XIIDRA Drug Patent Profile

✉ Email this page to a colleague

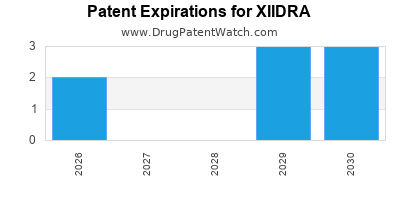

When do Xiidra patents expire, and when can generic versions of Xiidra launch?

Xiidra is a drug marketed by Bausch And Lomb Inc and is included in one NDA. There are eleven patents protecting this drug and one Paragraph IV challenge.

This drug has one hundred and fifty-seven patent family members in twenty-five countries.

The generic ingredient in XIIDRA is lifitegrast. Three suppliers are listed for this compound. Additional details are available on the lifitegrast profile page.

DrugPatentWatch® Generic Entry Outlook for Xiidra

Xiidra was eligible for patent challenges on July 11, 2020.

There have been two patent litigation cases involving the patents protecting this drug, indicating strong interest in generic launch. Recent data indicate that 63% of patent challenges are decided in favor of the generic patent challenger and that 54% of successful patent challengers promptly launch generic drugs.

There is one tentative approval for the generic drug (lifitegrast), which indicates the potential for near-term generic launch.

Indicators of Generic Entry

AI Deep Research

Questions you can ask:

- What is the 5 year forecast for XIIDRA?

- What are the global sales for XIIDRA?

- What is Average Wholesale Price for XIIDRA?

Summary for XIIDRA

| International Patents: | 157 |

| US Patents: | 11 |

| Applicants: | 1 |

| NDAs: | 1 |

| Finished Product Suppliers / Packagers: | 2 |

| Raw Ingredient (Bulk) Api Vendors: | 69 |

| Clinical Trials: | 16 |

| Patent Applications: | 1,126 |

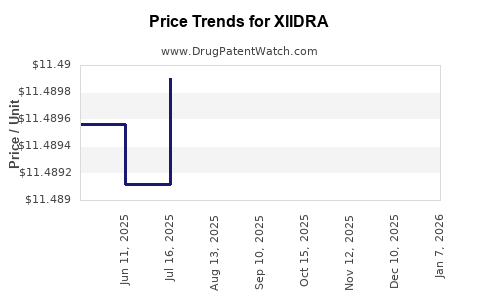

| Drug Prices: | Drug price information for XIIDRA |

| Patent Litigation and PTAB cases: | See patent lawsuits and PTAB cases for XIIDRA |

| What excipients (inactive ingredients) are in XIIDRA? | XIIDRA excipients list |

| DailyMed Link: | XIIDRA at DailyMed |

Recent Clinical Trials for XIIDRA

Identify potential brand extensions & 505(b)(2) entrants

| Sponsor | Phase |

|---|---|

| Southern College of Optometry | PHASE4 |

| Hoffmann-La Roche | PHASE4 |

| Mohsen Pourazizi | PHASE1 |

Pharmacology for XIIDRA

| Drug Class | Lymphocyte Function-Associated Antigen-1 Antagonist |

| Mechanism of Action | Lymphocyte Function-Associated Antigen-1 Antagonists |

Paragraph IV (Patent) Challenges for XIIDRA

| Tradename | Dosage | Ingredient | Strength | NDA | ANDAs Submitted | Submissiondate |

|---|---|---|---|---|---|---|

| XIIDRA | Ophthalmic Solution | lifitegrast | 5% | 208073 | 4 | 2020-07-13 |

US Patents and Regulatory Information for XIIDRA

XIIDRA is protected by eleven US patents.

| Applicant | Tradename | Generic Name | Dosage | NDA | Approval Date | TE | Type | RLD | RS | Patent No. | Patent Expiration | Product | Substance | Delist Req. | Exclusivity Expiration |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Bausch And Lomb Inc | XIIDRA | lifitegrast | SOLUTION/DROPS;OPHTHALMIC | 208073-001 | Jul 11, 2016 | RX | Yes | Yes | ⤷ Get Started Free | ⤷ Get Started Free | ⤷ Get Started Free | ||||

| Bausch And Lomb Inc | XIIDRA | lifitegrast | SOLUTION/DROPS;OPHTHALMIC | 208073-001 | Jul 11, 2016 | RX | Yes | Yes | ⤷ Get Started Free | ⤷ Get Started Free | Y | ⤷ Get Started Free | |||

| Bausch And Lomb Inc | XIIDRA | lifitegrast | SOLUTION/DROPS;OPHTHALMIC | 208073-001 | Jul 11, 2016 | RX | Yes | Yes | ⤷ Get Started Free | ⤷ Get Started Free | ⤷ Get Started Free | ||||

| >Applicant | >Tradename | >Generic Name | >Dosage | >NDA | >Approval Date | >TE | >Type | >RLD | >RS | >Patent No. | >Patent Expiration | >Product | >Substance | >Delist Req. | >Exclusivity Expiration |

Expired US Patents for XIIDRA

| Applicant | Tradename | Generic Name | Dosage | NDA | Approval Date | Patent No. | Patent Expiration |

|---|---|---|---|---|---|---|---|

| Bausch And Lomb Inc | XIIDRA | lifitegrast | SOLUTION/DROPS;OPHTHALMIC | 208073-001 | Jul 11, 2016 | ⤷ Get Started Free | ⤷ Get Started Free |

| Bausch And Lomb Inc | XIIDRA | lifitegrast | SOLUTION/DROPS;OPHTHALMIC | 208073-001 | Jul 11, 2016 | ⤷ Get Started Free | ⤷ Get Started Free |

| Bausch And Lomb Inc | XIIDRA | lifitegrast | SOLUTION/DROPS;OPHTHALMIC | 208073-001 | Jul 11, 2016 | ⤷ Get Started Free | ⤷ Get Started Free |

| >Applicant | >Tradename | >Generic Name | >Dosage | >NDA | >Approval Date | >Patent No. | >Patent Expiration |

International Patents for XIIDRA

When does loss-of-exclusivity occur for XIIDRA?

Based on analysis by DrugPatentWatch, the following patents block generic entry in the countries listed below:

Australia

Patent: 08317473

Patent: Compositions and methods for treatment of diabetic retinopathy

Estimated Expiration: ⤷ Get Started Free

Canada

Patent: 02984

Patent: COMPOSITIONS ET PROCEDES POUR LE TRAITEMENT DE LA RETINOPATHIE DIABETIQUE (COMPOSITIONS AND METHODS FOR TREATMENT OF DIABETIC RETINOPATHY)

Estimated Expiration: ⤷ Get Started Free

Patent: 58665

Patent: COMPOSITIONS ET PROCEDES POUR LE TRAITEMENT DE LA RETINOPATHIE DIABETIQUE (COMPOSITIONS AND METHODS FOR TREATMENT OF DIABETIC RETINOPATHY)

Estimated Expiration: ⤷ Get Started Free

Patent: 05972

Patent: COMPOSITIONS ET PROCEDES POUR LE TRAITEMENT DE LA RETINOPATHIE DIABETIQUE (COMPOSITIONS AND METHODS FOR TREATMENT OF DIABETIC RETINOPATHY)

Estimated Expiration: ⤷ Get Started Free

China

Patent: 1873797

Patent: Compositions and methods for treatment of diabetic retinopathy

Estimated Expiration: ⤷ Get Started Free

Patent: 2056485

Patent: Topical LFA-1 antagonists for use in localized treatment of immune related disorders

Estimated Expiration: ⤷ Get Started Free

Patent: 2065694

Patent: Aerosolized LFA-1 antagonists for use in localized treatment of immune related disorders

Estimated Expiration: ⤷ Get Started Free

Patent: 2065893

Patent: Delivery of LFA-1 antagonists to the gastrointestinal system

Estimated Expiration: ⤷ Get Started Free

Patent: 5943534

Patent: 用于局部治疗免疫相关疾病的局部LFA-1拮抗剂 (Topical LFA-1 antagonists for use in localized treatment of immune related disorders)

Estimated Expiration: ⤷ Get Started Free

European Patent Office

Patent: 09371

Patent: COMPOSITIONS ET PROCÉDÉS POUR LE TRAITEMENT DE LA RÉTINOPATHIE DIABÉTIQUE (COMPOSITIONS AND METHODS FOR TREATMENT OF DIABETIC RETINOPATHY)

Estimated Expiration: ⤷ Get Started Free

Patent: 65124

Patent: ANTAGONISTES DE LFA-1 SOUS FORME D'AÉROSOL UTILISÉS EN TRAITEMENT LOCALISÉ DE TROUBLES DE NATURE IMMUNITAIRE (AEROSOLIZED LFA-1 ANTAGONISTS FOR USE IN LOCALIZED TREATMENT OF IMMUNE RELATED DISORDERS)

Estimated Expiration: ⤷ Get Started Free

Patent: 65125

Patent: ANTAGONISTES DE LFA-1 TOPIQUES UTILISÉS DANS LE TRAITEMENT LOCALISÉ DE TROUBLES DE NATURE IMMUNITAIRE (TOPICAL LFA-1 ANTAGONISTS FOR USE IN LOCALIZED TREATMENT OF IMMUNE RELATED DISORDERS)

Estimated Expiration: ⤷ Get Started Free

Patent: 76508

Patent: ADMINISTRATION D'ANTAGONISTES DE LFA-1 AU SYSTÈME GASTRO-INTESTINAL (DELIVERY OF LFA-1 ANTAGONISTS TO THE GASTROINTESTINAL SYSTEM)

Estimated Expiration: ⤷ Get Started Free

Patent: 67886

Patent: COMPOSITIONS ET PROCÉDÉS POUR LE TRAITEMENT DE L'OEDÈME MACULAIRE (COMPOSITIONS AND METHODS FOR TREATMENT OF MACULAR EDEMA)

Estimated Expiration: ⤷ Get Started Free

Patent: 32444

Patent: ANTAGONISTES LFA-1 TOPIQUES POUR UNE UTILISATION DANS LE TRAITEMENT LOCALISÉ DE TROUBLES IMMUNITAIRES ASSOCIÉS (TOPICAL LFA-1 ANTAGONISTS FOR USE IN LOCALIZED TREATMENT OF IMMUNE RELATED DISORDERS)

Estimated Expiration: ⤷ Get Started Free

Patent: 97775

Patent: COMPOSITIONS ET PROCÉDÉS POUR LE TRAITEMENT DE LA RÉTINOPATHIE DIABÉTIQUE (COMPOSITIONS AND METHODS FOR TREATMENT OF DIABETIC RETINOPATHY)

Estimated Expiration: ⤷ Get Started Free

Japan

Patent: 08037

Estimated Expiration: ⤷ Get Started Free

Patent: 11500683

Estimated Expiration: ⤷ Get Started Free

Patent: 11516607

Estimated Expiration: ⤷ Get Started Free

Patent: 11518155

Estimated Expiration: ⤷ Get Started Free

Patent: 11521896

Estimated Expiration: ⤷ Get Started Free

Patent: 14132032

Patent: TOPICAL LFA-1 ANTAGONISTS FOR USE IN LOCALIZED TREATMENT OF IMMUNE RELATED DISORDERS

Estimated Expiration: ⤷ Get Started Free

Patent: 14132033

Patent: AEROSOLIZED LFA-1 ANTAGONISTS FOR USE IN LOCALIZED TREATMENT OF IMMUNE RELATED DISORDERS

Estimated Expiration: ⤷ Get Started Free

Patent: 14133751

Patent: DELIVERY OF LFA-1 ANTAGONISTS TO GASTROINTESTINAL SYSTEM

Estimated Expiration: ⤷ Get Started Free

Patent: 14221808

Patent: 糖尿病性網膜症の治療のための組成物及び方法 (COMPOSITION AND METHOD FOR TREATMENT OF DIABETIC RETINOPATHY)

Estimated Expiration: ⤷ Get Started Free

Patent: 16128515

Patent: 免疫関連障害の局所治療に使用するためのエアゾール化LFA−1アンタゴニスト (AEROSOLIZED LFA-1 ANTAGONIST TO BE USED FOR TOPICAL TREATMENT OF IMMUNE RELATED DISORDERS)

Estimated Expiration: ⤷ Get Started Free

Patent: 16153432

Patent: 胃腸系へのLFA−1アンタゴニストの送達 (DELIVERY OF LFA-1 ANTAGONISTS TO GASTROINTESTINAL SYSTEM)

Estimated Expiration: ⤷ Get Started Free

Patent: 17141310

Patent: 免疫関連障害の局所治療に使用するためのエアゾール化LFA−1アンタゴニスト (AEROSOLIZED LFA-1 ANTAGONIST TO BE USED FOR TOPICAL TREATMENT OF IMMUNE RELATED DISORDERS)

Estimated Expiration: ⤷ Get Started Free

Patent: 18127485

Patent: 胃腸系へのLFA−1アンタゴニストの送達 (DELIVERY OF LFA-1 ANTAGONISTS TO GASTROINTESTINAL SYSTEM)

Estimated Expiration: ⤷ Get Started Free

Patent: 20023546

Patent: 胃腸系へのLFA−1アンタゴニストの送達 (DELIVERY OF LFA-1 ANTAGONISTS TO GASTROINTESTINAL SYSTEM)

Estimated Expiration: ⤷ Get Started Free

Mexico

Patent: 10004281

Patent: COMPOSICIONES Y METODOS PARA EL TRATAMIENTO DE LA RETINOPATIA DIABETICA. (COMPOSITIONS AND METHODS FOR TREATMENT OF DIABETIC RETINOPATHY.)

Estimated Expiration: ⤷ Get Started Free

Spain

Patent: 30406

Estimated Expiration: ⤷ Get Started Free

Patent: 63703

Estimated Expiration: ⤷ Get Started Free

Patent: 30024

Estimated Expiration: ⤷ Get Started Free

Generics may enter earlier, or later, based on new patent filings, patent extensions, patent invalidation, early generic licensing, generic entry preferences, and other factors.

See the table below for additional patents covering XIIDRA around the world.

| Country | Patent Number | Title | Estimated Expiration |

|---|---|---|---|

| Australia | 2020281063 | ⤷ Get Started Free | |

| South Korea | 101891144 | ⤷ Get Started Free | |

| Mexico | 368876 | ⤷ Get Started Free | |

| >Country | >Patent Number | >Title | >Estimated Expiration |

Supplementary Protection Certificates for XIIDRA

| Patent Number | Supplementary Protection Certificate | SPC Country | SPC Expiration | SPC Description |

|---|---|---|---|---|

| 2444079 | C02444079/01 | Switzerland | ⤷ Get Started Free | FORMER OWNER: NOVARTIS AG, CH |

| >Patent Number | >Supplementary Protection Certificate | >SPC Country | >SPC Expiration | >SPC Description |

Market Dynamics and Financial Trajectory for Xiidra

More… ↓

Make Better Decisions: Try a trial or see plans & pricing

Drugs may be covered by multiple patents or regulatory protections. All trademarks and applicant names are the property of their respective owners or licensors. Although great care is taken in the proper and correct provision of this service, thinkBiotech LLC does not accept any responsibility for possible consequences of errors or omissions in the provided data. The data presented herein is for information purposes only. There is no warranty that the data contained herein is error free. We do not provide individual investment advice. This service is not registered with any financial regulatory agency. The information we publish is educational only and based on our opinions plus our models. By using DrugPatentWatch you acknowledge that we do not provide personalized recommendations or advice. thinkBiotech performs no independent verification of facts as provided by public sources nor are attempts made to provide legal or investing advice. Any reliance on data provided herein is done solely at the discretion of the user. Users of this service are advised to seek professional advice and independent confirmation before considering acting on any of the provided information. thinkBiotech LLC reserves the right to amend, extend or withdraw any part or all of the offered service without notice.