborations with healthcare providers and government health programs have augmented distribution networks, extend reach to underserved populations, and contribute to revenue growth.

Challenges

-

Safety and Side Effects: Skin reactions and concerns over hormonal side effects influence user persistence and can impede growth. The FDA’s black box warning on thromboembolic risks associated with hormonal contraceptives remains a barrier in some markets.

-

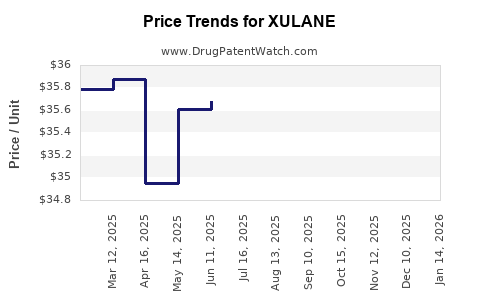

Pricing and Reimbursement Dynamics: Insurance coverage disparities and high out-of-pocket costs limit uptake, especially in price-sensitive regions.

-

Competitive Landscape: The market is highly competitive, with oral contraceptives, intrauterine devices (IUDs), implants, and newer hormonal methods vying for market share. Major competitors such as Ortho Evra (another transdermal patch) and hormonal IUDs pose significant challenges.

-

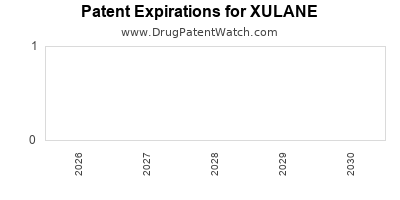

Patent and Regulatory Challenges: Patent expirations and regulatory hurdles in various jurisdictions can impact profitability and market exclusivity.

Financial Trajectory

Revenue Generation

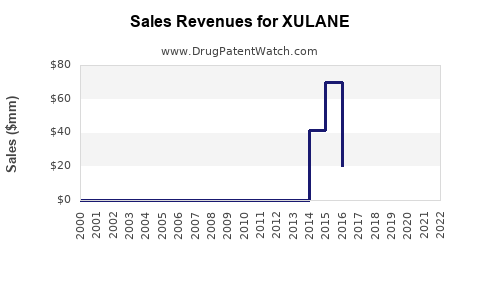

XULANE’s revenue is primarily derived from direct sales, insurance reimbursements, and distribution partnerships. Initial sales post-launch in 2014 were modest but gained momentum as awareness increased and distribution expanded, reflecting a typical product adoption curve for innovative contraceptives.

In its early lifecycle, XULANE faced slow penetration due to physician familiarity and reimbursement hurdles. However, recent market data indicates accelerated growth driven by improved acceptance and expanded indications.

Revenue Forecasts

-

2022-2025: The revenue trajectory is projected to grow at a CAGR of approximately 7-9%, influenced by expanding markets in North America, Europe, and select Asia-Pacific regions.

-

Key Factors Influencing Growth:

- Broadened insurance coverage and government procurement programs.

- Entry into emerging markets with large reproductive-age populations.

- Development of next-generation formulations to improve safety profiles and patient adherence.

-

Profitability Outlook: While current margins are affected by R&D expenditure and distribution costs, scaling production volume and enhanced market penetration are expected to improve profitability. Economies of scale and regulatory clarifications will further optimize margins.

Regulatory and Market Expansion Outlook

The future financial trajectory hinges on navigating regulatory pathways, especially in emerging markets where approval timelines can vary significantly. Countries like India, Brazil, and China present substantial growth opportunities given their large populations and rising contraceptive needs.

Recent efforts to change labeling for improved safety and efficacy will likely sustain compliance and consumer confidence, essential for long-term financial stability.

Technological Innovations and New Product Development

Ongoing research is exploring alternative delivery systems—such as biodegradable patches and combination hormonal formulations—that may enhance user experience and safety, potentially opening new revenue streams.

Investment in educational campaigns and partnerships can foster consumer acceptance, further boosting sales.

Impact of Market Competition and Consumer Preferences

The competitive landscape remains intense, with newer entrants attempting to leverage digital health solutions and personalized contraceptive options. The popularity of less invasive or hormone-free methods could challenge some market segments. Therefore, continuous innovation and strategic positioning are paramount for XULANE's sustained financial performance.

Conclusion

XULANE’s market dynamics are shaped by technological innovation, demographic trends, and regulatory factors. Its financial trajectory will likely follow a steady growth path over the next decade, supported by expanding global markets and evolving contraceptive preferences. Nonetheless, mitigating safety concerns, pricing pressures, and competitive threats remains critical to sustaining its growth momentum.

Key Takeaways

-

Market Growth: The contraceptive market’s anticipated CAGR of 4.5% provides a favorable backdrop for XULANE’s growth, particularly in key regions with high reproductive-age populations.

-

Revenue Drivers: Adoption is driven by convenience, increased awareness, reimbursement expansion, and strategic partnerships.

-

Challenges & Risks: Safety concerns, competitive pressure, and regulatory hurdles may temper growth; proactive innovation and market strategies are needed.

-

Investment Outlook: Continued R&D investment and market expansion into underserved regions are essential for future profitability.

-

Strategic Focus: Emphasizing safety profile improvements, patient adherence, and consumer education will solidify XULANE’s market position and enhance financial performance.

FAQs

1. What are the main advantages of XULANE over traditional oral contraceptives?

XULANE offers weekly transdermal hormone delivery, improving adherence and convenience compared to daily pills. Its discreet application reduces stigma and forgetfulness, enhancing efficacy.

2. How do safety concerns impact XULANE’s market potential?

While skin reactions and thromboembolic risks influence prescribing patterns, regulatory updates and patient education mitigate these concerns, maintaining its viability in the contraceptive market.

3. What emerging markets hold the most potential for XULANE?

India, Brazil, China, and Southeast Asian countries offer substantial growth opportunities due to large reproductive populations and increasing acceptance of hormonal contraceptives.

4. How does competition from other contraceptive methods affect XULANE?

Products like hormonal IUDs and implants provide longer-term solutions, but XULANE’s non-invasive, reversible nature appeals to users seeking flexibility, sustaining its niche in the market.

5. What technological innovations could influence XULANE’s future?

Developments in biodegradable patches, combination hormones, and personalized delivery systems could improve safety, reduce side effects, and broaden its appeal, impacting future revenue streams.

Sources

[1] Grand View Research, "Contraceptive Market Size & Share," 2022.

[2] U.S. Food and Drug Administration (FDA), "XULANE (etonogestrel transdermal system) Label."

[3] World Health Organization, "Reproductive Health Data," 2022.