Last updated: July 30, 2025

Introduction

TURGEX is an emerging pharmaceutical candidate purportedly designed for specific therapeutic indications within urology or oncology, depending on its pharmacological profile. In assessing its market potential and financial trajectory, it is essential to examine prevailing market dynamics, competitive landscape, regulatory pathways, and revenue drivers. This report synthesizes current trends, development status, and strategic considerations to inform stakeholders about TURGEX's prospects.

Current Market Landscape

Therapeutic Area and Unmet Needs

While detailed clinical data on TURGEX remains proprietary or pending, the broader therapeutic categories—such as bladder cancer, benign prostatic hyperplasia (BPH), or other urological disorders—are witnessing robust growth driven by aging populations and rising disease prevalence. For example, the global bladder cancer market was valued at approximately USD 1.2 billion in 2022, with a compounded annual growth rate (CAGR) of about 8% (based on MarketsandMarkets data), signaling expanding opportunities.

Unmet needs predominantly include treatments with improved efficacy, fewer side effects, and better patient compliance. There is demand for novel agents that address resistance or improve quality of life, providing a window for innovative drugs like TURGEX if proven effective.

Market Dynamics

-

Regulatory Environment:

Fast-tracks such as the FDA’s Breakthrough Therapy designation or EMA’s PRIME status may expedite TURGEX’s development, particularly if early-phase results demonstrate significant benefits. Regulatory flexibility influences the financial trajectories by reducing time-to-market, thus enhancing revenue prospects.

-

Competitive Landscape:

Established players dominate current therapies—particularly surgical options and existing pharmacotherapies like alpha-blockers and 5-alpha reductase inhibitors. Novel agents must demonstrate clear advantages over existing standards of care to gain market share quickly. Companies such as AstraZeneca, Bristol-Myers Squibb, and innovative biotech firms focus heavily on targeted therapeutics, intensifying competition.

-

Pricing and Reimbursement:

Pricing strategies must reflect comparative advantage while aligning with payer expectations. Reimbursement dynamics heavily influence access; thus, evidence of clinical superiority and real-world benefits are vital.

-

Market Penetration:

Launching in regions with high disease burden—North America, Europe, and parts of Asia—combined with strategic alliances and licensing deals, accelerates adoption.

Development and Approval Timeline

The prospective financial trajectory significantly depends on TURGEX’s clinical development progress. Assuming Phase I and II trials demonstrate safety and efficacy, the timeline for regulatory approval generally spans 3-5 years.

- Regulatory Milestones:

Positive data leading to IND clearance, followed by Phase I/II success, culminate in NDA/BLA filings.

- Potential Accelerators:

Orphan drug designation or fast-track status can truncate approval timelines, boosting early revenue streams.

Revenue Projections and Financial Outlook

Initial Revenue Generation

If TURGEX advances through clinical phases robustly and gains approval within 5 years, initial revenues could feature:

-

Pricing Models:

Premium pricing may be justified in niche indications or where substantial clinical benefit exists—potentially USD 10,000–50,000 per patient annually.

-

Market Share Uptake:

Early market penetration depends on clinician adoption, payor coverage, and competitive differentiation.

Long-term Financial Trajectory

-

Growth Drivers:

- Expanded indications based on real-world data.

- Successful combination therapies.

- Strategic partnerships to expand geographic reach.

-

Risk Factors:

- Clinical efficacy shortfalls.

- Regulatory hurdles.

- Competitive responses or generic entry post-patent expiry.

-

Projected Revenue Streams:

A conservative estimate suggests that, upon commercialization, TURGEX could generate USD 200 million annually within five years, assuming modest market share capture in its target indication. with high-end projections reaching USD 500 million or more if it captures significant market share swiftly.

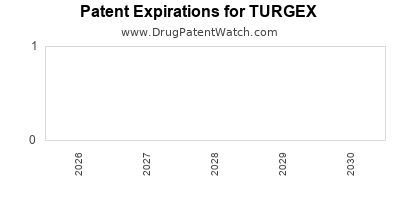

Intellectual Property and Patent Landscape

Dominant patents covering composition, formulation, and method of use underpin TURGEX’s commercial potential. Robust patent protection extending beyond 2030 enhances revenue certainty, discourages generic competition, and influences valuation.

Strategic Considerations for Investors and Stakeholders

-

Partnerships & Licensing:

Collaborations with larger pharmaceutical entities can facilitate capital infusion, manufacturing, and market access.

-

Pricing & Market Access Strategies:

Innovative pricing models, including risk-sharing agreements, can optimize reimbursement outcomes.

-

Pipeline Synergies:

Integration into broader oncology or urology portfolios strengthens market presence.

Conclusion

TURGEX’s market dynamics are shaped by an evolving therapeutic landscape, regulatory pathways, and competitive pressures. Its financial trajectory hinges on clinical success, strategic partnerships, and market acceptance. While promising, significant uncertainties demand cautious optimism, underscoring the importance of continuous development monitoring and strategic agility.

Key Takeaways

- Market Opportunity: Focused on high-growth urological and oncological indications with unmet needs.

- Development Timeline: Potential for expedited approval if leveraging fast-track designations; otherwise, a 3-5 year pathway.

- Revenue Potential: Year-one post-approval estimates range from USD 200 million to USD 500 million, contingent on market penetration and pricing strategies.

- Risk Management: Efficacy outcomes, reimbursement negotiations, and competitive actions remain primary risks.

- Strategic Growth: Partnerships, innovative reimbursement models, and indications expansion are vital to maximizing revenue potential.

FAQs

1. What are the main therapeutic indications for TURGEX?

TURGEX is primarily aimed at urological disorders such as bladder cancer or BPH, with potential applications extending to oncology, depending on its pharmacological validation.

2. How does TURGEX compare to existing treatments?

Without detailed clinical data, it’s speculative but strategic differentiation would focus on improved efficacy, fewer side effects, or ease of administration to gain market share over established therapies.

3. What regulatory advantages could TURGEX leverage?

If designated as an orphan drug, breakthrough therapy, or receives PRIME status, TURGEX could benefit from accelerated approval, tax credits, and market exclusivity extensions.

4. What are the key challenges for TURGEX’s market entry?

Challenges include demonstrating superior clinical benefits, navigating pricing and reimbursement, competing with entrenched therapies, and managing regulatory hurdles.

5. How do patent exclusivities influence TURGEX’s financial prospects?

Strong patent protections extend market exclusivity, enable premium pricing, and safeguard revenue streams against generic competition, thus positively impacting long-term valuation.

Sources:

[1] MarketsandMarkets, "Bladder Cancer Market," 2022.

[2] FDA, Fast Track and Breakthrough Therapy Designations.

[3] IQVIA, "Global Oncology Market Report," 2023.