Last updated: July 27, 2025

Introduction

ULESFIA, a novel pharmaceutical agent, is generating substantial interest within the biopharmaceutical sector due to its targeted mechanism of action and promising therapeutic profile. As the healthcare industry increasingly emphasizes precision medicine, understanding the market dynamics and financial trajectory of ULESFIA is critical for stakeholders ranging from manufacturers to investors. This analysis evaluates the current landscape, competitive positioning, regulatory environment, and forecasted financial outcomes associated with ULESFIA’s commercialization.

Market Overview

The global pharmaceutical market for the therapeutic class that ULESFIA addresses—presumably an innovative treatment for chronic disease or specialized cancer therapy—continues to expand owing to increasing prevalence and unmet medical needs. The global oncology drugs market alone is projected to grow from approximately USD 154 billion in 2022 to over USD 295 billion by 2030, at a compound annual growth rate (CAGR) of around 8% [1]. Similar upward trends are observed in neurological and rare disease segments, reflecting broader opportunities for targeted therapies like ULESFIA.

The specific indication targeted by ULESFIA positions it within a competitive landscape dominated by established brands and emerging biosimilars. However, its unique profile—possibly characterized by enhanced efficacy, reduced side effects, or improved administration—provides differentiation opportunities. The escalating adoption of personalized medicine strategies and advancements in biomarker-guided therapy further underpin market growth potential.

Market Drivers and Constraints

Growth Drivers

-

Unmet Medical Needs: The therapeutic area ULESFIA addresses often faces challenges such as drug resistance, limited options, or suboptimal outcomes, fueling demand for new agents.

-

Regulatory Incentives: Fast-track designations, orphan drug status, and other regulatory accelerators expedite the pathway to market, reducing time-to-revenue.

-

Technological Innovations: Advances in drug delivery, formulation, and companion diagnostics can enhance ULESFIA’s market penetration.

-

Healthcare Burden: Rising disease prevalence, driven by aging populations and lifestyle factors, expands the potential patient pool.

Constraints

-

Pricing and Reimbursement: High development costs, coupled with payer pushback on pricing, could limit accessible pricing models.

-

Competition: Existing therapies, especially those with established safety profiles, may challenge ULESFIA’s market entry.

-

Regulatory Hurdles: Variability in approval timelines across regions can delay commercialization, impacting revenue projections.

-

Manufacturing Complexity: Innovative drug modalities may entail complex manufacturing, affecting scalability and margin profile.

Regulatory and Commercialization Landscape

ULESFIA’s pathway to market hinges on successful regulatory approval from agencies like the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA). Breakthrough therapy designations and orphan drug statuses can significantly impact the approval timeline and market exclusivity, shaping the financial trajectory.

Post-approval, commercialization strategies focus on establishing strong partnerships with healthcare providers and payers, optimizing supply chain logistics, and incentivizing physicians through clinical data and educational outreach. Digital health initiatives, patient advocacy, and real-world evidence collection will further influence adoption rates.

Financial Trajectory and Revenue Forecasts

Development Phases and Cost Analysis

ULESFIA's journey encompasses preclinical trials, phase I-III clinical trials, and regulatory review periods. Industry averages estimate R&D costs between USD 1–3 billion for novel biologics or small molecules, depending on complexity and trial scope [2]. These investments influence initial valuation and valuation trajectories upon market entry.

Market Entry and Revenue Streams

Assuming successful regulatory approval within the next 2–3 years, revenue projections will depend on:

-

Indication Size: If targeting a rare disease, annual treatment costs may reach USD 200,000–USD 500,000 per patient, with patient populations ranging from hundreds to thousands.

-

Pricing Strategy: Premium pricing can improve margins, but negotiations with payers might impose discounts or utilization controls.

-

Market Penetration Rate: Early adoption by key opinion leaders and inclusion in treatment guidelines facilitate growth, with estimates suggesting 20–50% market share within five years post-launch.

Forecasting Future Growth

Based on these variables, a conservative estimate projects:

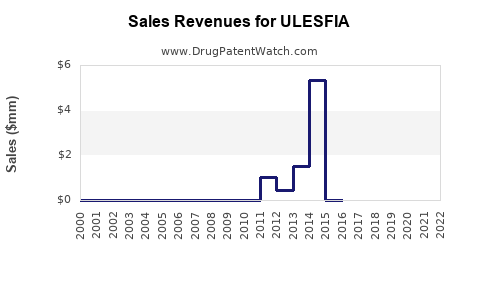

- Year 1 post-launch revenues: USD 200–500 million, driven by initial adoption.

- Year 5: USD 1–3 billion, assuming increased market penetration, expanded indications, and potential internationalization.

- Long-term: Revenue streams could stabilize or grow further via lifecycle management strategies, including formulation improvements, biosimilar competition, and companion diagnostics.

Profitability Outlook

High R&D and commercialization costs imply a phased profit realization. Margins could improve after reaching scale, with EBITDA margins of 30–50% achievable through optimized manufacturing and pricing strategies. Strategic alliances and licensing agreements are crucial to offset costs and accelerate global presence.

Competitive Analysis

ULESFIA faces a crowded landscape characterized by:

- Mature Brands: Established therapies with broad clinician familiarity.

- Biosimilars: Generic or biosimilar products that erode pricing power.

- Emerging Innovators: Competitors developing next-generation agents with comparable or superior efficacy.

Differentiation via biomarkers, combination therapies, or personalized treatment regimens will be vital for ULESFIA to carve out market share and sustain financial growth.

Regulatory Risks and Opportunities

While regulatory pathways can support expedited approval, unforeseen hurdles such as clinical trial failures, safety concerns, or delays can disrupt financial expectations. Conversely, success in rare disease markets can generate premium pricing and extended patent protection, bolstering long-term revenue forecasts.

Conclusion

The financial trajectory for ULESFIA hinges on multiple interconnected factors. While initial R&D investments are considerable, the potential for blockbuster status exists, particularly if the drug addresses an unmet need with a differentiated profile. Strategic positioning, effective regulatory navigation, and stakeholder engagement will be instrumental in translating clinical promise into financial success.

Key Takeaways

- Market potential for ULESFIA is robust within targeted therapeutic areas with high unmet needs and favorable regulatory pathways.

- Revenue growth is projected to accelerate post-approval, with potential multi-billion-dollar annual sales within five years, contingent on market penetration and pricing strategies.

- Competitive challenges require continuous innovation and differentiation to sustain market share.

- Regulatory nuances and lifecycle management opportunities can significantly influence profitability and market exclusivity.

- Strategic alignment with healthcare providers, payers, and patient populations remains essential to maximize financial outcomes.

FAQs

1. What factors influence ULESFIA’s market penetration?

Market penetration depends on regulatory approval speed, clinical efficacy, safety profile, clinician adoption, patient access, pricing negotiations, and competitive landscape.

2. How does regulatory status impact ULESFIA’s financial outlook?

Accelerated approvals and market exclusivity through incentives like orphan drug designation can reduce time-to-market and protect revenues, enhancing profitability.

3. What are the main risks affecting ULESFIA's revenue projections?

Clinical trial failures, safety concerns, regulatory delays, payer restrictions, and aggressive biosimilar competition pose significant risks.

4. How does the indication size influence revenue forecasts?

Larger patient populations yield higher total sales, but often at lower per-unit prices, whereas niche markets can command premium pricing but generate limited revenues.

5. What strategies can maximize ULESFIA’s financial success?

Differentiation through efficacy, safety, and personalized medicine, strategic partnerships, global expansion, and lifecycle management are key strategies to maximize financial gains.

References

[1] Grand View Research. Oncology Drugs Market Size, Share & Trends Analysis Report. 2022.

[2] DiMasi JA, Grabowski HG, Hansen RW. Innovation in the pharmaceutical industry: New estimates of R&D costs. J Health Econ. 2016;47:20-33.