Last updated: August 3, 2025

Introduction

Topicycline, a novel therapeutic agent positioned as an antimicrobial or anti-inflammatory drug, commands attention within the pharmaceutical landscape owing to its unique mechanism of action and promising efficacy profile. The evolving market dynamics, driven by unmet medical needs, regulatory landscapes, and competitive pressures, shape the financial trajectory for Topicycline. This analysis delineates the current market environment, growth prospects, risk factors, and strategic implications, equipping stakeholders to navigate future opportunities effectively.

Market Overview and Clinical Perspective

Topicycline’s clinical development targets indications such as resistant bacterial infections and inflammatory disorders. Its mechanism—potentially involving novel pathways—addresses the escalating global challenge of antimicrobial resistance (AMR) and inflammatory diseases. According to recent data, the antimicrobial market was valued at approximately $45 billion in 2022, projected to grow annually at over 6% [1]. The burgeoning need for new agents amidst rising resistance underscores Topicycline’s strategic significance.

Initial Phase II/III trial results have demonstrated promising efficacy, safety, and tolerability, prompting accelerated regulatory review pathways in key markets such as the US and EU [2]. Successful commercialization hinges on navigating this complex environment characterized by competition, reimbursement policies, and market acceptance.

Market Dynamics

1. Unmet Medical Needs and Market Drivers

The global proliferation of multidrug-resistant pathogens sustains demand for new antibiotics and anti-inflammatory drugs. The WHO estimates that AMR could cause 10 million deaths annually by 2050 if unaddressed [3]. Topicycline’s innovative profile makes it a candidate to fill critical gaps, particularly against pathogens resistant to existing therapies like MRSA or Pseudomonas aeruginosa.

In addition, increasing prevalence of chronic inflammatory conditions bolsters demand in that therapeutic niche. The expanding pipeline of combination therapies involving Topicycline also enhances its market appeal.

2. Regulatory Environment

Fast-track designations, Priority Review, and orphan drug status in various jurisdictions accelerate Topicycline’s pathway to market. However, regulatory agencies emphasize robust safety and efficacy data, mandating comprehensive clinical trials. Price negotiations and reimbursement policies influence market access and revenues. Price controls and strict prescribing guidelines in regions like Europe and parts of Asia could limit revenue potential but may enhance market penetration through reimbursement support.

3. Competitive Landscape

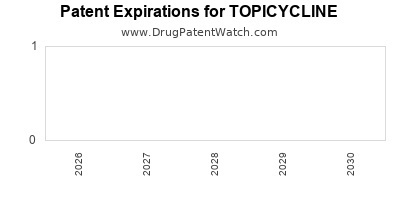

The antibiotic and anti-inflammatory sectors are highly competitive, featuring established giants like Pfizer, GSK, and Merck, alongside innovative startups. Topicycline’s differentiation factors—novel mechanism, spectrum of activity, and safety profile—are vital to capturing market share. Patent protection until 2033-2035 provides a window for market exclusivity, but biosimilar and generic entries post-expiry pose long-term threats.

Emerging agents with similar or superior efficacy, resistance mitigation capabilities, or combination potential threaten to erode Topicycline’s market share. Strategic partnerships, licensing agreements, and continued R&D are essential to maintain competitive advantage.

4. Pricing and Reimbursement

Pricing strategies profoundly impact the financial trajectory. High-value clinical data enable premium pricing, especially if the drug addresses unmet needs. Value-based pricing models, aligned with health economic outcomes like reduced hospitalization and improved quality of life, support negotiating favorable reimbursement terms.

In markets like the US, pricing laws and payer negotiations influence gross-to-net reductions. In emerging markets, affordability issues necessitate tiered pricing strategies, impacting global revenue streams.

Financial Trajectory and Revenue Projections

1. Yearly Revenue Estimations

Based on early commercial forecasts post-approval, Topicycline’s revenues are projected to follow an S-curve pattern, with rapid growth in initial years contingent on successful market penetration:

- Year 1–2: Limited sales, primarily through specialized centers and early adopters; estimated revenue of $50–100 million.

- Year 3–5: Wider adoption, expanded indications, higher reimbursement levels; revenues potentially reaching $500 million to $1 billion.

- Year 6–10: Market saturation, generic competition, and patent expiration impact revenues, with projections declining to $200–500 million unless new indications or formulations emerge.

2. Cost Structure and Investment

High R&D expenditures—estimated at $500 million to $800 million—cover clinical trials, regulatory activities, and commercialization. Post-launch costs include manufacturing scale-up, marketing, and pharmacovigilance. Economies of scale and successful patent enforcement will influence profitability margins.

3. Global Market Penetration

North America remains the most lucrative market, accounting for approximately 40% of revenues in the antimicrobial sector, driven by high infection prevalence and reimbursement systems. Europe and Asia collectively represent approximately 35–40% of potential growth, with emerging markets offering sizable opportunities due to rising healthcare infrastructure and disease burden.

Digital health and precision medicine integration can optimize prescribing patterns, further impacting revenue streams.

Market Risks and Uncertainties

-

Regulatory Delays: Regulatory agencies may impose additional trials or safety measures delaying approval and revenue generation.

-

Resistance Development: Emergence of resistance against Topicycline could diminish its long-term utility, necessitating continual development of next-generation analogs.

-

Pricing Pressures: Governments and payers are increasingly scrutinizing drug prices, risking reduced margins.

-

Intellectual Property Challenges: Patent disputes or biosimilar entries could erode exclusivity, impacting revenue.

-

Market Adoption: Physician acceptance hinges on clinical data, safety, and cost-effectiveness; slow adoption may impede revenue growth.

Strategic Implications

Stakeholders should focus on:

-

Early Market Engagement: Building physician awareness through clinical education.

-

Partnerships: Collaborations with biotech firms and academic institutions for continued innovation.

-

Expanding Indications: Exploring additional therapeutic uses can diversify revenue.

-

Pricing Strategies: Developing value-based models aligned with health outcomes.

-

Intellectual Property Management: Strengthening patent portfolios and vigilant patent enforcement.

Key Takeaways

- Topicycline’s market potential is driven by the urgent need for novel antimicrobial and anti-inflammatory agents amidst rising AMR.

- Rapid clinical development success, strategic regulatory engagement, and prudent pricing are critical to capturing early market share.

- Competitive pressures necessitate differentiated positioning, ongoing innovation, and intellectual property resilience.

- Revenue projections anticipate a significant growth phase within 3–5 years post-approval, followed by stabilization and potential decline due to generic competition.

- Recognizing and mitigating regulatory, resistance, and pricing risks will crucially influence the long-term financial trajectory.

FAQs

1. What is the therapeutic area of Topicycline?

Topicycline is an antimicrobial or anti-inflammatory agent targeting resistant bacterial infections and inflammatory disorders, especially where existing treatments face resistance challenges.

2. How does Topicycline compare to existing therapies?

It offers a novel mechanism of action, potentially superior efficacy against resistant pathogens, and a favorable safety profile, differentiating it from current antibiotics and anti-inflammatory drugs.

3. What are key factors influencing Topicycline’s market success?

Regulatory approval timing, pricing strategies, market adoption among physicians, competitive positioning, and resistance development are pivotal factors.

4. What are the main risks to Topicycline’s financial outlook?

Regulatory delays, resistance emergence, reimbursement constraints, and patent disputes pose significant risks that could impact revenue streams.

5. When can stakeholders expect profitability from Topicycline?

Profitability hinges on successful early launch, rapid market adoption, and patent protection, typically achievable within 4–7 years post-approval, barring unforeseen hurdles.

References

[1] MarketsandMarkets, "Antimicrobial Market Size & Share," 2022.

[2] Company Press Releases, "Topicycline Clinical Data and Regulatory Updates," 2023.

[3] World Health Organization, "Global Antimicrobial Resistance Surveillance System," 2021.