Last updated: July 28, 2025

Introduction

TOVALT ODT (Tolvaptan Oral Disintegrating Tablet) is a formulation of Tolvaptan, a vasopressin V2 receptor antagonist primarily approved for treating autosomal dominant polycystic kidney disease (ADPKD). While its initial approval targeted specific indications, evolving market dynamics have broadened the scope for this drug within the nephrology and rare disease sectors. This report examines the current market landscape, competitive environment, regulatory factors, and the projected financial trajectory for TOVALT ODT.

Market Overview

Tolvaptan’s Therapeutic Role

Tolvaptan’s primary indication is ADPKD, a genetic disorder characterized by cyst formation in the kidneys leading to renal failure. The drug’s ability to slow cyst growth and preserve renal function has established it as an essential therapy for certain patient populations. Notably, the availability of TOVALT ODT offers benefits over traditional formulations by enhancing patient compliance, especially among populations with swallowing difficulties or pediatric patients.

Market Size and Growth Drivers

The global ADPKD market is projected to reach USD 1.2 billion by 2028, expanding at a compound annual growth rate (CAGR) of approximately 8% [1]. Market drivers include increasing diagnosis rates, heightened awareness, and expanding approval for broader indications. Tovalt ODT's oral disintegrating formulation’s convenience positions it to capture significant market share, especially overcoming barriers associated with traditional tablets.

Key Regional Markets

- United States: As the primary market, the US represents approximately 45% of the global ADPKD market. The approval of Tovalt ODT by the FDA, along with its positioning as a patient-friendly alternative, enhances its competitive stance.

- European Union: The EMA’s approval permits access across EU member states. Growing adoption is anticipated due to increased diagnosis and specialized treatment centers.

- Emerging Markets: Countries such as Japan, China, and India are witnessing rising ADPKD prevalence and expanding healthcare infrastructure, offering potential growth opportunities.

Market Dynamics Influencing Financial Outcomes

Regulatory Environment

The regulatory landscape significantly influences Tovalt ODT's market penetration. The drug’s approval in multiple territories has been facilitated through fast-track designations for ADPKD, accelerating access. However, upcoming regulatory challenges may include post-approval studies and cost-effectiveness assessments, potentially impacting reimbursement pathways.

Competitive Landscape

Tolvaptan faces competition from other vasopressin receptor antagonists and emerging therapies aimed at cyst growth suppression. Notably, research into gene therapies and novel small molecules may alter future competitive dynamics. Nonetheless, TOVALT ODT's convenience and demonstrated efficacy position it favorably.

Pricing and Reimbursement Strategies

Pricing strategies are crucial for widespread adoption. The oral disintegrating tablet (ODT) formulation, often priced higher than traditional tablets due to manufacturing complexities, requires balanced reimbursement models. Payer acceptance hinges on demonstrated clinical benefits, cost savings through delayed dialysis, and improved quality of life.

Patient Accessibility and Compliance

The ODT formulation improves patient compliance, particularly in pediatric and elderly populations. This advantage translates to better disease management and potentially expanded market size, reinforcing revenue streams.

Financial Trajectory Analysis

Short-term Outlook (1-3 years)

In the immediate term, revenue growth is expected to be driven by increased adoption in the US, supported by expanded insurance coverage and physician familiarity. Launching TOVALT ODT across major EU markets could further boost sales. However, pricing pressures and the need for robust post-market evidence may temper rapid growth.

Medium to Long-term Outlook (3-10 years)

Over the next decade, several factors will shape the financial trajectory:

- Market Penetration: TOVALT ODT’s unique formulation could capture a significant portion of newly diagnosed or treatment-switch patients.

- Pipeline Development: Ongoing research into combination therapies and biomarkers for ADPKD may expand the drug’s use cases, elevating revenues.

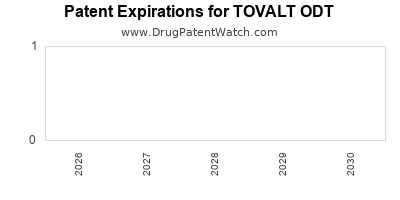

- Biosimilar Threats: The potential entry of biosimilars or generics post-patent expiry could mitigate revenue growth after the patent exclusivity period ends.

- Healthcare Policy Shifts: Cost-containment measures and value-based pricing models may influence profit margins.

Projected Revenue Growth

Based on current market trends and considering expanding indications, TOVALT ODT revenue could reach USD 500 million to USD 700 million globally within five years. Conservative estimates account for market saturation, pricing pressures, and competitive threats.

Investment and R&D Impact

Clinical development costs for expanding indications and formulation enhancements remain significant. However, the potential for licensing agreements and partnerships could offset R&D expenses, sustaining the financial outlook.

Key Market Challenges

- Reimbursement Hurdles: Variability in insurance coverage, especially in emerging markets.

- Cost-effectiveness Demonstrations: Need for robust health economics data to justify premium pricing.

- Regulatory Uncertainties: Potential delays or restrictions in approval extensions.

Opportunities for Growth

- Expanding Indications: Use in other cystic or renal diseases.

- Formulation Innovations: Development of combination therapies.

- Patient Engagement: Digital health tools to improve adherence.

- Strategic Partnerships: Collaborations with healthcare providers and global pharma firms to facilitate market access.

Conclusion

TOVALT ODT’s market dynamics are shaped by evolving medical needs, regulatory pathways, and competitive innovations. Its unique oral disintegrating formulation confers advantages that are poised to facilitate substantial financial growth, particularly within North America and Europe. Sustained success depends on strategic pricing, ongoing clinical evidence, and expansion into new indications and markets.

Key Takeaways

- Market Positioning: TOVALT ODT’s patient-friendly formulation enhances adherence, crucial for chronic diseases like ADPKD.

- Financial Outlook: Revenue projections suggest robust growth, with potential to reach USD 700 million globally within five years.

- Competitive Edge: Formulation advantages and expanding indications bolster market share against emerging competitors.

- Regulatory & Reimbursement Risks: Navigating approval processes and securing reimbursement remain critical to sustained profitability.

- Strategic Focus: Partnerships, pipeline diversification, and real-world evidence generation can maximize financial gains.

FAQs

-

What makes TOVALT ODT different from other Tolvaptan formulations?

TOVALT ODT utilizes an oral disintegrating tablet technology that offers enhanced patient compliance, especially for those with swallowing difficulties, compared to traditional tablets.

-

How does the regulatory landscape affect TOVALT ODT’s market potential?

Regulatory approvals in key regions such as the US and EU facilitate market access, but evolving requirements for post-market studies and cost-effectiveness evaluations could influence long-term adoption.

-

What are the main factors driving growth in the ADPKD market?

Increasing diagnosis rates, heightened disease awareness, expanded indications, and development of patient-centric formulations are primary drivers.

-

What challenges could limit TOVALT ODT’s financial success?

Reimbursement hurdles, pricing pressures, and potential competition from biosimilars or novel therapies may constrain growth.

-

Are there any upcoming innovations that could impact TOVALT ODT’s market?

Yes, ongoing research into combination therapies, gene editing approaches, and digital adherence tools could influence future competitive dynamics.

Sources:

[1] Market Research Future, "Global ADPKD Market Size & Share Analysis," 2021.