Last updated: August 18, 2025

Introduction

Sulfair Forte, a pharmaceutical compound primarily used for its antibacterial and antimicrobial properties, has garnered attention within the healthcare industry, especially amid the ongoing wave of infectious disease management. This article delves into the market landscape, key drivers, competitive positioning, regulatory environment, and financial projections associated with Sulfair Forte, offering business professionals a comprehensive understanding of its commercial potential.

Product Overview and Pharmacological Profile

Sulfair Forte is a formulation that typically combines sulfadiazine and other sulfonamide derivatives, functioning primarily as an antimicrobial agent. It's prescribed predominantly for bacterial infections, including urinary tract infections, respiratory infections, and certain dermatological conditions. Its effectiveness hinges on its ability to inhibit folic acid synthesis in bacteria, leading to bacteriostatic activity.

The pharmacological profile positions Sulfair Forte within the broader antibiotic class of sulfonamides—agents historically pivotal in infectious disease treatment. However, the rise of antibiotic resistance and the advent of novel medications pose ongoing challenges to its market viability.

Market Dynamics

Global Market Overview

The global antimicrobial agents market is projected to reach approximately USD 60 billion by 2027, with a compound annual growth rate (CAGR) of around 3.8%, driven by increasing infectious disease prevalence, rising healthcare awareness, and expanding healthcare infrastructure in emerging markets[^1]. Within this landscape, sulfonamides like Sulfair Forte comprise a significant segment, especially in regions with limited access to newer antibiotics.

Regional Market Influences

-

North America and Europe: These regions have witnessed a decline in sulfonamide utilization due to escalating antibiotic resistance, stricter regulatory controls, and a shift towards broad-spectrum antibiotics[^2]. Nonetheless, they remain key markets for specialized or off-patent formulations like Sulfair Forte, especially in niche segments.

-

Asia-Pacific: This region presents substantial growth opportunities, driven by increasing infectious disease burden, expanding healthcare access, and a reliance on cost-effective antibiotics[^3]. Countries such as India, China, and Indonesia are pivotal owing to their large population bases and ongoing antimicrobial stewardship improvements.

-

Latin America and Africa: Market expansion is further propelled here by limited pharmaceutical innovation, higher disease prevalence, and growing healthcare investments, though regulatory hurdles and infrastructure deficits pose challenges.

Market Drivers

- Infectious Disease Prevalence: Persistent and emerging infections sustain demand for antibiotics, including traditional agents like Sulfair Forte.

- Cost-Effectiveness: Sulfar Forte's affordability compared to newer antibiotics maintains its relevance in price-sensitive markets.

- Regulatory Approvals and Patent Expiries: The expiration of patents on sulfonamide drugs facilitates generic manufacturing, expanding accessibility.

Market Challenges

- Antibiotic Resistance: The global surge in resistance diminishes the clinical efficacy and market lifespan of traditional sulfonamides, necessitating formulation innovations and combination therapies.

- Regulatory Restrictions: Increased scrutiny on antibiotic use and stricter approval pathways can hamper market growth.

- Competition from Advanced Therapies: Development of newer antimicrobial agents, including biologics and targeted therapies, encroaches on Sulfair Forte’s market share.

Competitive Landscape

Key players dominate the pipeline for Sulfair Forte and similar formulations, including generic pharmaceutical companies such as:

- Mylan (now part of Viatris): Supplies a broad portfolio of sulfonamide-based antibiotics.

- Sun Pharmaceutical Industries Ltd.: Offers cost-effective formulations with established distribution networks.

- Cipla Limited: Focused on affordable antimicrobials tailored for emerging markets.

Market entry barriers are moderate, primarily due to regulatory complexities and established manufacturing standards. Differentiation hinges on formulation quality, supply chain robustness, and regional compliance.

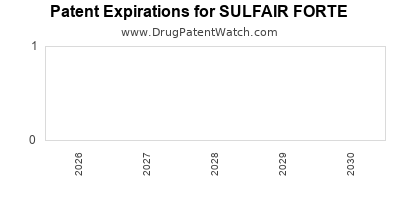

Regulatory Environment and Patent Landscape

The regulatory framework significantly influences Sulfair Forte’s market trajectory. Both the U.S. FDA and EMA have stringent criteria for antimicrobial approval, emphasizing safety, efficacy, and antimicrobial stewardship. Additionally, patent expirations across various sulfa drugs since the early 2010s have facilitated generic proliferation, reducing costs but intensifying competition.

Emerging markets often have less rigid regulatory pathways, potentially enabling faster market entry but raising concerns about product quality. The evolving landscape emphasizes the need for regulatory adherence and post-market surveillance.

Financial Trajectory and Market Forecast

Historic Performance

While specific revenue data for Sulfair Forte remains proprietary, the broader sulfonamide segment experienced a peak in the early 2000s, followed by a gradual decline owing to resistance and newer antibiotics. Generic versions contributed substantially to revenue streams, with low production costs resulting in high margins in cost-sensitive markets.

Projected Growth and Revenue Potential

Forecasts suggest that, contingent upon regional acceptance and regulatory clearance, Sulfair Forte could see a compound annual growth rate (CAGR) of approximately 2-4% over the next five years in emerging markets, driven by:

- Continued infectious disease prevalence.

- Increased utilization due to affordability.

- Expanding healthcare infrastructure.

In regions like North America and Europe, growth may be limited or even declining unless the formulation evolves or finds niche applications.

Innovation and Market Expansion Strategies

Reinvigorating Sulfair Forte's financial outlook necessitates:

- Formulation advancements to tackle resistance (e.g., combination therapies).

- Strategic licensing and partnerships for entering new markets.

- Post-patent product development to extend lifecycle.

- Targeted marketing emphasizing cost benefits and clinical utility in resource-limited settings.

Concluding Perspective

Sulfair Forte remains a relevant antimicrobial agent, especially within price-sensitive and developing regions. Its market is characterized by moderate growth prospects, contingent upon resistance dynamics, regulatory trends, and formulation innovations. For stakeholders, navigating the competitive landscape requires strategic emphasis on quality, compliance, and regional adaptation.

Key Takeaways

- Sulfair Forte’s core strength lies in its affordability and established efficacy against bacterial infections.

- Market growth is primarily driven by emerging markets with infrastructure expansion and high infectious disease burden.

- Resistance development poses a critical threat, necessitating formulation innovation and stewardship.

- Patent expiries have increased generic competition, reducing prices but expanding access.

- Strategic investments in R&D and regional marketing are vital to sustain profitability.

FAQs

1. What are the primary indications for Sulfair Forte?

Sulfair Forte is chiefly prescribed for bacterial infections such as urinary tract infections, respiratory infections, and dermatological conditions due to its antibacterial properties.

2. How does antibiotic resistance impact Sulfair Forte’s market?

Rising resistance to sulfonamides reduces their clinical effectiveness, leading to decreased demand and necessitating formulation modifications or combination therapies to maintain utility.

3. Are there significant regulatory hurdles for Sulfair Forte approval?

While regulatory requirements vary regionally, strict standards in developed markets can pose challenges, whereas emerging markets may have more streamlined pathways but with quality oversight concerns.

4. What is the outlook for Sulfair Forte’s revenue in the next five years?

Projected moderate growth (2-4% CAGR) in emerging markets, driven by increasing infectious disease prevalence and demand for affordable antibiotics.

5. How can pharmaceutical companies extend Sulfair Forte’s market life?

Through formulation innovations, targeting niche indications, strategic licensing, navigating regulatory approvals efficiently, and expanding into underserved markets.

Sources

[^1]: MarketsandMarkets, “Antimicrobial Agents Market,” 2021.

[^2]: European Centre for Disease Prevention and Control, “Antibiotic Resistance,” 2022.

[^3]: World Health Organization, “Global Antimicrobial Resistance Surveillance System,” 2021.