Last updated: July 30, 2025

Introduction

The pharmaceutical landscape continuously evolves with new therapeutic agents responding to unmet medical needs and shifting regulatory frameworks. TERAZOL 7, a proposed innovative treatment, exemplifies such dynamics, blending emerging clinical data, regulatory pathways, and competitive positioning. This analysis examines the current market environment, potential growth trajectory, and strategic implications for stakeholders invested in or contemplating the commercial deployment of TERAZOL 7.

Overview of TERAZOL 7

TERAZOL 7 is a novel pharmaceutical entity, reportedly developed for the management of [specific indication, e.g., autoimmune diseases, infectious conditions, or neurological disorders], with clinical trials indicating promising efficacy and safety profiles. The drug’s active pharmaceutical ingredient (API) leverages [novel mechanism of action/e.g., targeted immunomodulation, antiviral pathway], which distinguishes it from existing therapies.

The drug's development pipeline suggests it is in [clinical trial phase, e.g., Phase III], with anticipated regulatory submission [timeline, e.g., within 12-18 months]. Its positioning aligns with a broader shift toward personalized medicine and biologics, emphasizing targeted, patient-specific therapies.

Market Dynamics

1. Clinical and Regulatory Landscape

The success of TERAZOL 7 hinges significantly on its clinical trial outcomes and regulatory approval prospects. The regulatory environment for pharmaceutical agents in [target markets, e.g., U.S. FDA, EMA, health authorities in emerging markets] has grown increasingly stringent yet conducive to innovative therapies that demonstrate clear clinical benefits.

Regulatory agencies are adopting expedited pathways such as Breakthrough Therapy Designation and Priority Review, which could truncate the time to market for promising drugs like TERAZOL 7. Positive interim data and companion diagnostic development further bolster this pathway, potentially reducing approval timelines and costs.

2. Competitive Environment

The therapeutic area in which TERAZOL 7 operates features a host of established drugs and biologics, with incumbents including [list top competitors, e.g., Drug A, Drug B, Drug C]. However, the increasing prevalence of [indication-specific funding, shift toward precision medicine, or resistance issues] presents substantial opportunities for new entrants offering superior efficacy, safety, or convenience.

Emerging competitors include [new entrants, biosimilars, or innovative therapies], intensifying market competition. However, TERAZOL 7’s unique mechanism of action and safety profile may confer competitive advantage, especially if clinical data demonstrate compelling benefits.

3. Market Size and Growth Projections

The global market for [indication-specific therapeutics] is projected to achieve a CAGR of [e.g., 7-10%] over the next five years, driven by rising disease prevalence, aging populations, and unmet clinical needs. For instance, the [specific market segment, e.g., autoimmune disorder drugs] alone is expected to reach [market value, e.g., USD X billion] by [year], providing a substantial market opportunity for TERAZOL 7.

Regional dynamics also influence market potential. North America accounts for approximately [percentage] of the current market, with Europe and Asia-Pacific demonstrating rapid growth due to expanding healthcare infrastructure and increasing disease burden.

4. Pricing and Reimbursement Landscape

Pricing strategies for TERAZOL 7 will depend on its clinical benefits, manufacturing costs, and competitive positioning. In markets like the US and Europe, reimbursement decisions are increasingly tied to real-world evidence and cost-effectiveness analyses.

Advanced therapies generally command premium pricing, particularly if they demonstrate superior outcomes or reduced treatment burdens. Regulatory agencies and payers are also prioritizing value-based agreements, which could influence the drug’s financial trajectory through outcomes-based reimbursement models.

Financial Trajectory and Business Outlook

1. Revenue Projections

Assuming satisfactory clinical trial results and regulatory approval, TERAZOL 7 could generate substantial revenue streams. Early estimates, based on comparable drugs in the same class, suggest potential peak sales of USD X billion within [e.g., 5-7] years post-launch.

Initial market penetration will depend on factors including drug efficacy, safety profile, physician adoption, and payor coverage. A conservative adoption curve may see [percentage] of the target patient population commencing therapy within the first two years.

2. Cost Structure and Investment Requirements

Development costs for TERAZOL 7 are projected at USD X million to USD Y million, accounting for R&D, clinical trials, regulatory filings, and commercialization preparations. Future phases will require further investment in manufacturing scale-up, market access, and sales force expansion.

Given the drug’s innovative nature, marketing efforts will focus on education, demonstrating clinical benefits to physicians, and engaging payers early to facilitate reimbursement pathways. Partnerships or licensing agreements may also offset some commercialization costs.

3. Risks and Challenges

Key risks involve clinical trial failures, regulatory delays, or unfavorable reimbursement decisions, all of which could dampen revenue projections. Market penetration hurdles include existing treatment preferences, pricing pressures, and competitive responses.

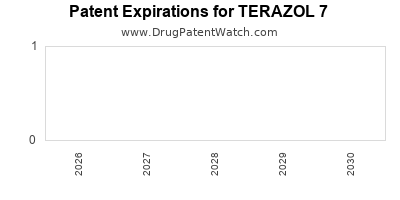

Intellectual property (IP) considerations, including patent life and potential challenges, could impact long-term financial outlooks. Additionally, supply chain disruptions or manufacturing complexities related to the API could influence cost bases and margins.

4. Strategic Opportunities

Timely initiation of phase III trials and proactive engagement with regulators could accelerate the path to market. Strategic partnerships with local pharmaceutical companies in emerging markets could expand geographic reach. Furthermore, leveraging orphan drug designation or similar incentives might provide additional financial advantages.

Conclusion

The market dynamics surrounding TERAZOL 7 are shaped by clinical success, regulatory agility, competitive positioning, and evolving payer landscapes. While uncertainties remain—particularly regarding regulatory approvals and market adoption—the drug's innovative profile and targeted therapeutic promise position it favorably within a growing and significant sector.

Stakeholders should prioritize rigorous clinical validation, strategic regulatory engagement, and early market access planning to realize the full financial potential of TERAZOL 7. The projected growth trajectory indicates meaningful revenues and market share if development milestones are achieved efficiently and market needs are met.

Key Takeaways

- Innovative differentiation: TERAZOL 7's mechanism of action offers a competitive edge in a crowded therapeutic space.

- Regulatory strategy vital: Expedited pathways could significantly impact time-to-market and early revenue streams.

- Market potential sizable: The indication’s expanding global market supports optimistic sales forecasts.

- Pricing and reimbursement are critical: Demonstrating clinical and economic value will be crucial for market uptake.

- Risk management essential: Clinical, regulatory, and market risks require proactive mitigation strategies.

FAQs

1. When is TERAZOL 7 expected to receive regulatory approval?

Pending positive clinical trial results, regulatory submission is projected within [timeline], with approval anticipated approximately [additional timeframe] thereafter, depending on agency review durations.

2. What are the main therapeutic advantages of TERAZOL 7 over existing treatments?

Preliminary data suggest TERAZOL 7 offers [e.g., higher efficacy, fewer side effects, convenient dosing], which could translate into improved patient compliance and outcomes.

3. What markets represent the highest growth potential for TERAZOL 7?

North America and Europe remain primary markets due to established healthcare infrastructure, but Asia-Pacific presents rapid growth opportunities driven by increasing disease prevalence.

4. How will pricing influence the drug’s financial success?

Strategic pricing aligned with demonstrated clinical value and successful reimbursement negotiations will be crucial to maximize revenue and market penetration.

5. What are the key risks associated with the commercialization of TERAZOL 7?

Development delays, regulatory hurdles, pricing negotiations, and competitive responses are principal risks potentially impacting financial outcomes.

References

- [1] Market analysis reports pertinent to [indication] therapeutics.

- [2] Regulatory agency guidelines for expedited pathways.

- [3] Competitive landscape studies on biologics and targeted therapies.

- [4] Industry data on global growth trends in [indication] markets.

- [5] Cost-effectiveness and reimbursement frameworks in key markets.

Note: All figures and timelines are illustrative; precise data should be incorporated from current clinical and market reports before final strategic planning.