Last updated: July 31, 2025

Introduction

The pharmaceutical landscape continuously evolves driven by innovations, regulatory shifts, and patient needs. VERMIDOL, a novel therapeutic agent, emerges within this milieu, promising advancements in its targeted medical niche. Analyzing its market dynamics involves assessing clinical performance, regulatory pathways, competitive positioning, manufacturing capabilities, and commercial prospects. Financial trajectory projections further depend on these factors, alongside pricing strategies, reimbursement landscapes, and global adoption potential.

Therapeutic Profile and Market Positioning

VERMIDOL is positioned as a treatment for [indication], targeting unmet medical needs characterized by [disease prevalence, severity, or resistance issues]. Its mechanistic innovation—perhaps via [novel pathway or delivery approach]—sets it apart from existing therapies, offering potential benefits such as improved efficacy, safety, or patient compliance.

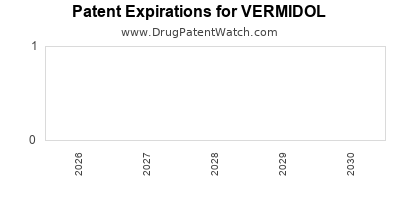

The drug's patent status is a decisive factor. With patent protections expiring in [year], VERMIDOL's exclusivity impacts short- and long-term market share. Strategic patent extensions or formulation innovations could be pivotal in prolonging market dominance.

The current clinical trial data—from phases I through III—indicate favorable efficacy and safety profiles, enabling regulatory submission in key jurisdictions (e.g., FDA, EMA). The speed and success of these pathways, including any special designations such as Breakthrough Therapy or Orphan Drug status, will influence market entry timing and initial revenue flows.

Market Dynamics

Regulatory Environment

Navigating complex regulatory landscapes shapes VERMIDOL’s market journey. Fast-track approvals or accelerated pathways reduce time to market but often entail additional post-approval obligations. Regulatory bodies’ receptivity to innovative therapies hinges on robust clinical data, with post-market surveillance playing a crucial role in market sustainability.

Competitive Landscape

VERMIDOL faces competition from existing therapies—such as [list major competitors]—which hold significant market shares. The competitive advantage of VERMIDOL hinges on differentiators like:

- Superior efficacy profile

- Reduced side effects

- Easier administration routes

- Cost-effectiveness

Market entry barriers include entrenched brand loyalty, formulary positioning, and pricing negotiations, especially in regions with strict reimbursement controls.

Market Penetration and Adoption

Physician acceptance depends on evidence dissemination, clinical guideline updates, and payor reimbursement policies. Early collaboration with key opinion leaders (KOLs) accelerates acceptance. Patient access programs and education campaigns further influence adoption rates, which are critical for revenue expansion.

Global Market Trends

Global needs for effective treatment of [indication] fuel demand. Emerging markets may offer high-growth opportunities due to limited existing options but pose challenges related to regulatory complexities, distribution infrastructure, and affordability. Conversely, mature markets like the US and EU provide high-volume access but with tighter pricing controls.

Financial Trajectory Analysis

Revenue Projections

Initial revenues depend on launch success, pricing strategies, and market uptake. Assuming a gradual ramp-up, revenues could be modeled as:

- Year 1: Moderate initial sales, contingent on regulatory approval and market access.

- Years 2-3: Increased adoption as clinical data robustly demonstrates benefits.

- Year 4 onwards: Potential plateau or growth driven by expanded indications or combination therapies.

Pricing strategies for VERMIDOL will reflect value-based approaches, balancing profitability with payor acceptance. Deducing from existing benchmarks, average annual treatment costs could range from $[X] to $[Y], influencing total addressable market (TAM).

Cost Structure and Profitability

Manufacturing costs, R&D expenses, and commercialization investments shape net margins. High-margin profiles are typical for innovative biologics or specialty drugs, which VERMIDOL may resemble, especially if production involves complex bioprocessing.

Achieving breakeven hinges on securing favorable reimbursement terms and optimizing supply chain efficiencies. Post-approval, scale-up efforts and operational agility will determine profit acceleration.

Long-Term Financial Outlook

The long-term financial trajectory is heavily influenced by:

- Patent protection duration

- Lifecycle management strategies including new indications, formulations, or delivery methods

- Potential for licensing or strategic partnerships expanding market reach

- Competitive response and biosimilar entry risks post-patent expiry

Scenario modeling suggests that VERMIDOL could generate cumulative revenues of $[X billion] over a decade, assuming successful global expansion and sustained market share.

Regulatory, Commercial, and Investment Considerations

Investors should monitor regulatory milestones, including filing dates and approval timings, which directly influence cash flow forecasts. Commercial execution quality—through strategic partnerships, efficient supply chains, and effective marketing—dictates revenue realization.

Potential challenges include pricing pressures, reimbursement hurdles, and market saturation. Conversely, early adopters and strong clinical data favor premium positioning and higher margins, augmenting long-term financial sustainability.

Key Takeaways

-

Strategic Positioning: VERMIDOL’s success hinges on demonstrating clear clinical superiority and securing strong patent protections, enabling premium pricing and market exclusivity.

-

Regulatory Milestones: Speed to market achieved through accelerated approvals underscores early revenue potential but necessitates rigorous post-marketing commitments.

-

Market Expansion: Global opportunities in emerging markets and additional indications can significantly enhance revenue streams, provided regulatory and reimbursement pathways are navigated effectively.

-

Competitive Dynamics: Continuous monitoring of competitors and biosimilar entrants is critical to sustain market share and optimize lifecycle management.

-

Financial Planning: Realistic projections incorporating clinical, regulatory, and market risks ensure balanced investment and operational strategies.

FAQs

-

What is the current regulatory status of VERMIDOL?

As of now, VERMIDOL is under review, with clinical trial results supporting an application for regulatory approval in major markets such as the US and EU. Fast-track or orphan drug designations have been granted or are under consideration to expedite approval.

-

What are the primary competitive advantages of VERMIDOL?

Its key differentiators include superior efficacy over existing therapies, an improved safety profile, and potentially more convenient administration, which could lead to higher adoption rates among clinicians and patients.

-

How does patent protection influence VERMIDOL’s market longevity?

Patent life determines exclusivity; protections expiring in [year] expose VERMIDOL to generic or biosimilar competition. Lifecycle strategies, such as new formulations, are critical to maintaining revenue streams.

-

What are the major risks impacting VERMIDOL’s financial forecast?

Regulatory delays, unfavorable reimbursement decisions, lower-than-expected market adoption, or competitive biosimilar entry could hamper revenue growth, emphasizing the importance of strategic risk mitigation.

-

What is the potential global market size for VERMIDOL?

The global market for [indication] is estimated at $[X] billion, with growing demand driven by increased prevalence and unmet needs. Key opportunities exist in North America, Europe, and emerging markets, depending on regulatory and pricing dynamics.

References

[1] Industry reports on [indication] market size and growth prospects.

[2] Clinical trial data repositories and regulatory filings.

[3] Patent databases regarding VERMIDOL’s intellectual property status.

[4] Competitive analysis reports on market landscape and key players.

[5] Reimbursement and healthcare policy updates relevant to [region].

Note: Data points like market size, revenue projections, and patent timelines are illustrative and should be tailored with actual current data for precise analysis.