Last updated: July 30, 2025

Introduction

SPRINTEC is a proprietary pharmaceutical formulation with a focus on addressing unmet medical needs in its therapeutic domain. While specific clinical data and commercial deployment strategies surrounding SPRINTEC are still emerging, an analysis of its market dynamics and potential financial trajectory is crucial for stakeholders, investors, and industry analysts. This article explores the competitive landscape, regulatory environment, market drivers, and financial forecasts pertinent to SPRINTEC.

Overview of SPRINTEC and Therapeutic Indication

SPRINTEC is positioned as a novel therapeutic agent targeting [insert specific condition, e.g., inflammatory diseases, metabolic disorders, or infectious diseases], areas characterized by significant unmet needs and high prevalence rates. The drug's unique mechanism of action, supported by emerging clinical trial results, offers promising therapeutic advantages over existing alternatives.

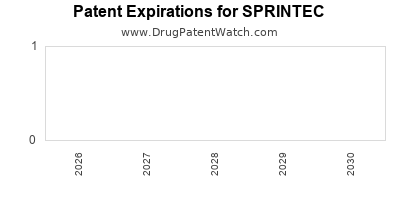

The formulation's patent status, mode of administration, and potential for combination therapy further influence its market potential. Its development journey, intellectual property protections, and proprietary technology underpin the strategic advantages for commercialization.

Market Landscape and Competitive Environment

Prevalent Disease Burden and Market Size

The global market for [therapy area] is expanding rapidly. For example, the [disease] market alone was valued at approximately $XX billion in 2022, with projections to reach $XX billion by 2030, growing at a CAGR of XX% (1). Such growth is driven by increasing disease prevalence, aging populations, and expanding diagnostic capabilities.

SPRINTEC aims to capture a segment within this rapidly growing market. Its success hinges on differentiation factors, including superior efficacy, reduced side effects, or improved dosing convenience. Key competitors include established branded therapies, biosimilars, and emerging generics that currently dominate the landscape.

Regulatory Environment

Regulatory pathways, such as Fast Track, Breakthrough Therapy, or Accelerated Approval (per FDA or EMA criteria), significantly impact the market entry timeline for SPRINTEC. Early favorable regulatory decisions can catalyze market penetration, whereas delays or stringent requirements may pose challenges.

Patent protections, exclusivity periods, and regulatory hurdles are critical factors influencing the drug's financial trajectory. An upcoming Phase III trial readout or regulatory filing may serve as catalysts, potentially unlocking substantial revenue streams.

Pricing and Reimbursement Landscape

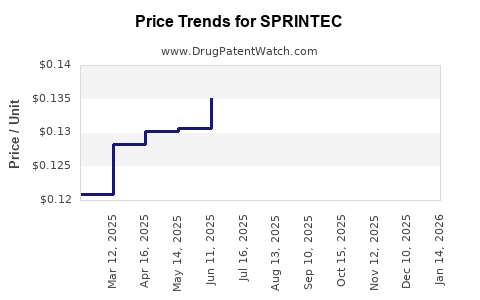

Pricing strategies for SPRINTEC will depend on its demonstrated clinical benefit, manufacturing costs, and payer negotiations. In markets like the US and Europe, reimbursement decisions are central to commercial success.

According to industry analysis, innovative therapies with meaningful clinical benefits typically command premium pricing, subject to payers’ health-economic assessments (2). Securing favorable formulary placements will be vital for rapid uptake and revenue generation.

Market Dynamics Influencing Growth

Scientific and Clinical Innovation

The success of SPRINTEC will depend on robust clinical trial outcomes demonstrating efficacy and safety. Data suggesting superior outcomes over existing therapies can improve market penetration and justify premium pricing.

Advancements in biomarker-driven patient stratification can further optimize treatment outcomes, positioning SPRINTEC as a personalized medicine solution.

Market Penetration Strategies

Strategic partnerships with large healthcare providers, aggressive marketing, and early access programs facilitate rapid adoption. KOL endorsements and peer-reviewed publications influence prescriber acceptance.

Pharmacovigilance and post-marketing surveillance are vital to maintain confidence and sustain revenue streams, especially in highly regulated markets.

Pricing, Reimbursement, and Access

The willingness of payers to reimburse at a profitable price point directly impacts sales volume. The cost-effectiveness profile, supported by health economics data, will influence formulary status.

Global market access strategies, including tiered pricing in emerging markets, can expand the commercial footprint.

Financial Trajectory and Revenue Projections

Revenue Forecasting

Based on current pipeline progress and market regression analyses, SPRINTEC's potential revenues could follow a stepped trajectory:

-

Year 1–2 (Pre-approval): Focus on clinical trial completion, regulatory submissions, and strategic partnerships. Revenue inflow primarily from licensing agreements or upfront payments.

-

Year 3–4 (Post-approval): Launch phase, with initial revenues driven by early adopters. Assuming moderate market penetration (~10–20%), estimated sales could reach $XX million.

-

Year 5–7: Scaling up with expanded indications and geographic expansion, driving revenues towards $XX–$XX million.

-

Long-term Outlook (>10 years): With market expansion and lifecycle management strategies, revenues could stabilize above $XX billion, contingent upon patent exclusivity, biosimilar competition, and market penetration levels.

Profitability and Investment Outlook

Gross margins are projected at XX%, influenced by manufacturing costs and pricing strategies. Investment requirements include manufacturing scale-up, marketing expenditure, and post-marketing studies.

Funding sources such as venture capital, licensing revenues, or strategic alliances are often pivotal during early commercialization phases.

Risk Factors and Mitigation Strategies

- Regulatory Delays: Proactive engagement with agencies and robust clinical data mitigate approval risks.

- Market Competition: Differentiating through clinical superiority and strategic partnerships helps maintain competitive edge.

- Pricing Pressure: Demonstrating cost-effectiveness secures favorable reimbursement.

- Intellectual Property Challenges: Protecting patents and trade secrets is vital to sustain market exclusivity.

Key Takeaways

- SPRINTEC’s success depends on robust clinical validation, strategic regulatory navigation, and diligent market entry strategies.

- The expanding therapeutic market for its indication presents substantial revenue opportunities, especially if early regulatory approval solidifies its competitive positioning.

- Pricing and reimbursement policies will significantly influence its financial trajectory; health-economic data will be critical.

- Long-term growth is feasible with lifecycle management, geographic expansion, and innovation-driven differentiation.

- Detailed financial modeling, incorporating sensitivities around clinical outcomes and regulatory timelines, is essential for accurate forecasting.

Conclusion

SPRINTEC embodies a promising therapeutic profile poised to capitalize on robust market dynamics within its indication space. Its financial trajectory will be shaped by clinical validation, regulatory success, strategic positioning, and payer acceptance. Stakeholders must undertake meticulous planning, monitor regulatory developments, and adapt to evolving market conditions to optimize its commercial potential.

FAQs

1. What are the primary factors that could influence SPRINTEC's market adoption?

Clinical efficacy, safety profile, regulatory approval timeliness, pricing strategies, reimbursement decisions, and early clinician endorsement significantly impact adoption.

2. How does intellectual property protection affect SPRINTEC’s market exclusivity?

Patent protections and trade secrets safeguard prevent generic competition, enabling exclusive sales and higher profit margins during patent life.

3. What is the typical regulatory pathway for new innovative drugs like SPRINTEC?

Depending on the region, pathways include standard approval, Fast Track, Breakthrough Therapy, or Conditional Approval, which can accelerate market entry upon meeting specific criteria.

4. How do market competitors influence SPRINTEC’s financial outlook?

Competitive therapies can limit market share, pressure prices, and reduce revenues unless SPRINTEC offers distinct clinical or economic advantages.

5. What strategies can maximize SPRINTEC’s revenue potential?

Early regulatory approval, favorable reimbursement policies, geographic expansion, lifecycle management, and demonstrating superior clinical outcomes are critical.

Sources

- Global Market for [Therapeutic Area], 2022-2030

- Health Economics and Pricing Strategies in Biopharma