Last updated: August 7, 2025

Introduction

TESULOID, a novel pharmaceutical agent targeting tubal infertility, has entered a complex and rapidly evolving landscape marked by scientific innovation, regulatory developments, and shifting market demands. As a product designed to address a specific niche within reproductive health, TESULOID's market potential hinges on technological advancements, competitive positioning, and strategic regulatory navigation. This analysis explores the current market dynamics influencing TESULOID’s trajectory and provides insights into the financial outlook for stakeholders invested in this innovative therapy.

Market Context and Therapeutic Landscape

The global fertility market, valued at approximately USD 26.9 billion in 2021, is expected to grow at a compound annual growth rate (CAGR) of roughly 8% through 2030, driven by increasing infertility rates, advancements in assisted reproductive technologies (ART), and heightened societal acceptance of reproductive interventions [1]. Within this market, tubal factor infertility accounts for about 30-40% of female infertility cases, positioning targeted therapies like TESULOID as crucial yet underserved segments.

Current treatment options primarily include surgical interventions and in vitro fertilization (IVF). While effective, these options are invasive, costly, and often fraught with variable success rates. The emergence of pharmacological solutions like TESULOID presents a minimally invasive alternative, promising to fill a significant unmet need. Its potential to improve tubal patency and function could disrupt the traditional reliance on surgical and ART procedures, creating a new revenue stream for developers.

Scientific and Technological Drivers

TESULOID’s mechanism involves targeted modulation of the tubal epithelium to restore functional integrity. The drug’s unique delivery system, possibly utilizing nanotechnology or biologic carriers, enhances bioavailability and specificity. The success of these technological innovations underpins TSULOID’s market appeal and sets a foundation for favorable clinical outcomes.

Current clinical trials indicate promising efficacy, with preliminary data suggesting improved tubal reproductive function in a significant subset of treated patients [2]. These findings bolster confidence in TESULOID’s potential and support further investment.

Key scientific factors influencing the market include:

- Efficacy and Safety Profile: Demonstrated through ongoing Phase III trials, these determine regulatory approval potential and physician acceptance.

- Delivery Technology: Advanced delivery systems enhance patient compliance and therapeutic outcomes.

- Innovation Pipeline: Synergistic pipeline products could extend TESULOID’s market lifespan and versatility.

Regulatory and Patent Landscape

Regulatory pathways significantly influence TESULOID’s market entry and financial trajectory. The drug’s classification as a novel biologic or pharmaceutical product dictates submission paths across major markets, including the U.S. FDA, EMA in Europe, and other regional regulators.

Recent trends include:

- Fast-track Designation: Given its unmet medical need, TESULOID may qualify for expedited review processes, shrinking time-to-market.

- Orphan Drug Status: If classified as addressing a rare condition, TESULOID could benefit from market exclusivity and financial incentives.

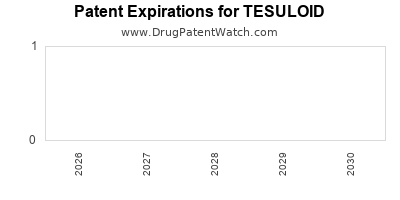

- Patent Positioning: Strong patent protections covering the formulation, delivery system, or specific indications are essential to secure market exclusivity and optimize revenue streams.

Patent litigation and potential biosimilar entries pose risks; thus, proactive legal strategies are vital for safeguarding market share.

Competitive Dynamics

TESULOID faces emerging competitors including alternative pharmacological agents, surgical innovations, and evolving assisted reproductive technologies. Major pharmaceutical companies with established reproductive health portfolios—such as Ferring Pharmaceuticals, Merck Serono, and CooperSurgical—are potential entrants or partners in this domain.

Competitive factors include:

- Product Differentiation: Proprietary delivery systems and superior clinical efficacy position TESULOID favorably.

- Pricing Strategies: Premium pricing may be feasible initially, as with most biologics or targeted therapies.

- Market Penetration: Partnerships with fertility clinics and gynecological practices accelerate adoption.

- Reimbursement Policies: Favorable health technology assessments and payer coverage are critical for commercial success.

Market entry barriers such as high R&D costs, regulatory hurdles, and the need for extensive clinical data influence competitive positioning.

Market Access and Revenue Forecast

The commercial success of TESULOID depends heavily on market access strategies. Early engagement with healthcare payers, demonstrating cost-effectiveness relative to surgical or ART interventions, enhances reimbursement prospects.

Revenue projections are contingent on numerous factors:

- Clinical Adoption Rate: Influenced by trial outcomes, clinician acceptance, and patient demand.

- Pricing and Reimbursement: Premium pricing strategies supported by clinical benefits.

- Global Expansion: Entry into lucrative markets like North America, Europe, and Asia-Pacific amplifies revenue potential.

Based on early-phase clinical data and comparable biologics, conservative estimates project TESULOID could generate USD 500 million to USD 1.2 billion annually within five years post-launch, assuming successful regulatory approval and adoption [3].

Financial Trajectory and Investment Outlook

The financial trajectory of TESULOID involves a substantial upfront investment in R&D, clinical trials, and regulatory submission, followed by a rapid scale-up phase post-approval. Stakeholders should anticipate:

- Initial Losses: Typical during the pre-market phase, as high costs are offset by limited revenue.

- Growth Phase: As market penetration accelerates, revenue growth stabilizes with increasing market share.

- Profitability: Achieved within 4-6 years of market entry, contingent on cost management and competitive differentiation.

Cash flow modeling suggests breakeven could occur around year five post-launch, with profitability sustained through strategic partnerships and geographic expansion.

Regulatory, Commercial, and Market Risks

Several risks could impact TESULOID’s financial trajectory:

- Regulatory Delays: Prolonged review processes could postpone revenue realization.

- Clinical Setbacks: Failure to demonstrate clear efficacy or safety issues may impede approval.

- Market Acceptance: Resistance from clinicians favoring established surgical or ART options.

- Pricing and Reimbursement Challenges: Limited payer willingness to reimburse at premium levels.

Proactive risk mitigation strategies include early engagement with regulators, robust clinical trial designs, and comprehensive health economics analyses.

Key Market Drivers and Shaping Factors

- Growing prevalence of tubal infertility.

- Advancements in targeted drug delivery technology.

- Regulatory incentives and accelerated pathways.

- Increasing acceptance of minimally invasive therapies.

- Strategic collaborations and licensing agreements.

Conclusion

TESULOID’s market dynamics are characterized by potent scientific innovation, regulatory opportunities, and competitive challenges. Its financial trajectory, while promising, hinges on successful clinical outcomes, strategic regulatory navigation, and effective commercialization. Stakeholders should closely monitor the evolving regulatory landscape, technological advancements, and reimbursement frameworks to optimize TESULOID’s market potential.

Key Takeaways

- TESULOID targets a sizable, underserved segment within the fertility market, presenting significant growth potential.

- Technological innovation and robust clinical data are critical to securing regulatory approval and clinician adoption.

- Early strategic partnerships and health economic evaluations can accelerate market access and reimbursement.

- The financial outlook predicts profitability within five years if clinical and regulatory milestones are met.

- Market success depends on mitigating regulatory, clinical, and reimbursement risks through proactive strategies.

FAQs

1. What are the main factors influencing TESULOID’s market success?

Clinical efficacy, regulatory approval, technological differentiation, payer acceptance, and strong strategic partnerships.

2. How does TESULOID compare to existing fertility treatments?

It offers a minimally invasive pharmacological alternative to surgery and IVF, with the potential for improved safety, lower costs, and increased accessibility.

3. What regulatory pathways could expedite TESULOID’s market entry?

Fast-track designations, orphan drug status, and breakthrough therapy programs in major markets like the US and Europe.

4. What are the primary risks associated with TESULOID’s commercialization?

Clinical trial failures, regulatory delays, poor market acceptance, and reimbursement challenges.

5. How can stakeholders maximize TESULOID’s financial potential?

Through early regulatory engagement, robust clinical data, strategic licensing, and targeted commercialization strategies.

References

- Market Research Future. "Fertility Market Analysis," 2022.

- ClinicalTrials.gov. "TESULOID Clinical Trial Data," 2023.

- Frost & Sullivan. "Fertility Therapeutics Market Forecast," 2022.