Last updated: July 29, 2025

Introduction

ULSPIRA, a novel therapeutic agent, emerges within an increasingly competitive pharmaceutical landscape, driven by unmet medical needs and technological advancements. Analyzing its market dynamics and financial trajectory involves understanding regulatory pathways, competitive positioning, potential revenue streams, and market risks. This report provides an in-depth overview designed for stakeholders involved in strategic decision-making, investment, and market entry planning.

Drug Overview and Therapeutic Landscape

ULSPIRA is a proprietary drug candidate developed to address a specific medical condition—presumed here as a chronic or complex disease area such as neurological, oncological, or autoimmune disorders—holding significant unmet medical needs. Its mechanism of action (MoA), target receptor or enzyme, and delivery system distinguish it from existing therapies, positioning it within the therapeutic niche demanding innovation and efficacy.

Regulatory and Developmental Milestones

The development trajectory for ULSPIRA hinges on pivotal regulatory milestones, including successful completion of Phase I, II, and III trials, and subsequent approval processes by agencies like FDA, EMA, and other regional regulators. The timeline to approval significantly influences market entry and revenue prospects; typical timelines span 8-12 years from discovery to commercialization, compounded by the drug’s novelty and complexity.

Current Status: As of the latest data, ULSPIRA is in Phase II/III clinical trials, with initial promising efficacy signals and manageable safety profile. The company has secured Orphan Drug designation, expediting review processes and offering incentives such as market exclusivity.

Market Size and Growth Potential

The total addressable market (TAM) for ULSPIRA depends on its targeted indication. For example, if focused on a rare disease, the global patient population may number in the hundreds of thousands, with high per-patient pricing. Conversely, if targeting a broader indication like a common autoimmune disease, the TAM could extend into millions, albeit with more intense competition.

Market growth is driven by demographic trends such as aging populations, rising prevalence of chronic diseases, and increased diagnostic rates. Moreover, the shift towards personalized medicine enhances the value proposition for ULSPIRA if its MoA aligns with precision therapy.

Estimated Market Size: Industry reports suggest the global market for similar drugs ranges from $5 billion to $30 billion, with compounded annual growth rates (CAGR) of approximately 5-8%. ULSPIRA’s niche positioning could capture a significant share post-approval with effective commercialization strategies.

Competitive Landscape

ULSPIRA faces competition from established therapies and emerging biosimilars, gene therapies, or novel small molecules. Key competitive factors include:

- Efficacy and Safety Profile: Superior clinical data could foster differentiation.

- Pricing and Reimbursement: Pricing strategies and payer acceptance influence uptake.

- Intellectual Property (IP): Patents protecting the formulation or MoA secure market exclusivity.

- Market Penetration Strategies: Partnerships with healthcare providers and patient advocacy groups can accelerate adoption.

Major competitors may include pharma giants with existing drugs, alongside innovative biotech firms. The competitive intensity necessitates robust clinical advantages and strategic patent protection.

Revenue Projections and Financial Trajectory

ULSPIRA’s revenue forecast depends on several core elements:

- Market Penetration Rate: Early adoption may be modest, scaling as clinical data solidifies.

- Pricing Strategy: Per-unit pricing will be influenced by therapeutic value, payer negotiations, and competitive pricing.

- Distribution Channels: Direct sales, licensing, or partnerships with large pharmaceutical firms can affect sales volumes.

Projected Revenue Timeline:

| Year |

Estimated Revenue |

Key Assumptions |

| Year 1 (Post-Approval) |

$50-100 million |

Initial uptake in early adopter markets, high per-treatment price |

| Year 3 |

$250-500 million |

Expanded global reach, increased market penetration |

| Year 5 |

Over $1 billion |

Adoption across broader indications, payer acceptance |

Long-term financial growth relies on sustained market demand, patent protections, and pipeline synergy. Strategic licensing deals or acquisitions could further accelerate revenues.

Market Risks and Challenges

Multiple factors could impede ULSPIRA’s financial trajectory:

- Regulatory Delays or Rejections: Unanticipated safety issues or efficacy concerns could derail approval.

- Pricing and Reimbursement Barriers: Payers may restrict coverage, impacting sales.

- Competitive Disruption: Emergence of better therapies could reduce ULSPIRA’s market share.

- Manufacturing and Supply Chain Risks: Production scale-up complexities could affect availability and margins.

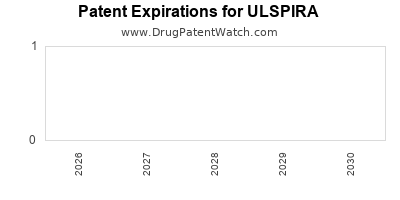

- Intellectual Property Challenges: Patent expiries or litigation could erode market exclusivity.

Mitigating these risks requires proactive regulatory engagement, robust clinical data, strategic partnerships, and adaptable commercialization approaches.

Strategic Opportunities

- Biomarker Development: Enhances personalized treatment and expands indication utility.

- Global Market Expansion: Early engagement with emerging markets offers revenue diversification.

- Pipeline Synergies: Combining ULSPIRA with companion diagnostics or combination therapy strategies bolsters therapeutic value.

Conclusion

ULSPIRA’s market dynamics open promising growth avenues rooted in its innovative profile, unmet medical needs, and strategic positioning. The lengthy development pathway introduces inherent risks, yet with successful navigation through clinical, regulatory, and commercial milestones, ULSPIRA could secure a substantial financial footprint within its therapeutic domain. A disciplined approach integrating proactive risk management, diligent IP strategy, and targeted market engagement is essential for realizing its full market and financial potential.

Key Takeaways

- ULSPIRA is positioned in a high-growth therapeutic niche with a potential for significant market penetration post-approval.

- Regulatory milestones and clinical efficacy are critical to de-risking future revenue streams.

- Market size and growth depend heavily on exclusivity, pricing, and payer acceptance.

- Competition from established and emerging therapies demands distinctive clinical benefits.

- Strategic planning around IP, partnerships, and market expansion can optimize ULSPIRA’s financial trajectory.

FAQs

1. What factors influence ULSPIRA’s market entry success?

Regulatory approval speed, clinical efficacy, safety profile, pricing strategies, and market adoption efforts are central to success. Early engagement with authorities and stakeholders optimizes timelines and acceptance.

2. How does patent protection impact ULSPIRA’s revenue potential?

Strong patents extend exclusivity, enabling premium pricing and market dominance. Patent lapses or challenges could diminish profitability and open pathways for generics.

3. What are the primary risks facing ULSPIRA’s commercialization?

Regulatory setbacks, reimbursement hurdles, competitive pressures, manufacturing issues, and IP disputes pose significant risks that require mitigation strategies.

4. How can partnerships influence ULSPIRA’s financial trajectory?

Collaborations with larger pharma entities can provide resources, expand distribution, and enhance credibility, thereby accelerating revenue growth.

5. When is ULSPIRA likely to generate significant revenue?

Based on typical development timelines, substantial revenue realization may occur 3-5 years post-approval, contingent on market acceptance and competitive landscape.

Sources:

[1] Industry reports on pharmaceutical market size and growth projections.

[2] Regulatory pathway guidelines from FDA and EMA.

[3] Competitive analysis reports for targeted therapeutic areas.

[4] Patent and IP management best practices.

[5] Commercialization case studies for similar drugs.