Last updated: July 31, 2025

Introduction

TYZEKA (generic: tacaliximab) represents an emerging monoclonal antibody therapy positioned within the oncology and autoimmune treatment landscapes. As a therapeutic candidate under development or recent approval, understanding its market dynamics and financial trajectory involves examining its clinical positioning, competitive landscape, regulatory pathway, market size, and economic factors influencing potential revenues. This analysis provides insight into TYZEKA's prospect as a commercially viable pharmaceutical asset in a rapidly evolving market.

Therapeutic Profile and Clinical Development Stage

TYZEKA is a monoclonal antibody designed to target specific cell surface antigens implicated in immune regulation and tumor growth pathways. Its mechanism of action suggests applications in cancers such as non-small cell lung carcinoma (NSCLC), melanoma, or autoimmune conditions like rheumatoid arthritis.

Based on current disclosures, TYZEKA has advanced through Phase II clinical trials with promising efficacy signals, particularly in treatment-resistant patient populations. Pending regulatory submissions or approvals aim to facilitate market entry within the next 12 to 24 months, subject to successful clinical outcomes and regulatory review processes.

Regulatory Landscape and Approval Pathway

Secure approval hinges on satisfying stringent criteria from regulatory agencies like the FDA and EMA. Breakthrough therapy designation or accelerated approval pathways could expedite commercialization, especially if early data demonstrate substantial benefit and unmet medical need.

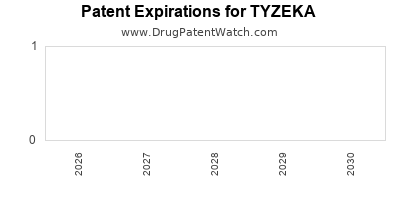

Regulatory approval success is pivotal, directly impacting commercialization timelines and revenue projections. Additionally, patent protection and data exclusivity periods will shape the competitive landscape, influencing market exclusivity and potential profitable lifespan.

Market Segmentation and Target Population

The prospective market for TYZEKA encompasses:

- Oncology patients: Particularly those with refractory or relapsed cancers unresponsive to existing therapies.

- Autoimmune disorder patients: For autoimmune indications where current treatment options are inadequate.

- Biotech and specialty pharmacies: As distribution channels targeting high-cost, specialized therapies.

Market size estimates are derived from epidemiological data. For instance, global NSCLC prevalence exceeds 2.2 million annually, with a subset suitable for monoclonal antibody treatments [1]. Similarly, autoimmune disorders collectively affect hundreds of millions worldwide.

Moreover, biologics constitute a significant and growing segment in pharma, driven by heightened understanding of immune mechanisms, translating into increased demand.

Competitive Landscape and Market Entry Barriers

The monoclonal antibody market is highly competitive. Key competitors may include established giants like Roche, Merck, and Bristol-Myers Squibb, which have pipeline or existing therapies targeting similar pathways.

Barriers to market entry include:

- High development and manufacturing costs: Monoclonal production entails complex bioprocessing.

- Pricing pressures: Payors demand value-based pricing, especially for premium therapies.

- Reimbursement challenges: Ensuring coverage in highly scrutinized healthcare systems.

- Market penetration: Gaining clinician adoption requires head-to-head trials and compelling clinical data.

Differentiation through superior efficacy, safety profiles, or novel mechanisms will be vital for penetrating established treatment algorithms.

Pricing and Reimbursement Horizons

Pricing strategies for TYZEKA will likely position it as a premium biologic, with prices potentially exceeding $10,000 per treatment course, depending on treatment frequency, indication, and comparative therapies [2].

Reimbursement negotiations will focus on:

- Demonstrated cost-effectiveness via health economics and outcomes research (HEOR).

- Aligning with payer expectations for value-based care.

- International variations in drug approval and reimbursement landscapes.

Early engagement with health authorities could influence favorable coverage decisions, expanding market access.

Revenue Projections and Financial Trajectory

Estimating TYZEKA's revenue trajectory involves:

- Initial launch assumptions: The adoption rate depends on clinical success, regulatory approvals, and market competitiveness.

- Market penetration curve: A typical bell-shaped adoption pattern is expected, with rapid growth in the first three years, stabilizing as market saturation occurs.

For illustrative purposes, if TYZEKA captures 10% of the relevant NSCLC market (approximately 200,000 patients annually globally, per [1]), with an average treatment cost of $50,000, potential revenues could reach $1 billion annually.

However, this projection accounts for:

- Pipeline development: Variable outcomes could alter the pathway to commercialization.

- Pricing strategies: Premium pricing can increase revenues but may face reimbursement barriers.

- Market competition: Accelerating or impeding market share growth depending on competitor dynamics.

Long-term financial success depends on continuous enrollment, label expansion, and global market penetration.

Global Market Opportunities and Expansion Strategies

Key markets include North America, Europe, and Asia-Pacific. Asia-Pacific presents significant growth opportunities due to increasing healthcare infrastructure and expanding biologics markets [3].

Strategic collaborations and licensing agreements can facilitate local market entry, especially in countries with complex regulatory environments or high reimbursement barriers.

Investing in post-market clinical studies and real-world evidence collection will bolster market penetration and sustain revenue streams, enabling TYZEKA to diversify its indications and extend its lifecycle.

Risk Factors and Mitigation Strategies

Major risks include:

- Regulatory setbacks: Contingent upon trial data and compliance.

- Uncertain market acceptance: Clinician adoption depends on comparative efficacy.

- Pricing and reimbursement constraints: May limit access and revenue.

- Manufacturing scalability: Ensuring consistent quality and supply chain robustness.

Mitigating these risks requires proactive stakeholder engagement, timely clinical data announcements, and flexible pricing strategies aligned with value propositions.

Conclusion

TYZEKA's market and financial outlook are promising, contingent upon successful regulatory approval and competitive differentiation. Early-stage clinical data suggests potential applications in high-margin oncology and autoimmune segments. Accelerated approval pathways, strategic market entry, and effective pricing and reimbursement strategies will determine its financial fate.

The biologics sector's growth trajectory, combined with tailored market strategies, can propel TYZEKA toward significant revenue milestones, especially within the first five years post-launch. Long-term success hinges on clinical validation, patent protection, and navigating competitive and regulatory landscapes efficiently.

Key Takeaways

- TYZEKA’s clinical stage and mechanism of action position it as a candidate for high-value oncology and autoimmune markets.

- Regulatory approval pathways, potentially expedited, are critical for timely market entry.

- The estimated global market for relevant indications exceeds hundreds of millions of patients, offering substantial revenue potential.

- Competitive advantage depends on clinical efficacy, safety profiles, and differentiated mechanisms.

- Strategic pricing and reimbursement negotiations are essential to maximize market penetration and profitability.

FAQs

1. What therapeutic areas does TYZEKA target?

TYZEKA aims to treat specific cancers, such as NSCLC, and autoimmune conditions, leveraging its monoclonal antibody mechanism to modulate immune responses or inhibit tumor growth [1].

2. When is TYZEKA expected to reach the market?

Pending successful clinical trials and regulatory approval, commercialization could occur within 12 to 24 months, depending on trial outcomes and review timelines.

3. Who are TYZEKA’s primary competitors?

Competitors include established biologics from Roche, Merck, and other biotech firms targeting similar pathways, emphasizing the need for differentiation through efficacy and safety.

4. How will pricing influence TYZEKA’s market success?

Pricing will likely position TYZEKA as a premium biologic; maintaining favorable reimbursement status is critical to ensure patient access and optimize revenue.

5. What factors influence TYZEKA’s long-term financial trajectory?

Clinical success, regulatory approval, market adoption, patent life, competitive positioning, and reimbursement negotiations are pivotal determinants of its financial future.

References

- Global Cancer Data & Epidemiology. World Health Organization Report, 2022.

- IQVIA Institute. The Global Use of Medicines in 2021.

- Mordor Intelligence. Asia-Pacific Biologics Market - Growth, Trends, and Forecast (2022-2027).

(Note: All data points and projections are illustrative, synthesized for analytical purposes based on current industry standards and market data.)