TEPMETKO Drug Patent Profile

✉ Email this page to a colleague

Which patents cover Tepmetko, and what generic alternatives are available?

Tepmetko is a drug marketed by Emd Serono Inc and is included in one NDA. There are eight patents protecting this drug.

This drug has seventy-nine patent family members in thirty-six countries.

The generic ingredient in TEPMETKO is tepotinib hydrochloride. One supplier is listed for this compound. Additional details are available on the tepotinib hydrochloride profile page.

DrugPatentWatch® Generic Entry Outlook for Tepmetko

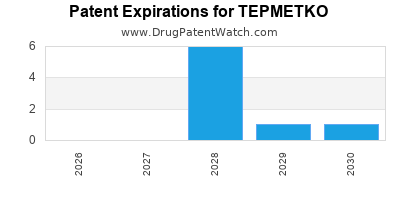

Tepmetko was eligible for patent challenges on February 3, 2025.

By analyzing the patents and regulatory protections it appears that the earliest date

for generic entry will be March 19, 2030. This may change due to patent challenges or generic licensing.

There has been one patent litigation case involving the patents protecting this drug, indicating strong interest in generic launch. Recent data indicate that 63% of patent challenges are decided in favor of the generic patent challenger and that 54% of successful patent challengers promptly launch generic drugs.

Indicators of Generic Entry

AI Deep Research

Questions you can ask:

- What is the 5 year forecast for TEPMETKO?

- What are the global sales for TEPMETKO?

- What is Average Wholesale Price for TEPMETKO?

Summary for TEPMETKO

| International Patents: | 79 |

| US Patents: | 8 |

| Applicants: | 1 |

| NDAs: | 1 |

| Finished Product Suppliers / Packagers: | 1 |

| Raw Ingredient (Bulk) Api Vendors: | 8 |

| Patent Applications: | 147 |

| Drug Prices: | Drug price information for TEPMETKO |

| Patent Litigation and PTAB cases: | See patent lawsuits and PTAB cases for TEPMETKO |

| What excipients (inactive ingredients) are in TEPMETKO? | TEPMETKO excipients list |

| DailyMed Link: | TEPMETKO at DailyMed |

DrugPatentWatch® Estimated Loss of Exclusivity (LOE) Date for TEPMETKO

Generic Entry Date for TEPMETKO*:

Constraining patent/regulatory exclusivity:

NDA:

Dosage:

TABLET;ORAL |

*The generic entry opportunity date is the latter of the last compound-claiming patent and the last regulatory exclusivity protection. Many factors can influence early or later generic entry. This date is provided as a rough estimate of generic entry potential and should not be used as an independent source.

Pharmacology for TEPMETKO

| Drug Class | Kinase Inhibitor |

| Mechanism of Action | Mesenchymal Epithelial Transition Inhibitors P-Glycoprotein Inhibitors |

US Patents and Regulatory Information for TEPMETKO

TEPMETKO is protected by eight US patents and two FDA Regulatory Exclusivities.

Based on analysis by DrugPatentWatch, the earliest date for a generic version of TEPMETKO is ⤷ Get Started Free.

This potential generic entry date is based on patent ⤷ Get Started Free.

Generics may enter earlier, or later, based on new patent filings, patent extensions, patent invalidation, early generic licensing, generic entry preferences, and other factors.

| Applicant | Tradename | Generic Name | Dosage | NDA | Approval Date | TE | Type | RLD | RS | Patent No. | Patent Expiration | Product | Substance | Delist Req. | Exclusivity Expiration |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Emd Serono Inc | TEPMETKO | tepotinib hydrochloride | TABLET;ORAL | 214096-001 | Feb 3, 2021 | RX | Yes | Yes | ⤷ Get Started Free | ⤷ Get Started Free | ⤷ Get Started Free | ||||

| Emd Serono Inc | TEPMETKO | tepotinib hydrochloride | TABLET;ORAL | 214096-001 | Feb 3, 2021 | RX | Yes | Yes | ⤷ Get Started Free | ⤷ Get Started Free | Y | ⤷ Get Started Free | |||

| Emd Serono Inc | TEPMETKO | tepotinib hydrochloride | TABLET;ORAL | 214096-001 | Feb 3, 2021 | RX | Yes | Yes | ⤷ Get Started Free | ⤷ Get Started Free | Y | Y | ⤷ Get Started Free | ||

| Emd Serono Inc | TEPMETKO | tepotinib hydrochloride | TABLET;ORAL | 214096-001 | Feb 3, 2021 | RX | Yes | Yes | ⤷ Get Started Free | ⤷ Get Started Free | Y | ⤷ Get Started Free | |||

| >Applicant | >Tradename | >Generic Name | >Dosage | >NDA | >Approval Date | >TE | >Type | >RLD | >RS | >Patent No. | >Patent Expiration | >Product | >Substance | >Delist Req. | >Exclusivity Expiration |

International Patents for TEPMETKO

When does loss-of-exclusivity occur for TEPMETKO?

Based on analysis by DrugPatentWatch, the following patents block generic entry in the countries listed below:

Argentina

Patent: 6543

Patent: DERIVADOS DE PIRIDAZINONA

Estimated Expiration: ⤷ Get Started Free

Patent: 7505

Patent: DERIVADOS DE PIRIMIDINIL-PIRIDAZINONA

Estimated Expiration: ⤷ Get Started Free

Australia

Patent: 08274534

Patent: Pyrimidinyl pyridazinone derivates

Estimated Expiration: ⤷ Get Started Free

Patent: 08274670

Patent: Pyridazinone derivates

Estimated Expiration: ⤷ Get Started Free

Brazil

Patent: 0813707

Patent: DERIVADOS DE PIRIMIDINIL-PIRIDAZINONA

Estimated Expiration: ⤷ Get Started Free

Patent: 0814616

Patent: DERIVADOS DE PIRIDAZINONA

Estimated Expiration: ⤷ Get Started Free

Canada

Patent: 92867

Patent: DÉRIVÉS DE PYRIDAZINONE (Pyrimidinyl-pyridazinone derivatives.)

Estimated Expiration: ⤷ Get Started Free

Patent: 93600

Patent: DERIVES DE PYRIDAZINONE (PYRIDAZINONE DERIVATES)

Estimated Expiration: ⤷ Get Started Free

Chile

Patent: 08001392

Patent: Compuestos derivados de piridazinona, con actividad moduladora de quinasas; procedimiento de preparacion de dichos compuestos; composicion farmaceutica que comprende a dichos compuestos; kit farmaceutico; y uso para tratar un tumor solido.

Estimated Expiration: ⤷ Get Started Free

China

Patent: 1687857

Patent: Pyridazinone derivates

Estimated Expiration: ⤷ Get Started Free

Patent: 1743241

Patent: Pyridazinone derivates

Estimated Expiration: ⤷ Get Started Free

Colombia

Patent: 70360

Patent: DERIVADOS DE PIRIMIDINIL - PIRIDAZINONA

Estimated Expiration: ⤷ Get Started Free

Patent: 70257

Patent: DERIVADOS DE PIRIDAZINONA

Estimated Expiration: ⤷ Get Started Free

Croatia

Patent: 0120661

Estimated Expiration: ⤷ Get Started Free

Patent: 0150031

Estimated Expiration: ⤷ Get Started Free

Patent: 0170100

Estimated Expiration: ⤷ Get Started Free

Cyprus

Patent: 13137

Estimated Expiration: ⤷ Get Started Free

Patent: 15925

Estimated Expiration: ⤷ Get Started Free

Patent: 18498

Estimated Expiration: ⤷ Get Started Free

Patent: 22017

Estimated Expiration: ⤷ Get Started Free

Denmark

Patent: 64843

Estimated Expiration: ⤷ Get Started Free

Patent: 64844

Estimated Expiration: ⤷ Get Started Free

Patent: 54660

Estimated Expiration: ⤷ Get Started Free

Ecuador

Patent: 109953

Patent: DERIVADOS DE PIRIDAZINONA

Estimated Expiration: ⤷ Get Started Free

Patent: 109957

Patent: DERIVADOS DE PIRIMIDINIL-PIRIDAZINONA.

Estimated Expiration: ⤷ Get Started Free

Eurasian Patent Organization

Patent: 6782

Patent: ПРОИЗВОДНЫЕ ПИРИДАЗИНОНА (PYRIDAZINONE DERIVATES)

Estimated Expiration: ⤷ Get Started Free

Patent: 7281

Patent: ПРОИЗВОДНЫЕ ПИРИМИДИНИЛПИРИДАЗИНОНА (PYRIMIDINYL PYRIDAZINONE DERIVATES)

Estimated Expiration: ⤷ Get Started Free

Patent: 1000093

Patent: ПРОИЗВОДНЫЕ ПИРИДАЗИНОНА

Estimated Expiration: ⤷ Get Started Free

Patent: 1000094

Patent: ПРОИЗВОДНЫЕ ПИРИМИДИНИЛ-ПИРИДАЗИНОНА

Estimated Expiration: ⤷ Get Started Free

European Patent Office

Patent: 64843

Patent: DÉRIVÉS DE PYRIDAZINONE (PYRIDAZINONE DERIVATES)

Estimated Expiration: ⤷ Get Started Free

Patent: 64844

Patent: DÉRIVÉS DE PYRIMIDINYLPYRIDAZINONE (PYRIMIDINYL PYRIDAZINONE DERIVATES)

Estimated Expiration: ⤷ Get Started Free

Patent: 54660

Patent: Dérivés de pyridazinone (Pyridazinone derivatives)

Estimated Expiration: ⤷ Get Started Free

France

Patent: C1024

Estimated Expiration: ⤷ Get Started Free

Germany

Patent: 2007032507

Patent: Pyridazinonderivate

Estimated Expiration: ⤷ Get Started Free

Hong Kong

Patent: 42891

Patent: PYRIMIDINYL PYRIDAZINONE DERIVATES

Estimated Expiration: ⤷ Get Started Free

Patent: 45265

Patent: PYRIDAZINONE DERIVATES

Estimated Expiration: ⤷ Get Started Free

Hungary

Patent: 30519

Estimated Expiration: ⤷ Get Started Free

Patent: 200024

Estimated Expiration: ⤷ Get Started Free

Israel

Patent: 3091

Patent: נגזרות פירידאזינון (Pyridazinone derivatives)

Estimated Expiration: ⤷ Get Started Free

Patent: 3094

Patent: נגזרות פירימידיניל-פירידאזינון (Pyrimidinyl-pyridazinone derivatives)

Estimated Expiration: ⤷ Get Started Free

Japan

Patent: 26543

Estimated Expiration: ⤷ Get Started Free

Patent: 26544

Estimated Expiration: ⤷ Get Started Free

Patent: 10532768

Estimated Expiration: ⤷ Get Started Free

Patent: 10532774

Estimated Expiration: ⤷ Get Started Free

Lithuania

Patent: 2022009

Estimated Expiration: ⤷ Get Started Free

Patent: 54660

Estimated Expiration: ⤷ Get Started Free

Luxembourg

Patent: 0264

Estimated Expiration: ⤷ Get Started Free

Malaysia

Patent: 3727

Patent: PYRIDAZINONE DERIVATIVES

Estimated Expiration: ⤷ Get Started Free

Patent: 3477

Patent: PYRIMIDINYL-PYRIDAZINONE DERIVATIVES

Estimated Expiration: ⤷ Get Started Free

Netherlands

Patent: 1176

Estimated Expiration: ⤷ Get Started Free

New Zealand

Patent: 3186

Patent: PYRIMIDINYL-PYRIDAZINONE DERIVATIVES

Estimated Expiration: ⤷ Get Started Free

Patent: 3187

Patent: PYRIDAZINONE DERIVATIVES

Estimated Expiration: ⤷ Get Started Free

Norway

Patent: 22015

Estimated Expiration: ⤷ Get Started Free

Peru

Patent: 090287

Patent: DERIVADOS DE PIRIDAZINONA

Estimated Expiration: ⤷ Get Started Free

Poland

Patent: 64843

Estimated Expiration: ⤷ Get Started Free

Patent: 64844

Estimated Expiration: ⤷ Get Started Free

Patent: 54660

Estimated Expiration: ⤷ Get Started Free

Portugal

Patent: 64843

Estimated Expiration: ⤷ Get Started Free

Patent: 64844

Estimated Expiration: ⤷ Get Started Free

Patent: 54660

Estimated Expiration: ⤷ Get Started Free

Singapore

Patent: 3739

Patent: PYRIDAZINONE DERIVATES

Estimated Expiration: ⤷ Get Started Free

Slovenia

Patent: 64843

Estimated Expiration: ⤷ Get Started Free

Patent: 64844

Estimated Expiration: ⤷ Get Started Free

Patent: 54660

Estimated Expiration: ⤷ Get Started Free

South Africa

Patent: 1001023

Patent: PYRIMIDINYL PYRIDAZINONE DERIVATES

Estimated Expiration: ⤷ Get Started Free

South Korea

Patent: 1544624

Estimated Expiration: ⤷ Get Started Free

Patent: 1553418

Estimated Expiration: ⤷ Get Started Free

Patent: 100031771

Patent: PYRIMIDINYL PYRIDAZINONE DERIVATIVES

Estimated Expiration: ⤷ Get Started Free

Patent: 100050504

Patent: PYRIDAZINONE DERIVATES

Estimated Expiration: ⤷ Get Started Free

Spain

Patent: 88883

Estimated Expiration: ⤷ Get Started Free

Patent: 26352

Estimated Expiration: ⤷ Get Started Free

Patent: 14283

Estimated Expiration: ⤷ Get Started Free

Taiwan

Patent: 01768

Estimated Expiration: ⤷ Get Started Free

Patent: 0906409

Patent: Pyridazinone derivatives

Estimated Expiration: ⤷ Get Started Free

Ukraine

Patent: 621

Patent: ПОХІДНІ ПІРИДАЗИНОНУ[ПРОИЗВОДНЫЕ ПИРИДАЗИНОНА (PYRIDAZINONE DERIVATES)

Estimated Expiration: ⤷ Get Started Free

Patent: 833

Patent: ПОХІДНІ ПІРИМІДИНІЛ-ПІРИДАЗИНОНУ[ПРОИЗВОДНЫЕ ПИРИМИДИНИЛ-ПИРИДАЗИНОНА (PYRIMIDINYL PYRIDAZINONE DERIVATES)

Estimated Expiration: ⤷ Get Started Free

Generics may enter earlier, or later, based on new patent filings, patent extensions, patent invalidation, early generic licensing, generic entry preferences, and other factors.

See the table below for additional patents covering TEPMETKO around the world.

| Country | Patent Number | Title | Estimated Expiration |

|---|---|---|---|

| Norway | 2022015 | ⤷ Get Started Free | |

| European Patent Office | 2754660 | Dérivés de pyridazinone (Pyridazinone derivatives) | ⤷ Get Started Free |

| Eurasian Patent Organization | 017281 | ПРОИЗВОДНЫЕ ПИРИМИДИНИЛПИРИДАЗИНОНА (PYRIMIDINYL PYRIDAZINONE DERIVATES) | ⤷ Get Started Free |

| Taiwan | 200906409 | Pyridazinone derivatives | ⤷ Get Started Free |

| >Country | >Patent Number | >Title | >Estimated Expiration |

Supplementary Protection Certificates for TEPMETKO

| Patent Number | Supplementary Protection Certificate | SPC Country | SPC Expiration | SPC Description |

|---|---|---|---|---|

| 2164843 | C02164843/01 | Switzerland | ⤷ Get Started Free | PRODUCT NAME: TEPOTINIB; REGISTRATION NO/DATE: SWISSMEDIC-ZULASSUNG 68113 22.06.2021 |

| 2164843 | 122022000047 | Germany | ⤷ Get Started Free | PRODUCT NAME: TEPOTINIB SOWIE DIE PHARMAZEUTISCH VERWENDBAREN SOLVATE, SALZE UND TAUTOMERE DAVON, EINSCHL. DEREN MISCHUNGEN IN ALLEN VERHAELTNISSEN; REGISTRATION NO/DATE: EU/1/21/1596 20220216 |

| 2164843 | 2022C/519 | Belgium | ⤷ Get Started Free | PRODUCT NAME: TEPOTINIB EN FARMACEUTISCH AANVAARDARBE SOLVATEN, ZOUTEN, TAUTOMEREN EN STEREOISOMEREN DAARVAN; AUTHORISATION NUMBER AND DATE: EU/1/21/1596 20220217 |

| 2164843 | PA2022009,C2164843 | Lithuania | ⤷ Get Started Free | PRODUCT NAME: TEPOTINIBAS IR FARMACINIU POZIURIU TINKAMI NAUDOTI JO SOLVATAI, DRUSKOS, TAUTOMERAI IR STEREOIZOMERAI ; REGISTRATION NO/DATE: EU/1/21/1596 20220216 |

| >Patent Number | >Supplementary Protection Certificate | >SPC Country | >SPC Expiration | >SPC Description |

Market Dynamics and Financial Trajectory for TEPMETKO

More… ↓

Make Better Decisions: Try a trial or see plans & pricing

Drugs may be covered by multiple patents or regulatory protections. All trademarks and applicant names are the property of their respective owners or licensors. Although great care is taken in the proper and correct provision of this service, thinkBiotech LLC does not accept any responsibility for possible consequences of errors or omissions in the provided data. The data presented herein is for information purposes only. There is no warranty that the data contained herein is error free. We do not provide individual investment advice. This service is not registered with any financial regulatory agency. The information we publish is educational only and based on our opinions plus our models. By using DrugPatentWatch you acknowledge that we do not provide personalized recommendations or advice. thinkBiotech performs no independent verification of facts as provided by public sources nor are attempts made to provide legal or investing advice. Any reliance on data provided herein is done solely at the discretion of the user. Users of this service are advised to seek professional advice and independent confirmation before considering acting on any of the provided information. thinkBiotech LLC reserves the right to amend, extend or withdraw any part or all of the offered service without notice.