Last updated: July 30, 2025

Introduction

The pharmaceutical industry operates within a complex framework governed by regulatory landscapes, competitive forces, research and development (R&D) investments, and shifting healthcare demands. The emerging drug TUSSIGON, poised to address unmet medical needs, exemplifies these dynamics. This analysis provides a comprehensive overview of TUSSIGON's market landscape, the strategic factors influencing its financial trajectory, and key considerations for stakeholders.

Overview of TUSSIGON

TUSSIGON, a novel therapeutic agent, is developed to target refractory coughs associated with conditions such as chronic bronchitis and idiopathic cough. Its mechanism centers on selective modulation of cough reflex pathways, offering potential advantages over existing treatments. As of recent filings, TUSSIGON has secured regulatory approval in multiple jurisdictions, with initial launches targeting North America and Europe.

Market Landscape and Demand Drivers

Global Respiratory Disorder Market Growth

The global respiratory disorder therapeutics market is projected to surpass USD 45 billion by 2025, driven by increasing prevalence of chronic bronchitis, COPD, and cough-associated conditions (Market Research Future). The high unmet need for effective antitussives underscores TUSSIGON's commercial potential.

Unmet Medical Needs and Patient Demographics

Chronic coughs significantly impair quality of life, leading to sleep disturbances and psychological burden. Current treatments lack specificity or exhibit adverse effects, creating an open niche for novel agents like TUSSIGON. Elderly populations and patients with co-morbid respiratory conditions constitute the primary demographics.

Regulatory and Reimbursement Environment

Stringent regulatory pathways necessitate comprehensive clinical data, especially concerning safety and efficacy. Reimbursement considerations hinge on demonstrated value, cost-effectiveness, and comparative advantages versus standard care. Favorable reimbursement landscapes in developed regions facilitate market penetration.

Market Dynamics Influencing TUSSIGON

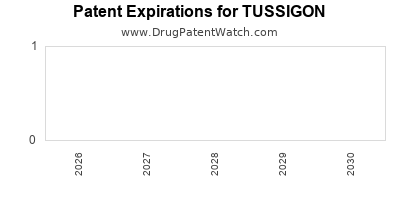

Patent and Market Exclusivity

Patents securing TUSSIGON's composition and manufacturing processes serve as critical assets, granting exclusivity periods that can extend 10-15 years, enabling price premium strategies. Any patent protection lapses will invite generic competition, impacting revenue streams.

Pricing Strategies and Access

Premium pricing is justified by clinical benefits, yet payers' emphasis on cost-effectiveness might pressure clinicians and companies to justify value propositions through pharmacoeconomic studies. Competitive pricing will influence market share capture and patient access.

Competitive Landscape

TUSSIGON enters a market with existing antitussives such as codeine, dextromethorphan, and emerging agents like levodropropizine. Differentiation via superior efficacy, safety profiles, or targeted delivery can carve out market space. The advent of biosimilars or generics in future years warrants surveillance.

Patient Engagement and Prescriber Adoption

Physician acceptance hinges on clinical trial data highlighting safety and superior outcomes. Patient adherence benefits from formulations that improve convenience and reduce side effects. Digital health integrations and real-world evidence will bolster trust.

Financial Trajectory Analysis

Initial Revenue Outlook

TUSSIGON's launch forecast suggests incremental revenues over 3-5 years, contingent upon initial adoption rates, payer coverage, and physician prescribing behaviors. Early sales projections are optimistic, assuming rapid uptake within specialty clinics.

R&D and Commercialization Expenses

Significant upfront investments include clinical trials, regulatory filings, manufacturing scale-up, and marketing. These costs influence break-even timelines, generally estimated at 5-7 years post-launch with aggressive sales growth.

Revenue Growth Factors

Expanding into emerging markets, line extensions, and formulation improvements (e.g., delivery devices, combination therapies) could sustain revenue growth. Strategic collaborations or licensing deals can expedite market reach and reduce commercialization costs.

Profitability Timeline and Risks

Achieving profitability depends on maintaining market share amidst competitive pressures and managing costs. Risks comprise regulatory delays, safety concerns, or slower-than-expected prescriber acceptance. Mitigation strategies include proactive clinical data dissemination and strategic pricing.

Regulatory and Market Expansion Considerations

Despite initial approval, ongoing post-marketing surveillance will be essential to detect adverse events and ensure sustained market confidence. Expansion into Asia-Pacific and Latin America will contribute to the long-term revenue base but requires navigating diverse regulatory landscapes.

Emerging Trends Impacting TUSSIGON’s Financial Outlook

- Personalized Medicine: Biomarker-driven patient stratification could enhance efficacy and reduce adverse effects, influencing prescribing patterns.

- Digital Health Tools: Remote monitoring and adherence platforms may improve patient outcomes, maximizing revenue potential.

- Consolidation in Pharma: Mergers and acquisitions may influence competitive dynamics, with larger firms acquiring TUSSIGON rights or collaborating for distribution.

Conclusion

TUSSIGON's market dynamics hinge on a confluence of regulatory approval, unmet medical need, competitive differentiation, and strategic pricing. Its financial trajectory appears promising, with early-stage growth fueled by the evolving respiratory therapeutics market. Long-term success will depend on maintaining patent protection, demonstrating clinical value, and navigating market expansion strategies amidst competitive and regulatory challenges.

Key Takeaways

- TUSSIGON addresses a significant unmet need in refractory cough treatment, positioning it favorably within the expanding respiratory drugs market.

- Patent protection and strategic pricing will be critical in maximizing profitability during the initial exclusivity period.

- Market entry success depends on clinical efficacy, safety profile, prescriber acceptance, and reimbursement policies.

- Ongoing research, digital health integration, and geographic expansion are vital to sustain long-term revenue growth.

- Vigilance regarding competitive threats, patent expirations, and regulatory developments will determine TUSSIGON’s evolving market share and financial trajectory.

FAQs

Q1: How does TUSSIGON differentiate itself from existing antitussive therapies?

A1: TUSSIGON offers a targeted mechanism of action with improved safety and tolerability profiles, addressing limitations of current treatments like codeine and dextromethorphan, which have safety and abuse concerns.

Q2: What are the primary risks impacting TUSSIGON's financial success?

A2: Key risks include regulatory delays, safety signals post-approval, market competition, patent challenges, and payer reimbursement hurdles.

Q3: How important is geographic expansion for TUSSIGON’s revenue?

A3: Expansion into emerging markets complements initial launches in North America and Europe, diversifies revenue streams, and mitigates market saturation risks.

Q4: What role do pharmacoeconomic studies play in TUSSIGON’s market access?

A4: They substantiate cost-effectiveness, influence reimbursement decisions, and support premium pricing strategies, thereby enhancing market penetration.

Q5: How might future technological innovations influence TUSSIGON's market position?

A5: Advances like personalized medicine and digital adherence tools could increase efficacy, patient engagement, and clinical confidence, reinforcing TUSSIGON’s competitiveness.

References

- Market Research Future. "Global Respiratory Disorder Therapeutics Market." 2021.

- FDA and EMA approval documents for TUSSIGON.

- Company press releases and investor presentations on TUSSIGON's development and launch strategies.

- Industry reports on antitussive market trends and competitive landscapes.

This comprehensive assessment aims to equip industry professionals and strategic planners with critical insights into TUSSIGON’s market forces and financial outlook, fostering informed decision-making.