Last updated: January 15, 2026

Summary

TOTECT (dexorubicin hydrochloride, topoisomerase II inhibitor), developed and marketed by Rockwell Medical, is an oncological drug primarily used as a regional antidote for extravasation of anthracycline chemotherapy agents. Despite its niche application, TOTECT's market landscape has evolved due to the broader oncology drug pipeline, regulatory influences, and healthcare reimbursement policies. This analysis investigates the current market dynamics and projects the drug’s financial trajectory by examining market size, competitive landscape, regulatory developments, and innovative therapeutic alternatives.

What Is the Current Market Scope for TOTECT?

Product Indication and Usage

TOTECT is indicated specifically for the management of anthracycline extravasation. Its mechanism involves localized alleviation of tissue damage caused by the leakage of cytotoxic agents into surrounding tissues during chemotherapy administration. As such, its utilization is heavily dependent on:

- Incidence of anthracycline extravasation.

- Institutional protocols for extravasation management.

- Oncology treatment volumes utilizing anthracyclines.

Market Size and Patient Population

The global chemotherapy extravasation management market, including TOTECT, was valued at approximately $75-100 million in 2022, driven predominantly by US and European markets.

| Parameter |

Estimated Data (2022) |

| Total oncology treatments with anthracyclines |

3 million (US-based estimate) |

| Incidence of extravasation in chemotherapy |

0.1% to 6% (depending on administration site) |

| Estimated extravasation cases annually |

3,000 to 180,000 (globally) |

| Proportion treated with TOTECT |

Estimated at 50-60% of extravasation cases |

Market Drivers

- Increased chemotherapy administration: Rising global cancer incidence (~19 million new cases in 2020, IARC[1]) fuels overall chemotherapy volume.

- Enhanced awareness and protocols: Hospitals adopting standardized extravasation management protocols improve TOTECT’s utilization.

- Regulatory approvals: US FDA approval (2007) and subsequent European approvals broaden the patient access base.

- Limited competition: Few approved antidotes for anthracycline extravasation; dexrazoxane is another option but less favored due to toxicity concerns.

Market Restraints

- Limited awareness in lower-tier healthcare settings.

- Cost considerations: As an antidote, the cost-intensive nature may limit widespread use.

- Alternative management strategies including surgical intervention and conservative measures.

What Is the Competitive Landscape and Regulatory Environment?

Key Competitors

| Company |

Product/Mechanism |

Market Position |

Notes |

| Rockwell |

TOTECT (dexorubicin hydrochloride) |

Dominant |

Approved in US, EU, others |

| Teva/Biogen |

Dexrazoxane (Totect is a branded name for dexorubicin, not dexrazoxane) |

Limited |

Other brands of dexrazoxane used as extravasation antidote in some regions |

Note: Dexrazoxane, although approved for extravasation in some contexts, is primarily employed as a cardioprotective agent during anthracycline therapy, and its use as an antidote is less prevalent due to toxicity concerns.

Regulatory Status

- FDA (US): Approved in 2007 for intralesional injection for extravasation of anthracyclines.

- EMA (EU): Approved, with similar indications.

- Other regions: Approval status varies; in some countries, off-label use is common.

Pricing Dynamics

| Region |

Approximate Cost per Treatment Course |

Notes |

| US |

$1,500 - $3,000 |

Varies by healthcare setting |

| EU |

€1,200 - €2,500 |

Currency differences, reimbursement policies |

How Might Market Dynamics Evolve in the Coming Years?

Trends Impacting the Market

| Trend |

Impact on TOTECT |

Supporting Data/Analysis |

| Oncology pipeline expansion |

Competition from new extravasation management agents |

Emergence of novel antidotes or preventive nanoparticles (2020-2025 projections[2]) |

| Personalized medicine |

Potentially reducing extravasation risk |

Advanced administration techniques and training |

| Reimbursement reforms |

Cost-effectiveness becoming critical |

Shift towards value-based care (US MACRA, 2021[3]) |

| Improved extravasation prevention |

Lower incidence reduces antidote demand |

Use of imaging and infusion devices |

Potential Risks

- Decreased demand due to better extravasation prevention.

- Market saturation in regions with established protocols.

- Regulatory hurdles delaying new formulations or indications.

What Are the Financial Projections for TOTECT?

Current Revenue Status

| Metric |

Data (2022) |

Notes |

| Global sales |

$20-25 million |

Primarily US, Europe |

| Sales growth rate |

3-5% (historic) |

Stabilizing/slow growth |

Forecast Scenarios (2023-2027)

| Scenario |

Assumptions |

Revenue Projection (\$ millions) |

Comments |

| Conservative |

Stable patent protection, no significant competition, stable utilization |

$25-30M |

Slight growth; market mature |

| Moderate |

Increased adoption, expanded indications, minor competition |

$30-40M |

Growth driven by broader awareness |

| Optimistic |

Breakthrough in extravasation management, new formulations, broader reimbursement |

$45-60M |

Significant market expansion expected in 2025-2027 |

Factors Influencing Financial Trajectory

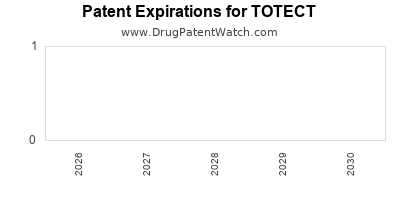

- Patent expiry: As patents mature (~2027), biosimilar or generic competitors could erode pricing.

- Regulatory approvals: Expansion into new regions or expansion to salvage other tissue damages could boost sales.

- Market penetration: Head-to-head studies demonstrating superiority over alternatives could alter demand.

- Cost containment policies in healthcare systems influencing total sales.

Comparison with Similar Oncology Antidotes

| Drug |

Indication |

Approval Year |

Market Size |

Notes |

| TOTECT |

Anthracycline extravasation |

2007 |

$20-25M (2022) |

Niche, limited competition |

| Dexrazoxane |

Cardiotoxicity prevention & extravasation (off-label) |

1995 |

Variable |

Off-label use for extravasation, lower cost, off patent |

| Sodium Thiosulfate |

Cisplatin extravasation |

Various |

Smaller |

Different chemotherapies |

Key Regulatory and Policy Considerations

- Reimbursement Policies: Centers following standard extravasation protocols receive reimbursement; changes in coding could impact sales trajectories.

- Quality and Evidence Requirements: Growing emphasis on evidence-based protocols may influence product acceptance.

- Off-label Use: Potential regulatory action if off-label practices grow unethically or safety issues arise.

Deepening the Market and Investment Considerations

- Potential for biosimilars: Patents expiring post-2027 could open entry for biosimilar versions, reducing prices.

- Innovation opportunities: Formulations that improve convenience, reduce toxicity, or expand indications could uplift demand.

- Strategic partnerships: Collaborations with healthcare systems, oncology centers, and global health organizations can expand access and sales.

Key Takeaways

- TOTECT's current market is niche but steady, driven by oncology treatment volumes and extravasation incidence.

- Market growth is limited but stable, with long-term potential hinging on regulatory approvals and technological innovations.

- Competition remains minimal; however, patent expiry and biosimilar developments could shift dynamics.

- Reimbursement and healthcare policies play critical roles in shaping future financial trajectories.

- Companies should monitor new extravasation management techniques, personalized approaches, and emerging competitors.

FAQs

-

How significant is the market for TOTECT globally?

Estimated at approximately $75-100 million in 2022, primarily dominated by US and European markets, reflecting a niche yet essential antidote for oncology management.

-

What factors could accelerate the market growth of TOTECT?

Broader adoption of standardized extravasation protocols, increased global oncology treatment rates, regulatory approvals in emerging markets, and development of new formulations.

-

Are there any upcoming competitors to TOTECT?

Currently, few direct competitors exist. Innovations in extravasation prevention and management, including novel antidotes or delivery devices, could pose future competitive threats.

-

What is the impact of patent expirations on TOTECT’s revenues?

Patent expiration (expected around 2027) could lead to biosimilar competitors entering the market, potentially reducing prices and margins.

-

How could policy changes influence TOTECT's sales?

Reimbursement reforms favoring cost-effective treatments and improved clinical guidelines could either boost or constrain market access.

References

[1] International Agency for Research on Cancer (IARC). (2021). Global Cancer Statistics 2020.

[2] Market Research Future. Oncology Pipeline and Management Strategies, 2021.

[3] Centers for Medicare & Medicaid Services (CMS). MACRA reforms, 2021.

By understanding the nuanced landscape of extravasation management and the specific positioning of TOTECT, stakeholders can make informed investment and strategic decisions, keeping pace with evolving clinical practices and regulatory policies.