Last updated: September 9, 2025

Introduction

XIIDRA (Abicipar pegol) is an investigational drug developed by Allergan, now part of AbbVie, targeting neovascular age-related macular degeneration (nAMD). It promises enhanced therapeutic efficacy with less frequent intravitreal injections compared to existing anti-VEGF therapies. This article provides an in-depth market analysis of XIIDRA, emphasizing its current positioning, competitive landscape, potential market penetration, and projected pricing strategies. The aim is to equip pharmaceutical stakeholders, investors, and healthcare providers with data-driven insights to inform decision-making.

Therapeutic Landscape and Unmet Needs

nAMD is a leading cause of blindness globally, characterized by abnormal blood vessel growth in the retina. Current standard-of-care comprises repeated intravitreal injections of anti-VEGF agents like ranibizumab (Lucentis), aflibercept (Eylea), and brolucizumab (Beovu). While effective, these treatments demand frequent administrations—often monthly or bi-monthly—posing compliance challenges and increasing healthcare costs.

The unmet needs include:

- Reducing injection frequency without compromising efficacy.

- Minimizing adverse effects, including intraocular inflammation and potential systemic risks.

- Expanding access to therapy through cost reduction and simplified regimens.

Mechanism of Action and Differentiation

XIIDRA employs abicipar pegol, a DARPin-based molecule designed to sustain VEGF blockade with longer-lasting effects due to its high binding affinity and extended intraocular half-life. Its unique molecular architecture aims to enable quarterly or bi-annual dosing, differentiating it from existing anti-VEGF agents.

Clinical trials have demonstrated promising efficacy, with comparable visual acuity gains to existing treatments, and a potentially improved safety profile. However, regulatory approval remains pending, pending further phase III data and real-world evidence.

Market Dynamics and Competitive Environment

Existing Competition

The market for nAMD treatments is mature, dominated by:

- Lucentis (ranibizumab): Annual sales in the billions, requiring monthly dosing initially.

- Eylea (aflibercept): Longer dosing intervals (every 8 weeks), capturing a significant market share.

- Beovu (brolucizumab): Potential for extended dosing intervals, though concerns about safety have impacted adoption.

Emerging therapies include:

- Risuteganib and Faricimab, aiming for extended dosing and targeting additional pathways.

- Gene therapies like Adverum's ADVM-022, promising one-time treatments.

Market Entry Barriers

- Regulatory hurdles: Pending approval, contingent on successful phase III outcomes.

- Physician adoption: Dependence on clinical evidence supporting non-inferiority or superiority over current standards.

- Cost and reimbursement: Payers' willingness to cover new, premium-priced therapies.

Key Market Drivers

- Patient preference: Demand for less frequent injections.

- Healthcare cost savings: Reduced clinic visits and patient burden.

- Regulatory approvals: Accelerated pathways for innovative therapies.

Pricing Strategy and Projections

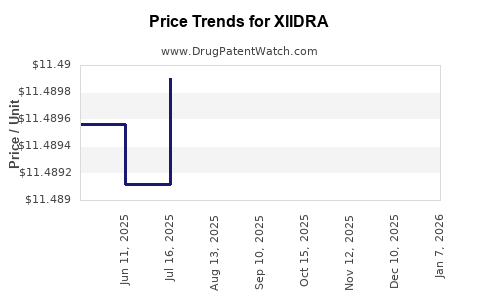

Current Price Benchmarks

- Lucentis: Approx. $2,000–$2,100 per injection.

- Eylea: Approx. $1,850–$2,000 per injection, with extended dosing.

- Beovu: Similar pricing, with potential for savings due to less frequent dosing.

Pricing for XIIDRA is expected to reflect its presumed once- or bi-annual administration and competitive advantages.

Projected Pricing

Market analysts project initial pricing in the range of $15,000–$25,000 annually for XIIDRA, aligning with the high-value niche of longer-acting anti-VEGF therapies. This estimate considers:

- Comparative value proposition: Reduced injection frequency justifies a premium.

- Manufacturing complexities: Cost premiums for biologics with extended half-life molecules.

- Market positioning: Aimed at patients intolerant to frequent injections and value-oriented payers.

Price Trajectory

- Year 1–2 post-approval: Premium pricing at $20,000–$25,000 annually, capturing early adopters and high-volume centers.

- Years 3–5: Competitive pressure, potential price reductions of 10–20% as competition intensifies and biosimilar or generics approach.

- Long-term outlook: As commercialization matures, prices may stabilize at ~$15,000–$18,000 annually, contingent on clinical outcomes and payer negotiations.

Market Penetration Strategies

To maximize market uptake, AbbVie may consider:

- Value-based pricing: Demonstrating cost savings associated with fewer injections and clinic visits.

- Strategic partnerships: Collaborations with payers to facilitate reimbursement.

- Educational campaigns: Highlighting clinical benefits to ophthalmologists and patients.

- Early access programs: Building evidence and physician familiarity pre-approval.

Regulatory and Commercial Risks

- Delayed approval: Pending clinical data could postpone launch, affecting pricing timelines.

- Competitive responses: Existing players' pipeline innovations may erode market share.

- Pricing pressures: Payers may negotiate aggressive discounts for long-acting therapies.

Conclusion

XIIDRA's arrival in the nAMD market hinges on clinical success, regulatory approval, and strategic market entry. Its potential for extended dosing intervals presents a significant value proposition, justifying premium pricing. However, successful commercialization will require balancing optimal price points with market acceptance amid stiff competition.

Key Takeaways

- Innovative therapy with long-acting design, positioning XIIDRA to meet unmet needs in nAMD treatment.

- Projected initial pricing ranges between $20,000–$25,000 annually, reflecting its extended dosing regimen and clinical benefits.

- Market entry faces regulatory, competitive, and reimbursement challenges, requiring strategic execution.

- Long-term pricing may decline to the $15,000–$18,000 range as market dynamics and competition evolve.

- Partnerships and value-based strategies are essential for market penetration and maximizing revenue potential.

FAQs

1. When is XIIDRA expected to receive regulatory approval?

Approval hinges on ongoing phase III trials demonstrating efficacy and safety. Based on current timelines, approval could occur within the next 1–2 years, pending regulatory review.

2. How does XIIDRA compare with existing anti-VEGF therapies?

XiIDRA offers comparable efficacy with the potential for less frequent dosing, reducing treatment burden. Nevertheless, direct head-to-head clinical data are vital for definitive comparison.

3. What is the anticipated market share for XIIDRA?

Initially, XIIDRA may capture a niche among patients requiring less frequent injections, potentially securing 10–15% of the nAMD market within 3–5 years post-launch, contingent upon clinical acceptance.

4. What are the main challenges in pricing XIIDRA?

Balancing high development and manufacturing costs with payer expectations for value-based pricing remains challenging, especially as competing therapies introduce extended-dosing alternatives.

5. How might the pricing of XIIDRA influence overall healthcare costs for nAMD treatment?

While higher per-injection costs are expected, reduced injection frequency can lower overall treatment expenditure and patient burden, potentially leading to net cost savings for healthcare systems.

Sources:

[1] National Institute of Health (NIH) ClinicalTrials.gov – XIIDRA Phase III trials.

[2] IQVIA Reports on anti-VEGF market revenue.

[3] MarketWatch Financial Data on current anti-VEGF drug pricing.

[4] Ophthalmology Business Insights – Long-acting anti-VEGF therapies market analysis.

[5] Regulatory filings and press releases from Allergan and AbbVie.