TUDORZA PRESSAIR Drug Patent Profile

✉ Email this page to a colleague

Which patents cover Tudorza Pressair, and when can generic versions of Tudorza Pressair launch?

Tudorza Pressair is a drug marketed by Covis and is included in one NDA. There are two patents protecting this drug.

This drug has seventy-two patent family members in thirty-six countries.

The generic ingredient in TUDORZA PRESSAIR is aclidinium bromide. There is one drug master file entry for this compound. One supplier is listed for this compound. Additional details are available on the aclidinium bromide profile page.

DrugPatentWatch® Generic Entry Outlook for Tudorza Pressair

Tudorza Pressair was eligible for patent challenges on July 23, 2016.

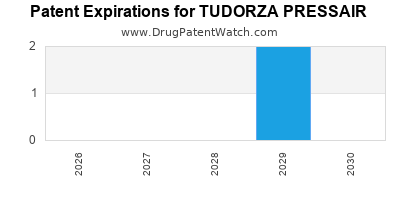

By analyzing the patents and regulatory protections it appears that the earliest date

for generic entry will be March 13, 2029. This may change due to patent challenges or generic licensing.

Indicators of Generic Entry

AI Deep Research

Questions you can ask:

- What is the 5 year forecast for TUDORZA PRESSAIR?

- What are the global sales for TUDORZA PRESSAIR?

- What is Average Wholesale Price for TUDORZA PRESSAIR?

Summary for TUDORZA PRESSAIR

| International Patents: | 72 |

| US Patents: | 2 |

| Applicants: | 1 |

| NDAs: | 1 |

| Finished Product Suppliers / Packagers: | 1 |

| Raw Ingredient (Bulk) Api Vendors: | 59 |

| Patent Applications: | 484 |

| Drug Prices: | Drug price information for TUDORZA PRESSAIR |

| What excipients (inactive ingredients) are in TUDORZA PRESSAIR? | TUDORZA PRESSAIR excipients list |

| DailyMed Link: | TUDORZA PRESSAIR at DailyMed |

DrugPatentWatch® Estimated Loss of Exclusivity (LOE) Date for TUDORZA PRESSAIR

Generic Entry Date for TUDORZA PRESSAIR*:

Constraining patent/regulatory exclusivity:

NDA:

Dosage:

POWDER, METERED;INHALATION |

*The generic entry opportunity date is the latter of the last compound-claiming patent and the last regulatory exclusivity protection. Many factors can influence early or later generic entry. This date is provided as a rough estimate of generic entry potential and should not be used as an independent source.

Pharmacology for TUDORZA PRESSAIR

| Drug Class | Anticholinergic |

| Mechanism of Action | Cholinergic Antagonists |

US Patents and Regulatory Information for TUDORZA PRESSAIR

TUDORZA PRESSAIR is protected by two US patents.

Based on analysis by DrugPatentWatch, the earliest date for a generic version of TUDORZA PRESSAIR is ⤷ Get Started Free.

This potential generic entry date is based on patent ⤷ Get Started Free.

Generics may enter earlier, or later, based on new patent filings, patent extensions, patent invalidation, early generic licensing, generic entry preferences, and other factors.

| Applicant | Tradename | Generic Name | Dosage | NDA | Approval Date | TE | Type | RLD | RS | Patent No. | Patent Expiration | Product | Substance | Delist Req. | Exclusivity Expiration |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Covis | TUDORZA PRESSAIR | aclidinium bromide | POWDER, METERED;INHALATION | 202450-001 | Jul 23, 2012 | RX | Yes | Yes | ⤷ Get Started Free | ⤷ Get Started Free | Y | ⤷ Get Started Free | |||

| Covis | TUDORZA PRESSAIR | aclidinium bromide | POWDER, METERED;INHALATION | 202450-001 | Jul 23, 2012 | RX | Yes | Yes | ⤷ Get Started Free | ⤷ Get Started Free | Y | ⤷ Get Started Free | |||

| >Applicant | >Tradename | >Generic Name | >Dosage | >NDA | >Approval Date | >TE | >Type | >RLD | >RS | >Patent No. | >Patent Expiration | >Product | >Substance | >Delist Req. | >Exclusivity Expiration |

Expired US Patents for TUDORZA PRESSAIR

| Applicant | Tradename | Generic Name | Dosage | NDA | Approval Date | Patent No. | Patent Expiration |

|---|---|---|---|---|---|---|---|

| Covis | TUDORZA PRESSAIR | aclidinium bromide | POWDER, METERED;INHALATION | 202450-001 | Jul 23, 2012 | ⤷ Get Started Free | ⤷ Get Started Free |

| Covis | TUDORZA PRESSAIR | aclidinium bromide | POWDER, METERED;INHALATION | 202450-001 | Jul 23, 2012 | ⤷ Get Started Free | ⤷ Get Started Free |

| Covis | TUDORZA PRESSAIR | aclidinium bromide | POWDER, METERED;INHALATION | 202450-001 | Jul 23, 2012 | ⤷ Get Started Free | ⤷ Get Started Free |

| >Applicant | >Tradename | >Generic Name | >Dosage | >NDA | >Approval Date | >Patent No. | >Patent Expiration |

EU/EMA Drug Approvals for TUDORZA PRESSAIR

| Company | Drugname | Inn | Product Number / Indication | Status | Generic | Biosimilar | Orphan | Marketing Authorisation | Marketing Refusal |

|---|---|---|---|---|---|---|---|---|---|

| Covis Pharma Europe B.V. | Bretaris Genuair | aclidinium bromide | EMEA/H/C/002706Bretaris Genuair is indicated as a maintenance bronchodilator treatment to relieve symptoms in adult patients with chronic obstructive pulmonary disease (COPD). | Authorised | no | no | no | 2012-07-20 | |

| Covis Pharma Europe B.V. | Eklira Genuair | aclidinium bromide | EMEA/H/C/002211Eklira Genuair is indicated as a maintenance bronchodilator treatment to relieve symptoms in adult patients with chronic obstructive pulmonary disease (COPD). | Authorised | no | no | no | 2012-07-20 | |

| >Company | >Drugname | >Inn | >Product Number / Indication | >Status | >Generic | >Biosimilar | >Orphan | >Marketing Authorisation | >Marketing Refusal |

International Patents for TUDORZA PRESSAIR

When does loss-of-exclusivity occur for TUDORZA PRESSAIR?

Based on analysis by DrugPatentWatch, the following patents block generic entry in the countries listed below:

Argentina

Patent: 0835

Estimated Expiration: ⤷ Get Started Free

Australia

Patent: 09224895

Estimated Expiration: ⤷ Get Started Free

Brazil

Patent: 0905775

Estimated Expiration: ⤷ Get Started Free

Canada

Patent: 16724

Estimated Expiration: ⤷ Get Started Free

Chile

Patent: 09000602

Estimated Expiration: ⤷ Get Started Free

China

Patent: 2083416

Estimated Expiration: ⤷ Get Started Free

Patent: 4473911

Estimated Expiration: ⤷ Get Started Free

Colombia

Patent: 90636

Estimated Expiration: ⤷ Get Started Free

Croatia

Patent: 0151214

Estimated Expiration: ⤷ Get Started Free

Patent: 0220919

Estimated Expiration: ⤷ Get Started Free

Patent: 0220929

Estimated Expiration: ⤷ Get Started Free

Cyprus

Patent: 16926

Estimated Expiration: ⤷ Get Started Free

Patent: 25381

Estimated Expiration: ⤷ Get Started Free

Patent: 25382

Estimated Expiration: ⤷ Get Started Free

Denmark

Patent: 65257

Estimated Expiration: ⤷ Get Started Free

Patent: 54889

Estimated Expiration: ⤷ Get Started Free

Patent: 54891

Estimated Expiration: ⤷ Get Started Free

Ecuador

Patent: 10010300

Estimated Expiration: ⤷ Get Started Free

European Patent Office

Patent: 00599

Estimated Expiration: ⤷ Get Started Free

Patent: 65257

Estimated Expiration: ⤷ Get Started Free

Patent: 54889

Estimated Expiration: ⤷ Get Started Free

Patent: 54890

Estimated Expiration: ⤷ Get Started Free

Patent: 54891

Estimated Expiration: ⤷ Get Started Free

Finland

Patent: 65257

Estimated Expiration: ⤷ Get Started Free

Hong Kong

Patent: 45815

Estimated Expiration: ⤷ Get Started Free

Hungary

Patent: 27726

Estimated Expiration: ⤷ Get Started Free

Patent: 59019

Estimated Expiration: ⤷ Get Started Free

Patent: 59020

Estimated Expiration: ⤷ Get Started Free

Israel

Patent: 1132

Estimated Expiration: ⤷ Get Started Free

Japan

Patent: 70460

Estimated Expiration: ⤷ Get Started Free

Patent: 11513451

Estimated Expiration: ⤷ Get Started Free

Patent: 14139233

Estimated Expiration: ⤷ Get Started Free

Patent: 16130248

Estimated Expiration: ⤷ Get Started Free

Lithuania

Patent: 54889

Estimated Expiration: ⤷ Get Started Free

Patent: 54891

Estimated Expiration: ⤷ Get Started Free

Malaysia

Patent: 7027

Estimated Expiration: ⤷ Get Started Free

Mexico

Patent: 8774

Estimated Expiration: ⤷ Get Started Free

Patent: 10008235

Estimated Expiration: ⤷ Get Started Free

Montenegro

Patent: 286

Estimated Expiration: ⤷ Get Started Free

New Zealand

Patent: 5857

Estimated Expiration: ⤷ Get Started Free

Peru

Patent: 091672

Estimated Expiration: ⤷ Get Started Free

Patent: 141036

Estimated Expiration: ⤷ Get Started Free

Patent: 190406

Estimated Expiration: ⤷ Get Started Free

Poland

Patent: 65257

Estimated Expiration: ⤷ Get Started Free

Patent: 54889

Estimated Expiration: ⤷ Get Started Free

Patent: 54891

Estimated Expiration: ⤷ Get Started Free

Portugal

Patent: 65257

Estimated Expiration: ⤷ Get Started Free

Patent: 54889

Estimated Expiration: ⤷ Get Started Free

Patent: 54891

Estimated Expiration: ⤷ Get Started Free

Russian Federation

Patent: 08713

Estimated Expiration: ⤷ Get Started Free

Patent: 10141333

Estimated Expiration: ⤷ Get Started Free

Patent: 14140674

Estimated Expiration: ⤷ Get Started Free

Patent: 19100425

Estimated Expiration: ⤷ Get Started Free

Serbia

Patent: 241

Estimated Expiration: ⤷ Get Started Free

Patent: 398

Estimated Expiration: ⤷ Get Started Free

Patent: 399

Estimated Expiration: ⤷ Get Started Free

Singapore

Patent: 8825

Estimated Expiration: ⤷ Get Started Free

Slovenia

Patent: 65257

Estimated Expiration: ⤷ Get Started Free

Patent: 54889

Estimated Expiration: ⤷ Get Started Free

Patent: 54891

Estimated Expiration: ⤷ Get Started Free

South Africa

Patent: 1003900

Patent: NOVEL DOSAGE AND FORMULATION

Estimated Expiration: ⤷ Get Started Free

South Korea

Patent: 100126322

Estimated Expiration: ⤷ Get Started Free

Patent: 180125055

Estimated Expiration: ⤷ Get Started Free

Patent: 200054329

Estimated Expiration: ⤷ Get Started Free

Spain

Patent: 51307

Estimated Expiration: ⤷ Get Started Free

Patent: 14674

Estimated Expiration: ⤷ Get Started Free

Patent: 16831

Estimated Expiration: ⤷ Get Started Free

Taiwan

Patent: 39296

Estimated Expiration: ⤷ Get Started Free

Patent: 0938232

Patent: Novel dosage and formulation

Estimated Expiration: ⤷ Get Started Free

Ukraine

Patent: 1652

Patent: КОМПОЗИЦИЯ ДЛЯ ИНГАЛЯЦИИ, КОТОРАЯ СОДЕРЖИТ АКЛИДИНИЙ ДЛЯ ЛЕЧЕНИЯ АСТМЫ И ХРОНИЧЕСКОГО ОБСТРУКТИВНОГО ЗАБОЛЕВАНИЯ ЛЕГКИХ;КОМПОЗИЦІЯ ДЛЯ ІНГАЛЯЦІЇ, ЩО МІСТИТЬ АКЛІДИНІЙ ДЛЯ ЛІКУВАННЯ АСТМИ ТА ХРОНІЧНОГО ОБСТРУКТИВНОГО ЗАХВОРЮВАННЯ ЛЕГЕНЬ (COMPOSITION FOR INHALATION COMPRISING ACLIDINIUM FOR THE TREATMENT OF ASTHMA AND CHRONIC OBSTRUCTIVE PULMONARY DISEASE)

Estimated Expiration: ⤷ Get Started Free

Uruguay

Patent: 687

Patent: NUEVA DOSIFICACION Y FORMULACION

Estimated Expiration: ⤷ Get Started Free

Generics may enter earlier, or later, based on new patent filings, patent extensions, patent invalidation, early generic licensing, generic entry preferences, and other factors.

See the table below for additional patents covering TUDORZA PRESSAIR around the world.

| Country | Patent Number | Title | Estimated Expiration |

|---|---|---|---|

| Argentina | 002534 | CARTUCHO PARA UN POLVO FARMACEUTICO Y UN INHALADOR QUE LO COMPRENDE | ⤷ Get Started Free |

| China | 1325129 | ⤷ Get Started Free | |

| Uruguay | 26244 | NUEVOS DERIVADOS DE QUINUCLIDINA Y COMPOSICIONES FARMACÉUTICAS QUE LOS CONTIENEN. | ⤷ Get Started Free |

| >Country | >Patent Number | >Title | >Estimated Expiration |

Supplementary Protection Certificates for TUDORZA PRESSAIR

| Patent Number | Supplementary Protection Certificate | SPC Country | SPC Expiration | SPC Description |

|---|---|---|---|---|

| 1200431 | 2013/002 | Ireland | ⤷ Get Started Free | PRODUCT NAME: ACLIDINIUM SALT WITH A PHARMACEUTICALLY ACCEPTABLE ANION OF A MONO OR POLYVALENT ACID ESPECIALLY AS ACLIDINIUM BROMIDE; NAT REGISTRATION NO/DATE: EU/1/12/778/001-003 20120720; FIRST REGISTRATION NO/DATE: EU/1/12/781/001-003 20/07/2012 EUROPEAN UNION EU/1/12/778/001-003 20/07/2012 EUROPEAN UNION EU/1/12/781/001-003 20120720 |

| 1200431 | C01200431/01 | Switzerland | ⤷ Get Started Free | PRODUCT NAME: ACLIDINIUM; REGISTRATION NO/DATE: SWISSMEDIC 62590 25.04.2013 |

| 1200431 | PA2013001,C1200431 | Lithuania | ⤷ Get Started Free | PRODUCT NAME: ACLIDINII BROMIDUM; REGISTRATION NO/DATE: EU/1/12/778/001 - EU/1/12/778/003, 2012 07 20 EU/1/12/781/001 - EU/1/12/781/003 20120720 |

| >Patent Number | >Supplementary Protection Certificate | >SPC Country | >SPC Expiration | >SPC Description |

Market Dynamics and Financial Trajectory for TUDORZA PRESSAIR (Aclidinium Bromide)

More… ↓

Make Better Decisions: Try a trial or see plans & pricing

Drugs may be covered by multiple patents or regulatory protections. All trademarks and applicant names are the property of their respective owners or licensors. Although great care is taken in the proper and correct provision of this service, thinkBiotech LLC does not accept any responsibility for possible consequences of errors or omissions in the provided data. The data presented herein is for information purposes only. There is no warranty that the data contained herein is error free. We do not provide individual investment advice. This service is not registered with any financial regulatory agency. The information we publish is educational only and based on our opinions plus our models. By using DrugPatentWatch you acknowledge that we do not provide personalized recommendations or advice. thinkBiotech performs no independent verification of facts as provided by public sources nor are attempts made to provide legal or investing advice. Any reliance on data provided herein is done solely at the discretion of the user. Users of this service are advised to seek professional advice and independent confirmation before considering acting on any of the provided information. thinkBiotech LLC reserves the right to amend, extend or withdraw any part or all of the offered service without notice.