Last updated: July 28, 2025

Introduction

TRILYTE, a commercially available osmotic laxative primarily prescribed for bowel preparation prior to colonoscopy procedures, has demonstrated consistent demand within its therapeutic niche. Understanding its market dynamics and financial trajectory involves analyzing factors such as clinical efficacy, competitive landscape, regulatory environment, reimbursement policies, and evolving healthcare needs. This comprehensive review aims to elucidate these factors, providing insights for stakeholders interested in TRILYTE’s current positioning and future prospects.

Market Overview and Therapeutic Context

TRILYTE (isotonic polyethylene glycol-electrolyte solution) is part of the broader colonoscopy bowel preparation market, a segment characterized by steady demand driven by colorectal cancer screening programs and increasing awareness of gastrointestinal health. The global market for bowel prep solutions was valued at approximately USD 1.4 billion in 2022, with a compound annual growth rate (CAGR) forecasted around 4% through 2030 [1].

In this ecosystem, TRILYTE competes primarily with other osmotic agents such as Golytely, MoviPrep, and Prepopik. Its appeal lies in efficacy, tolerability, and patient compliance, factors that influence prescribing behaviors and ultimately, market share.

Market Dynamics Influencing TRILYTE

1. Clinical Efficacy and Patient Compliance

TRILYTE's efficacy in bowel cleansing and safety profile directly influence its adoption. The product's isotonic formulation offers advantages over hypertonic solutions, notably reduced electrolyte imbalance risk, which enhances physician confidence and patient adherence. As clinical guidelines increasingly endorse effective bowel prep regimens with lower adverse effects, TRILYTE’s market position benefits.

Patient tolerability factors, such as taste and volume of solution, are critical. Innovations aiming to improve palatability and reduce solution volume may influence market demand. The development of more patient-friendly formulations remains a key area affecting therapy choices.

2. Competition and Market Share Dynamics

The bowel prep market is highly competitive with several established brands. TRILYTE faces price-based competition and differentiation challenges. Major competitors like MoviPrep and Picoprep have significantly captured market share owing to aggressive marketing and clinical endorsements.

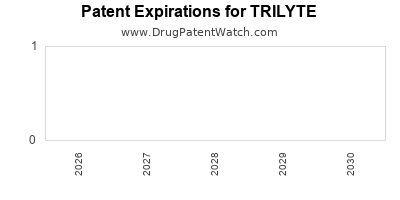

Genericization, especially after patent expirations of flagship products, influences pricing pressure. While TRILYTE remains under patent protection or branding exclusivity, its market share may be insulated; however, if patent cliffs occur, competitive entry could diminish profitability.

3. Regulatory Landscape

Regulatory bodies such as the FDA (U.S.) and EMA (Europe) maintain stringent approval and post-market surveillance requirements. Any new indications, formulations, or safety concerns can impact TRILYTE’s regulatory status, market access, and reimbursement policies.

Expedited approvals or inclusion in clinical guidelines can enhance market penetration. Conversely, safety alerts or adverse event reports may restrict use or increase safety requirements, affecting sales trajectories.

4. Reimbursement and Pricing Policies

Reimbursement policies heavily influence drug accessibility and sales volume. TRILYTE’s reimbursement status varies by geography, with favorable coverage in countries prioritizing colorectal cancer screening programs.

Pricing negotiations with payers affect profit margins. As healthcare systems increasingly emphasize cost-effectiveness, demonstrating superior efficacy or tolerability becomes crucial for securing favorable reimbursement.

5. Healthcare Infrastructure and Procedure Volume

The volume of colonoscopy procedures correlates directly with the demand for bowel preparation solutions. Growing screening initiatives, especially in aging populations, bolster TRILYTE’s market.

Technological advancements such as capsule endoscopy may eventually impact traditional colonoscopy volumes; however, as of now, colonoscopy remains the gold standard, supporting stable demand for prep solutions.

Financial Trajectory and Growth Potential

Revenue Trends

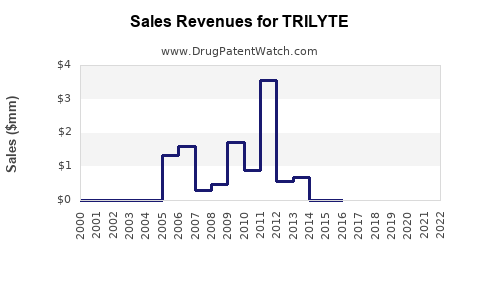

TRILYTE’s revenue trajectory depends on factors such as market penetration, pricing strategies, and healthcare budget allocations. For exemplar companies operating in this segment, revenue growth rates have hovered around 3-5% annually, driven by expanding screening programs and product line extensions [2].

In developed markets, mature sales tend to stabilize, with growth driven by increased screening adherence and potential formulation improvements. Emerging markets present opportunities for expansion, although competitive pricing pressures and varying regulatory hurdles pose challenges.

Profitability Outlook

Profit margins are influenced by R&D investments, manufacturing costs, and reimbursement negotiations. The high fixed costs associated with manufacturing sterile solutions impose limitations on margin improvements unless economies of scale are achieved.

Strategic partnerships, licensing agreements, or product line diversification (such as combining TRILYTE with other diagnostic agents) could amplify revenue streams. Additionally, patent protection may safeguard margins during the early stages of commercialization.

Pipeline and Future Opportunities

Although TRILYTE is currently positioned as a symptomatic therapy, ongoing research into novel bowel prep formulations, including low-volume or taste-masked solutions, can reshape the market landscape. Innovations such as combining osmotic agents with prokinetics or probiotics could offer incremental benefits, increasing TRILYTE’s market relevance.

Furthermore, expanding indications into other gastrointestinal applications or integrating with enhanced endoscopy techniques could diversify revenue opportunities.

Market Challenges and Risks

- Generic Competition: Patent expiry risks eroding market exclusivity, leading to price erosion.

- Safety and Tolerability: Rare adverse events or reformulation failures can impact clinician prescribing.

- Regulatory Hurdles: Delays or restrictions on new indications or formulations can hamper growth.

- Healthcare Policy Changes: Cost containment initiatives may favor cheaper alternatives or reduce procedure volumes.

Strategic Outlook and Recommendations

To sustain growth, stakeholders should prioritize enhancing patient compliance through formulation improvements, strengthening payer negotiations via demonstrable cost-effectiveness, and investing in clinical studies validating efficacy and safety. Digital health integrations, such as remote monitoring of bowel prep adherence, represent emerging avenues for market differentiation.

For pharmaceutical companies owning TRILYTE, establishing strategic alliances with endoscopy centers and healthcare providers can solidify market presence. Meanwhile, investing in lifecycle management through new formulations or extended indications can prolong profitability.

Key Takeaways

- TRILYTE operates within a stable yet highly competitive bowel preparation market, with growth driven by increased colorectal screening initiatives.

- Its success hinges on clinical efficacy, patient tolerability, and regulatory compliance, with innovation and strategic positioning critical for maintaining market share.

- Revenue growth prospects are moderate, with potential for expansion into emerging markets and through formulation upgrades.

- Patent protection offers short-term exclusivity, but generic entry remains a significant competitive threat.

- Healthcare policy shifts towards value-based care necessitate demonstrating cost-effectiveness to sustain reimbursement and profitability.

FAQs

1. What are the primary differentiators of TRILYTE in the bowel prep market?

TRILYTE’s main differentiators include its isotonic formulation reducing electrolyte imbalance risk and its proven efficacy. Enhancements in taste and volume reduction also influence patient compliance, setting it apart from competitors.

2. How does patent expiration impact TRILYTE’s market share?

Patent expirations open the door for generic competitors, exerting pricing pressure and potentially reducing TRILYTE’s market share unless exclusive formulations or new indications are developed.

3. What regulatory considerations influence TRILYTE’s market trajectory?

Regulatory agencies scrutinize safety data and efficacy; approvals or restrictions can significantly impact market access. Post-market safety updates and new indication approvals shape the drug’s commercial future.

4. How does increasing colorectal cancer screening affect TRILYTE sales?

An increase in screening programs raises demand for bowel prep solutions, positively impacting TRILYTE’s sales volumes, especially if reimbursement and clinician acceptance are favorable.

5. What innovations could influence TRILYTE’s future market position?

Innovations include low-volume or flavored formulations, combination therapies, and digital adherence tools, all of which could enhance patient experience and clinical outcomes, thus strengthening market position.

References

[1] Market Data Forecast. (2022). Global Bowel Preparation Market Analysis & Trends.

[2] Research and Markets. (2023). Colonoscopy Preparation Market Insights & Opportunities.