TEKAMLO Drug Patent Profile

✉ Email this page to a colleague

Which patents cover Tekamlo, and what generic alternatives are available?

Tekamlo is a drug marketed by Novartis and is included in one NDA. There is one patent protecting this drug.

This drug has twenty-three patent family members in twenty-one countries.

The generic ingredient in TEKAMLO is aliskiren hemifumarate; amlodipine besylate. There are four drug master file entries for this compound. Additional details are available on the aliskiren hemifumarate; amlodipine besylate profile page.

DrugPatentWatch® Generic Entry Outlook for Tekamlo

Tekamlo was eligible for patent challenges on March 5, 2011.

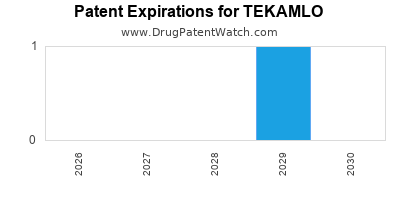

By analyzing the patents and regulatory protections it appears that the earliest date

for generic entry will be December 21, 2029. This may change due to patent challenges or generic licensing.

Indicators of Generic Entry

AI Deep Research

Questions you can ask:

- What is the 5 year forecast for TEKAMLO?

- What are the global sales for TEKAMLO?

- What is Average Wholesale Price for TEKAMLO?

Summary for TEKAMLO

| International Patents: | 23 |

| US Patents: | 1 |

| Applicants: | 1 |

| NDAs: | 1 |

| Raw Ingredient (Bulk) Api Vendors: | 2 |

| Patent Applications: | 31 |

| DailyMed Link: | TEKAMLO at DailyMed |

DrugPatentWatch® Estimated Loss of Exclusivity (LOE) Date for TEKAMLO

Generic Entry Date for TEKAMLO*:

Constraining patent/regulatory exclusivity:

NDA:

Dosage:

TABLET;ORAL |

*The generic entry opportunity date is the latter of the last compound-claiming patent and the last regulatory exclusivity protection. Many factors can influence early or later generic entry. This date is provided as a rough estimate of generic entry potential and should not be used as an independent source.

US Patents and Regulatory Information for TEKAMLO

TEKAMLO is protected by one US patents.

Based on analysis by DrugPatentWatch, the earliest date for a generic version of TEKAMLO is ⤷ Get Started Free.

This potential generic entry date is based on patent ⤷ Get Started Free.

Generics may enter earlier, or later, based on new patent filings, patent extensions, patent invalidation, early generic licensing, generic entry preferences, and other factors.

| Applicant | Tradename | Generic Name | Dosage | NDA | Approval Date | TE | Type | RLD | RS | Patent No. | Patent Expiration | Product | Substance | Delist Req. | Exclusivity Expiration |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Novartis | TEKAMLO | aliskiren hemifumarate; amlodipine besylate | TABLET;ORAL | 022545-001 | Aug 26, 2010 | DISCN | No | No | ⤷ Get Started Free | ⤷ Get Started Free | Y | ⤷ Get Started Free | |||

| Novartis | TEKAMLO | aliskiren hemifumarate; amlodipine besylate | TABLET;ORAL | 022545-004 | Aug 26, 2010 | DISCN | No | No | ⤷ Get Started Free | ⤷ Get Started Free | Y | ⤷ Get Started Free | |||

| Novartis | TEKAMLO | aliskiren hemifumarate; amlodipine besylate | TABLET;ORAL | 022545-002 | Aug 26, 2010 | DISCN | No | No | ⤷ Get Started Free | ⤷ Get Started Free | Y | ⤷ Get Started Free | |||

| Novartis | TEKAMLO | aliskiren hemifumarate; amlodipine besylate | TABLET;ORAL | 022545-003 | Aug 26, 2010 | DISCN | No | No | ⤷ Get Started Free | ⤷ Get Started Free | Y | ⤷ Get Started Free | |||

| >Applicant | >Tradename | >Generic Name | >Dosage | >NDA | >Approval Date | >TE | >Type | >RLD | >RS | >Patent No. | >Patent Expiration | >Product | >Substance | >Delist Req. | >Exclusivity Expiration |

Expired US Patents for TEKAMLO

| Applicant | Tradename | Generic Name | Dosage | NDA | Approval Date | Patent No. | Patent Expiration |

|---|---|---|---|---|---|---|---|

| Novartis | TEKAMLO | aliskiren hemifumarate; amlodipine besylate | TABLET;ORAL | 022545-001 | Aug 26, 2010 | ⤷ Get Started Free | ⤷ Get Started Free |

| Novartis | TEKAMLO | aliskiren hemifumarate; amlodipine besylate | TABLET;ORAL | 022545-004 | Aug 26, 2010 | ⤷ Get Started Free | ⤷ Get Started Free |

| Novartis | TEKAMLO | aliskiren hemifumarate; amlodipine besylate | TABLET;ORAL | 022545-003 | Aug 26, 2010 | ⤷ Get Started Free | ⤷ Get Started Free |

| Novartis | TEKAMLO | aliskiren hemifumarate; amlodipine besylate | TABLET;ORAL | 022545-002 | Aug 26, 2010 | ⤷ Get Started Free | ⤷ Get Started Free |

| >Applicant | >Tradename | >Generic Name | >Dosage | >NDA | >Approval Date | >Patent No. | >Patent Expiration |

International Patents for TEKAMLO

When does loss-of-exclusivity occur for TEKAMLO?

Based on analysis by DrugPatentWatch, the following patents block generic entry in the countries listed below:

Argentina

Patent: 3384

Estimated Expiration: ⤷ Get Started Free

Australia

Patent: 09292908

Estimated Expiration: ⤷ Get Started Free

Brazil

Patent: 0919350

Patent: combinação de dose fixa oral farmacêutica na forma de uma comprimido monocamada, bem como seu uso e seu método de preparação

Estimated Expiration: ⤷ Get Started Free

Canada

Patent: 36257

Patent: FORMULATIONS GALENIQUES DE COMPOSES ORGANIQUES (GALENICAL FORMULATIONS OF ORGANIC COMPOUNDS)

Estimated Expiration: ⤷ Get Started Free

Chile

Patent: 11000594

Patent: Combinacion farmaceutica que comprende: a) 10-45% de alisquireno, b) 0,5-5% de amlodipina, c) 2-15% de un desintegrante, d) 1-60% de un diluyente, e) 0,1-20% de un aglutinante, f) 0,1-5% de un lubricante, g) 0,05-5% de un derrapante y h) opcionalmente un relleno; metodo de preparacion; uso para tratar hipertension.

Estimated Expiration: ⤷ Get Started Free

China

Patent: 2159195

Patent: Dual-layer or monolayer form fixed dose combination of aliskiren and amlodipine

Estimated Expiration: ⤷ Get Started Free

Colombia

Patent: 51711

Patent: COMBINACION DE DOSIS FIJA EN LA FORMA DE UNA TABLETA DE DOS COPAS O DE UNA SOLA CAPA DE ALISQUIRENO Y AMLODIPINA

Estimated Expiration: ⤷ Get Started Free

Ecuador

Patent: 11010999

Patent: COMBINACIÓN DE DOSIS FIJA EN LA FORMA DE UNA TABLETA DE DOS CAPAS O DE UNA SOLA CAPA DE ALISQUIRENO Y AMLODIPINA

Estimated Expiration: ⤷ Get Started Free

European Patent Office

Patent: 28564

Patent: FORMULATIONS GALÉNIQUES DE COMPOSÉS ORGANIQUES (FIXED DOSE COMBINATION IN FORM OF A BILAYERED OR MONOLAYERED TABLET OF ALISKIREN AND AMLODIPINE)

Estimated Expiration: ⤷ Get Started Free

Japan

Patent: 12503020

Estimated Expiration: ⤷ Get Started Free

Patent: 15091830

Patent: 有機化合物のガレヌス製剤 (GALENICAL FORMULATIONS OF ORGANIC COMPOUNDS)

Estimated Expiration: ⤷ Get Started Free

Jordan

Patent: 39

Patent: تركيبات جالينية من مركبات عضوية (Galenical Formulations of Organic Compounds)

Estimated Expiration: ⤷ Get Started Free

Malaysia

Patent: 3610

Patent: FIXED DOSE COMBINATION IN FORM OF A BILAYERED OR MONOLAYERED TABLET OF ALISKIREN AND AMLODIPINE

Estimated Expiration: ⤷ Get Started Free

Mexico

Patent: 11002988

Patent: COMBINACION DE DOSIS FIJA EN LA FORMA DE UNA TABLETA DE DOS CAPAS O DE UNA SOLA CAPA DE ALISQUIRENO Y AMLODIPINA. (FIXED DOSE COMBINATION IN FORM OF A BILAYERED OR MONOLAYERED TABLET OF ALISKIREN AND AMLODIPINE.)

Estimated Expiration: ⤷ Get Started Free

Morocco

Patent: 719

Patent: تركيبات خاصة بصناعة الأدوية من مركبات عضوية

Estimated Expiration: ⤷ Get Started Free

Peru

Patent: 110293

Patent: COMBINACION DE DOSIS FIJA EN LA FORMA DE UNA TABLETA DE UNA SOLA CAPA QUE COMPRENDE ALISQUIRENO Y AMLODIPINA

Estimated Expiration: ⤷ Get Started Free

Russian Federation

Patent: 11115712

Patent: КОМБИНАЦИИ С ФИКСИРОВАННОЙ ДОЗОЙ АЛИСКИРЕНА И АМЛОДИПИНА В ФОРМЕ ДВУХСЛОЙНЫХ ИЛИ ОДНОСЛОЙНЫХ ТАБЛЕТОК

Estimated Expiration: ⤷ Get Started Free

Patent: 14140552

Patent: КОМБИНАЦИИ С ФИКСИРОВАННОЙ ДОЗОЙ АЛИСКИРЕНА И АМЛОДИПИНА В ФОРМЕ ДВУХСЛОЙНЫХ ИЛИ ОДНОСЛОЙНЫХ ТАБЛЕТОК

Estimated Expiration: ⤷ Get Started Free

South Africa

Patent: 1101644

Patent: FIXED DOSE COMBINATION IN FORM OF A BILAYERED OR MONOLAYERED TABLET OF ALISKIREN AND AMLODIPINE

Estimated Expiration: ⤷ Get Started Free

South Korea

Patent: 110060942

Patent: FIXED DOSE COMBINATION IN FORM OF BILAYERED OR MONOLAYERED TABLET OF ALISKIREN AND AMLODIPINE

Estimated Expiration: ⤷ Get Started Free

Taiwan

Patent: 1016217

Patent: Galenical formulations of organic compounds

Estimated Expiration: ⤷ Get Started Free

Tunisia

Patent: 11000100

Patent: GALENICAL FORMULATIONS OF ORGANIC COMPOUNDS

Estimated Expiration: ⤷ Get Started Free

Generics may enter earlier, or later, based on new patent filings, patent extensions, patent invalidation, early generic licensing, generic entry preferences, and other factors.

See the table below for additional patents covering TEKAMLO around the world.

| Country | Patent Number | Title | Estimated Expiration |

|---|---|---|---|

| Norway | 310410 | ⤷ Get Started Free | |

| Norway | 2009011 | ⤷ Get Started Free | |

| China | 1266118 | ⤷ Get Started Free | |

| Netherlands | 300386 | ⤷ Get Started Free | |

| Cyprus | 2208 | Delta-amino-gamma-hydroxy-omega-aryl alkanoic acidamides with enzyme especially renin inhibiting ac tivities | ⤷ Get Started Free |

| New Zealand | 270938 | ALPHA-AMINOALKANOIC ACIDS AND DERIVATIVES THEREOF AS REAGENTS | ⤷ Get Started Free |

| >Country | >Patent Number | >Title | >Estimated Expiration |

Supplementary Protection Certificates for TEKAMLO

| Patent Number | Supplementary Protection Certificate | SPC Country | SPC Expiration | SPC Description |

|---|---|---|---|---|

| 0678503 | 91373 | Luxembourg | ⤷ Get Started Free | 91373, EXPIRES: 20200407 |

| 0678503 | SPC041/2007 | Ireland | ⤷ Get Started Free | SPC041/2007: 20080416, EXPIRES: 20200406 |

| 0678503 | C300386 | Netherlands | ⤷ Get Started Free | PRODUCT NAME: COMBINATIE OMVATTENDE ALISKIREN, ALS VRIJE BASE OF EEN FARMACEUTISCH AANVAARDBAAR ZOUT DAARVAN, EN HYDROCHLOORTHIAZIDE OF EEN FARMACEUTISCH AANVAARDBAAR ZOUT ERVAN; NATL. REGISTRATION NO/DATE: EU/1/08/491/001-080 20090116; FIRST REGISTRATION: CH 58935 01-04 20081028 |

| 1915993 | 1390055-0 | Sweden | ⤷ Get Started Free | PRODUCT NAME: KOMBINATION INNEFATTANDE ALISKIREN, ELLER ETT FARMACEUTISKT ACCEPTABELT SALT DAERAV, OCH AMLODIPIN, ELLER ETT FARMACEUTISKT ACCEPTABELT SALT DAERAV.; REG. NO/DATE: EU/1/11/686/001 20110414 |

| 0678503 | C300296 | Netherlands | ⤷ Get Started Free | PRODUCT NAME: ALISKIREN OF EEN; REGISTRATION NO/DATE: EU/1/07/405/001-020 20070822 |

| 2305232 | 122019000098 | Germany | ⤷ Get Started Free | PRODUCT NAME: ALISKIREN HEMIFUMARAT UND HYDROCHLOROTHIAZID; REGISTRATION NO/DATE: EU/1/08/491/001-080 20090116 |

| >Patent Number | >Supplementary Protection Certificate | >SPC Country | >SPC Expiration | >SPC Description |

Market Dynamics and Financial Trajectory of TEKAMLO

More… ↓

Make Better Decisions: Try a trial or see plans & pricing

Drugs may be covered by multiple patents or regulatory protections. All trademarks and applicant names are the property of their respective owners or licensors. Although great care is taken in the proper and correct provision of this service, thinkBiotech LLC does not accept any responsibility for possible consequences of errors or omissions in the provided data. The data presented herein is for information purposes only. There is no warranty that the data contained herein is error free. We do not provide individual investment advice. This service is not registered with any financial regulatory agency. The information we publish is educational only and based on our opinions plus our models. By using DrugPatentWatch you acknowledge that we do not provide personalized recommendations or advice. thinkBiotech performs no independent verification of facts as provided by public sources nor are attempts made to provide legal or investing advice. Any reliance on data provided herein is done solely at the discretion of the user. Users of this service are advised to seek professional advice and independent confirmation before considering acting on any of the provided information. thinkBiotech LLC reserves the right to amend, extend or withdraw any part or all of the offered service without notice.