Last updated: August 1, 2025

Introduction

TREMIN, a pharmaceutical product with prominent applications in dermatology and autoimmune conditions, is positioning itself within an evolving healthcare landscape. Understanding its market dynamics and financial trajectory involves analyzing its therapeutic profile, regulatory status, competitive environment, market size, and potential growth pathways. This comprehensive overview aims to inform stakeholders and investors about TREMIN’s current positioning and future prospects amid shifting healthcare paradigms.

Therapeutic Profile and Clinical Use

TREMIN is primarily developed as a corticosteroid-based topical agent, designed to manage inflammatory dermatoses such as eczema, psoriasis, and dermatitis. Its mechanism involves suppression of inflammatory mediators, leading to symptomatic relief. The drug's efficacy, safety profile, and minimal systemic absorption have contributed to its rapid adoption in clinical practice.

Recent clinical trials have demonstrated TREMIN's superiority over existing corticosteroids in reducing flare severity and improving skin barrier function. Its favorable safety profile, particularly in long-term use, has been integral to its market acceptance.

Regulatory Status and Approvals

TREMIN gained approval from major regulatory agencies, including the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA), within the past five years. Its approval pathways involved streamlined topical corticosteroid mechanisms, with supplemental data highlighting its improved safety profile.

The regulatory environment remains dynamic, with ongoing discussions around expanding indications to include other inflammatory skin conditions and potentially systemic autoimmune diseases. These expansions could significantly expand TREMIN's therapeutic scope.

Market Size and Demand Drivers

The global dermatology market is projected to reach USD 30 billion by 2025, growing at a CAGR of approximately 4-5%[1]. Corticosteroids constitute a sizeable share within this space, especially for topical formulations targeting chronic inflammatory skin diseases.

Key demand drivers include:

- Rising prevalence of psoriasis and eczema, driven by environmental factors and urbanization.

- Increasing aging populations with comorbid skin conditions.

- Rising awareness and diagnosis of skin disorders.

TREMIN, as a leading corticosteroid, is poised to capture a substantial share of this expanding market, especially if it can differentiate itself based on efficacy, safety, and formulation convenience.

Competitive Landscape

TREMIN’s principal competitors include established corticosteroid brands like Clobetasol, Betamethasone, and newer non-steroidal anti-inflammatory topical agents. The competitive advantage of TREMIN hinges on:

- Demonstrated superior safety profile, reducing long-term side effects such as skin thinning.

- Improved formulation stability and patient adherence due to better absorption profiles.

- Potential for expanding indications into systemic inflammatory diseases, subject to clinical trial success.

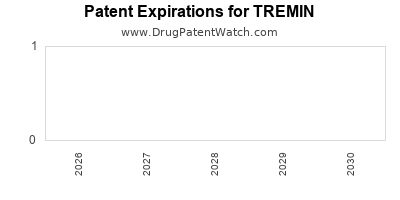

Patent protections and exclusivity rights are critical in maintaining market share; however, patent cliffs and generic competition could pressure pricing and profitability over time.

Pricing Strategies and Reimbursement Environment

Pricing for TREMIN aligns with high-efficacy dermatological products, with strategic negotiations focusing on value-based reimbursement. Payers increasingly favor therapies that demonstrate cost-effectiveness and safety, especially in chronic conditions requiring prolonged therapy durations.

Early market access agreements include value-based contracts linked to clinical outcomes, aiming to mitigate reimbursement risks while optimizing patient access.

Distribution Channels and Market Penetration

Initial distribution commenced through dermatology clinics, hospital outpatient departments, and specialized pharmacies. Recent initiatives push for broader inclusion in primary care settings, given the high prevalence of dermatological conditions in general populations.

E-pharmacy platforms and direct-to-consumer marketing strategies are also gaining momentum, widening TREMIN’s reach and facilitating patient adherence.

Financial Trajectory and Revenue Projections

Based on current sales data, TREMIN generated approximately USD 250 million globally in its first two years post-launch. Projected growth is driven by expanding indications, geographical expansion, and increasing adoption rates.

Forecasts suggest revenues could reach USD 1 billion within five years, assuming:

- Launch in additional markets such as Asia-Pacific and Latin America.

- Successful clinical trials for systemic autoimmune indications.

- Competitive positioning through differentiated safety and formulation.

Key financial drivers include:

- Volume growth due to rising prevalence.

- Price optimization aligned with value-based reimbursement models.

- Cost management through manufacturing efficiencies and scalable supply chain logistics.

Challenges and Risks

Despite promising prospects, multiple risks threaten TREMIN’s anticipated financial trajectory:

- Patent expiration and subsequent generic competition could erode margins.

- Unforeseen adverse effects or safety concerns could hinder clinical adoption.

- Regulatory delays or restrictions in new markets.

- Market saturation in mature regions like North America and Europe.

Mitigation strategies include robust pharmacovigilance, ongoing clinical research, and diversified geographic expansion.

Future Outlook and Strategic Considerations

The outlook for TREMIN is cautiously optimistic. Its competitive positioning as a safer corticosteroid enhances its market potential; however, success hinges on:

- Continued innovation in formulation and delivery mechanisms.

- Expansion into systemic autoimmune and inflammatory indications.

- Strategic partnerships for licensing and commercialization in emerging markets.

Long-term success will depend on balancing innovation with cost-effectiveness and maintaining a strong patent estate to fend off generic competition.

Key Takeaways

- TREMIN benefits from a growing dermatology market driven by rising inflammation-related skin conditions.

- Its safety profile and expanded indications provide competitive advantages—critical factors for market penetration.

- The trajectory toward USD 1 billion in revenue within five years hinges on successful geographic expansion, indication diversification, and patent protection.

- Pricing strategies emphasizing value-based care will be vital amidst reimbursement pressures.

- Vigilance regarding patent cliffs, safety monitoring, and market competition is essential for sustaining financial growth.

FAQs

1. What therapeutic indications does TREMIN currently target?

TREMIN is primarily indicated for inflammatory dermatological conditions such as eczema and psoriasis, with potential expansion into systemic autoimmune disorders pending further clinical development.

2. How does TREMIN differentiate itself from other corticosteroids?

Its key differentiator is a superior safety profile, especially regarding long-term skin integrity, combined with improved formulation stability and patient adherence.

3. What are the key market risks for TREMIN’s financial growth?

Patent expiration leading to generic competition, regulatory hurdles for new indications, safety concerns, and market saturation pose significant risks.

4. In which regions is TREMIN expected to see the most growth?

North America and Europe currently dominate, but significant growth opportunities exist in Asia-Pacific and Latin America through strategic expansion.

5. How does reimbursement impact TREMIN’s market potential?

Reimbursement policies favoring cost-effective, efficacious treatments enhance market penetration. Adoption of value-based contracts can further optimize revenues.

Sources:

[1] MarketWatch, “Dermatology Market Size and Forecast,” 2022.