Last updated: August 13, 2025

Introduction

Tenofovir alafenamide (TAF) is a potent prodrug of tenofovir, a nucleotide reverse transcriptase inhibitor used primarily in the treatment and prevention of HIV and hepatitis B virus (HBV) infections. Since its FDA approval in 2015 under Gilead Sciences’ portfolio, TAF has gained prominence as a superior alternative to tenofovir disoproxil fumarate (TDF), with enhanced safety profiles, improved pharmacokinetics, and increased market adoption. This analysis explores the market landscape, competitive dynamics, and financial prospects shaping TAF’s trajectory in the pharmaceutical industry.

Market Overview

Therapeutic Indications and Clinical Use

TAF is integrated into multiple antiretroviral regimens for HIV-1, often in combination with other agents such as emtricitabine. Additionally, TAF has demonstrated efficacy in suppressing HBV. Its improved safety profile, particularly reduced renal and bone toxicity, has led to widespread preference among clinicians, supplanting older formulations containing TDF.

Market Size and Growth Drivers

The global HIV treatment market exceeded USD 29 billion in 2021, with annual growth rates around 3–4% (source: IQVIA). The increasing prevalence of HIV, particularly in sub-Saharan Africa, and the shift toward novel drug formulations underpin future growth. The HBV treatment segment, valued at approximately USD 2 billion, is also expanding due to rising diagnosis and treatment rates.

Key drivers fueling TAF’s market penetration include:

- Superior Safety Profile: Reduced renal and bone adverse effects encourage long-term adherence.

- Regulatory Adoption: Rapid uptake of TAF-based products globally due to favorable clinical data and approvals.

- Pipeline Expansion: Introduction of new fixed-dose combinations (FDCs) incorporating TAF widens therapeutic options.

Competitive Landscape

While Gilead pioneered TAF with its Truvada and Descovy brands, several competitors are entering or expanding their portfolios with TAF-based drugs. GlaxoSmithKline’s (GSK) implementation of TAF in its HIV regimens signifies significant competition. Additionally, emerging biosimilars and generics, particularly in low- and middle-income countries, threaten to diminish pricing power.

Market Dynamics

Regulatory and Patent Environment

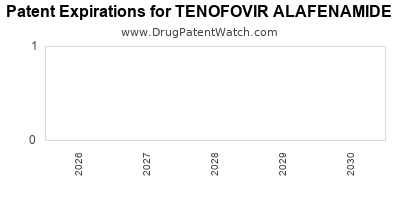

Gilead’s patents for TAF-containing formulations expire in key markets over the next 5–7 years, opening avenues for biosimonilar and generic entrants. Regulatory authorities, such as the EMA and FDA, continue to approve new combination therapies, reinforcing TAF’s dominance.

Pricing and Reimbursement Trends

Pricing strategies are critical; TAF-based regimens command premium pricing, partly justified by improved safety outcomes. However, pricing pressures from governments and payers, especially as generics emerge, are impacting margins.

Adoption Patterns and Geographic Distribution

Developed markets such as North America and Western Europe exhibit high adoption rates due to advanced healthcare infrastructure. In contrast, emerging markets display slower uptake owing to affordability and patent challenges but offer substantial growth potential once patent protections lapse.

Innovation and Pipeline Development

R&D efforts focus on novel delivery systems, such as long-acting injectables, and combination therapies to enhance adherence and treatment efficacy. Gilead’s recent investments aim to extend TAF formulations into unserved or underserved populations.

Financial Trajectory

Revenue Analysis and Projections

Gilead’s revenues for TAF-containing products, notably Descovy, reached over USD 6 billion in 2021, representing a significant portion of its HIV portfolio. Given the expected patent expiries and emerging biosimilar competition, growth in revenue may plateau or decline from 2023 onwards.

However, pipeline products and expanded indications could provide offsetting growth. According to global market forecasts, the TAF market could sustain compound annual growth rates of 2–3% through 2025, driven by new formulations and increasing global demand.

Profitability and Cost Considerations

TAF’s manufacturing costs are relatively optimized due to global supply chains and Gilead’s established R&D infrastructure. Price erosion from generic competition can pressure profit margins, yet high barriers to entry and brand loyalty mitigate immediate impact.

Outlook and Long-Term Trends

Long-term prospects hinge on patent strategies, regulatory approvals for new indications, and success in penetrating emerging markets. Revenues may stabilize or decline post-patent expiry unless Gilead innovates with long-acting injectables or expanded indications. Strategic licensing and collaboration could foster sustained growth.

Conclusion

The TAF market is characterized by robust initial growth, driven by clinical advantages and expanding treatment guidelines. However, impending patent cliffs and competitive pressures necessitate strategic innovation and geographic expansion to sustain financial performance. Companies investing in pipeline expansion, especially in long-acting formulations, are poised to capitalize on emerging trends in HIV and HBV management.

Key Takeaways

- Market Leadership: Gilead currently dominates the TAF market with established brand approvals and extensive clinical data.

- Growth Opportunities: Expanding into emerging markets and developing long-acting formulations present significant revenue prospects.

- Competitive Challenges: Patent expiries and biosimilar entrants threaten pricing power; diversification and innovation are essential.

- Regulatory Landscape: Rapid approvals and expanded indications will shape future market trajectories.

- Strategic Outlook: Sustained profitability depends on pipeline success, patent management, and leveraging geographic expansion.

FAQs

1. What makes TAF a preferred choice over TDF in HIV treatment?

TAF offers enhanced safety due to reduced renal and bone toxicity, allowing for lower dosing and improved patient adherence, making it preferable for long-term therapy.

2. When will Gilead’s patents for TAF formulations expire, and what are the implications?

Patents for key TAF formulations are set to expire in North America and Europe between 2023 and 2025, which could lead to increased generic competition and downward pressure on prices.

3. Are there ongoing developments to extend TAF’s market beyond HIV and HBV?

Yes. Research is ongoing into long-acting injectable formulations, potential prophylactic uses, and expanded indications for other viral infections.

4. How is the emerging competition affecting TAF’s market share?

Competitors like GSK are launching their own TAF-inclusive regimens, and generic manufacturers could enter post-patent expiries, challenging Gilead’s dominance.

5. What strategic moves can pharmaceutical companies adopt to maximize TAF’s revenue potential?

Companies should invest in pipeline innovation, expand into untapped markets, forge partnerships for combination therapies, and develop long-acting formulations to maintain competitive advantage.

Sources:

[1] IQVIA, Global HIV Market Data, 2021

[2] Gilead Sciences Annual Reports, 2021

[3] European Medicines Agency (EMA), Drug Approvals

[4] U.S. Food and Drug Administration (FDA), Regulatory Filings

[5] MarketWatch, HIV Treatment Market Analysis, 2022