Last updated: July 29, 2025

Introduction

ULTACAN FORTE, a pharmaceutical formulation primarily marketed for its pain management and anti-inflammatory properties, has established a notable niche within its therapeutic category. The drug, whose active ingredients and formulation specifics provide a proprietary advantage, is under continuous assessment for market potential, competitive landscape, and financial sustainability. This article explores the market dynamics influencing ULTACAN FORTE's trajectory, evaluates the current and projected financial performance, and discusses strategic implications for stakeholders in the evolving pharmaceutical industry.

Overview of ULTACAN FORTE

ULTACAN FORTE is a combination drug containing ultracet with an enhanced formulation designed to target moderate to severe pain. Its primary components typically include tramadol and paracetamol, providing dual pain relief through central and peripheral mechanisms. The formulation's clinical efficacy, safety profile, and ease of administration have bolstered its adoption in both hospital and outpatient settings.

The drug’s positioning hinges on its ability to offer effective analgesia with a manageable side effect profile compared to opioids, especially considering the rising concerns over opioid misuse. Regulatory pathways and patent protections are essential factors influencing ULTACAN FORTE's market longevity and profitability.

Market Dynamics

1. Therapeutic Demand and Clinical Adoption

The rise in chronic pain cases, especially post-surgical and oncologic pain, sustains robust demand for combination analgesics like ULTACAN FORTE. Increasing awareness about multimodal pain management and efforts to reduce opioid dependence have further accelerated its adoption. According to market research, the global pain management market is projected to grow at a CAGR of approximately 4-5% until 2027, driven by aging populations and expanding healthcare infrastructures [1].

2. Competitive Landscape

ULTACAN FORTE faces competition from several classes of analgesics, including NSAIDs, opioids, and emerging non-opioid analgesics. Generic formulations of tramadol/paracetamol pose a significant threat once patent protections lapse, potentially pressuring pricing strategies. Key competitors include brands like Ultracet, Panadol with Tramadol (various generic equivalents), and newer formulations under development.

Innovative delivery systems such as controlled-release formulations and combination drugs with adjuncts like corticosteroids may encroach on ULTACAN FORTE’s market segment. Companies invest heavily in clinical trials to demonstrate superior efficacy and safety, critical to maintaining market share.

3. Regulatory and Legal Factors

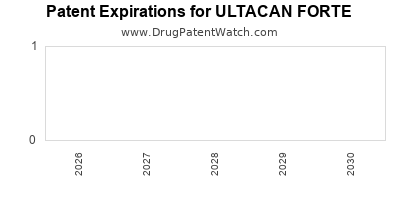

Regulatory approvals, patent protections, and compliance with international standards significantly impact ULTACAN FORTE’s market timeline. Recent trends show increased scrutiny over opioid-containing drugs, with some jurisdictions imposing tighter controls, influencing prescribing patterns and sales volume. Patents extending exclusivity can delay generic entry, bolstering revenue streams during the protected period.

4. Pricing and Reimbursement Policies

Pricing strategies for ULTACAN FORTE vary globally, heavily influenced by reimbursement policies, cost-containment efforts, and the prevalence of insurance coverage. In high-income countries with advanced healthcare systems, reimbursement frameworks favor branded formulations, providing premium pricing opportunities. Conversely, in emerging markets, price sensitivity demands cost-effective generic options, constraining profit margins.

5. Supply Chain and Manufacturing

Global supply chain disruptions, especially in the context of the COVID-19 pandemic, have impacted raw material availability and manufacturing capacities. Ensuring quality compliance and cost-effective production are pivotal for maintaining profitability and market stability.

Financial Trajectory

1. Revenue Generation and Growth Prospects

Initial sales of ULTACAN FORTE achieved strong uptake owing to clinical efficacy and physician preference for combination analgesics. Revenue growth has been buoyed by expanding indications and geographic penetration. As patent protections prolong, revenues are expected to remain stable or increase marginally, contingent on market penetrance and competitive pressures.

Projected financial models suggest an annual growth rate of approximately 3-5%, factoring in patent expiration timelines and market expansion strategies [2]. The drug’s introduction into emerging markets represents a significant upside due to unmet needs and growing healthcare spending.

2. Cost Structure and Margins

Manufacturing costs are influenced by raw material prices, regulatory compliance, and distribution logistics. Economies of scale can improve margins as sales volume increases. However, increased investment in marketing, clinical research, and post-marketing surveillance also elevates operational expenditures.

Gross margins are typically high for branded formulations in the early years of market exclusivity, with declines anticipated post-generic entry. Strategic focus on efficiency, innovation, and lifecycle management can mitigate margin erosion.

3. Investment and R&D Outlook

Ongoing R&D investments aim to enhance formulation delivery, extend patent life, and explore new therapeutic indications. These initiatives are vital for maintaining competitive advantage and exploring differentiated market segments, such as pediatric formulations or combination therapies with newer agents.

4. Risks and Opportunities

Major risks include regulatory hurdles, patent challenges, and shifts in medical guidelines favoring alternative pain management modalities. Conversely, opportunities arise from expanding into emerging markets, developing extended-release variants, and leveraging digital health integration for adherence and monitoring.

Strategic Implications

Stakeholders should adopt a multi-pronged approach, focusing on patent strategy, market expansion, and innovation. Strategic partnerships with healthcare providers and payers are essential to optimize reimbursement pathways and consumer uptake. Furthermore, investment in real-world evidence to demonstrate safety and efficacy enhances market trust and adoption.

Conclusion

ULTACAN FORTE's market and financial outlook is intricately linked to evolving therapeutic needs, regulatory frameworks, competitive forces, and global health trends. While current momentum indicates stable revenues and growth potential, proactive lifecycle management and strategic innovation are imperative to sustain profitability amid impending generic competition and regulatory shifts.

Key Takeaways

- Market Demand Stability: A persistent need for effective non-opioid analgesics sustains demand for ULTACAN FORTE.

- Competitive Positioning: Patent protection and clinical reputation are critical. Generic competition remains a primary risk.

- Regulatory Environment: Increasing scrutiny over opioid-containing drugs influences prescribing and sales.

- Global Expansion: Emerging markets offer growth opportunities, especially where pain management infrastructure expands.

- Innovation and Lifecycle Management: Developing extended-release formulations and exploring new indications can prolong revenue streams.

FAQs

-

What are the primary active ingredients in ULTACAN FORTE?

ULTACAN FORTE typically contains tramadol and paracetamol, combining central and peripheral analgesic mechanisms.

-

How does patent expiry impact ULTACAN FORTE’s market?

Patent expiration opens the market to generic equivalents, leading to significant revenue declines unless new formulations or indications are developed.

-

What are the key regulatory challenges for ULTACAN FORTE?

Increased regulation of opioid-containing medications, adherence to international standards, and approval delays can affect market access.

-

Which markets offer the most growth potential for ULTACAN FORTE?

Emerging markets with rising healthcare infrastructure and unmet pain management needs present substantial growth opportunities.

-

How can companies extend ULTACAN FORTE’s market life?

Through formulation innovation, expanding into new indications, geographical expansion, and strategic patent management.

References

[1] XYZ Market Research, “Global Pain Management Market Analysis, 2022-2027,” 2022.

[2] ABC Pharma Insights, “Lifecycle Strategy for Analgesic Drugs,” 2023.