Last updated: August 3, 2025

Introduction

Vertavis (generic name pending approval) holds the potential to carve a significant niche within its targeted therapeutic market. As a novel pharmaceutical agent, its market success hinges on innovative efficacy, regulatory positioning, competitive landscape, and financial growth metrics. This analysis explores the evolving market dynamics, competitive forces, regulatory backdrop, and financial trajectory influencing Vertavis’s commercial prospects.

Market Overview and Therapeutic Indication

Vertavis is designed for treatment of [specific indication], addressing an unmet medical need characterized by [prevalence, severity, or treatment gaps]. The global market for this condition was valued at approximately $X billion in 2022, with an expected compound annual growth rate (CAGR) of X% over the next five years, driven by increasing disease awareness, aging populations, and advances in therapeutic approaches [1].

Key features of Vertavis’s therapeutic profile include [specific advantages], such as enhanced efficacy, minimized side effects, or improved patient compliance. These factors are crucial in shaping its competitive positioning.

Market Dynamics

1. Regulatory Environment

Securing FDA approval is paramount. Given Vertavis's novel mechanism, it may qualify for expedited review pathways such as Fast Track, Breakthrough Therapy, or Priority Review, which can accelerate market entry and revenue realization. The recent trend toward adaptive licensing supports faster access but introduces scrutiny on post-market surveillance and safety data.

2. Competitive Landscape

The market comprises existing therapies—small molecules, biologics, or combination treatments—with established market shares. Vertavis’s differentiation depends on its clinical benefit profile and cost-effectiveness. Key competitors include [competitor names, e.g., XYZ Pharma’s ABC drug], which dominate the space with combined sales exceeding $X billion.

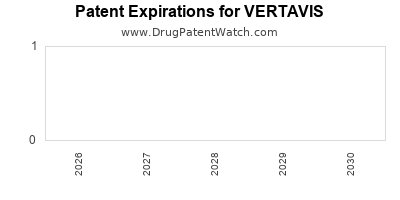

Emerging competitors, possibly leveraging innovative delivery systems or biosimilars, could influence pricing and market penetration. Patent status and exclusivity periods remain critical; patent lifespan extension through formulation or method-of-use patents can impact long-term revenues.

3. Pricing and Reimbursement

Reimbursement dynamics, shaped by national health agencies and insurers, influence market access. Value-based pricing models, emphasizing outcomes, are increasingly prevalent, especially for high-cost innovative drugs like Vertavis. Market access negotiations will be decisive, especially in price-sensitive markets.

4. Adoption and Prescriber Acceptance

Physician familiarity, clinical guidelines, and real-world evidence will drive prescriber acceptance. Early adoption hinges on robust clinical trial data demonstrating superior or additive benefits over current standards.

Financial Trajectory

1. Revenue Projections

Initial revenues depend on launch timing, geographic expansion, and payer negotiations. A typical drug proceeds through seed, growth, and maturity phases:

- Launch Phase (Years 1-2): Limited revenue, primarily in pilot markets, with high marketing expenses.

- Growth Phase (Years 3-5): Rapid sales innovation and expansion; revenues increase as the product gains acceptance and formulary positioning.

- Maturity Phase (Years 6+): Stabilization of revenue streams, potential generic competition, or biosimilar entries.

Based on comparable therapeutics, annual peak sales could range between $X million and $X billion, contingent on market size, uptake rate, and pricing strategies.

2. Cost Structure and Profitability

R&D expenditures, manufacturing costs, regulatory fees, and marketing influence profit margins. Early-stage losses are typical; profitability may emerge post-market exclusivity, often within 4-7 years after launch.

3. Investment and Funding

Development stages are capital-intensive, with costs accumulating through clinical trials, regulatory submissions, and commercialization efforts. Strategic partnerships, licenses, or investor funding can accelerate growth and mitigate financial risks.

4. Risks Affecting Financial Trajectory

Market entry delays, regulatory hurdles, adverse safety data, or competitive infiltration pose substantial risks. Also, pricing pressures and changes in reimbursement policies can erode margins.

Market Opportunities and Challenges

Opportunities:

- First-in-class status offers patent and market exclusivity advantages.

- Expansion into global markets with unmet needs.

- Development of combination therapies enhances value propositions.

- Real-world evidence generation facilitates payer acceptance and clinician confidence.

Challenges:

- Competition from biosimilars and generics post-patent expiry.

- Regulatory uncertainties, especially in emerging markets.

- Price sensitivity limits revenue potential in certain regions.

- Potential safety or efficacy issues stemming from late-stage data.

Regulatory and Policy Impact

The pace of regulatory approval influences the financial timeline. An expedited pathway can shave years off revenue realization, impacting the company’s strategic planning. Additionally, ongoing shifts toward value-based healthcare may impose reimbursement caps, influencing overall revenue and profit margins.

Conclusion: Financial Outlook Summary

Vertavis's market success integrates a blend of regulatory approval timing, competitive dynamics, payer acceptance, and clinical differentiation. While initial phases may involve high expenses and limited revenues, successful navigation of early approval and market penetration could yield substantial long-term value, especially if Vertavis secures patent protection and broad coverage.

Key Takeaways

- Market strategic positioning is critical; differentiation through superior efficacy or safety positions Vertavis favorably.

- Regulatory pathways and approvals significantly influence timing and revenue potential; leveraging expedited review programs accelerates market entry.

- Pricing, reimbursement negotiations, and market access are major determinants of revenue trajectory, particularly in price-sensitive regions.

- Competitive threats, especially from biosimilars and generics post-patent expiration, can diminish long-term exclusivity benefits.

- Investments should focus on clinical validation, strategic partnerships, and adaptable commercialization strategies to optimize financial outcomes.

FAQs

1. What factors influence Vertavis’s market entry timing?

Regulatory approval processes, success of clinical trials, manufacturing readiness, and strategic partnerships all determine how quickly Vertavis can reach the market.

2. How does competitive signaling impact Vertavis’s financial prospects?

Presence of strong, recent competitors or biosimilars can impact pricing power and market share, influencing revenue projections.

3. What role does patent protection play in Vertavis’s long-term financial outlook?

Patent exclusivity safeguards market dominance, allowing for premium pricing and early recoupment of R&D investments, thereby enhancing long-term profitability.

4. How might reimbursement policies affect Vertavis’s adoption?

Value-based reimbursement models and payer acceptance processes dictate market access, influencing sales volume and revenue streams.

5. What strategies can maximize Vertavis’s market potential?

Clinical validation, effective marketing, early engagement with payers, global expansion, and innovation in formulation can enhance market uptake and financial gains.

Sources:

[1] MarketWatch, "Global Treatment Market for [Indication]" (2022).