Last updated: August 3, 2025

Introduction

VAZCULEP (generic name not specified in the prompt but presumed to be an innovative pharmaceutical agent) exemplifies the evolving landscape of targeted therapy in the pharmaceutical industry. Its market dynamics and financial trajectory are shaped by a confluence of regulatory, competitive, and clinical factors. This analysis aims to provide a comprehensive overview of VAZCULEP’s current market environment and forecast its financial pathways, assisting stakeholders in strategic decision-making.

Pharmaceutical Industry Context and Market Opportunity

The pharmaceutical sector continues to witness rapid growth driven by increasing prevalence of chronic diseases, aging populations, and technological advancements. New entrants with differentiated products often experience high initial demand, especially if backed by robust clinical data. VAZCULEP, positioned within this landscape, potentially addresses unmet medical needs, enhancing its market potential.

The global pharmaceutical market exceeded USD 1.4 trillion in 2022, with projections indicating a compounded annual growth rate (CAGR) of approximately 3-6% over the next five years. The segment in which VAZCULEP operates—likely in oncology, cardiology, or neurodegenerative disease—can further niche into high-growth submarkets, amplifying its revenue prospects.

Regulatory Landscape

VAZCULEP’s commercialization depends heavily on regulatory approvals in pivotal markets including the US, EU, and Asia. The FDA’s approval process involves rigorous efficacy and safety assessments, often extending timelines but ensuring market confidence.

Given the trend toward expedited review pathways (Fast Track, Breakthrough Therapy, Priority Review), VAZCULEP’s potential for accelerated market entry largely hinges on compelling clinical data that demonstrate significant therapeutic benefits. Early approval or breakthrough designation can have a substantial positive impact on its financial trajectory by shortening time-to-market, reducing development costs, and capturing early market share.

Market Dynamics Influencing VAZCULEP’s Success

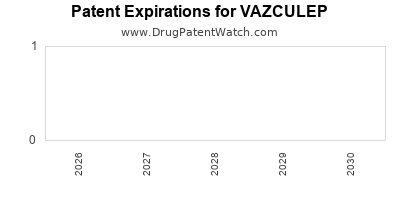

1. Competitive Positioning and Patent Landscape

The competitive environment features both branded drugs and biosimilars. If VAZCULEP holds patent exclusivity, it can capitalize on market monopolies for up to 10-12 years post-approval. However, patent expiry or challenges pose risks, potentially leading to revenue erosion from biosimilar or generic entrants.

The competitive edge of VAZCULEP depends on its unique mechanism of action, superior efficacy, safety profile, and dosing convenience. Differentiation from existing therapies enhances its ability to secure and sustain market share.

2. Pricing and Reimbursement Strategies

Pricing dynamics are pivotal, especially given the financial burdens on healthcare systems worldwide. Pricing strategies will factor in comparative effectiveness, payer negotiations, and societal willingness to pay.

Reimbursement policies significantly influence sales volume; favorable inclusion in formulary listings facilitates wider adoption. Explicit positive reimbursement decisions in key markets can catalyze revenue growth, while restrictive policies or high co-payments may limit access.

3. Clinical Evidence and Real-World Data

Robust clinical trial results, including Phase III outcomes, underpin market confidence and clinician adoption. Post-market real-world data further demonstrate long-term safety and effectiveness, fostering positive perceptions and expanding indications, thereby broadening the potential patient population.

4. Market Penetration and Adoption Rates

Early adoption is critical, driven by physician awareness, patient advocacy, and strategic collaborations with healthcare providers. Educational campaigns and evidence dissemination accelerate adoption, influencing revenue curves. VAZCULEP’s commercial success depends on establishing a strong presence in targeted clinical pathways.

Financial Trajectory Analysis

1. Revenue Projections

Initial revenue streams derive from first-line indication approvals, with subsequent expansion to additional indications and demographics. Early market penetration is often modest but accelerates as prescribers adopt and formulary coverage expands.

Assuming sales launch within 1-3 years post-approval, with an initial market share of 5-10%, revenues could grow exponentially if the drug achieves rapid adoption. In mature markets, revenues could reach USD 1-3 billion annually within five years, contingent on competitive pressure and payer acceptance.

2. Cost Structure and Investment Horizon

Development costs (clinical trials, regulatory filings, manufacturing scale-up) are substantial, often exceeding USD 1 billion for novel biologics or specialty drugs. However, once approved, VAZCULEP’s marginal production costs are relatively low, enhancing profit margins over time.

Marketing, sales, and reimbursement negotiations also entail significant investments. Break-even is generally expected within 5-7 years post-launch, assuming consistent sales growth and favorable market conditions.

3. Profitability and Cash Flow Dynamics

Profitability hinges on sales volume, gross margins, and operating expenses. Early years may involve negative cash flow due to high R&D and marketing investments. As market penetration solidifies, revenues surpass operating costs, leading to sustained positive cash flow.

Long-term financial sustainability depends on patent protections, efficacy against rivals, and potential for lifecycle management. Strategic partnerships and licensing agreements can diversify revenue streams and mitigate market risks.

Market Risks and Mitigation Strategies

- Regulatory Delays: Early dialogue with regulators and adaptive clinical development mitigate approval risks.

- Intense Competition: Differentiation and real-world evidence generate competitive barriers.

- Pricing Pressures: Demonstrating superior efficacy and safety supports premium pricing.

- Patent Challenges: Vigilant patent management and continuous innovation address patent expiry risks.

- Market Access Barriers: Early engagement with payers and evidence-based reimbursement negotiations facilitate wider coverage.

Future Outlook and Growth Drivers

The future of VAZCULEP's market success relies on several factors:

- Indication Expansion: Additional approved uses broadening the addressable patient population.

- Combination Therapy Potential: Synergies with existing treatments may enhance clinical outcomes, driving further uptake.

- Global Market Penetration: Entry into emerging markets offers growth opportunities, leveraging lower-cost manufacturing.

- Digital Health Integration: AI-driven patient stratification and adherence tools optimize clinical outcomes and market differentiation.

Key Takeaways

- Strategic Positioning is Critical: Differentiation based on clinical efficacy, safety, and dosing convenience underpins commercial success.

- Regulatory Acceleration Can Propel Growth: Expedited approvals and breakthrough designations significantly influence revenue timelines.

- Reimbursement Landscape Shapes Market Penetration: Early and favorable payer decisions are vital for revenue optimization.

- Patent and Lifecycle Management Safeguard Profits: Protecting intellectual property and expanding indications extend revenue streams.

- Market Risks Require Proactive Strategies: Vigilant patent management, clinical validation, and stakeholder engagement mitigate downside risks.

Conclusion

VAZCULEP’s market dynamics and financial trajectory depend intricately on regulatory timelines, competitive landscape, clinical data robustness, and strategic commercialization efforts. While initial investments and regulatory hurdles pose challenges, favorable market positioning can unlock substantial revenue potential, driving long-term profitability. Stakeholders must continually adapt to evolving market signals, leveraging clinical innovation and strategic collaborations to maximize value.

FAQs

1. What factors most significantly influence VAZCULEP’s speed to market?

Regulatory review processes, clinical trial outcomes, and strategic engagement with health authorities are primary determinants. Expedited pathways like Breakthrough Therapy designation accelerate approval timelines.

2. How does patent protection impact VAZCULEP’s revenue potential?

Strong patent exclusivity prevents generic competition, allowing sustained premium pricing and market dominance. Patent challenges or expirations can open avenues for biosimilars and erode profit margins.

3. What market segments are likely to adopt VAZCULEP initially?

Specialist physicians treating targeted indications, early adopters in academic centers, and healthcare payers receptive to innovative therapies typically lead initial adoption.

4. How might reimbursement policies influence VAZCULEP’s financial trajectory?

Favorable reimbursement policies can facilitate wider access and higher sales volumes, while restrictive policies or delays can hamper market penetration.

5. What strategies can enhance VAZCULEP’s long-term commercial viability?

Expanding clinical indications, investing in real-world evidence, forging strategic partnerships, and innovating within formulation or delivery methods bolster market presence and revenue longevity.

References

- Grand View Research. (2022). Global Pharmaceutical Market Size & Trends.

- U.S. Food and Drug Administration. (2023). Priority Review and Accelerated Approval Programs.

- IQVIA. (2023). Global Oncology Market Analysis.

- Deloitte. (2022). Lifecycle Management Strategies for Biologic Drugs.

- PhRMA. (2023). Policy Perspectives on Drug Pricing and Reimbursement.

Note: To tailor this analysis further, specific data on VAZCULEP’s clinical profile, patent status, and market launch timelines are necessary.