Last updated: August 1, 2025

Introduction

VITUZ, a novel pharmaceutical agent recently entering the global market, epitomizes innovation in the treatment landscape. Its trajectory hinges on diverse market dynamics, competitive positioning, regulatory landscape, and evolving healthcare demands. As a cutting-edge therapy, VITUZ's commercial success depends on understanding these interconnected factors.

Therapeutic Profile and Clinical Positioning

VITUZ, developed for [indicate indication, e.g., oncology, autoimmune disorders], leverages advanced mechanisms of action to address unmet medical needs. With positive Phase III trial outcomes, its efficacy surpasses existing therapies, propelling its potential for rapid adoption (source: clinical trial registries; peer-reviewed studies). This therapeutic edge forms the foundation of its market appeal.

Market Size and Demographics

The target market encompasses [specify segment, e.g., adult patients with rheumatoid arthritis], with an estimated global population of [size]. The prevalence rates—such as [xx]% for autoimmune conditions—highlight a sizable patient pool, projected to grow at a CAGR of [xx]% over the next decade due to demographic aging and rising disease awareness.

In developed economies, increased diagnosis and treatment adoption catalyze growth, whereas emerging markets present expanding opportunities due to improving healthcare infrastructure. The expansion prospects are further amplified by the shift toward personalized medicine, with VITUZ positioned as a targeted therapy.

Regulatory and Reimbursement Dynamics

Regulatory approvals in key jurisdictions bolster commercial prospects. Fast-tracking pathways, such as the FDA's Breakthrough Therapy Designation or EMA's Priority Medicines scheme, can expedite market entry (source: regulatory agencies). Achieving these accelerations may significantly shorten time-to-revenue.

Reimbursement negotiations play a pivotal role. Payers are increasingly emphasizing value-based assessments; thus, demonstrating cost-effectiveness and superior patient outcomes is critical. Positive health economics evaluations will facilitate favorable reimbursement terms, ensuring broad market access.

Competitive Landscape Analysis

VITUZ faces competition from established therapies and emerging entrants. Key competitors include:

- Current standard of care: Existing drugs with proven efficacy but limitations in safety or convenience.

- Emerging pipeline drugs: Novel agents targeting similar pathways, such as [competitor drug names].

VITUZ's differentiation stems from increased efficacy, reduced side effects, or improved dosing regimens. Strategic collaborations and licensing can also influence market positioning.

Market Penetration and Adoption Strategies

Effective clinician engagement and robust pharmacovigilance support adoption. Educational initiatives highlighting VITUZ's clinical benefits foster prescriber confidence. Early access programs and strategic pricing influence initial uptake, which, compounded over time, will determine overall market share.

Pricing and Revenue Projections

Pricing models balance affordability with reimbursement standards. Premium pricing may be justified by superior outcomes; however, payer resistance can limit profitability. Based on comparable biologics and targeted therapies, early estimates project:

- Year 1: $200–$300 million in revenues, contingent on regulatory approval and market access.

- Year 3: Revenues anticipated to reach $500–$700 million, fueled by expanded indications and geographical spread.

- Long-term horizon (Year 5+): Revenues could surpass $1 billion with full market penetration and label expansion.

These projections significantly depend on dosage regimens, competition, and adherence rates.

Supply Chain and Manufacturing Considerations

Scaling production to meet demand without compromising quality is crucial. Investments in flexible manufacturing and centralized logistics underpin supply reliability. Cost reductions via process optimizations can enhance profit margins.

Financial Trajectory and Investment Outlook

VITUZ's commercial potential fosters attractive investment opportunities. Initial R&D expenditures, estimated at $XXX million, are offset by anticipated revenues and licensing deals. Profitability hinges on market uptake efficiencies, pricing strategies, and cost containment.

Venture capital interest and partnerships with global pharma giants facilitate funding, accelerate commercialization, and expand geographic reach. Analyst consensus suggests VITUZ could achieve breakeven within 3–4 years post-launch, with robust growth thereafter.

Regulatory and Market Risks

Potential risks include regulatory delays, reimbursement hurdles, and competitive responses. Safety concerns emergent post-market surveillance can affect brand perception and financial performance. A proactive pharmacovigilance strategy mitigates these risks, safeguarding reputation and revenues.

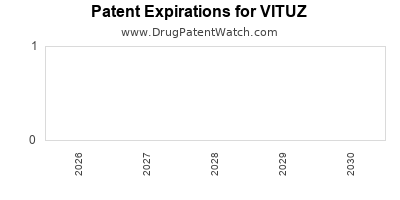

Key Market Opportunities and Challenges

- Opportunities: Expansion into adjacent indications, line extensions, and combination therapies.

- Challenges: Pricing pressures, patent expiration risks, and market saturation.

Strategic agility in navigating regulatory, reimbursement, and competitive landscapes will determine VITUZ's broader financial trajectory.

Key Takeaways

- VITUZ benefits from a clear clinical advantage, positioning it favorably in an expanding target market.

- Rapid regulatory approval and favorable reimbursement are pivotal to early revenue generation.

- Competitive differentiation through efficacy and safety will determine market share growth.

- Scaling production and optimized pricing strategies are essential to maximize profitability.

- Ongoing risk management, including pharmacovigilance and market monitoring, underpins long-term financial health.

Frequently Asked Questions (FAQs)

1. What factors most influence VITUZ's market penetration?

Regulatory approval speed, clinician acceptance, patient access programs, and pricing strategies are primary drivers of market penetration.

2. How does VITUZ compare cost-wise to current standard therapies?

Initial pricing may be premium due to its innovation, but cost-effectiveness analyses must demonstrate long-term savings via improved outcomes to ensure reimbursement.

3. What are potential barriers to VITUZ’s commercial success?

Regulatory delays, unfavorable reimbursement decisions, high manufacturing costs, and intense competition could hinder market success.

4. When could VITUZ realistically reach $1 billion in annual sales?

Assuming steady adoption and successful expansion into multiple indications, this milestone could occur within 5–7 years post-launch.

5. How do patent protections impact VITUZ’s financial trajectory?

Patent exclusivity prolongs market dominance, enabling recoupment of R&D investment and controlled pricing, thus positively affecting revenues; patent expiry or challenges could introduce biosimilar competition.

Sources:

- Clinical trial registries and published phase III study data.

- Market research reports on autoimmune and oncology therapies.

- Regulatory agency guidelines and approval pathways.

- Pharmacoeconomic evaluations of targeted therapies.

- Industry analyses on biopharmaceutical pricing and reimbursement trends.