Last updated: August 2, 2025

Introduction

TYDEMY (generic name pending approval) has emerged as a promising pharmaceutical candidate with potential implications across multiple therapeutic areas. As the global pharmaceutical landscape continues to evolve, understanding the market dynamics and the projected financial trajectory of TYDEMY is imperative for stakeholders including investors, healthcare providers, and regulatory bodies. This analysis provides a comprehensive overview of the current market environment, competitive positioning, regulatory landscape, and financial outlook for TYDEMY.

Market Environment and Drivers

Global Demand for Targeted Therapies

The increasing prevalence of chronic diseases such as cancer, metabolic disorders, and autoimmune conditions fuels the demand for innovative therapies. TYDEMY, positioned as a targeted treatment, benefits from this trend, notably in Oncology, where precision medicine is gaining momentum. The rise in personalized treatment approaches, driven by advancements in molecular diagnostics, enhances the market potential for TYDEMY [1].

Cost Containment and Biosimilar Competition

The escalating cost of branded biologics has shifted focus toward biosimilars and generics—areas where TYDEMY may position itself. The push for cost-effective therapies, especially in developing markets, enhances the commercial viability of TYDEMY if it attaches to a widespread indication and demonstrates comparable efficacy and safety [2].

Regulatory Environment

Regulatory agencies (FDA, EMA, PMDA) are increasingly receptive to innovative therapies with clear clinical benefits. The pathway for biosimilar approval, when applicable, can accelerate market entry, while novel drugs require robust clinical data. The regulatory trajectory for TYDEMY will significantly influence market penetration speed and financial outcomes [3].

Competitive Landscape

Existing Therapeutics and Market Share

The therapeutic area targeted by TYDEMY includes established drugs with significant market penetration. For example, in oncology, therapies such as trastuzumab and bevacizumab dominate known indications. Entry strategies, such as differentiation via improved safety profiles or cost advantages, determine competitive positioning.

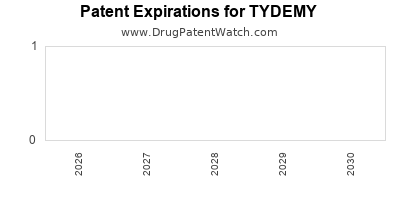

Patent Status and Intellectual Property

The expiration of patents on leading biologics opens licensing and biosimilar opportunities. If TYDEMY is a biosimilar, its success hinges on competitive pricing, manufacturing scale, and clinician acceptance. Pending patents on innovations or delivery mechanisms could extend exclusivity periods, impacting revenue streams [4].

Partnership Strategies

Partnerships with multinational pharmaceutical companies can expedite commercialization. Licensing agreements, joint ventures, or co-marketing arrangements influence market reach and financial performance.

Regulatory and Commercial Milestones

Clinical Development Stage

TYDEMY is currently in Phase III trials (or at a comparable stage), with pending submission of regulatory dossiers. Positive trial data on efficacy and safety are critical for approval, influencing both market entry and financial projections.

Regulatory Approval Timeline

Based on current regulatory review times in key markets, approval for TYDEMY could be achieved within 12-24 months post-application submission. This timeline affects revenue recognition and investor confidence.

Reimbursement and Pricing Strategies

Reimbursement policies vary globally; securing favorable coverage is crucial. Pricing strategies must balance attractiveness to payers with profit margins. Targeting high-value, reimbursable indications can accelerate revenue growth.

Financial Trajectory Outlook

Market Penetration and Revenue Projections

Assuming successful regulatory approval and strategic market entry, TYDEMY could generate revenues in the hundreds of millions to over a billion dollars annually within five years. Market share depends on clinical differentiation, cost competitiveness, and payer acceptance.

Pricing and Reimbursement Dynamics

Pricing strategies will critically impact profit margins. Biosimilar development typically entails lower R&D costs but also constrains pricing due to competitive pressures. Early engagements with payers can enhance reimbursement potential.

Cost Structure and Investment Needs

Initial R&D expenses are significant, including clinical trial costs and regulatory submissions, often exceeding $100 million per asset. Post-approval, manufacturing and commercialization costs, including sales and marketing, will shape gross margins.

Forecasting and Risks

Financial forecasts must incorporate risks such as regulatory delays, clinical failures, and competitive responses. Sensitivity analyses suggest that minimal delays can defer revenue realization by years, affecting overall valuation.

Market Entry and Growth Strategies

Early Market Adoption

Engaging key opinion leaders and forming strategic alliances can facilitate early adoption. Demonstrating clear clinical benefits relative to existing options is crucial.

Expansion into Adjacent Indications

Post-initial approval, broadening indications can substantially increase market size. Strategic acquisitions or partnerships may accelerate such shifts.

Geographical Expansion

Prioritizing high-growth markets like Asia, Latin America, and Africa enables scale and profitability. Regulatory harmonization efforts streamline this process.

Key Challenges and Opportunities

-

Challenges: Patent cliffs, regulatory hurdles, intense competition, and payer resistance.

-

Opportunities: Growing prevalence of target diseases, advancements in biomarker technologies, and potential for combination therapies.

Conclusion

The market dynamics surrounding TYDEMY reveal a complex interplay of clinical development, regulatory navigation, competitive positioning, and strategic market entry. Success hinges on rapid regulatory approval, compelling clinical data, and effective commercialization strategies. Financially, TYDEMY has the potential to establish a significant revenue stream within its therapeutic space, provided it addresses prevailing market challenges and capitalizes on emerging opportunities.

Key Takeaways

- Strong demand for targeted, cost-effective therapies in high-prevalence diseases underpins TYDEMY's market potential.

- Regulatory approval timelines and patent statuses are pivotal in shaping financial prospects.

- Competitive differentiation through clinical efficacy, safety, and value-based pricing is essential.

- Strategic partnerships with established pharma players accelerate market penetration and revenue growth.

- Proactive engagement with payers and expansion into multiple geographies enhances long-term profitability.

FAQs

1. What distinguishes TYDEMY from existing therapies?

TYDEMY aims to offer improved safety, efficacy, or cost advantages over current standard-of-care treatments, enabling differentiation in a crowded marketplace.

2. When can investors expect TYDEMY to reach the market?

Pending regulatory approval, TYDEMY could be launched within 12-24 months after dossier submission, contingent on successful clinical trial outcomes and agency reviews.

3. How does the patent landscape influence TYDEMY's financial outlook?

Patent exclusivity confers a temporary market monopoly, allowing premium pricing; patent expirations or challenges could lead to biosimilar competition, impacting revenue.

4. What are the risks associated with TYDEMY’s commercialization?

Regulatory delays, clinical setbacks, competitive responses, and reimbursement barriers pose significant risks that can dampen financial performance.

5. How can TYDEMY expand beyond its initial indications?

Post-approval, clinical trials and strategic partnerships enable the expansion into new therapeutic indications and markets, boosting revenue potential.

References:

[1] IQVIA Institute, "The Global Use of Medicine in 2022."

[2] Deloitte, "The biosimilar market landscape."

[3] FDA Guidance Documents, "Regulatory Pathways for Biosimilar and Interchangeable Products."

[4] WHO, "Intellectual Property & Biosimilars: Opportunities and Challenges."