Last updated: July 28, 2025

Introduction

Sufentanil citrate, a potent synthetic opioid analgesic primarily employed in anesthesia and pain management, has garnered significant attention within the pharmaceutical landscape. This analgesic agent, derived from fentanyl, exhibits high potency, making it suitable for inpatient settings and surgical procedures. Understanding its market dynamics and financial trajectory involves analyzing therapeutic demand, manufacturing trends, regulatory factors, and competitive positioning. This report offers a comprehensive assessment tailored for stakeholders, including investors, healthcare strategists, and pharmaceutical companies.

Pharmaceutical Profile and Therapeutic Context

Sufentanil citrate, chemically distinct due to its higher potency—estimated to be approximately five to ten times more potent than fentanyl—serves primarily in anesthesia induction and maintenance, as well as in intensive care units for analgesia [1]. Its rapid onset and short duration of action are advantageous in controlled surgical environments. However, the drug's high potency also raises concerns regarding potential misuse and regulatory scrutiny.

Market Drivers

Rising Surgical Volumes and Pain Management Needs

The global increase in surgical procedures, driven by aging populations and expanding healthcare infrastructure, directly amplifies demand for potent opioids like sufentanil citrate. The growing prevalence of chronic pain conditions further sustains consumption, especially in regions with specialized anesthesia practices [2].

Preference for Short-Acting Anesthetics

Medical practitioners favor short-acting agents to optimize patient recovery times. Sufentanil's pharmacokinetic profile aligns with these clinical needs, encouraging high adoption rates in operating rooms and ICU settings.

Regulatory and Manufacturing Trends

While stringent regulations on opioids aim to curb misuse, they simultaneously promote innovation in secure drug handling, safer formulations, and compliance-based manufacturing. Advances in synthesis and formulation techniques bolster supply chain stability, supporting consistent market growth.

Technological Advancements and New Delivery Systems

Innovative delivery methods, such as transdermal patches and controlled-release formulations, are under investigation, promising expanded therapeutic applications and potentially opening new revenue streams.

Market Restraints and Challenges

Regulatory and Legal Barriers

Globally, classification under controlled substance schedules imposes severe restrictions on manufacturing, distribution, and prescribing practices. The U.S. Drug Enforcement Administration (DEA) categorizes sufentanil as a Schedule II controlled substance. Such designations complicate market expansion and heighten compliance costs [3].

Risk of Misuse and Abuse

The opioid epidemic underscores the risks associated with potent opioids. Intense scrutiny on prescribing practices and increased monitoring undermine market growth prospects, especially in regions with high misuse prevalence.

Manufacturing and Supply Chain Constraints

Manufacturing complex molecules like sufentanil citrate necessitates specialized facilities and rigorous quality controls. Supply chain disruptions, especially amid geopolitical tensions and pandemic-related challenges, could impact availability and pricing.

Competition from Alternative Anesthetics

Emerging anesthetic agents and multimodal pain management strategies pose competitive threats. Non-opioid analgesics and regional anesthesia techniques are increasingly substituting opioid-centric protocols, restricting market expansion.

Competitive Landscape

Major pharmaceutical players involved in sufentanil citrate production include AbbVie, Euticals SA, and various generic manufacturers. Brand and generic versions coexist in key markets, influencing pricing and market share dynamics [4].

The entry barriers remain substantial, given the need for specialized infrastructure, regulatory compliance, and reputation management amid opioid-sensitive environments. Nonetheless, strategic collaborations and licensing agreements facilitate geographic expansion.

Regional Market Perspectives

North America

Dominating the market due to high surgical volumes and established medical infrastructure, North America also faces the highest regulatory barriers. The opioid crisis has led to heightened scrutiny, yet demand persists in hospital settings where regulation is more permissive.

Europe

Regulatory frameworks are stringent but generally allow for controlled usage. Europe's aging population and surgical trends support steady demand, bolstered by healthcare modernization initiatives.

Asia-Pacific

This region anticipates rapid growth driven by expanding healthcare access, increasing surgery rates, and emerging pharmaceutical manufacturing capabilities. However, regulatory fragmentation may delay some market opportunities.

Latin America and Middle East & Africa

Emerging markets display slower adoption but present significant long-term growth potential, especially with infrastructural development and increasing healthcare spending.

Financial Trajectory and Market Forecast

Market Size and Growth Rate

The global opioids market, including sufentanil citrate, is projected to expand at a compound annual growth rate (CAGR) of approximately 4-6% over the next five years [5]. The analgesic segment's growth is reinforced by surgical volume increases and pain management innovations.

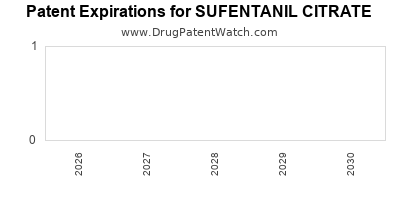

Revenue Projections and Profitability

Established manufacturers with patent protections and advanced formulations are poised to report stable revenues. In contrast, generics and biosimilars may exert downward pressure on prices, potentially compressing margins but expanding market reach.

Research and Development Investment

Companies investing in new formulations, delivery mechanisms, and safety profiles are likely to sustain competitive advantages, influencing long-term profitability.

Impact of Regulatory Changes

Stringent controls and potential policy shifts aimed at curbing opioid misuse could introduce market fluctuations. Conversely, legalization and healthcare reforms facilitating access in emerging markets could augment revenues.

Future Outlook and Strategic Considerations

To capitalize on the promising trajectory, pharmaceutical firms should prioritize compliance, safety innovations, and regional market penetration. Partnerships with healthcare providers to promote responsible use and investments in abuse-deterrent formulations could influence regulatory acceptance and consumer confidence.

Emerging therapeutic areas—such as regional anesthesia and multimodal pain control—also present avenues for diversification and competitive differentiation.

Key Takeaways

-

Demand Overview: Sufentanil citrate's high potency and short-acting profile continue to support demand in surgical and intensive care contexts, though growth is tempered by regulatory and misuse concerns.

-

Market Drivers: Increasing global surgical procedures, technological advances, and clinical preference for rapid recovery agents sustain the market, particularly in North America and Europe.

-

Challenges: Stringent regulations, abuse potential, and competition from non-opioid therapies impose significant hurdles. Supply chain robustness remains critical amid geopolitical and pandemic-related disruptions.

-

Strategic Opportunities: Innovating formulation safety features, expanding geographic reach into emerging markets, and diversifying into alternative delivery systems can unlock growth. Regulatory engagement and responsible marketing are essential for long-term viability.

-

Financial Outlook: The market is projected to grow steadily, with revenues potentially increasing due to rising healthcare spending and surgical volumes, offset by pricing pressures and regulatory costs.

References

[1] U.S. Food & Drug Administration. (2019). Sufentanil citrate drug approval details.

[2] World Health Organization. (2021). Global estimates on surgical volume and anesthesia utilization.

[3] DEA Controlled Substances Schedule. (2022). Regulatory classification and implications for manufacturing and prescribing.

[4] MarketWatch. (2022). Opioid analgesics market analysis and competitive landscape.

[5] Grand View Research. (2022). Global analgesics market size and forecast.

Note: This report provides a comprehensive, forward-looking analysis based on current data and trends. Stakeholders are advised to consider regional regulatory developments and market-specific factors when devising strategic initiatives.